Now let's get to work.

We will teach you how to do this in 6 simple steps via Morningstar’s website (morningstar.com). We take Quality Company Mastercard ($MA) as an example.

We will teach you how to do this in 6 simple steps via Morningstar’s website (morningstar.com). We take Quality Company Mastercard ($MA) as an example.

Step 1: Look at the company profile.

Go to Morningstar and take a look at the company profile of the firm you are looking at.

Make sure that you understand how the company makes money. If you don’t understand the business model, you can stop looking at the stock right away.

Go to Morningstar and take a look at the company profile of the firm you are looking at.

Make sure that you understand how the company makes money. If you don’t understand the business model, you can stop looking at the stock right away.

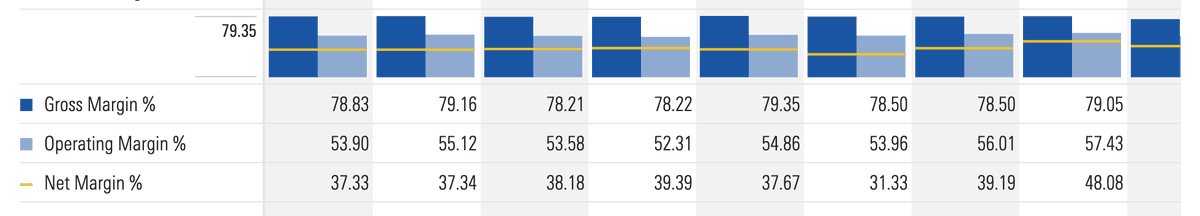

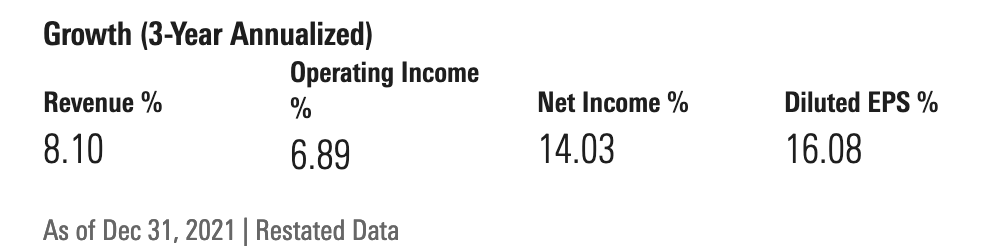

Step 2: Only invest in very profitable companies.

Go to the tab ‘Operating Performance’ and look at the profitability.

You want to invest in companies with a consistent gross margin of at least 50% and a profit margin of at least 15%.

Go to the tab ‘Operating Performance’ and look at the profitability.

You want to invest in companies with a consistent gross margin of at least 50% and a profit margin of at least 15%.

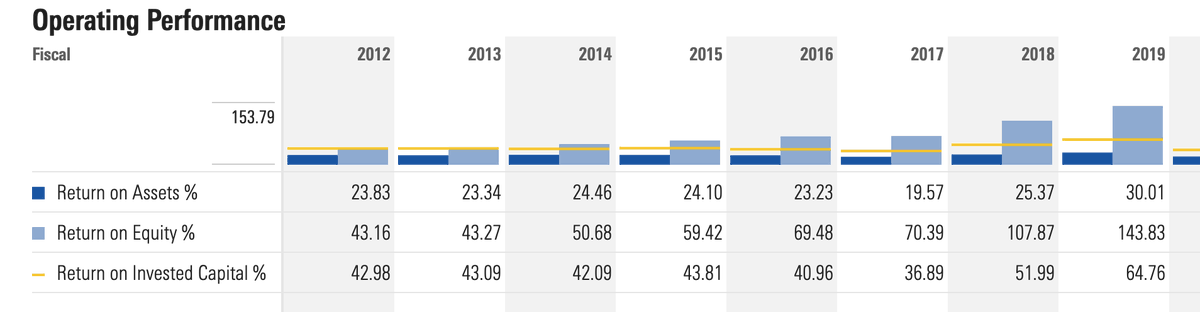

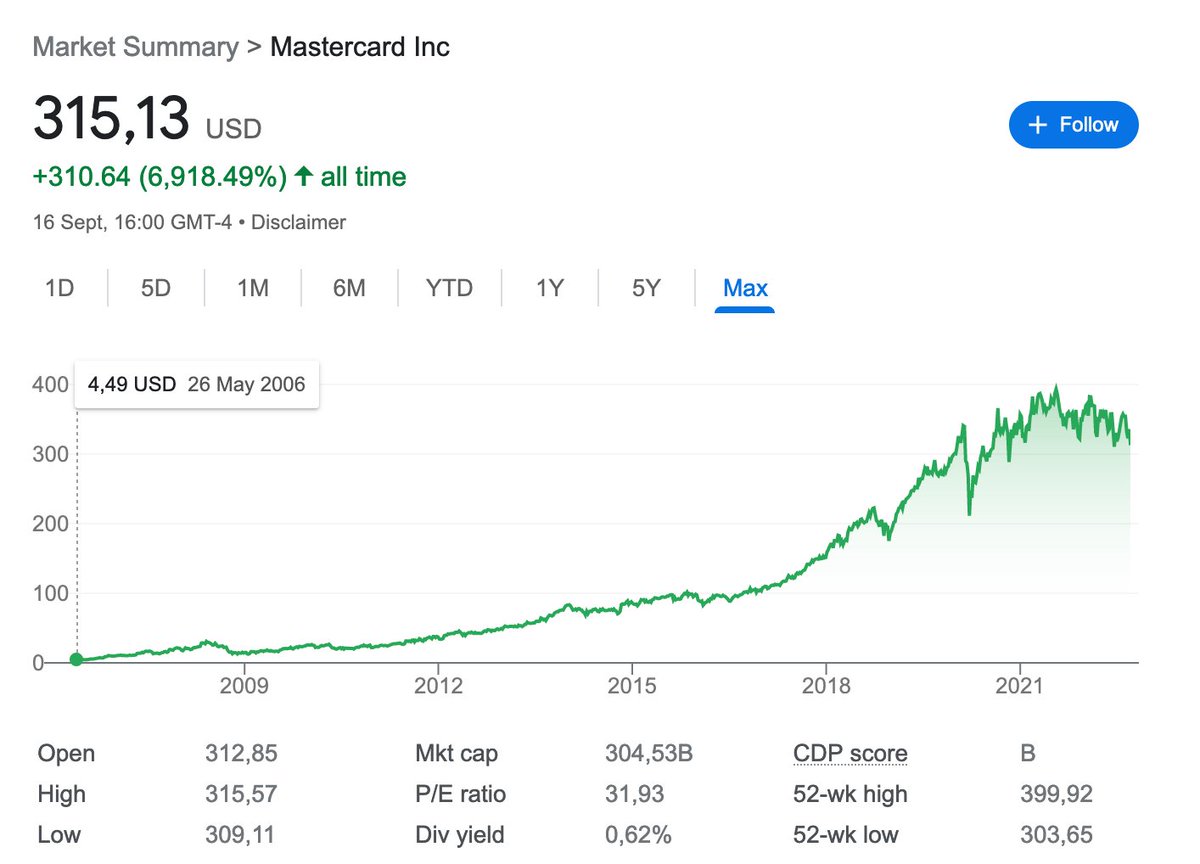

Step 4: Only invest in winners.

As a Quality Investor, you only want to invest in winners.

Via the tab trailing returns you can look at the annual stock price performance over the past 15 years.

As a Quality Investor, you only want to invest in winners.

Via the tab trailing returns you can look at the annual stock price performance over the past 15 years.

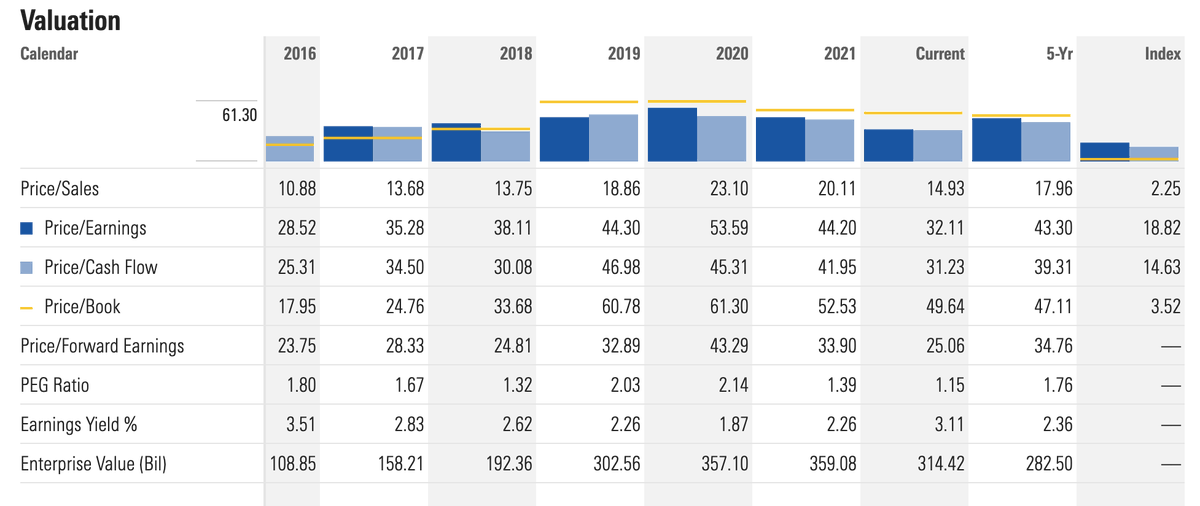

Step 6: Don’t overpay.

Look at the valuation of the company (you can do this via the ‘Valuation’ tab on Morningstar).

You don’t want to pay too much for a stock.

Look at the valuation of the company (you can do this via the ‘Valuation’ tab on Morningstar).

You don’t want to pay too much for a stock.

Compare the current price/cash flow ratio with the average price/cash flow ratio of the company over the past 5 years.

Invest in companies that are trading at a discount compared to its average valuation of the past 5 years.

Invest in companies that are trading at a discount compared to its average valuation of the past 5 years.

In a deeper analysis, you should look at the moat, the integrity of management, the capital intensity, expected growth, and so on.

It's a wrap!

If you liked this thread, you'll love our website: qualitycompounding.substack.com

If you liked this thread, you'll love our website: qualitycompounding.substack.com

If you liked this thread, please retweet the first tweet:

Loading suggestions...