1/ Does generating high protocol fees convert into better token performance?

In other words, do #realyield tokens outperform other #DeFi tokens?

Let's find out 🧵

In other words, do #realyield tokens outperform other #DeFi tokens?

Let's find out 🧵

2/ I researched this question two months ago.

Before the #realyield narrative consolidated.

Back then the answer was no.

Short term product development/shilling > generated fees.

And now?

Before the #realyield narrative consolidated.

Back then the answer was no.

Short term product development/shilling > generated fees.

And now?

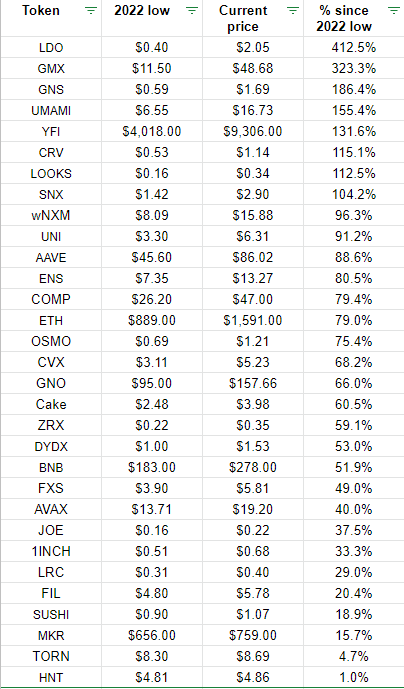

3/ This time the answer is yes. The narrative worked!

In general, tokens considered #realyield outperformed other #DeFi tokens.

$GMX, $GNS, $UMAMI, $SNX and $CRV price rebounds from all time lows were impressive!

Still, $LDO outperformed them all.

The merge > all else 😅

In general, tokens considered #realyield outperformed other #DeFi tokens.

$GMX, $GNS, $UMAMI, $SNX and $CRV price rebounds from all time lows were impressive!

Still, $LDO outperformed them all.

The merge > all else 😅

4/ It's worth mentioning, that not all high revenue generating tokens did so well.

$DYDX, $JOE or $ENS also generate high revenue

But token rebounds were much weaker than 'not real yield $UNI' and they failed to outperform $ETH.

$DYDX, $JOE or $ENS also generate high revenue

But token rebounds were much weaker than 'not real yield $UNI' and they failed to outperform $ETH.

5/ At the end of the day #crypto token prices are driven by narratives.

If with the #realyield you are looking for passive income, then stablecoin farming or #ETH staking might be the best choice for you.

If with the #realyield you are looking for passive income, then stablecoin farming or #ETH staking might be the best choice for you.

6/ Having said so, real revenue generation is a welcoming development in crypto.

It means protocols find Product Market Fit and manage to generate income during a tough bear market.

But we are still early, so don't expect to avoid volatility by investing in #realyield tokens.

It means protocols find Product Market Fit and manage to generate income during a tough bear market.

But we are still early, so don't expect to avoid volatility by investing in #realyield tokens.

7/ To learn more about #realyield tokens, check the OG threads below👇

8/ By @thedefiedge

9/ And by @TheDeFinvestor

Loading suggestions...