Utility:

This is where tokens are a lot more complex to evaluate.

Nobody just evaluates shares without the business.

You shouldn't do this in crypto either, but paying attention to utility and mechanisms is a lot more important.

You know this. Let's look at the business side:

This is where tokens are a lot more complex to evaluate.

Nobody just evaluates shares without the business.

You shouldn't do this in crypto either, but paying attention to utility and mechanisms is a lot more important.

You know this. Let's look at the business side:

Fundamentals:

If the tokenomics are great, but the project or business is not, then that’s a huge red flag.

An obvious part for traditional businesses, but often overlooked in crypto.

These questions might help you assess a crypto business.

If the tokenomics are great, but the project or business is not, then that’s a huge red flag.

An obvious part for traditional businesses, but often overlooked in crypto.

These questions might help you assess a crypto business.

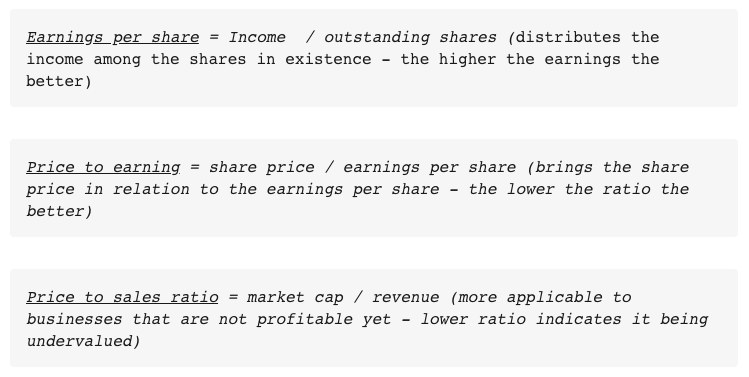

Evaluating tokens:

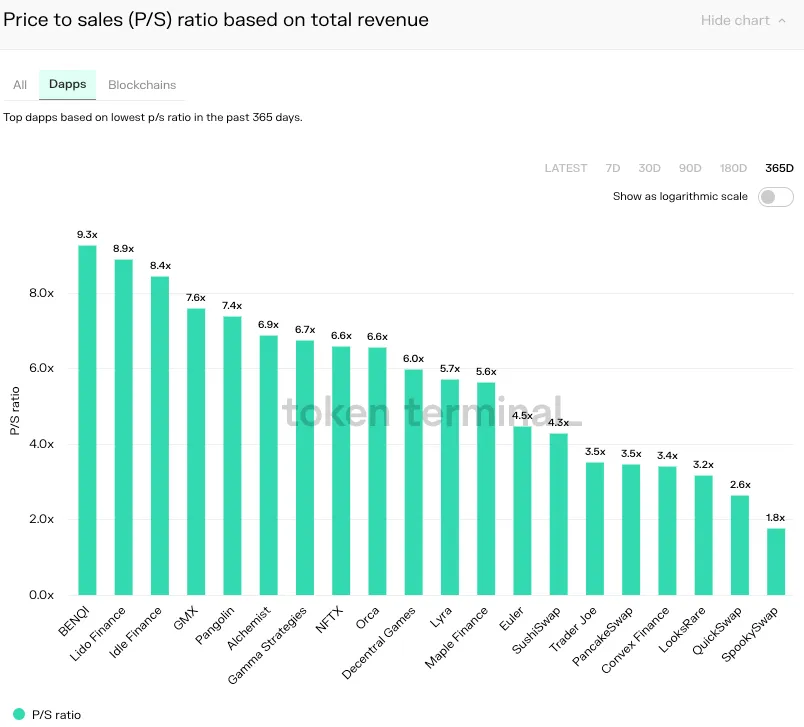

@tokenterminal gives good insights, showing that LooksRare with a P/S of 3.2x fits somewhat in the 4-6x range of smaller tech companies.

Sounds great? Let's bring in the token.

@tokenterminal gives good insights, showing that LooksRare with a P/S of 3.2x fits somewhat in the 4-6x range of smaller tech companies.

Sounds great? Let's bring in the token.

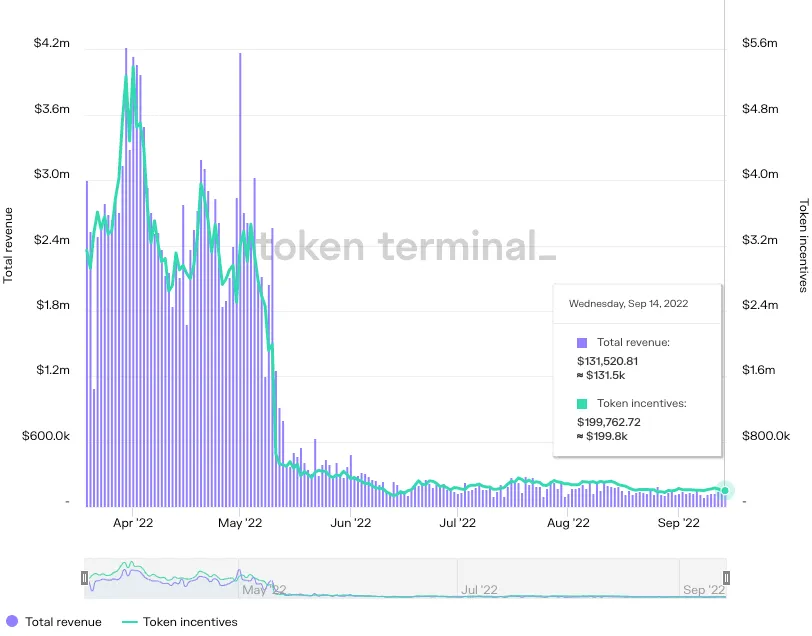

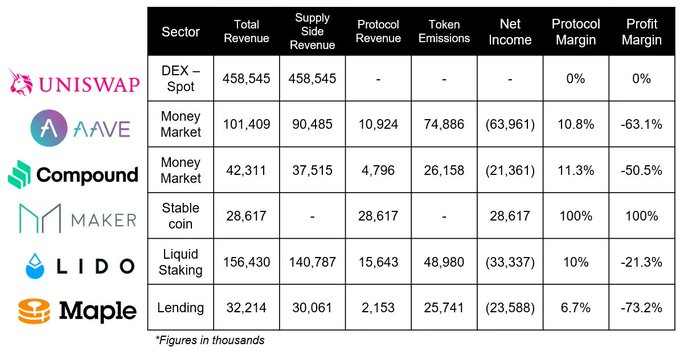

This great breakdown goes even deeper, showing that when deducting token emissions revenues don't look that great anymore.

Evaluating tokens like shares is a great idea, but the token often plays a very different role.

newsletter.banklesshq.com

Evaluating tokens like shares is a great idea, but the token often plays a very different role.

newsletter.banklesshq.com

Token Terminal has since added even better data points

Governance:

If we look at crypto businesses like real businesses, governance becomes interesting.

Instead of searching for a number-go-up mechanism, try to find those that have sustainable revenue and a path towards profit.

A pure governance token might be a good proxy then.

If we look at crypto businesses like real businesses, governance becomes interesting.

Instead of searching for a number-go-up mechanism, try to find those that have sustainable revenue and a path towards profit.

A pure governance token might be a good proxy then.

In summary, it's important to look at both business and mechanism

Don’t disregard either

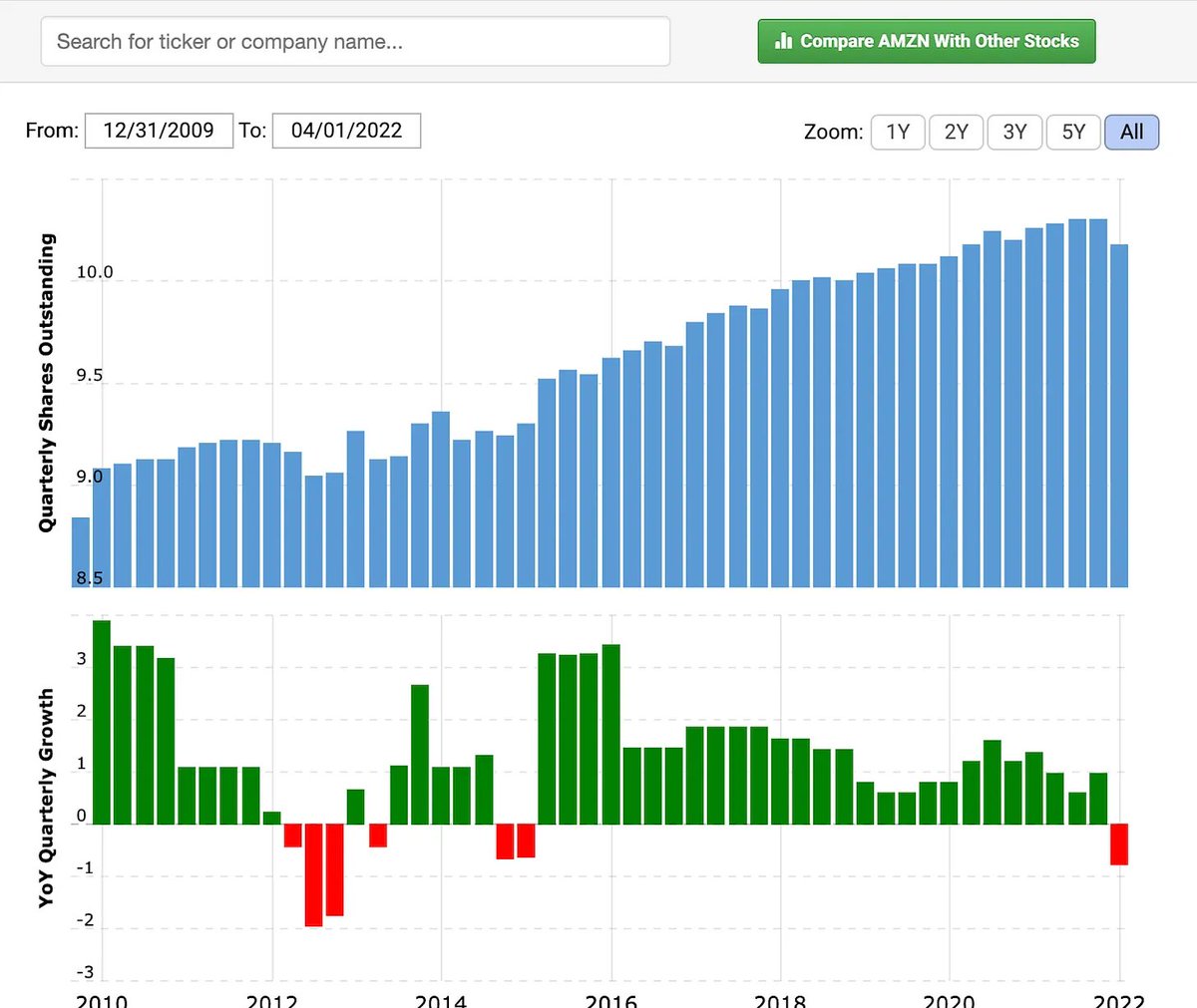

Crypto should be evaluated with the tools that exist for traditional businesses

The token makes things a little more complex though, and require us to evaluate both business and mechansim

Don’t disregard either

Crypto should be evaluated with the tools that exist for traditional businesses

The token makes things a little more complex though, and require us to evaluate both business and mechansim

Read the full breakdown of the topic here:

Questions? Would like to discuss? Join us on Discord

discord.gg

discord.gg

Loading suggestions...