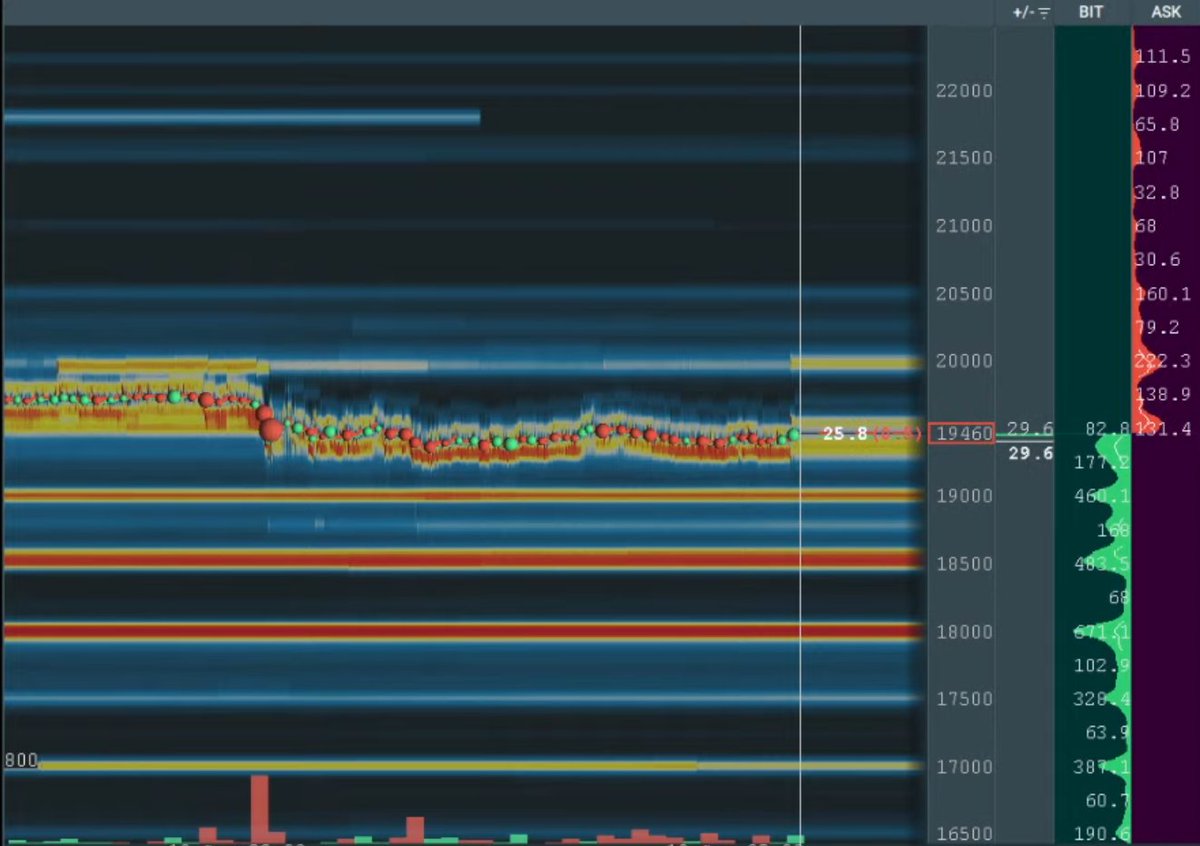

So the liquidity we see in the orderbook (tweet n.2) is pretty much in my opinion:

$19k and $18.5k stop losses (tweet n.1)

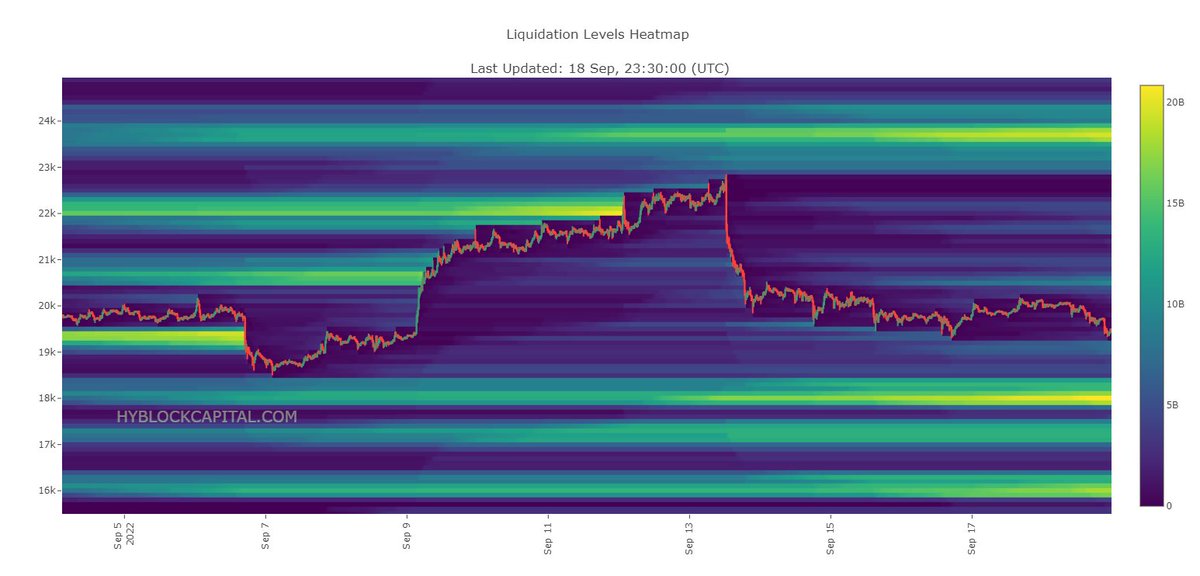

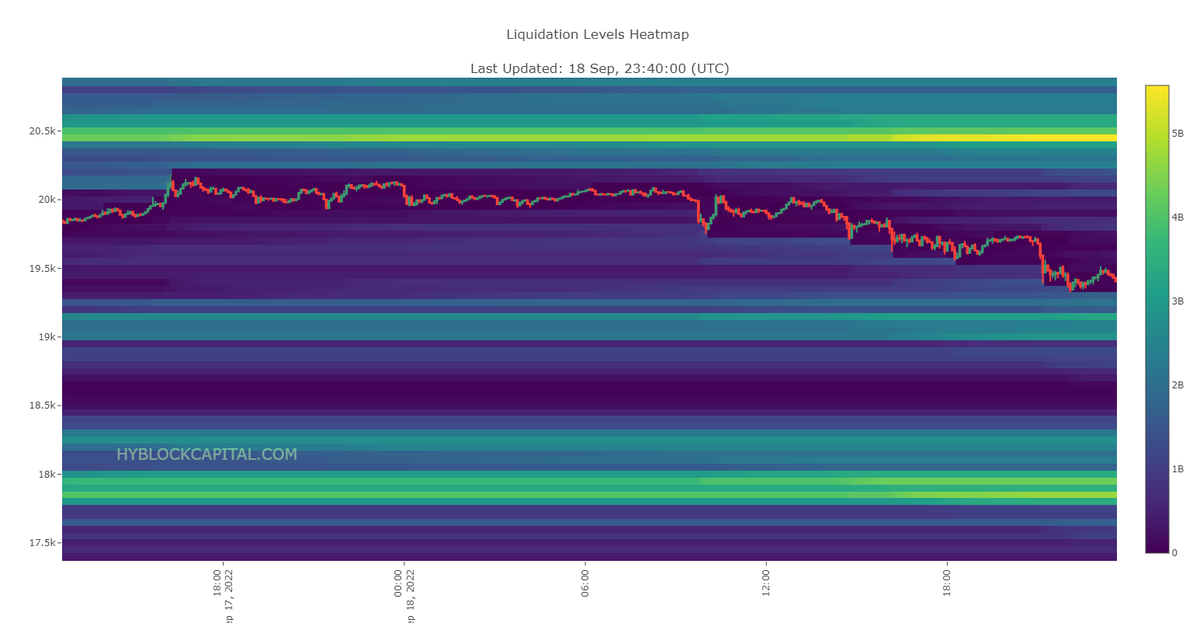

$18k liquidations (1 month tf) (tweet n.3)

It's too much liquidity to leave behind. I can't imagine a definite move up without attacking these zones first

$19k and $18.5k stop losses (tweet n.1)

$18k liquidations (1 month tf) (tweet n.3)

It's too much liquidity to leave behind. I can't imagine a definite move up without attacking these zones first

A recap:

It should be a week marked by the news announcements on Wednesday.

75bsp is very likely priced in so we could see some fake moves until Wednesday and a potential bounce to the imbalance $21k-$22k.

100bsp and they'll attack the SL and liquidations below current price.

It should be a week marked by the news announcements on Wednesday.

75bsp is very likely priced in so we could see some fake moves until Wednesday and a potential bounce to the imbalance $21k-$22k.

100bsp and they'll attack the SL and liquidations below current price.

Loading suggestions...