“Fed needs to raise rates above the CPI to kill inflation” → widely spread narrative on Twitter

Inflation is at 8.3%, meaning the Fed would need to raise an additional 5% aka play with fire.

Let's debunk this narrative.

A thread

Inflation is at 8.3%, meaning the Fed would need to raise an additional 5% aka play with fire.

Let's debunk this narrative.

A thread

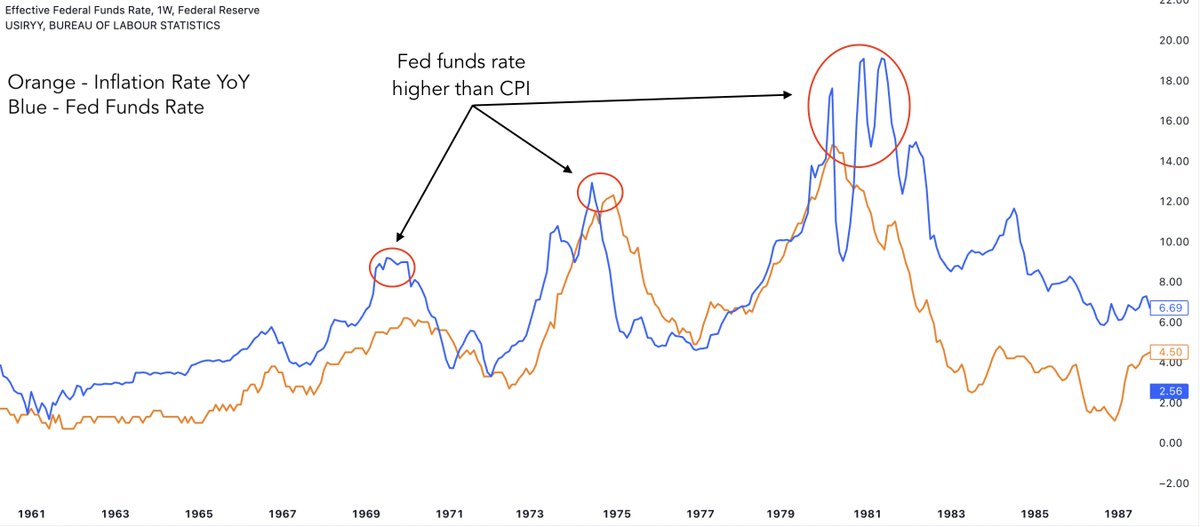

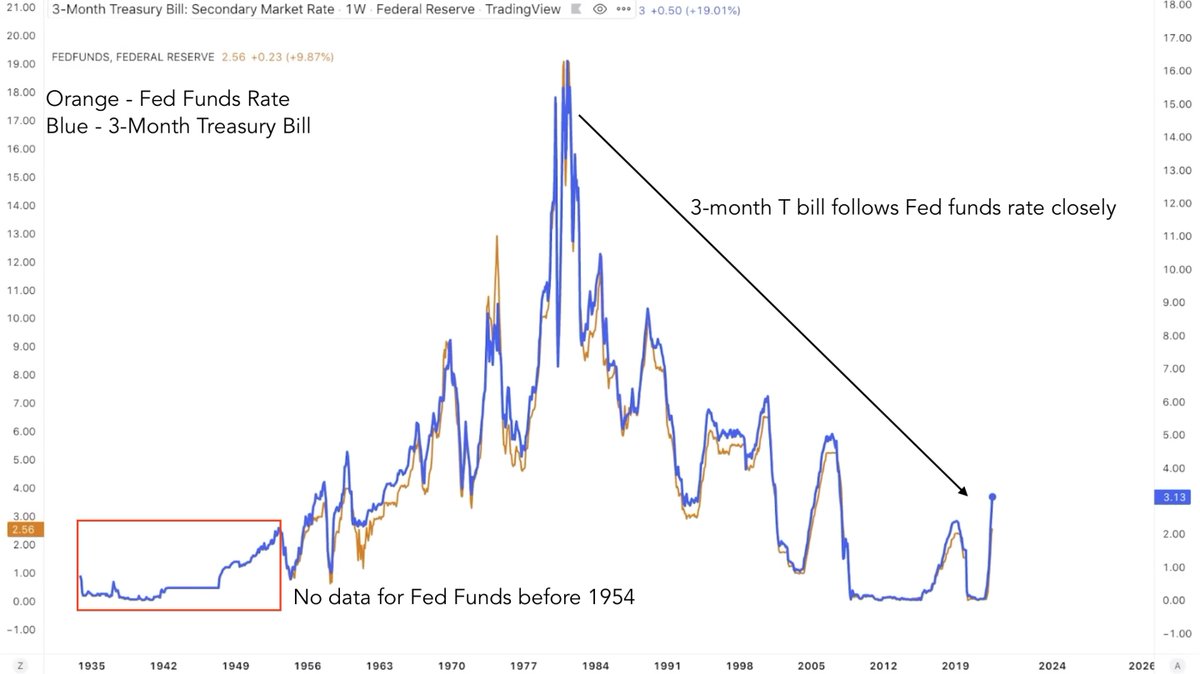

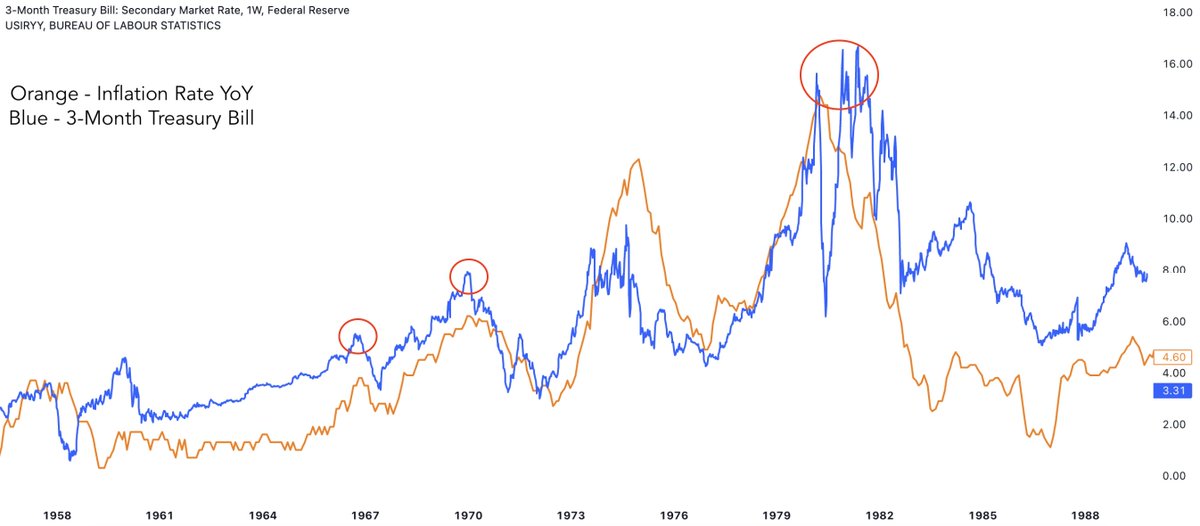

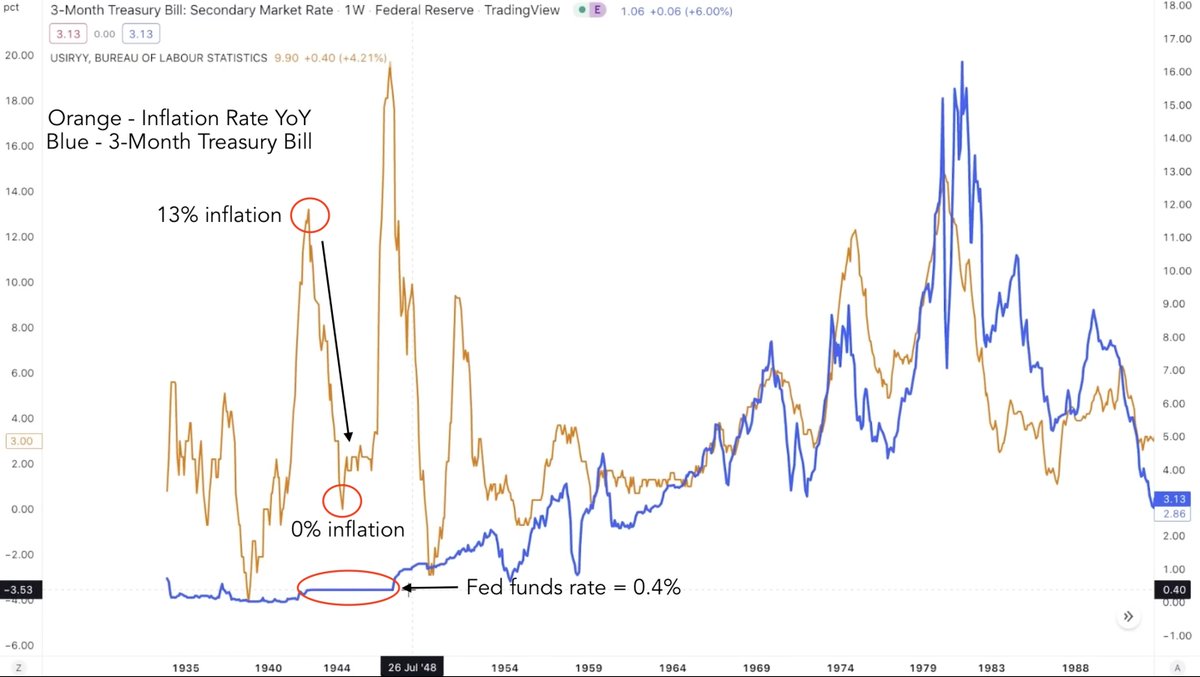

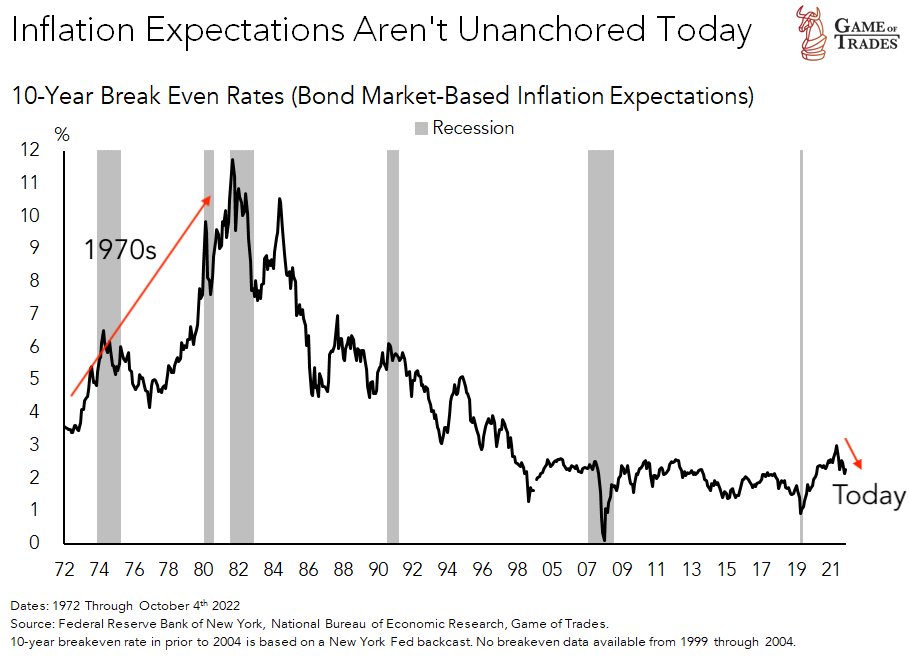

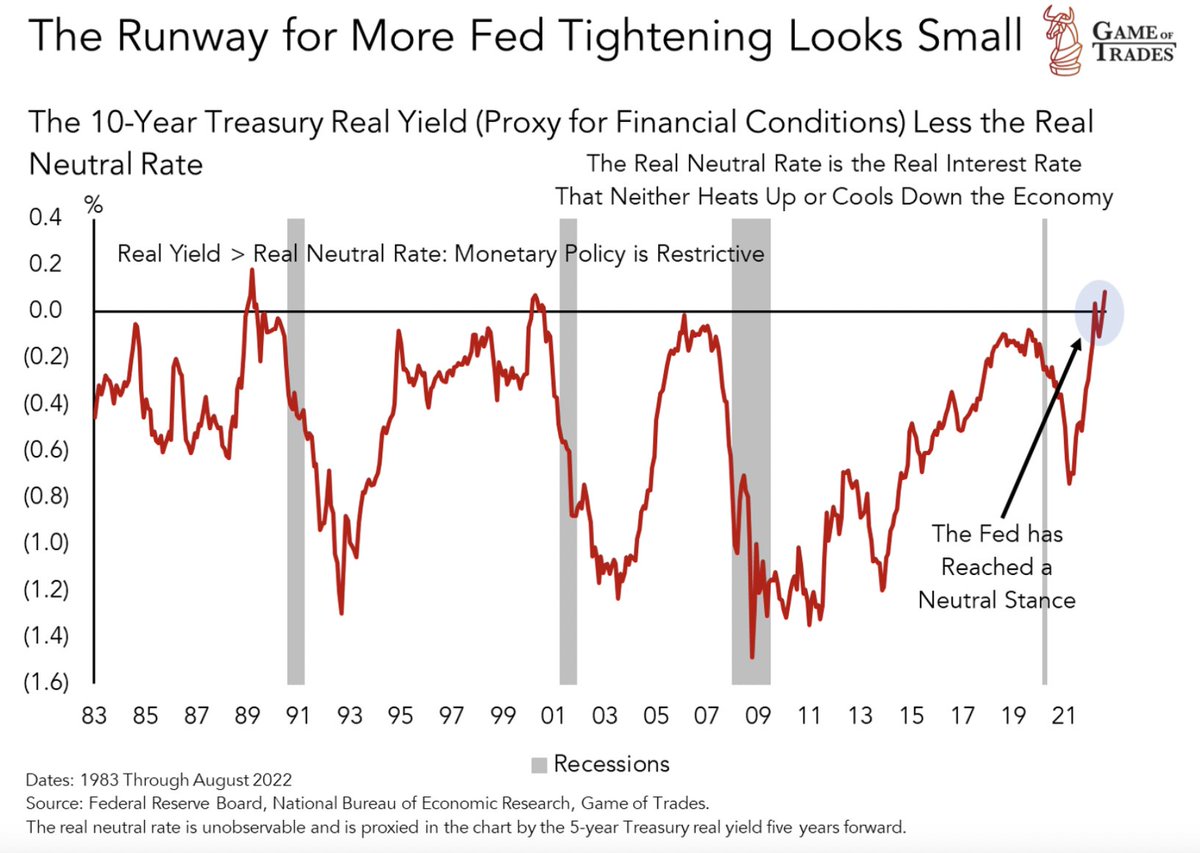

4/ To better understand if the Fed needs to raise rates above CPI we have to look at history.

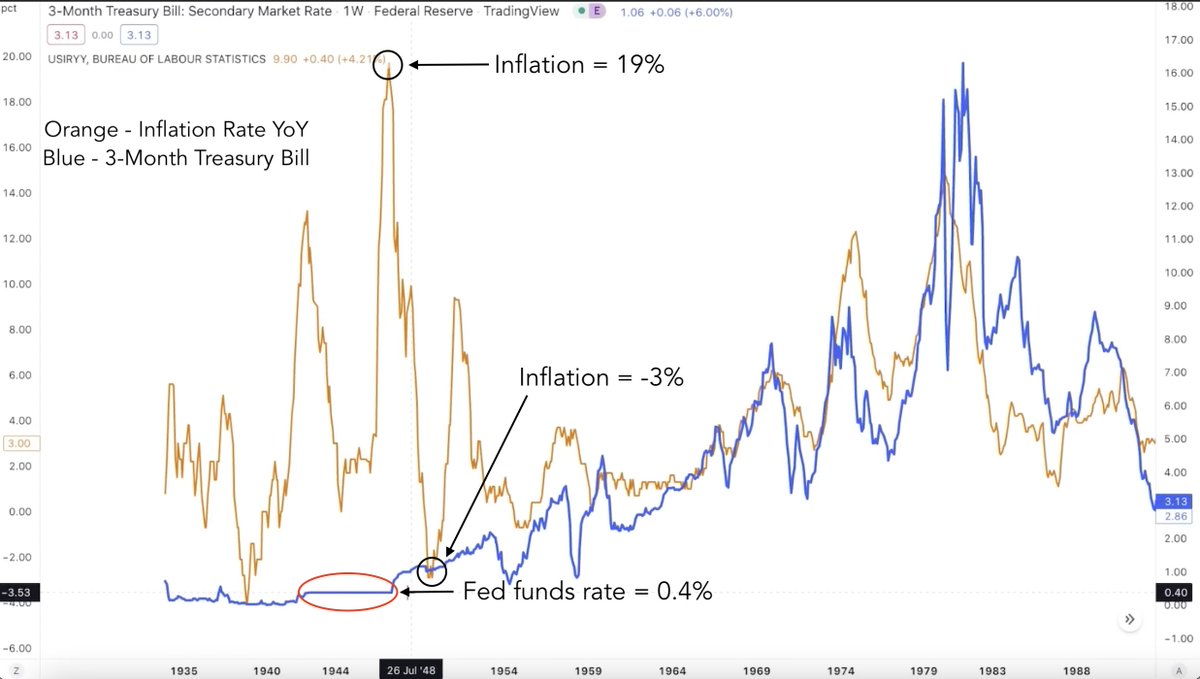

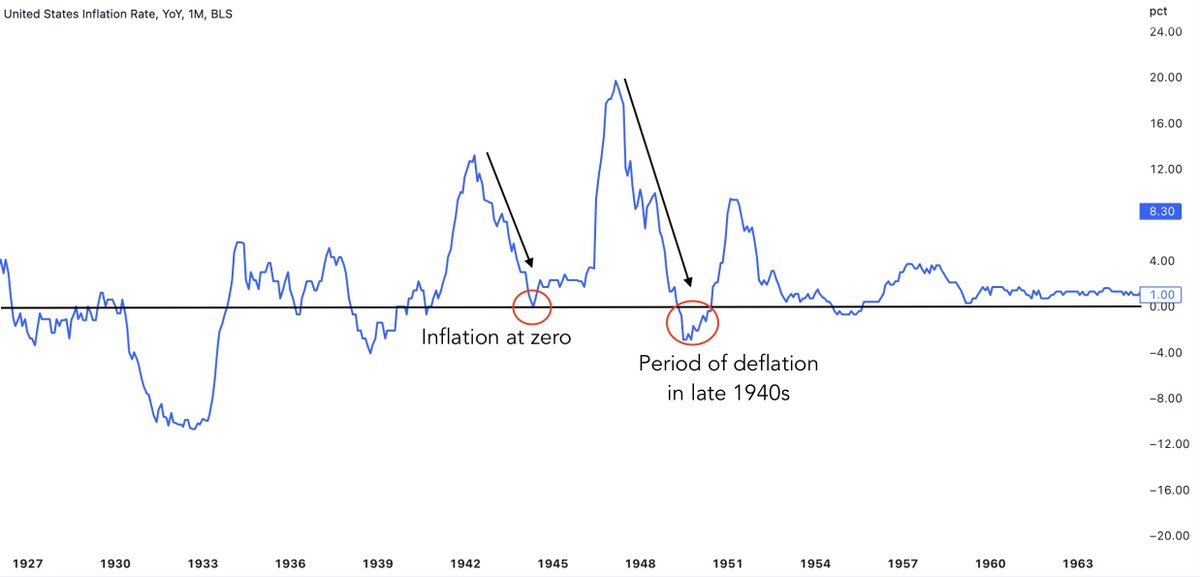

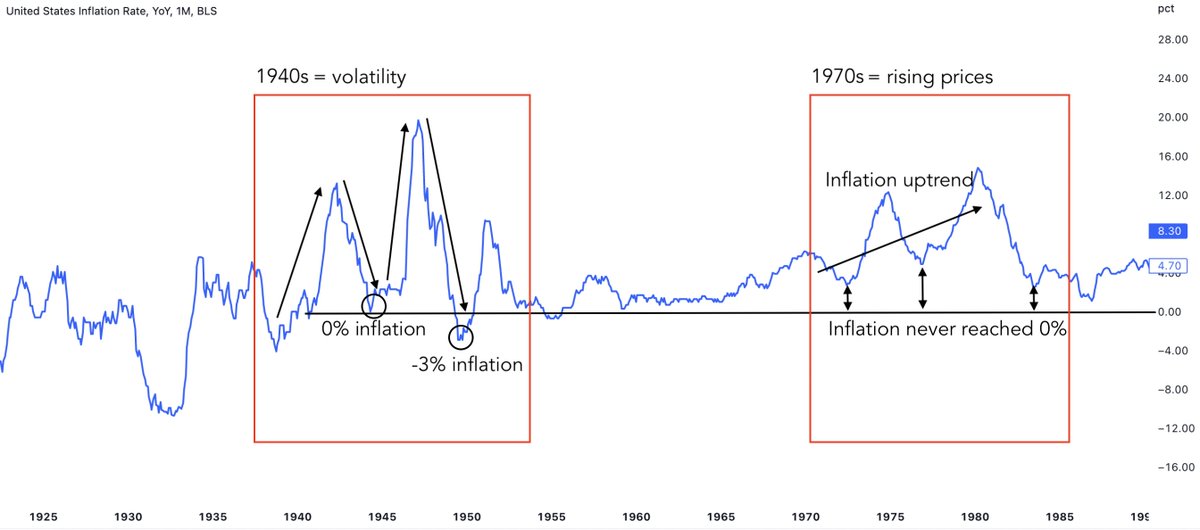

7/ Let’s go back further in time when inflation and interest rate dynamics have been much different.

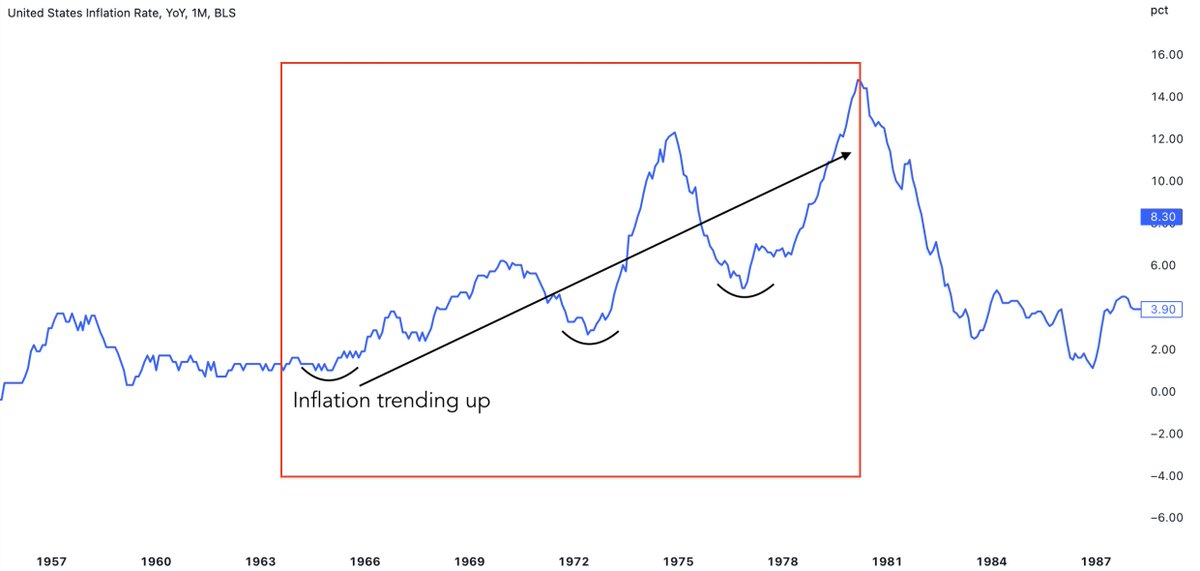

10/ So why did the Fed have to raise interest rates above CPI in the 1970s?

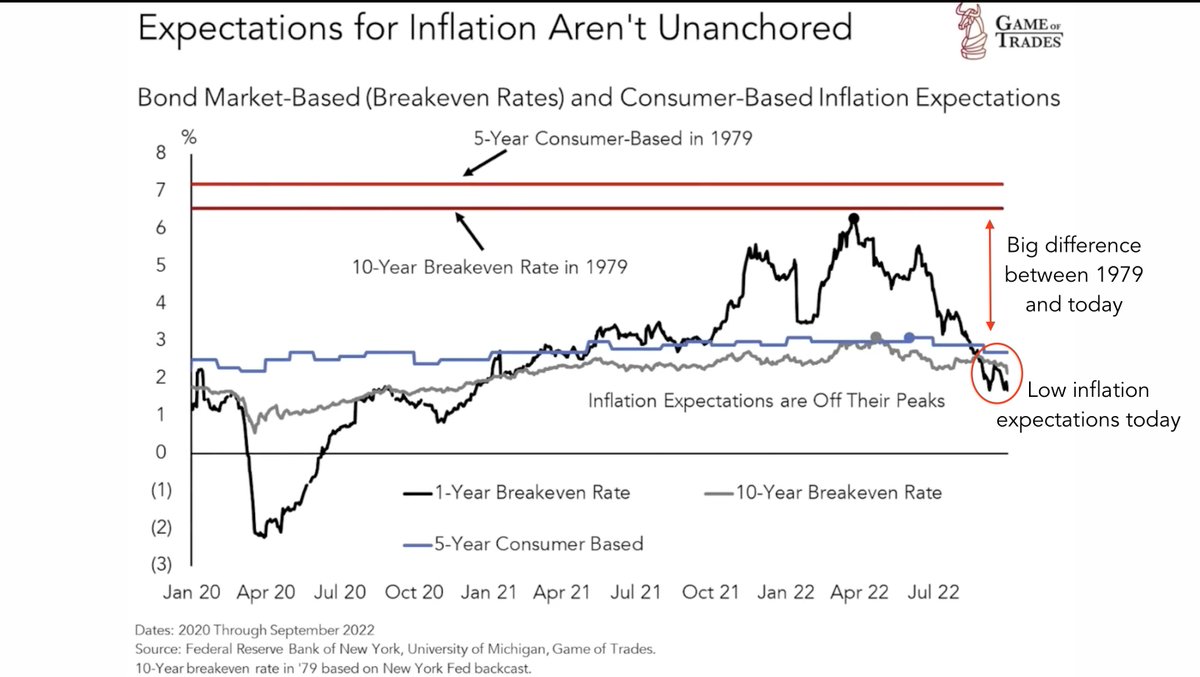

→ Inflation Expectations

→ Inflation Expectations

14/ High inflation expectations lead to increased consumer spending because consumers expect higher prices in the future.

That doesn’t necessarily hold true when inflation expectations are low.

So what are inflation expectations today?

That doesn’t necessarily hold true when inflation expectations are low.

So what are inflation expectations today?

18/ Thanks for reading!

If you liked this, please like and retweet the first tweet below.

And follow @gameoftrades_ for more market insights, finance and investment strategy content.

If you liked this, please like and retweet the first tweet below.

And follow @gameoftrades_ for more market insights, finance and investment strategy content.

جاري تحميل الاقتراحات...