Today we're launching a product that's been in the works for months: Delta Neutral Yields

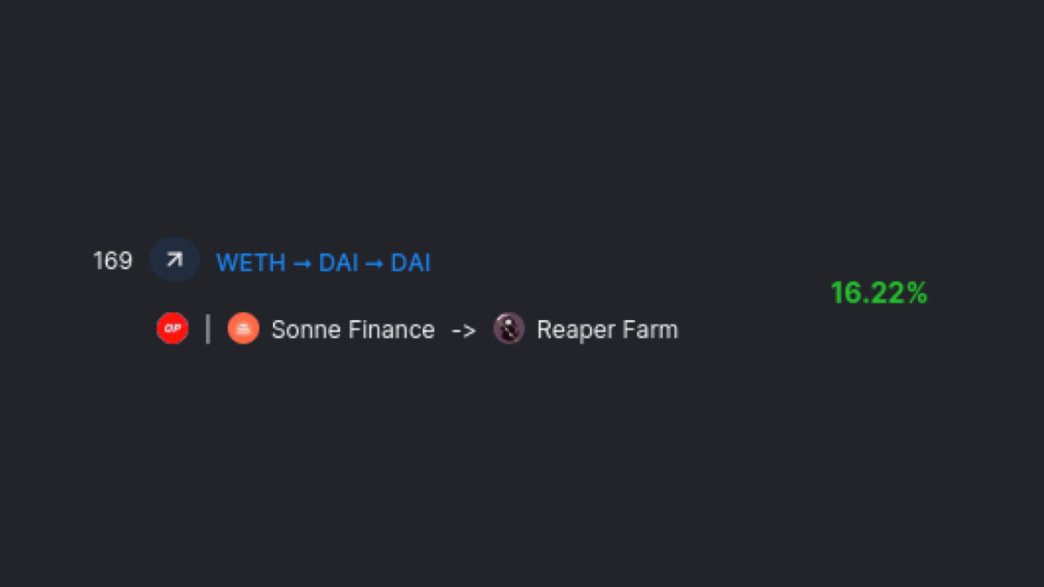

It uses our huge DB to find opportunities where you borrow a token and then farm with it

With this you can get >20% APY on BTC, ETH, USDC...

Thread on how to get that APY + examples

It uses our huge DB to find opportunities where you borrow a token and then farm with it

With this you can get >20% APY on BTC, ETH, USDC...

Thread on how to get that APY + examples

There are thousands of other strategies like these uncovered by our yield dashboard

All these allow you to maintain your original exposure (eg: BTC, ETH, USDC..) while farming the higher yields that are provided for other tokens, with no exposure to their price!

All these allow you to maintain your original exposure (eg: BTC, ETH, USDC..) while farming the higher yields that are provided for other tokens, with no exposure to their price!

This dashboard is now live and available for free at defillama.com

We heavily recommend using the project filter to remove all projects you consider sketchy and to narrow down results, as otherwise the list is really long

We heavily recommend using the project filter to remove all projects you consider sketchy and to narrow down results, as otherwise the list is really long

If you found this helpful, make sure to retweet the first tweet

Loading suggestions...