1/ BarnBridge V2 launched yesterday.

The goal is to offer the best fixed-rate yield in #DeFi

But how does it actuallly work?🧵

The goal is to offer the best fixed-rate yield in #DeFi

But how does it actuallly work?🧵

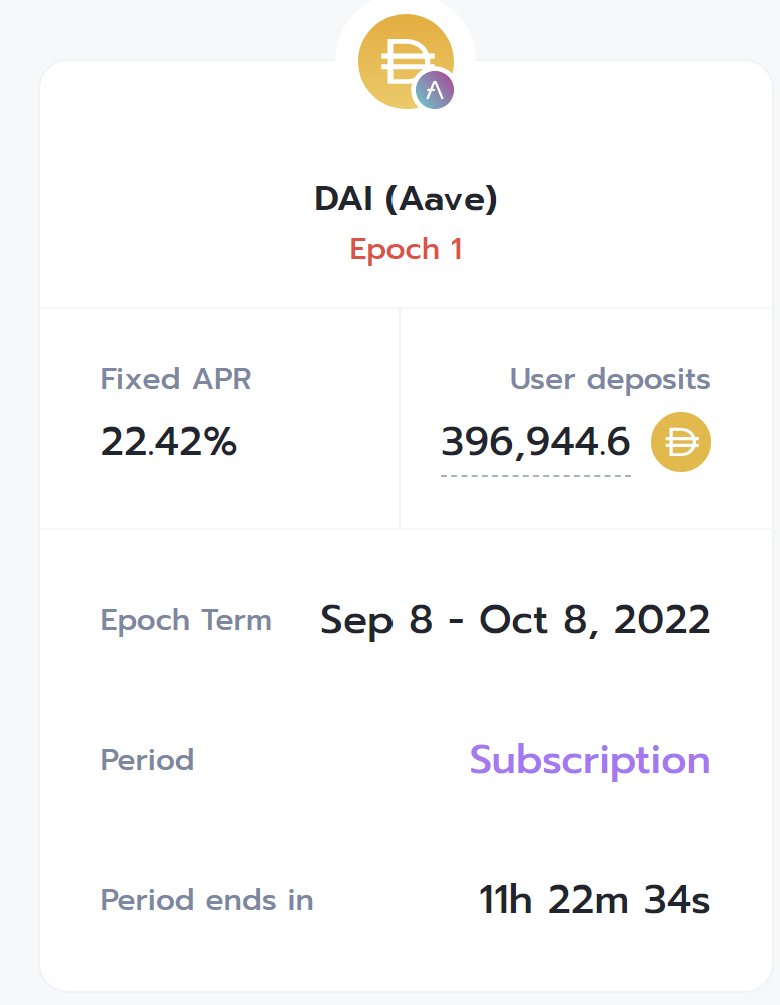

4/ Finally the Epoch running period starts for a fixed period of time for a fixed interest rate.

No deposits or withdrawals are allowed.

No deposits or withdrawals are allowed.

5/ If you suddenly need your deposited money, there is a way.

When you make a deposit, you receive ERC-20 pool tokens that represent your share of the active pool.

They are transferable, but you need to find a counterparty willing to buy Proof of Liquidity tokens from you.

When you make a deposit, you receive ERC-20 pool tokens that represent your share of the active pool.

They are transferable, but you need to find a counterparty willing to buy Proof of Liquidity tokens from you.

8/ BarnBridge V2 is currently live on #Ethereum

But soon it will launch on @optimismFND for lower gas fees.

It makes sense, as depositing and withdrawing from Epoch costs gas, which would cut down on that precious yield.

But soon it will launch on @optimismFND for lower gas fees.

It makes sense, as depositing and withdrawing from Epoch costs gas, which would cut down on that precious yield.

Loading suggestions...