1. Microeconomics vs. Macroeconomics

Sleep, like many other investors, focuses on microeconomics instead of macroeconomics.

He calls this an “information diet.”

He ignores noise that doesn’t influence his investment decisions.

Sleep, like many other investors, focuses on microeconomics instead of macroeconomics.

He calls this an “information diet.”

He ignores noise that doesn’t influence his investment decisions.

Macroeconomics also often acts as a call to action.

Every week something seemingly important happens, and you feel the urge to act on that news.

For investors like Sleep, this is a negative. Their success stems from inaction.

Every week something seemingly important happens, and you feel the urge to act on that news.

For investors like Sleep, this is a negative. Their success stems from inaction.

2. Never Break Your Rules

Since being always rational is impossible, you need a clear set of rules.

Think about your investment strategy and figure out those things that pose the biggest risk to its success.

Most of the time, it’ll be leverage or derivatives.

Since being always rational is impossible, you need a clear set of rules.

Think about your investment strategy and figure out those things that pose the biggest risk to its success.

Most of the time, it’ll be leverage or derivatives.

3. What’s the Destination?

An investor should know what’s the final destination of a company.

Obviously, you can’t know specific numbers.

But you should have an idea of the industries it’ll eventually operate in, the size of those markets, and the position it’ll take.

An investor should know what’s the final destination of a company.

Obviously, you can’t know specific numbers.

But you should have an idea of the industries it’ll eventually operate in, the size of those markets, and the position it’ll take.

From there, you can reverse engineer what needs to be done to get there.

In most cases, you’ll realize it’s tough to figure these points out.

But every now and then, there will be a company that these questions can be answered for.

Those can be big opportunities.

In most cases, you’ll realize it’s tough to figure these points out.

But every now and then, there will be a company that these questions can be answered for.

Those can be big opportunities.

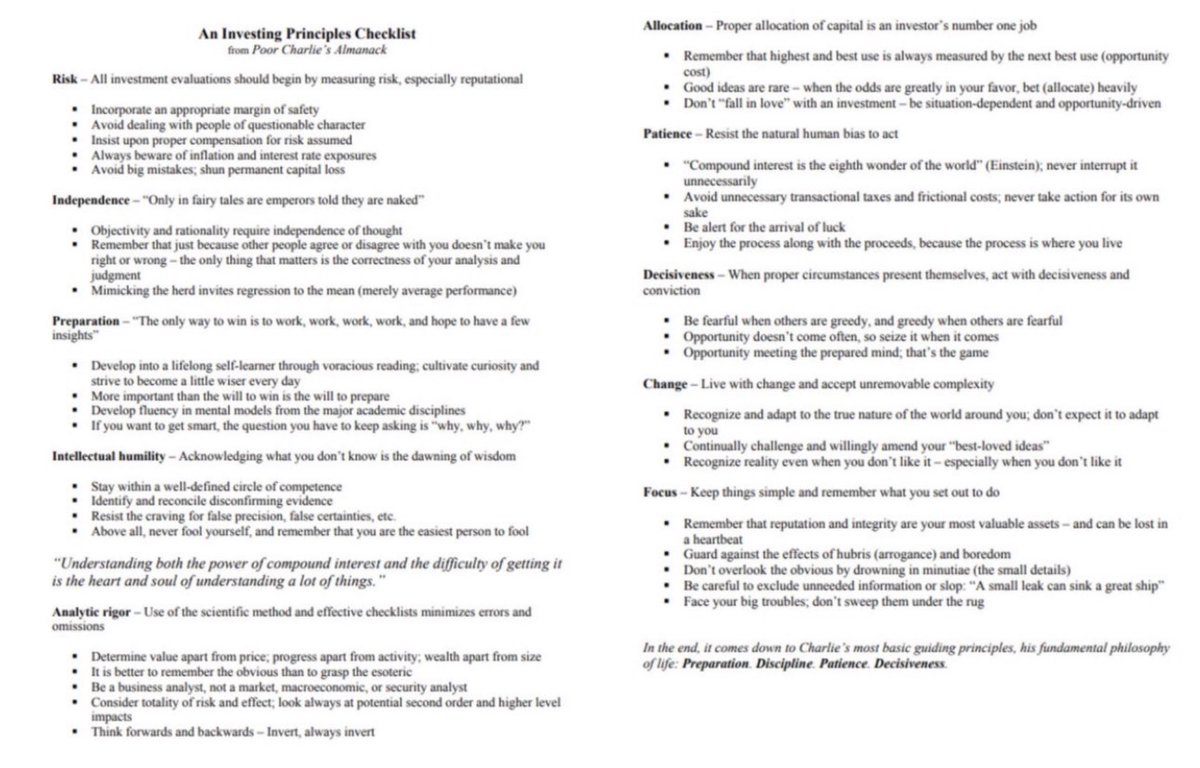

4. Lollapalooza Moat

When analyzing companies, Sleep looks for so-called “Lollapalooza Moats”.

Lollapalooza is a term popularized by Charlie Munger when discussing biases and how they interact.

When analyzing companies, Sleep looks for so-called “Lollapalooza Moats”.

Lollapalooza is a term popularized by Charlie Munger when discussing biases and how they interact.

Lollapalooza Moats consist of many small competitive advantages that add up and create a strong and well-diversified advantage.

Due to their diversification, these are the most durable moats and, therefore, the best compounders.

Due to their diversification, these are the most durable moats and, therefore, the best compounders.

5. Spawner

Apart from Lollapalooza Moats, Sleep also looks for Spawners.

Companies that have one big and profitable business that is responsible for the cash flows.

Simultaneously, it invests into many small ventures with huge potential.

Apart from Lollapalooza Moats, Sleep also looks for Spawners.

Companies that have one big and profitable business that is responsible for the cash flows.

Simultaneously, it invests into many small ventures with huge potential.

Most of them will fail.

But the money lost is only a small part of cash flows.

And the ones who succeed become huge and profitable new businesses.

Many of the big tech firms grew their businesses that way.

Today’s Cloud businesses are a perfect example of that.

But the money lost is only a small part of cash flows.

And the ones who succeed become huge and profitable new businesses.

Many of the big tech firms grew their businesses that way.

Today’s Cloud businesses are a perfect example of that.

That’s it for today!

If you learned something new, please Retweet and Like this Thread so more get to see it.

If you want to learn more about investing, follow me @MnkeDaniel to see them.

Have a great day!

If you learned something new, please Retweet and Like this Thread so more get to see it.

If you want to learn more about investing, follow me @MnkeDaniel to see them.

Have a great day!

Loading suggestions...