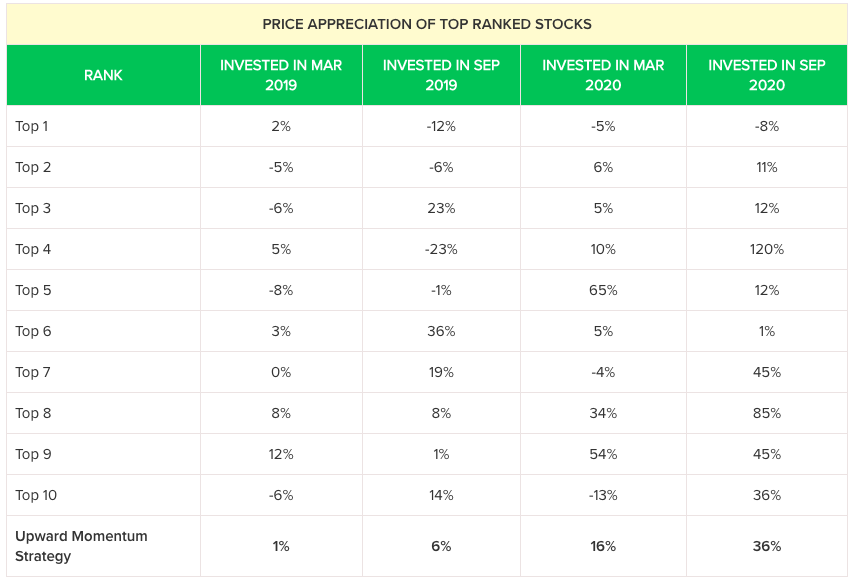

1. Momentum Investing is a strategy where investors buy rising shares and sell them when they look to have peaked

The goal is to take advantage of volatility, buy high and sell higher instead of the conventional wisdom of buy low, sell high.

The goal is to take advantage of volatility, buy high and sell higher instead of the conventional wisdom of buy low, sell high.

Such investors hope the upward trajectory of the stock will continue for some time and seek to take advantage of it

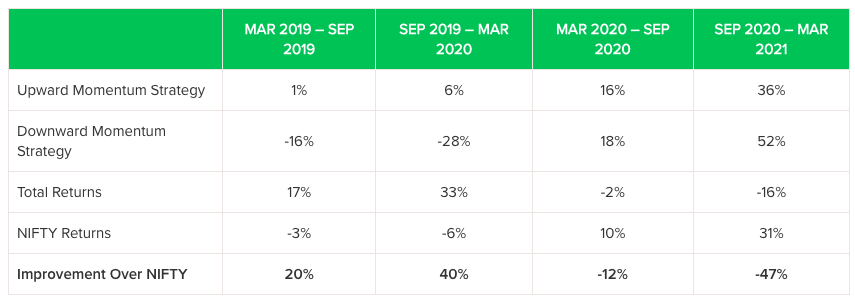

Stocks that have outperformed are expected to continue their outperformance & stocks that have underperformed are expected to underperform even further

Stocks that have outperformed are expected to continue their outperformance & stocks that have underperformed are expected to underperform even further

high higher, low lower is the crux of Momentum investing

2. Momentum Effect is caused by

a/Overreaction of the market in both outperformance and underperformance

b/Conservatism Bias - Investors react slowly to new information, and this causes delay in a trend to reverse

2. Momentum Effect is caused by

a/Overreaction of the market in both outperformance and underperformance

b/Conservatism Bias - Investors react slowly to new information, and this causes delay in a trend to reverse

5. Two likely drawbacks of Momentum Strategy are

A/ Higher volatility in returns compared to the Market cap index

B/ Higher transaction cost due to the churning of the Portfolio at regular intervals

A/ Higher volatility in returns compared to the Market cap index

B/ Higher transaction cost due to the churning of the Portfolio at regular intervals

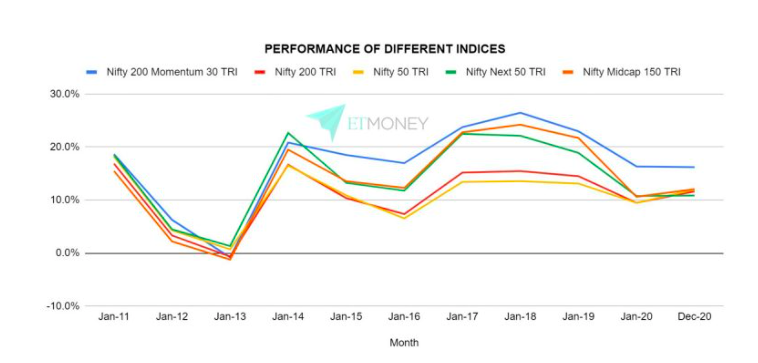

UTI Nifty 200 Momentum 30 Index Fund is a passive index fund which can be used to try the momentum strategy without getting into the complexity of doing it on own

However it is best to be cautious and use this if you are okay with high volatility and cost

However it is best to be cautious and use this if you are okay with high volatility and cost

If you liked this thread

Consider sharing and following. I write threads on Investment related topics regularly

Thanks for your time.

Consider sharing and following. I write threads on Investment related topics regularly

Thanks for your time.

جاري تحميل الاقتراحات...