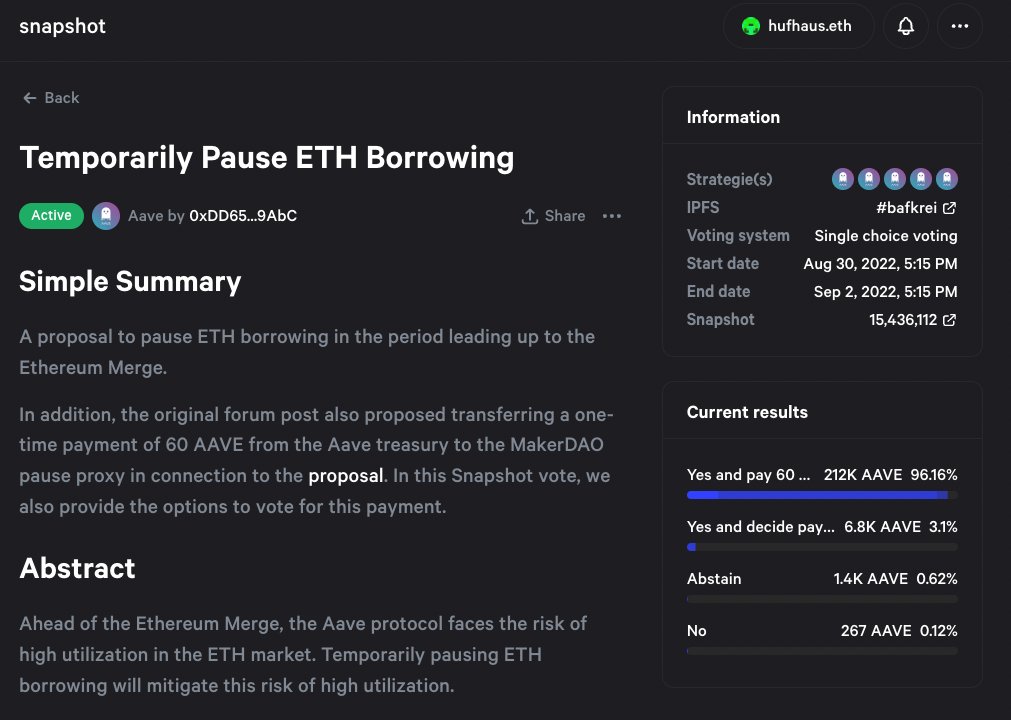

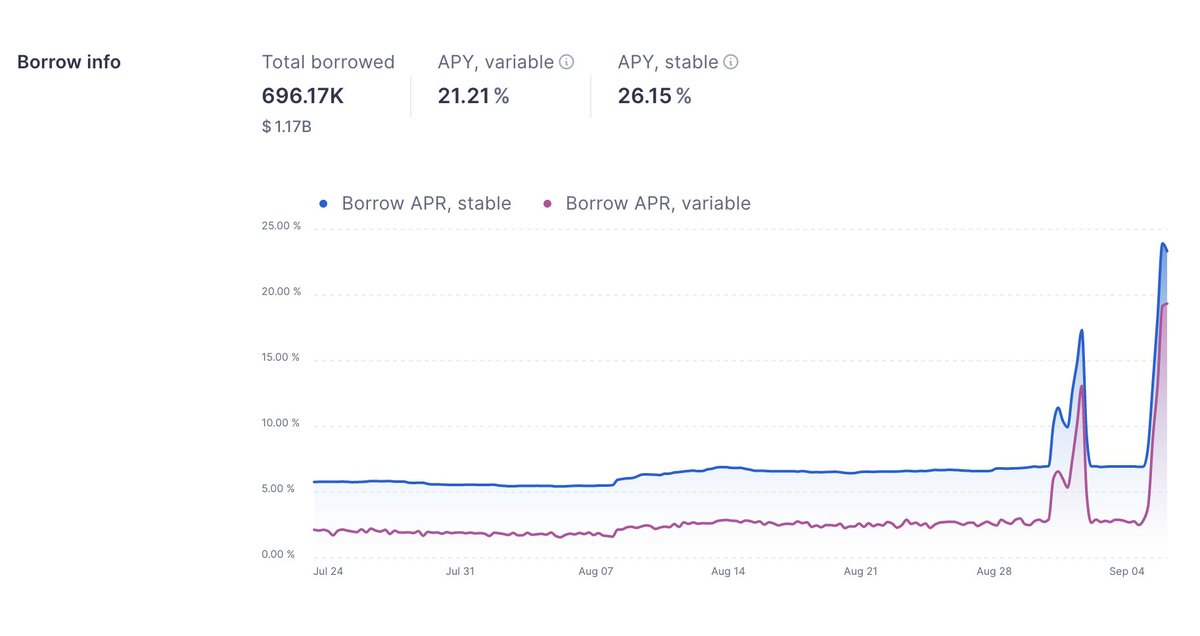

So they also propose a more aggressive interest rate curve for ETH by increasing the variable borrow APR at 100% utilization from 103% to 1,000%. Interesting times in DeFi!

governance.aave.com

governance.aave.com

Loading suggestions...