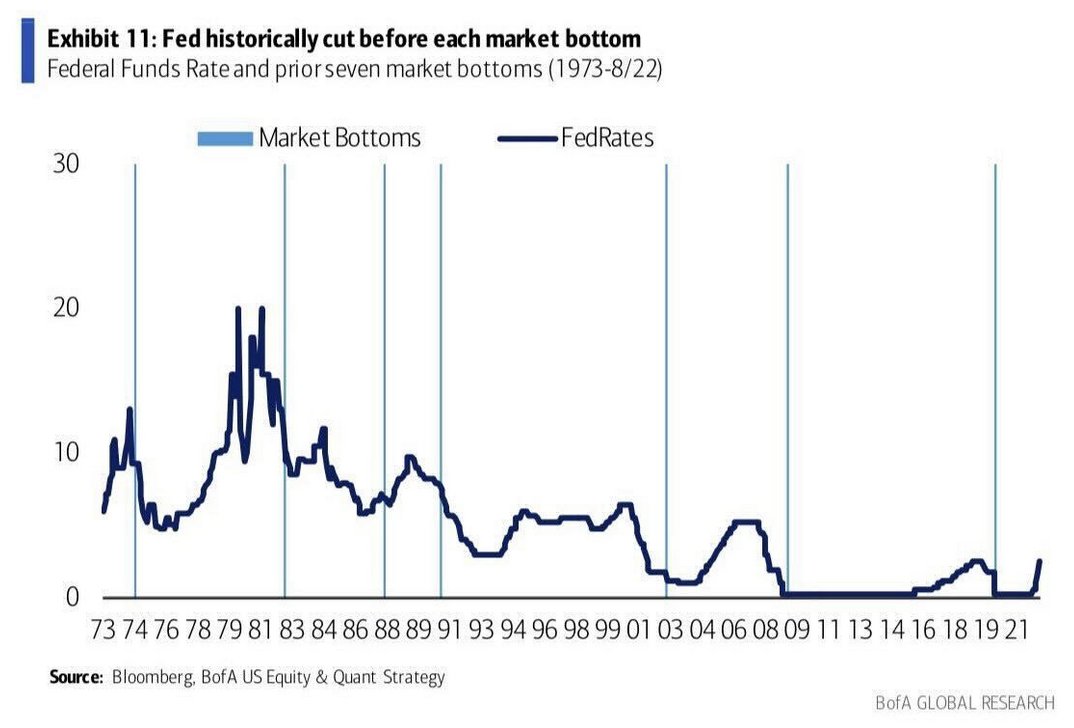

The Fed is driving backwards.

Is a soft-ish landing still possible?

Let's see what the charts are saying 🧵

By @bgilliam1982

Is a soft-ish landing still possible?

Let's see what the charts are saying 🧵

By @bgilliam1982

9/ Daily Macro And Crypto Breakdowns

Subscribe to our free newsletter and receive @bgilliam1982's daily breakdown of the markets.

blockworks.co

Subscribe to our free newsletter and receive @bgilliam1982's daily breakdown of the markets.

blockworks.co

Loading suggestions...