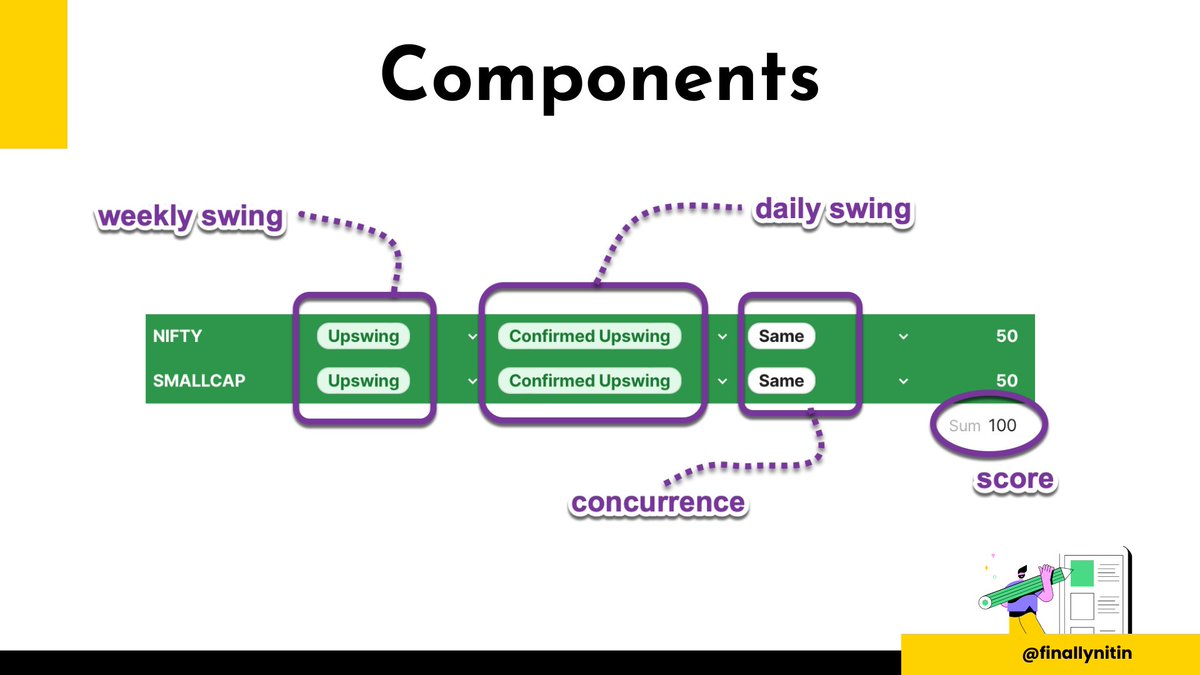

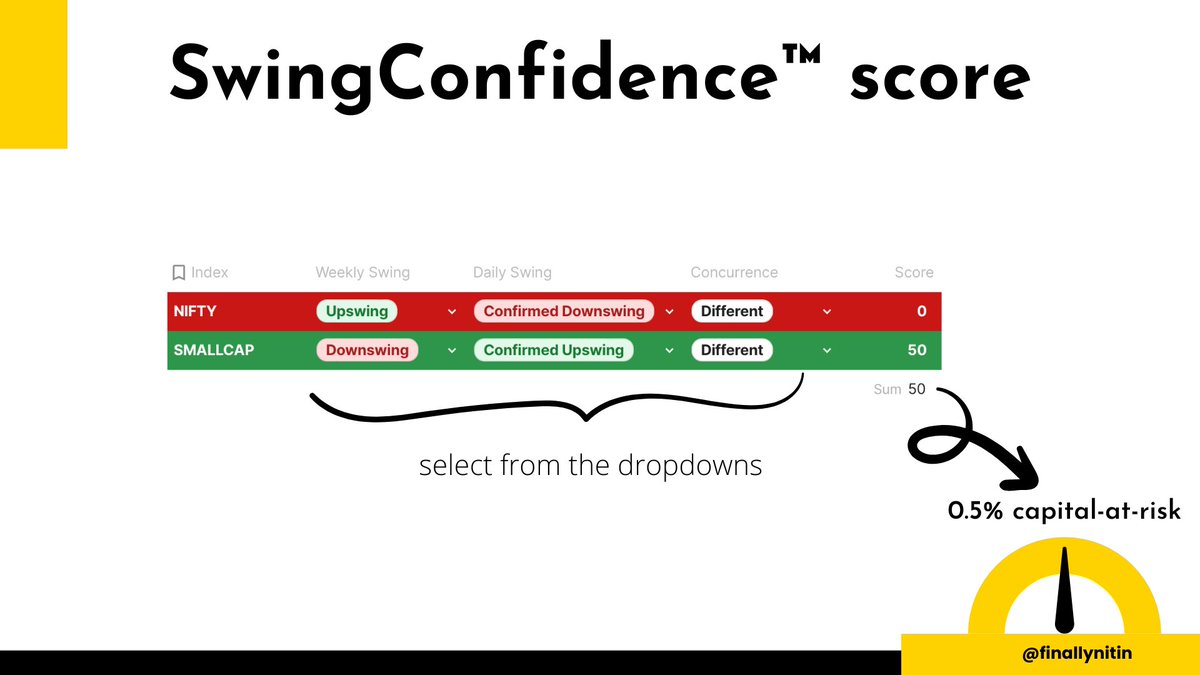

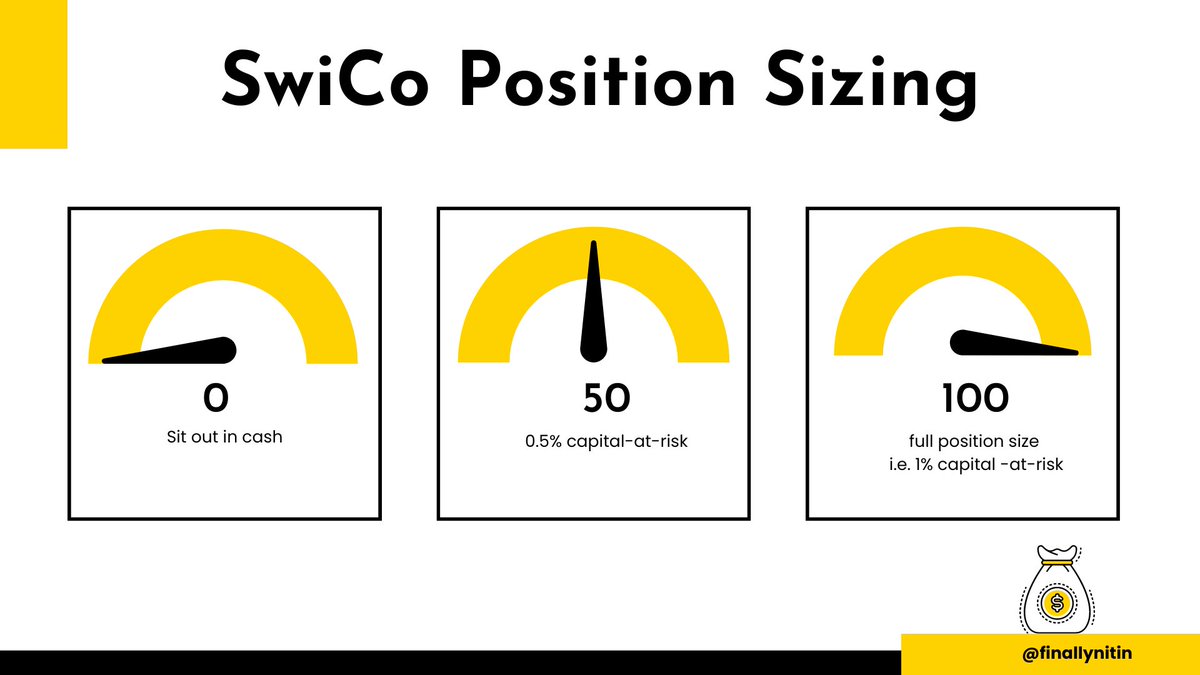

SwingConfidence™ is a scoring system that helps us decide position size in swing trading, & take sit-out-in-cash decisions in an objective way.

Here is the SwingConfidence™ tool where you can now calculate the score (on your own) daily:

@finallynitin/swingconfidence" target="_blank" rel="noopener" onclick="event.stopPropagation()">coda.io

Here is the SwingConfidence™ tool where you can now calculate the score (on your own) daily:

@finallynitin/swingconfidence" target="_blank" rel="noopener" onclick="event.stopPropagation()">coda.io

Hope you find this useful. If you'd like to read this as a newsletter (& without Twitter’s word limit), find it here:

world.hey.com

world.hey.com

Loading suggestions...