1. RSI Strategy

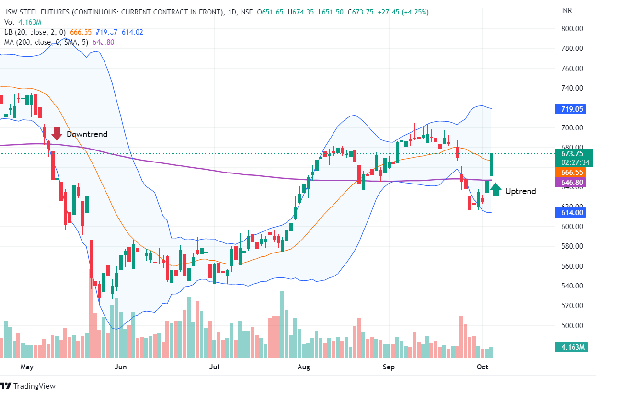

The Bollinger Bands indicator is excellent for identifying value areas on your chart. But there’s a problem: it doesn’t tell you whether the move is strong or weak. 👇

The Bollinger Bands indicator is excellent for identifying value areas on your chart. But there’s a problem: it doesn’t tell you whether the move is strong or weak. 👇

2. The Options Trading Strategy

The Bollinger Band indicator has the advantage of making it very easy to identify periods when the

market is more likely to break out in the near term. 👇

The Bollinger Band indicator has the advantage of making it very easy to identify periods when the

market is more likely to break out in the near term. 👇

The main advantages of this are that it allows

options traders to, while also allowing them to identify potentially profitable trading opportunities 👇

options traders to, while also allowing them to identify potentially profitable trading opportunities 👇

Loading suggestions...