Now what is Liquidity ?? Liquidity per say refers to the ease with which a token can be swapped to other tokens, theoretically you can say that. but trading or spotting liquidities can be a gruesome task for most upcoming traders

Now lemme use an Analogy I used on my previous

Now lemme use an Analogy I used on my previous

Thread. Okay let's say I'm on a journey from Awka Anambra state to Imo state right ?, now one of the very essential things I'd need for my journey to be a smooth one is fuel, True or Yes ? YES !!

Without fuel I would be stopped half way into the trip and return back to buy fuel

Without fuel I would be stopped half way into the trip and return back to buy fuel

That's simply how liquidities are important for your trades/entries, liquidity is what fuels your trades to move your desired direction, without it your trades would be stopped out at some point in order to go in search of liquidities below your entry that you couldn't find

Thereby Certifying the claims that if you cannot see the liquidity you are the liquidity, now after the trade has gone against you in search of liquidities that you couldn't find,your body go calm down !! Then self doubt , revenge trading and other trading vices begin to pop up

Nwoke zuruike and learn some more, what I'll be teaching you today wouldn't be alot per say, but it'll open up your heart to appreciating liquidities, therefore going to research on more

Today there are countless types of liquidities

Some of them were even self named by traders

Today there are countless types of liquidities

Some of them were even self named by traders

I have 5 of them and some entry models I use steady and I'll elaborate them for you in this thread, the rest is then up to you to go research by yourself

For liquidities I trade with,I have BSL, SSL, TLL

Then I have liquidity sweep and order block sweeps which are on my past🧵

For liquidities I trade with,I have BSL, SSL, TLL

Then I have liquidity sweep and order block sweeps which are on my past🧵

Links to my other threads to read up on orderblock sweeps and liquidity sweeps below 👇

Orderblock sweep

Liquidity sweep trading strategy👇

Now that is cleared, lemme explain liquidities on a chart !!

Orderblock sweep

Liquidity sweep trading strategy👇

Now that is cleared, lemme explain liquidities on a chart !!

Now liquidities exist with equal touches or equal Highs or lows ( EQH & EQL )

Also exists for equal touches on a trendline. Now because these zones look enticing to clumsy retailers who buy at resistant lines or support, they go to set orders on them

Once an equal high or low

Also exists for equal touches on a trendline. Now because these zones look enticing to clumsy retailers who buy at resistant lines or support, they go to set orders on them

Once an equal high or low

Or trendline touches are created liquidities are formed !!

Liquidity is in form of money and The BFI (Banking & Finance institute) needs it from our orders

One importantly thing to also note is that Liquidities are usually wicky. Yh wicks meaning presence of wicks

Liquidity is in form of money and The BFI (Banking & Finance institute) needs it from our orders

One importantly thing to also note is that Liquidities are usually wicky. Yh wicks meaning presence of wicks

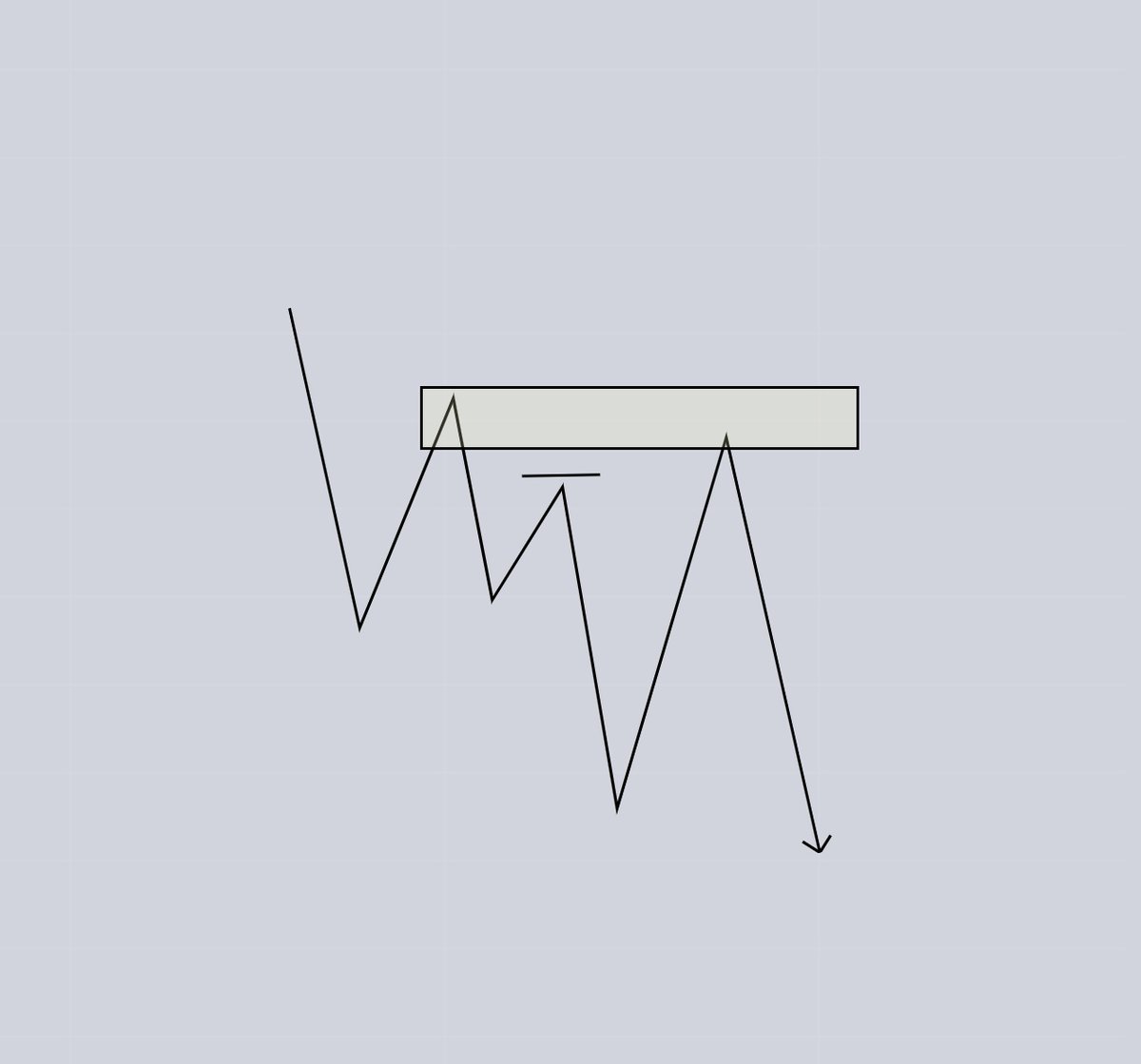

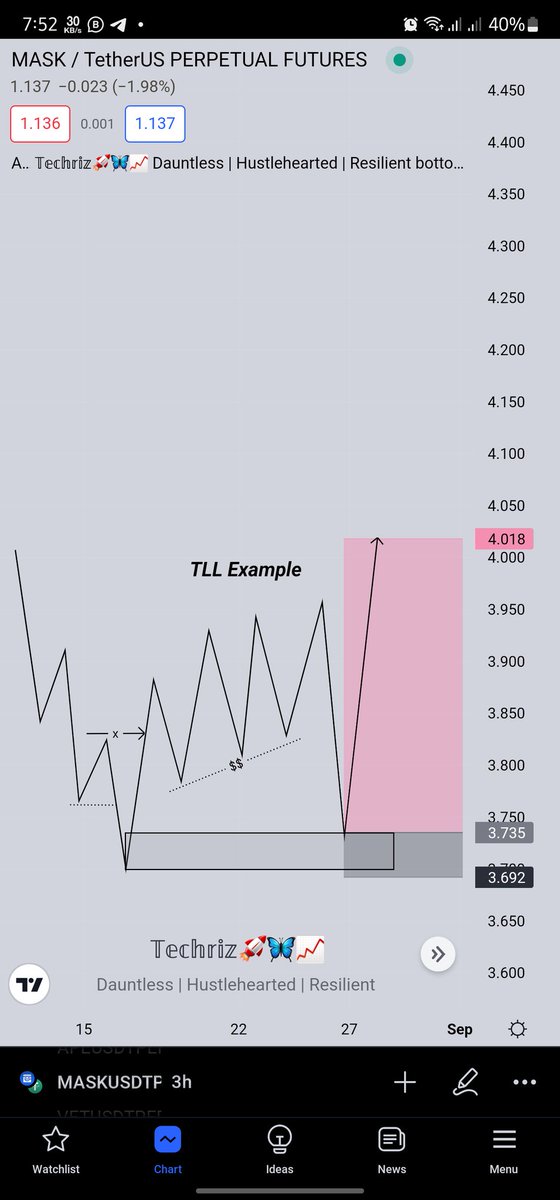

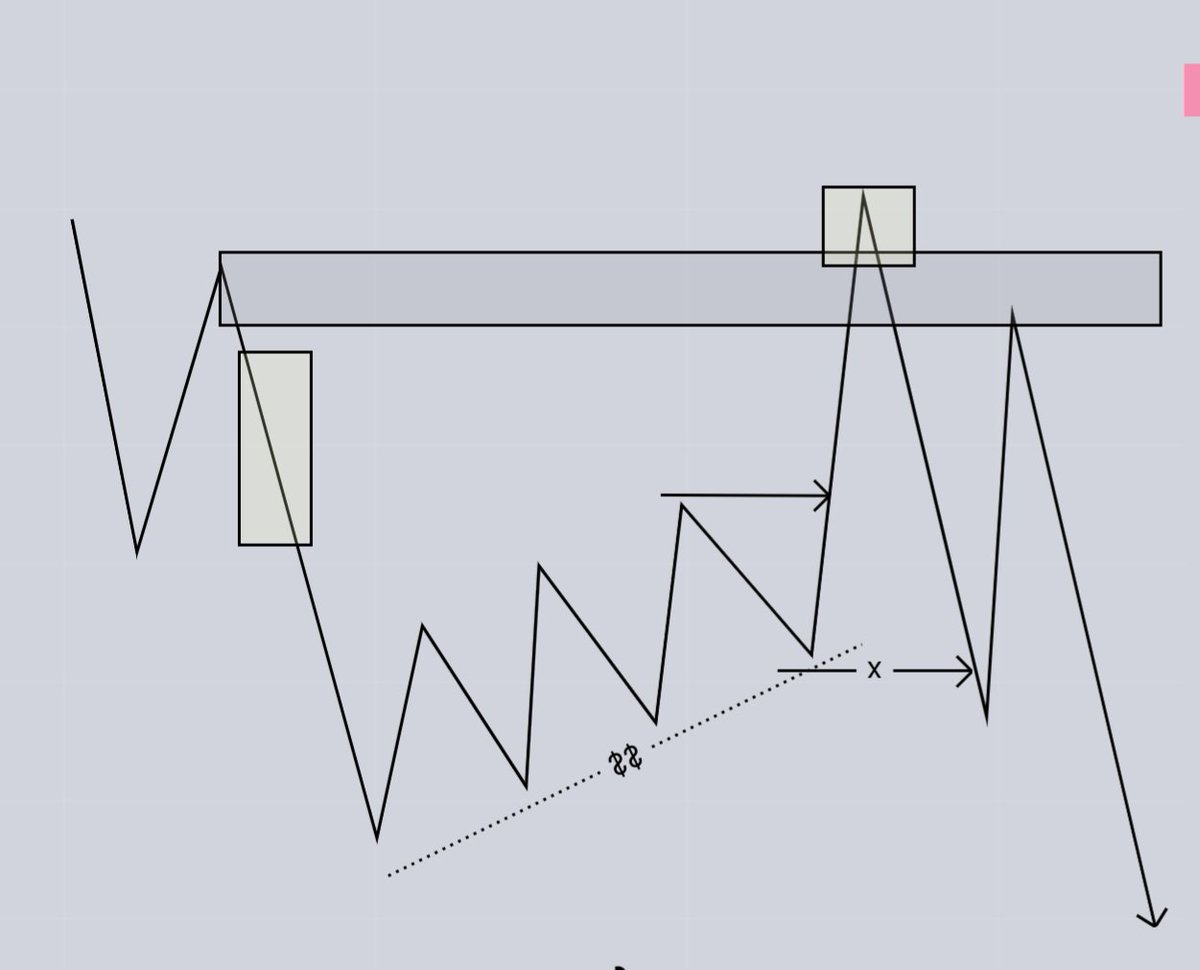

When you spot a TLL close to a probable orderblock , Bam !! You have a high probability trade/setup

The BSL ( buy side liquidity) typically a buy side liquidity, I know alot of persons have been taught what they believe to be the position of the BSL but to not confuse you

The BSL ( buy side liquidity) typically a buy side liquidity, I know alot of persons have been taught what they believe to be the position of the BSL but to not confuse you

Learning and understanding, in real terms the SSL should be below and the BSL above , but then, this way I've presented it makes it alot more easier even for the coconut heads to understand 😅😅

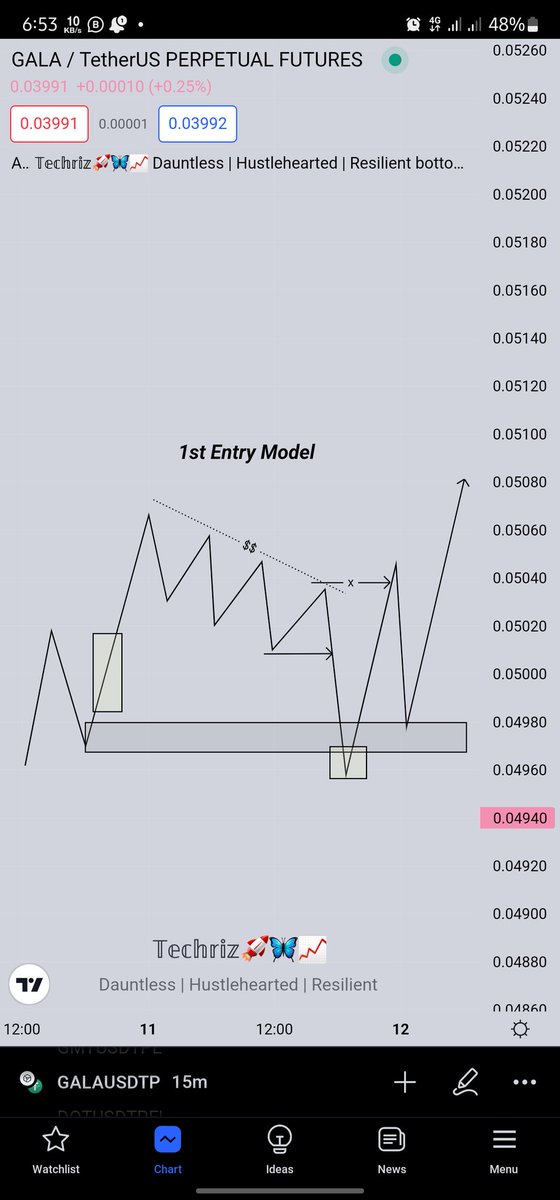

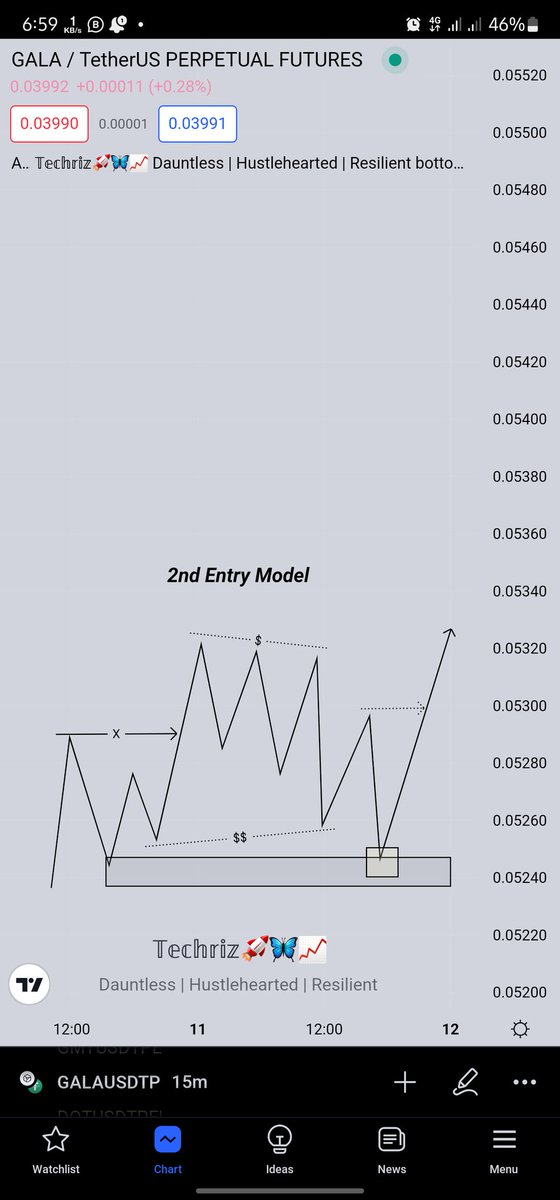

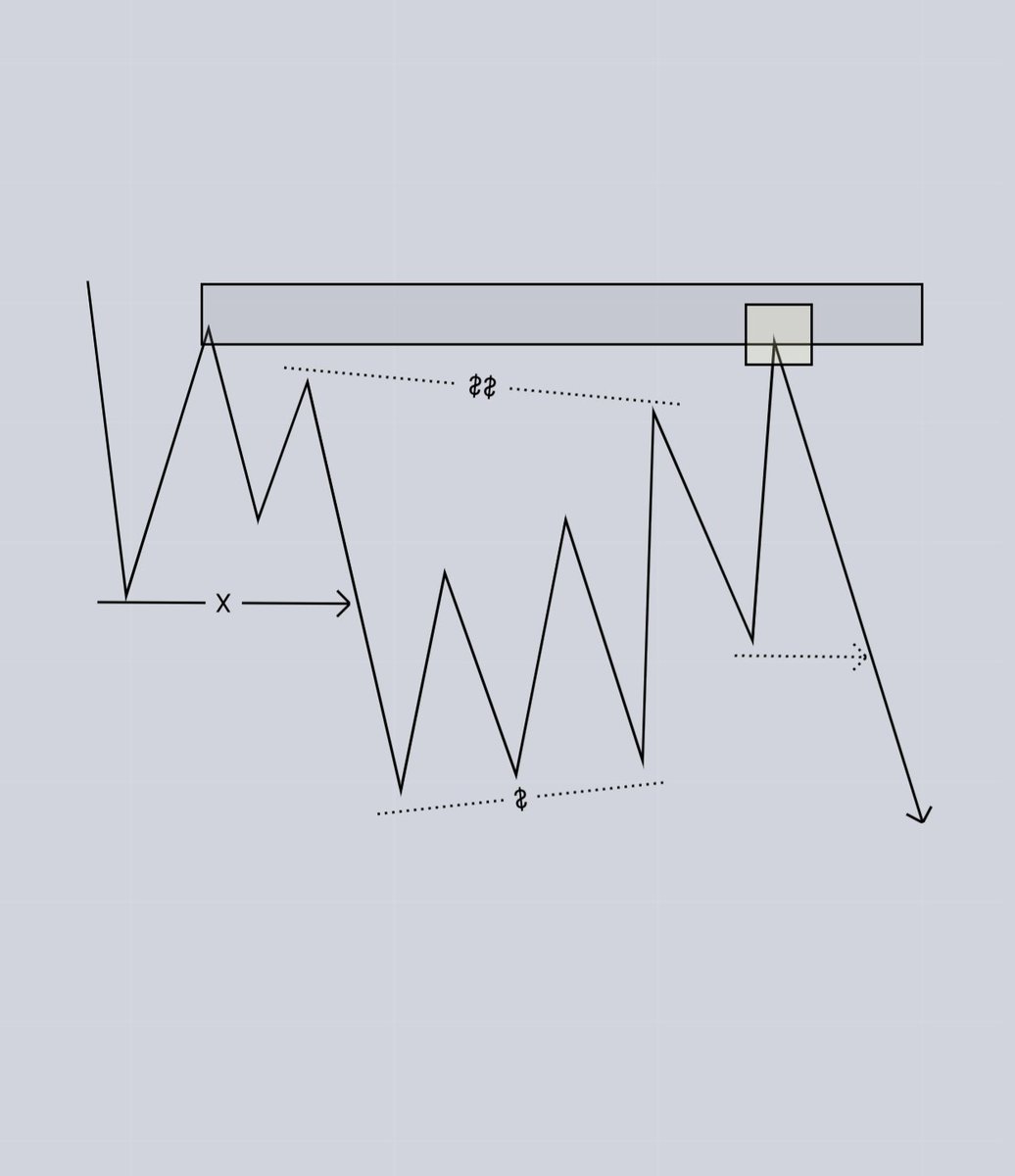

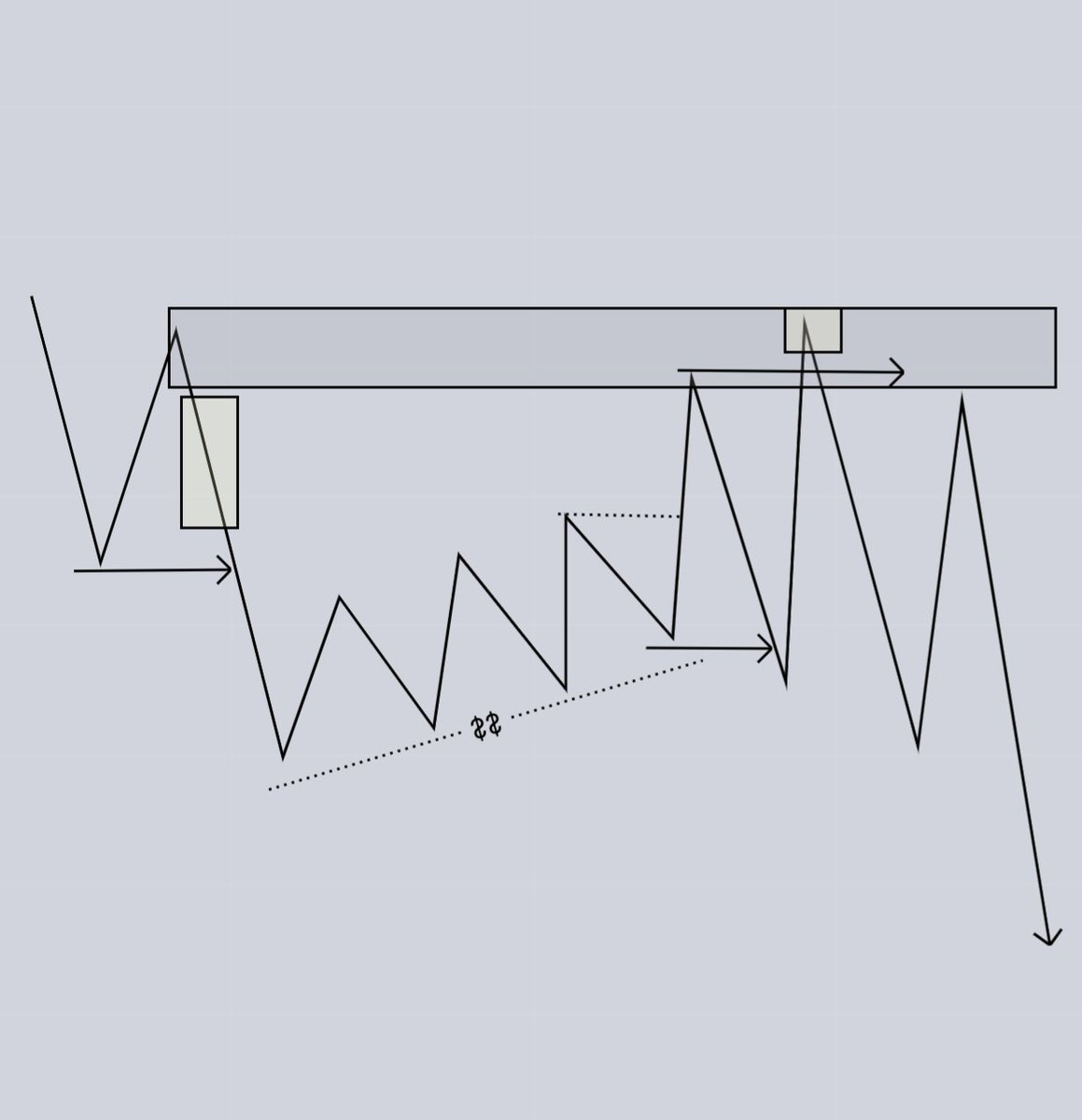

Now onto the liquidity models I trade with,I'd just share 3 now, will update on more

Now onto the liquidity models I trade with,I'd just share 3 now, will update on more

Couldn't find any recent examples on the last Model

But I'd update them on this thread if I see one ongoing

But anyways

That'll be the end !!

Are there other models you trade with that I'm not aware of ??

You can comment them I'd love to see your view and backtest on them

But I'd update them on this thread if I see one ongoing

But anyways

That'll be the end !!

Are there other models you trade with that I'm not aware of ??

You can comment them I'd love to see your view and backtest on them

Meanwhile >>>

That'll be the end of today's thread

Comment on what you learnt or questions you have , I'd attend to them all

Also Don't forget to Turn on post notification to my tweets so you're first to know when things like this drop on here

Also like + Retweet + Engage !!

That'll be the end of today's thread

Comment on what you learnt or questions you have , I'd attend to them all

Also Don't forget to Turn on post notification to my tweets so you're first to know when things like this drop on here

Also like + Retweet + Engage !!

Loading suggestions...