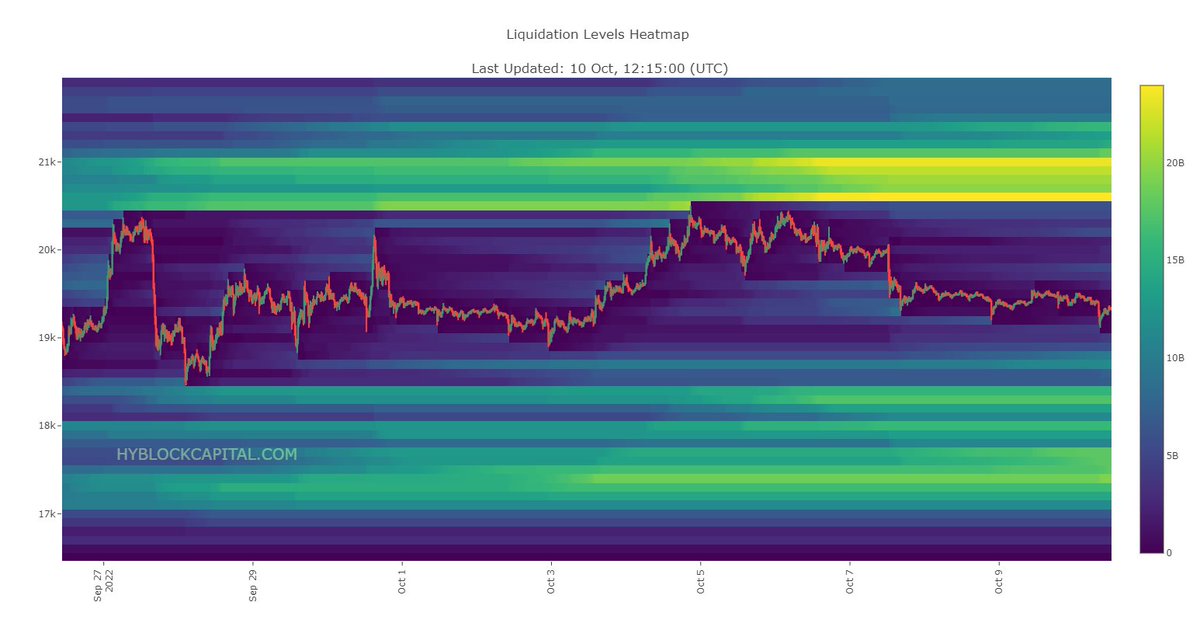

So we could say that what the MM has archieved with this move was:

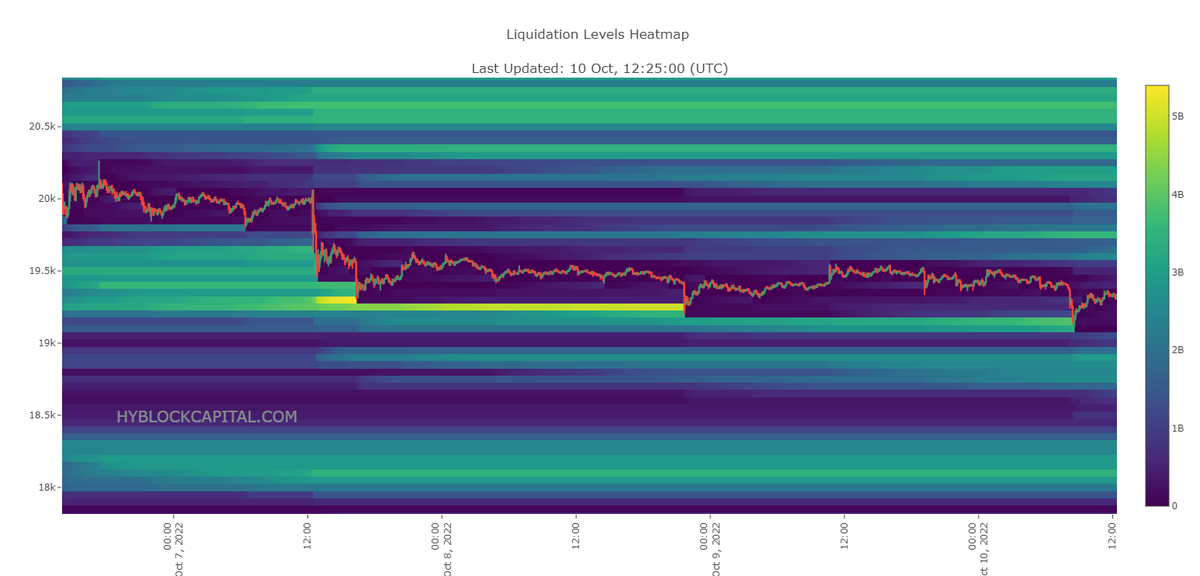

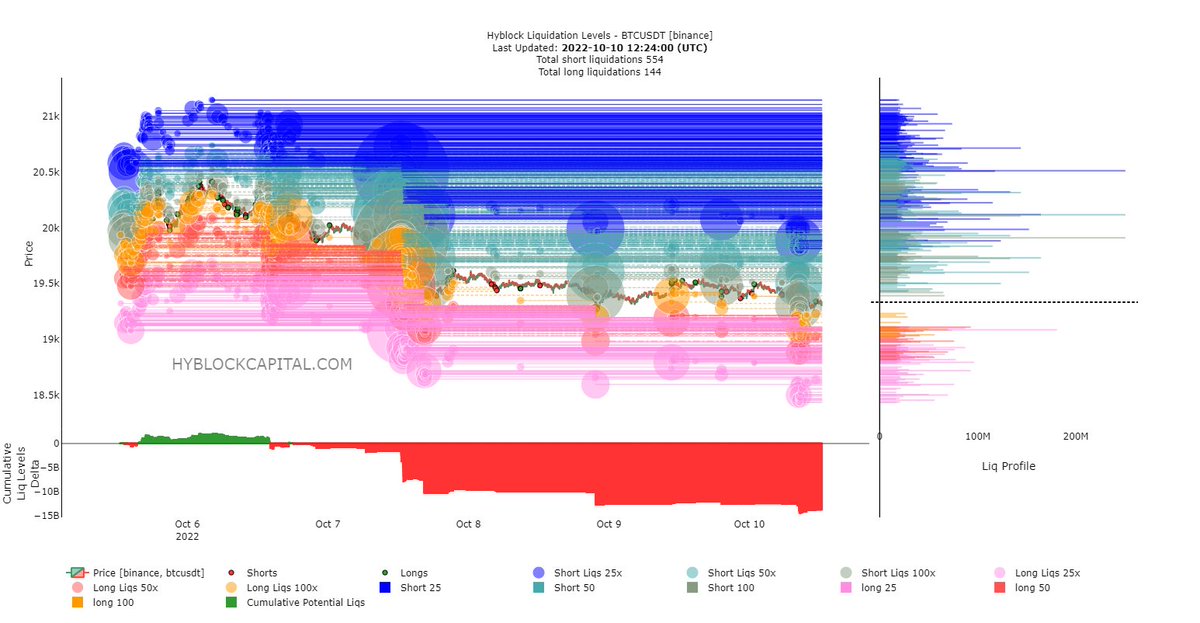

To hit key long liquidations levels at the same time as retail short liquidations were increasing.

This sets up the next move to liquidate the short positions.

To hit key long liquidations levels at the same time as retail short liquidations were increasing.

This sets up the next move to liquidate the short positions.

Loading suggestions...