التعليم

التكنولوجيا

التمويل

تطوير الذات

الاستثمار

الشؤون المالية الشخصية

الشركات الناشئة

توليد الدخل

15 Personal Finance Hacks to help you Manage Your Money Better

Read the complete Thread if you are under 25 to outperform 99% people of your age 🧵

Read the complete Thread if you are under 25 to outperform 99% people of your age 🧵

1) Investing is Overrated 💸

Focus on maximising your income first, building a passive source of income.

Savings and Investing comes later. Let’s understand this better?

Focus on maximising your income first, building a passive source of income.

Savings and Investing comes later. Let’s understand this better?

You need to build an income stream that earns money while you sleep

You need to let your money work for you, your YouTube, Social Media could be more worthy than an Engineering or MBA Degree

Someone with 100K credible followers are earning 5-10x more than a typical graduate

You need to let your money work for you, your YouTube, Social Media could be more worthy than an Engineering or MBA Degree

Someone with 100K credible followers are earning 5-10x more than a typical graduate

In my case Brand Consulting, Partnerships, Overseas One Time Projects, Social Media have outperformed active income many times.

I actively monetise my knowledge and time. This Thread by @naval changed my life and career 4 years back

I actively monetise my knowledge and time. This Thread by @naval changed my life and career 4 years back

2) Savings Rate & Cash Flow 💲

You need to closely track your monthly Cashflow. How much you are earning, spending and investing

You don’t to track every rupee you are spending but allocate a specific budget for all 3 categories

You need to closely track your monthly Cashflow. How much you are earning, spending and investing

You don’t to track every rupee you are spending but allocate a specific budget for all 3 categories

You should know what’s Month on Month and Year on Year appreciation or depreciation in your overall Cashflow.

The day you start tracking this, your relationship with money will significantly improve and you’ll see positive changes.

The day you start tracking this, your relationship with money will significantly improve and you’ll see positive changes.

3) Separating Bank Account 📊

You need to open 3 Bank Accounts

a - Salary Account

b) - Spends Account (Day to Day, UPI)

c) Investing Bank Account

Transfer a fixed amount at the start of every month, Your primary bank account will look clean and you might avoid overspending

You need to open 3 Bank Accounts

a - Salary Account

b) - Spends Account (Day to Day, UPI)

c) Investing Bank Account

Transfer a fixed amount at the start of every month, Your primary bank account will look clean and you might avoid overspending

Remember, Investing comes first and spending money later

If you earn ₹1 Lakh a month and committed a savings (Investment) rate of 45%, so ₹45,000 should be transferred to another account without any delay

Same goes for pre-defined monthly spend limit, keep your accounts clean

If you earn ₹1 Lakh a month and committed a savings (Investment) rate of 45%, so ₹45,000 should be transferred to another account without any delay

Same goes for pre-defined monthly spend limit, keep your accounts clean

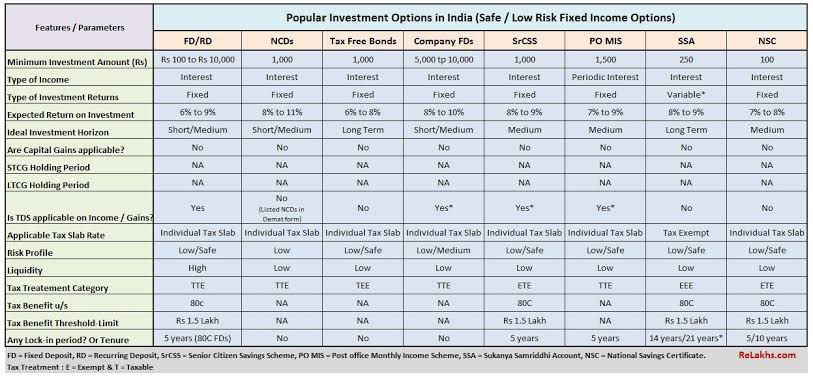

FDs aren’t bad, Don’t let influencers fool you. You should have some money parked in FD that earns you 6-7% returns

You could also get a Credit Card against FD that can help you in an emergency.

Earn Interest and Enjoy Liquidity

You could also get a Credit Card against FD that can help you in an emergency.

Earn Interest and Enjoy Liquidity

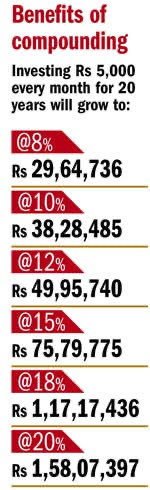

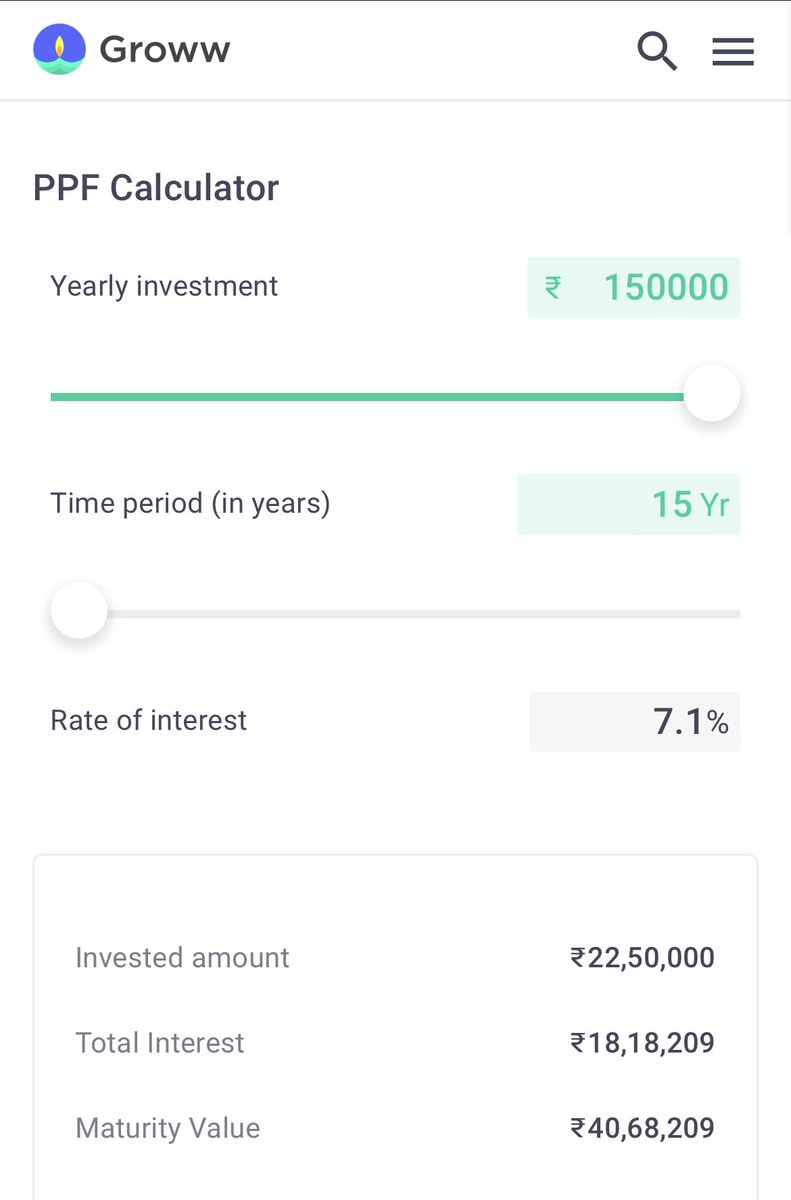

Don’t forget to read more about traditional Investing instruments such as PPF, Sovereign Gold etc

They help you with Tax Benefits, long term wealth creation, compounding and protect you from volatility of the stock market

They help you with Tax Benefits, long term wealth creation, compounding and protect you from volatility of the stock market

6) Should you Invest in Gold 🌟

I have a decent allocation of Gold in my Portfolio, mostly buy SGBs

They’re backed by RBI and earn 2.5% Annual Interest and Capital Gains are Tax Free

You can also try Gold ETFs, avoid Digital Gold (3% GST and Hidden Charges)

I have a decent allocation of Gold in my Portfolio, mostly buy SGBs

They’re backed by RBI and earn 2.5% Annual Interest and Capital Gains are Tax Free

You can also try Gold ETFs, avoid Digital Gold (3% GST and Hidden Charges)

7) High Interest Savings Account 🤑

Pick a Savings or Salary Account that gives you better rate, good customer service and excellent digital experience

I use IDFC First Bank, 4-6% Interest Rate on Savings Account and LTF Credit Cards

HDFC and ICICI are also good choice

Pick a Savings or Salary Account that gives you better rate, good customer service and excellent digital experience

I use IDFC First Bank, 4-6% Interest Rate on Savings Account and LTF Credit Cards

HDFC and ICICI are also good choice

8) Learn Taxation and Planning 🧾

Declare your upcoming investments for this FY to the HR Portal to avoid Excessive TDS deduction

You can declare your rent (HRA), Home Loan, 80C Investment, Insurance etc and submit the actual proofs at the year end.

Declare your upcoming investments for this FY to the HR Portal to avoid Excessive TDS deduction

You can declare your rent (HRA), Home Loan, 80C Investment, Insurance etc and submit the actual proofs at the year end.

9) LIC and Bank RM 👹

Bank Relationship Managers and that LIC Uncle can’t be your Financial or Investment Adviser

They earn 5-30% commission on your money, simply calculate and compare on a spreadsheet

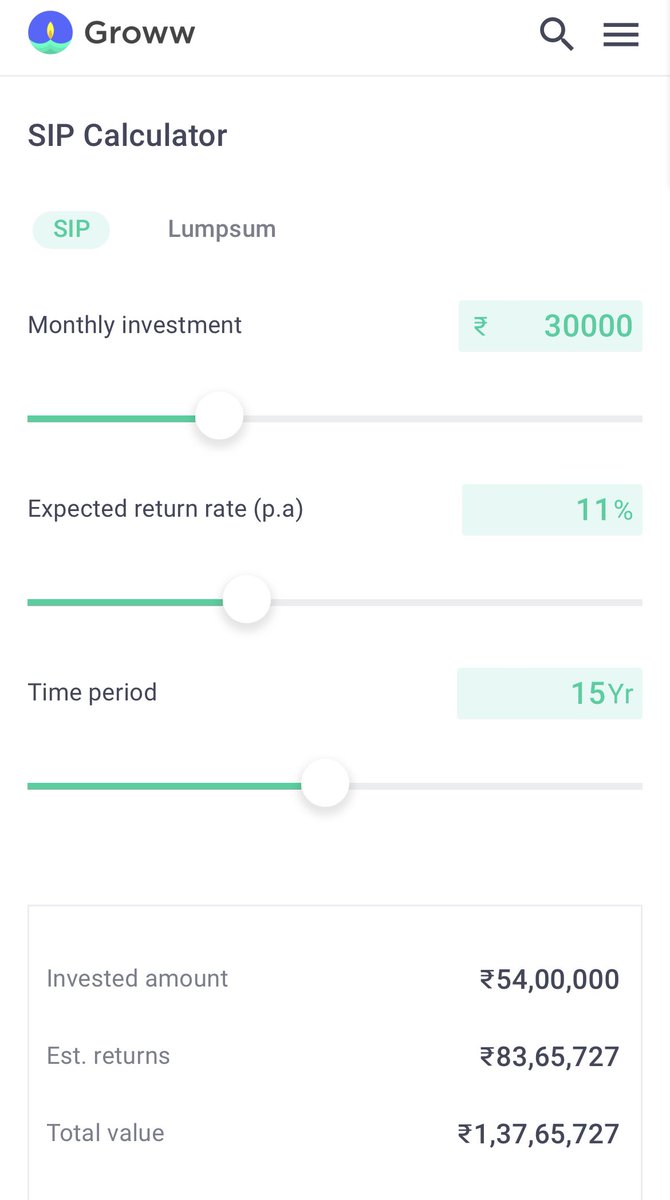

99% times you’ll find Mutual Fund SIPs will outperform all of them

Bank Relationship Managers and that LIC Uncle can’t be your Financial or Investment Adviser

They earn 5-30% commission on your money, simply calculate and compare on a spreadsheet

99% times you’ll find Mutual Fund SIPs will outperform all of them

10) Crypto, P2P, Startups, Invoice Discounting ❌

Many FinTech platforms these days are offering new investing solutions, mostly unregulated

That means you could lose money, I don’t invest in something I don’t understand

They’re highly volatile!

Many FinTech platforms these days are offering new investing solutions, mostly unregulated

That means you could lose money, I don’t invest in something I don’t understand

They’re highly volatile!

11) Credit Cards 💳

They’re good for people who know how to manage money and financially disciplined. They earn you

•Reward Points & Cashback

•Interest Free Credit

•Airport Lounge

•Free Insurance

Get a Card that offers 2-4% Cashback, saves money on Shopping & Travel

They’re good for people who know how to manage money and financially disciplined. They earn you

•Reward Points & Cashback

•Interest Free Credit

•Airport Lounge

•Free Insurance

Get a Card that offers 2-4% Cashback, saves money on Shopping & Travel

12) Insurance🛡️

Very Important, Medical Inflation is real. Ensure you and your family is properly covered.

Buy a proper Health & Term Insurance, if you’re under 25 your premium would be very minimal

Remember, most Indians are just one hospital bill away from going into poverty

Very Important, Medical Inflation is real. Ensure you and your family is properly covered.

Buy a proper Health & Term Insurance, if you’re under 25 your premium would be very minimal

Remember, most Indians are just one hospital bill away from going into poverty

13) Emergency Funds 💵

Given the uncertainty of jobs these days, medical emergency etc

It’s extremely important to build an emergency fund of 6-12 months advance to protect your Bills/EMIs

That money should be accessible to you asap even if you are earning low return on that

Given the uncertainty of jobs these days, medical emergency etc

It’s extremely important to build an emergency fund of 6-12 months advance to protect your Bills/EMIs

That money should be accessible to you asap even if you are earning low return on that

14) Network & Upskilling 🤝

Your network is your net worth

Build great relationships with people around, that’s how you eliminate resume from your life

Keep upskilling yourself, both of these can help you with the next amazing job or business opportunities

Your network is your net worth

Build great relationships with people around, that’s how you eliminate resume from your life

Keep upskilling yourself, both of these can help you with the next amazing job or business opportunities

15) Quality of Surroundings 🚀

The kind of friends and people you spend your time with plays a very important role in overall growth & development

Enjoy your life to the fullest but at the same time be highly aware of time and opportunity cost.

The kind of friends and people you spend your time with plays a very important role in overall growth & development

Enjoy your life to the fullest but at the same time be highly aware of time and opportunity cost.

And that’s all, Thanks for Reading

Appreciate you RT on this Thread to help me reach more people, Follow @Ravisutanjani for more! Best

Appreciate you RT on this Thread to help me reach more people, Follow @Ravisutanjani for more! Best

جاري تحميل الاقتراحات...