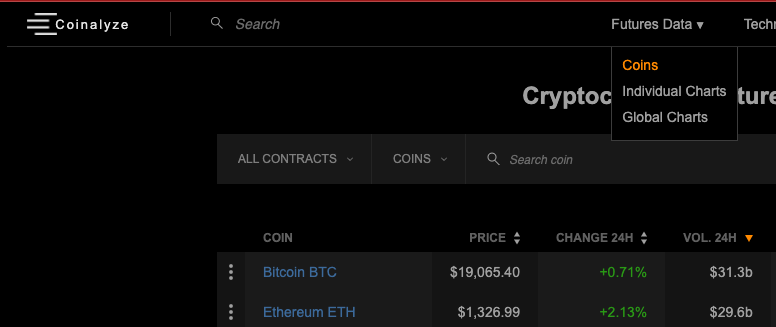

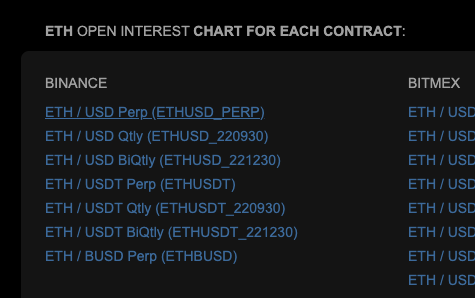

So to get this up and running first head to coinalyze.net > Futures Data > Coins

In this example, I'll choose $ETH

In this example, I'll choose $ETH

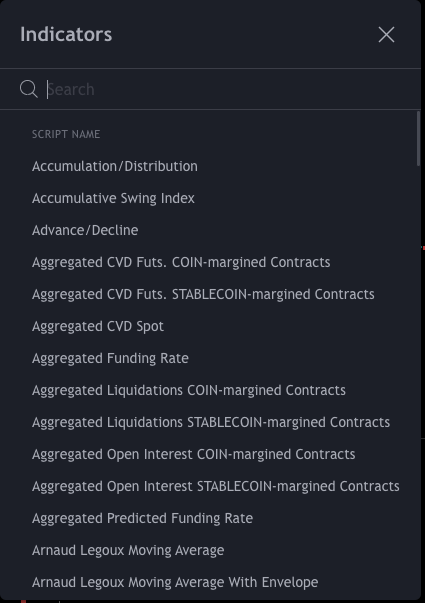

Now you're on this TradingView chart again, but the Indicators Tab will have a whole bunch of indicators that are only available on @coinalyzetool

The ones we want to set up are the following:

- Volume

- Aggregated Open Interest STABLECOIN-margined

- Aggregated CVD Spot

- Aggregated CVD Futs. STABLECOIN-margined

- Predicted Funding Rate

- Aggregated Liquidations STABLECOIN-margined

- Volume

- Aggregated Open Interest STABLECOIN-margined

- Aggregated CVD Spot

- Aggregated CVD Futs. STABLECOIN-margined

- Predicted Funding Rate

- Aggregated Liquidations STABLECOIN-margined

Now I'm not going to spell out how to use each of these as a lot of this comes from experience and has to be used in conjunction with other context-specific things like Macro, event risk, what's happening on the higher time frame chart etc.

This data is most useful on LTF like the 5 min or 15 minute when planning an exit or entry. In general, look for signs of froth in OI, crowded funding positioning, spot deviating from what perps are doing, and a relatively quiet period of liquidations (calm before a storm?)

You'll notice these charts disappear and you'll have to set it all up again if you close the tab you're on. I have a premium account and I think it's worth it. But by now y'all know I ain't the kinda guy to shill a ref link so figure out if it's worth it for you.

Peace ✌️

Peace ✌️

Loading suggestions...