You all know what dollar cost averaging is. Pick an asset:

- Buy a fixed $ amount of that asset.

- Do that at regular time intervals.

Continue until you are tired of it.

- Buy a fixed $ amount of that asset.

- Do that at regular time intervals.

Continue until you are tired of it.

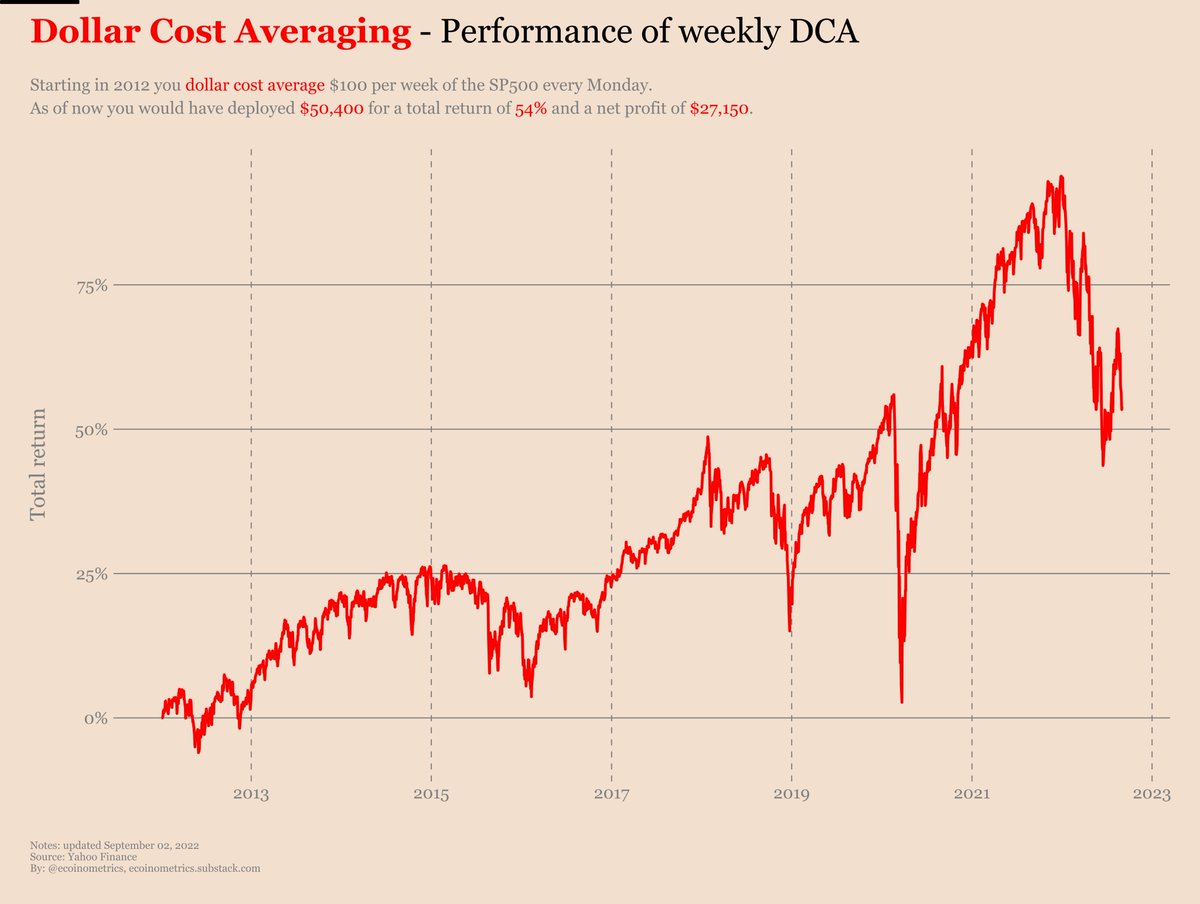

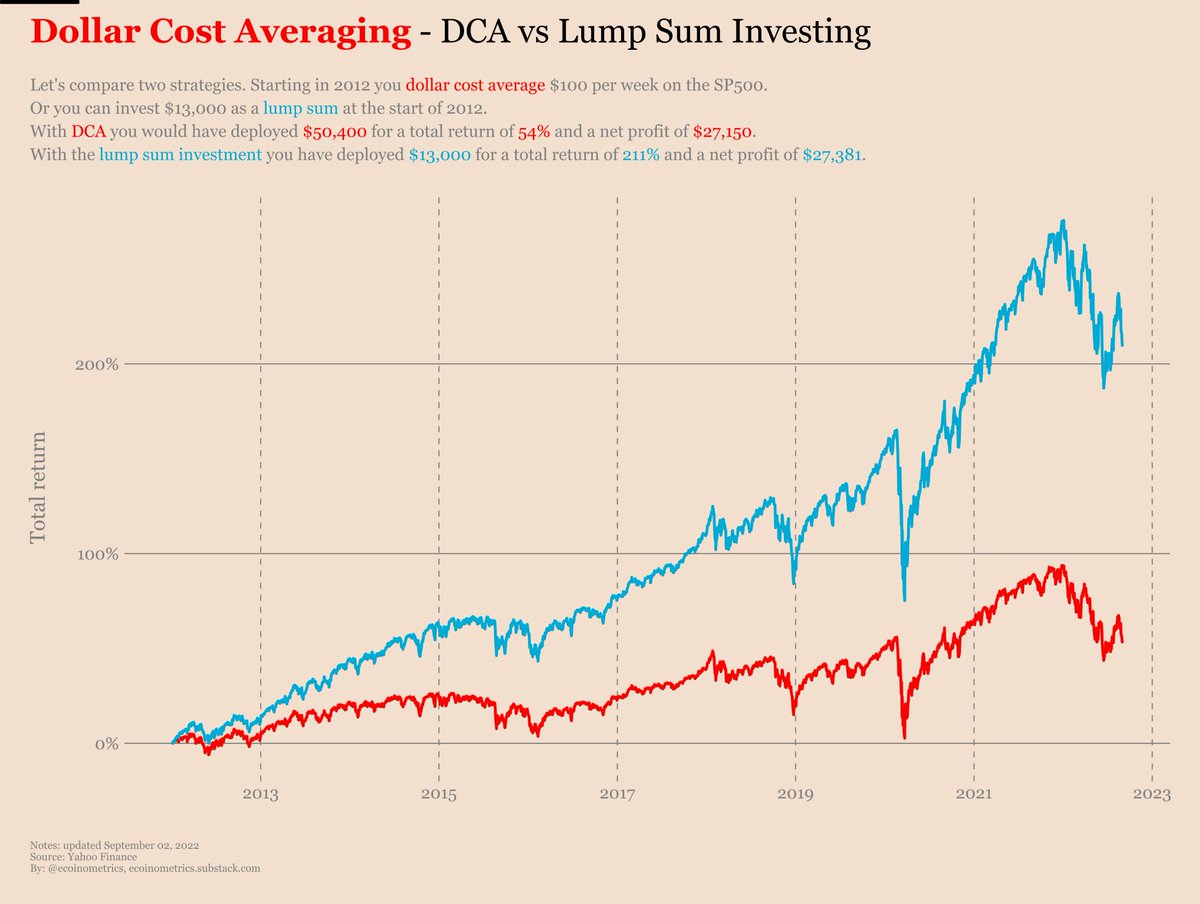

Now the reason is simple. If you DCA long enough in an uptrend, the average price at which you have been buying will be moving up and up and up.

Since your ROI is based on that average price that means the longer you DCA in a bull market the worst performance you get.

Since your ROI is based on that average price that means the longer you DCA in a bull market the worst performance you get.

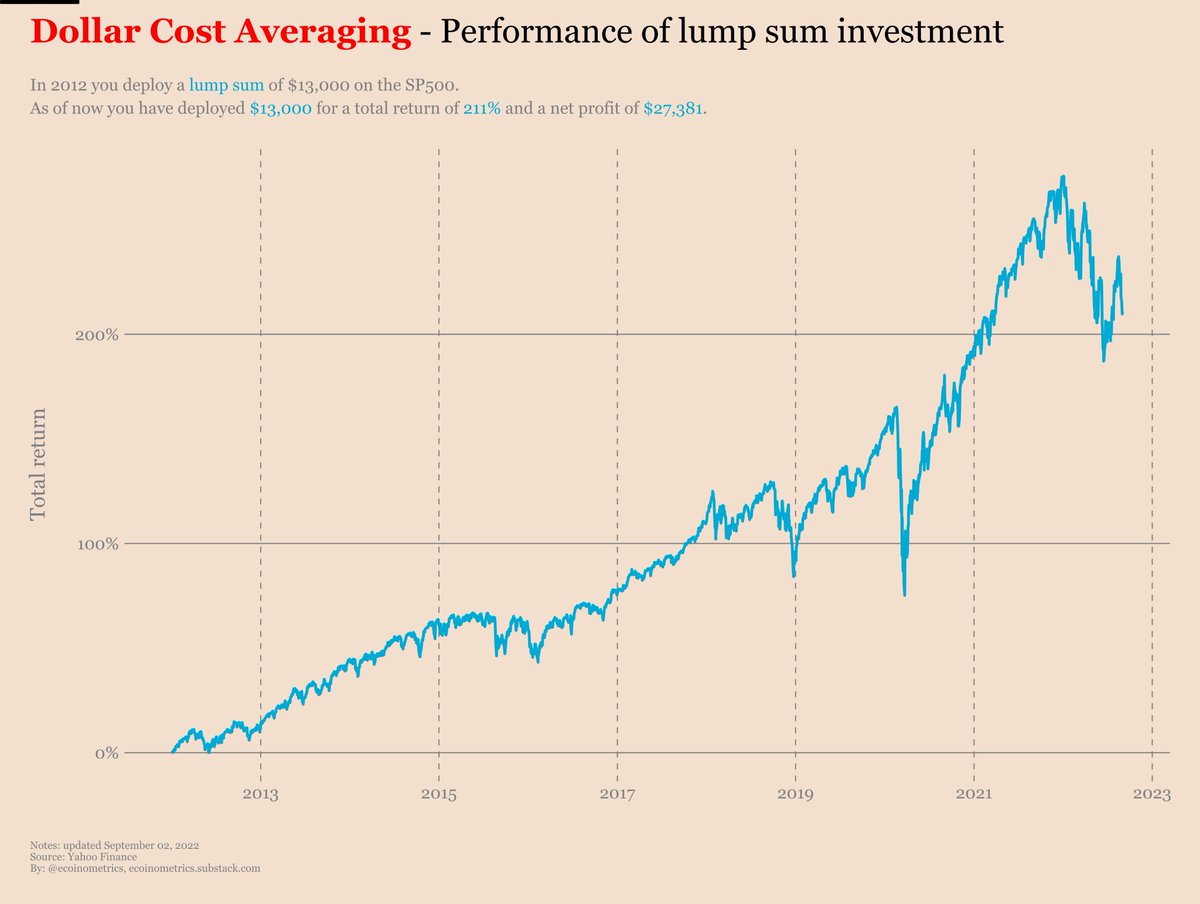

Of course if you don’t have enough capital to deploy a big lump sum, dollar cost averaging can still be put to good use.

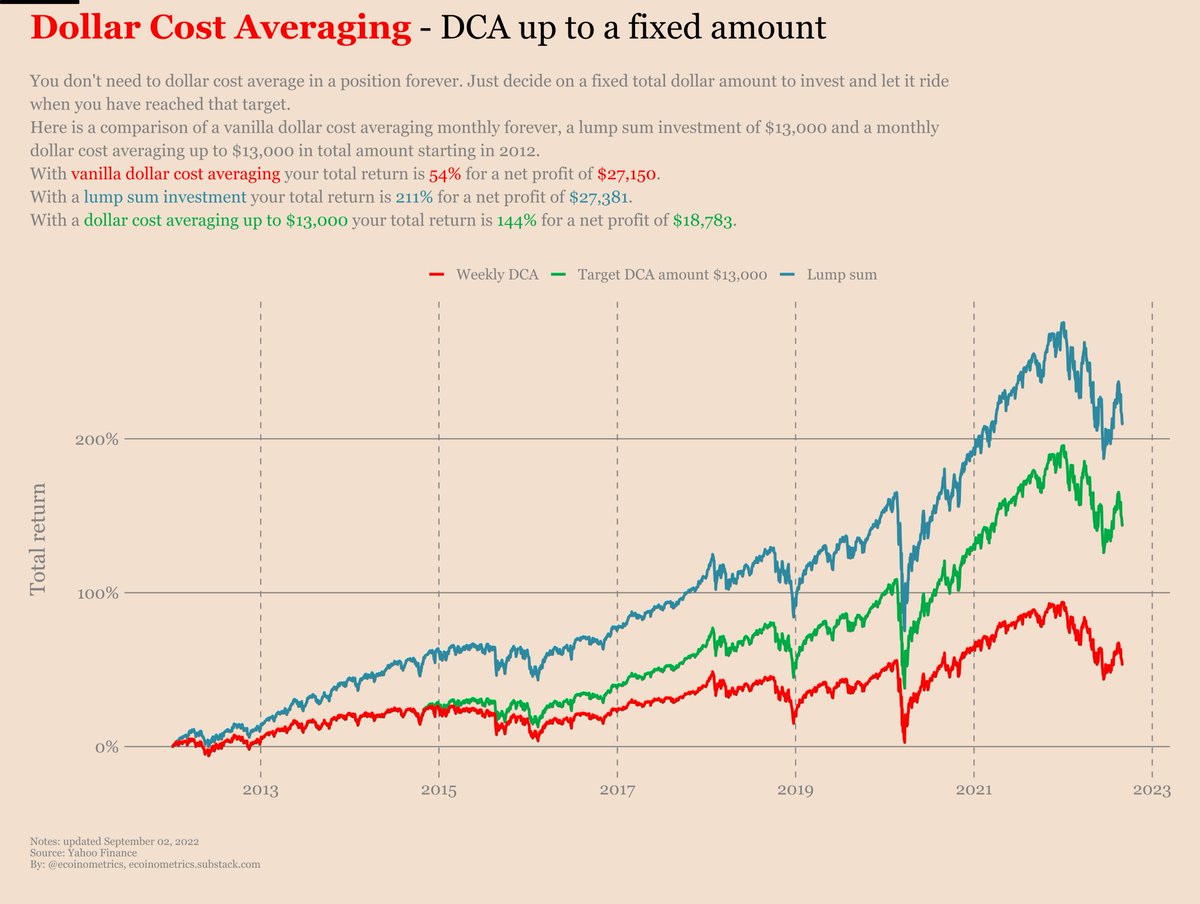

Choose a fixed amount of cash you want to deploy on a position. DCA up to that amount. Then just let that investment grow by itself.

Choose a fixed amount of cash you want to deploy on a position. DCA up to that amount. Then just let that investment grow by itself.

Now it isn't always about pure ROI.

Say you expect the SP500 to continue growing at a rate somewhere north of 6% annualized.

Then using DCA as a savings strategy with compounding effects totally makes sense.

You should always tailor your investment strategies to your goals.

Say you expect the SP500 to continue growing at a rate somewhere north of 6% annualized.

Then using DCA as a savings strategy with compounding effects totally makes sense.

You should always tailor your investment strategies to your goals.

This is just one aspect of DCA. There is much more to learn if you want to dig deeper.

Does it matter how often you do it? Is the day of the week you DCA on important?

For answers to these questions and more go checkout the article.

ecoinometrics.com

Does it matter how often you do it? Is the day of the week you DCA on important?

For answers to these questions and more go checkout the article.

ecoinometrics.com

If you want more analysis of investment strategies backed by data gives us a follow @ecoinometrics and go checkout the Ecoinometrics newsletter.

ecoinometrics.substack.com

ecoinometrics.substack.com

PS Here is another thread you don’t want to miss: why it is never too late to invest in the big trends…

جاري تحميل الاقتراحات...