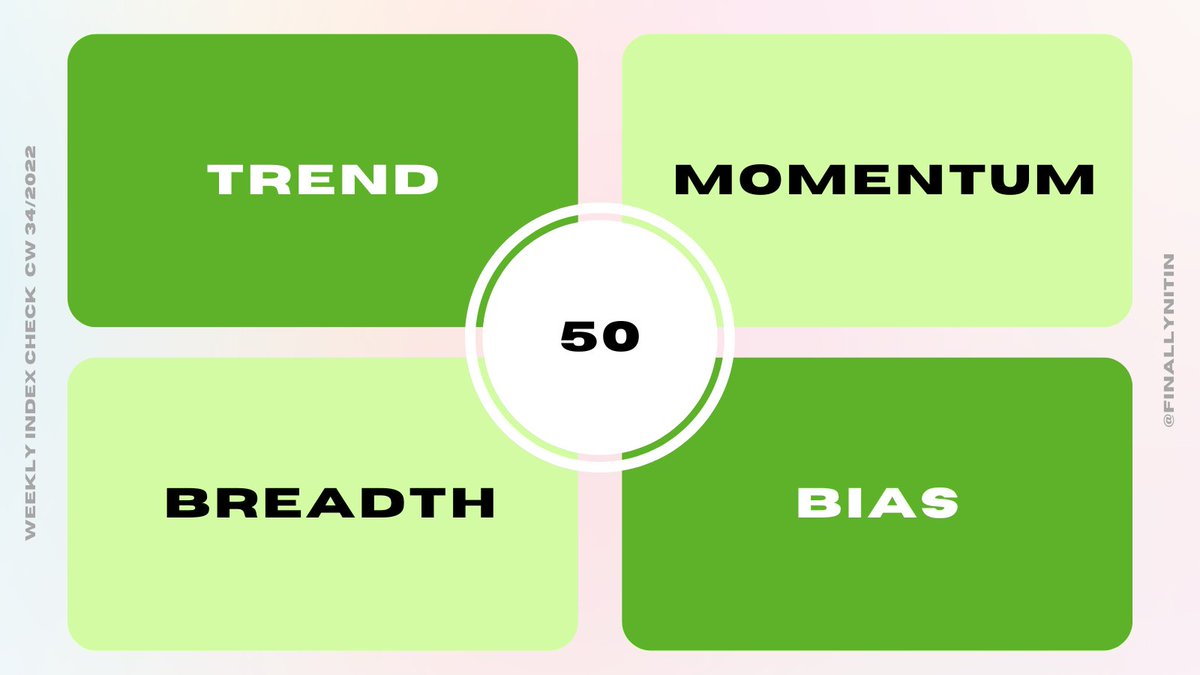

#WeeklyIndexCheck CW34/2022

Market Quadrant:

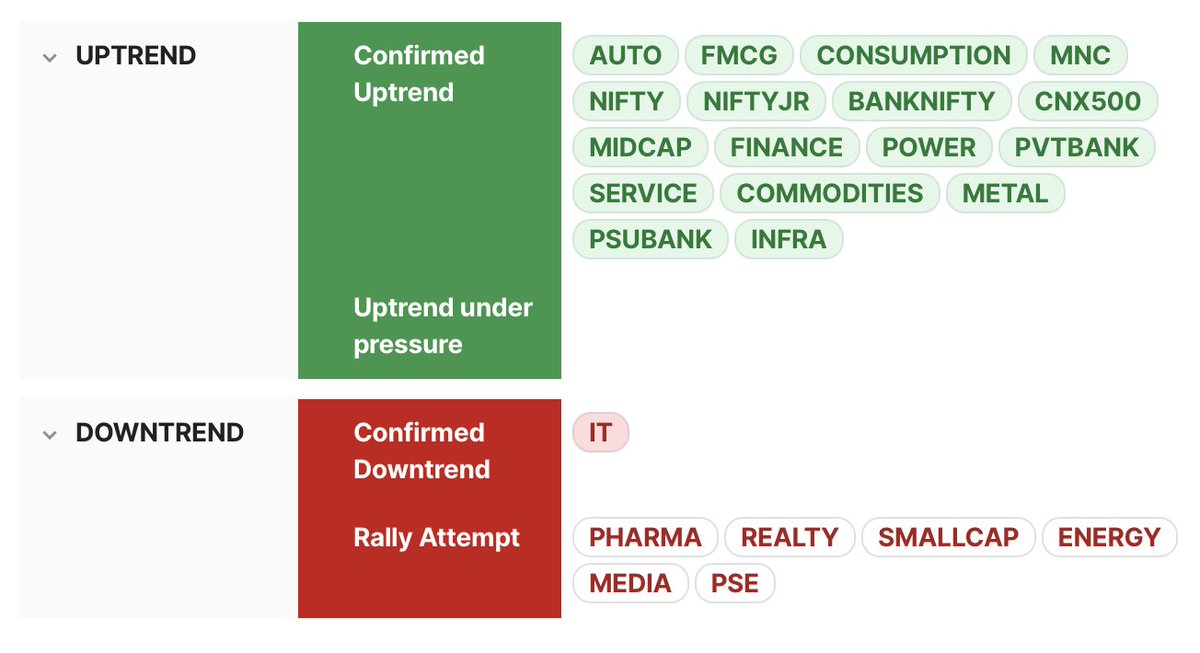

⦿ Trend: Confirmed Uptrend

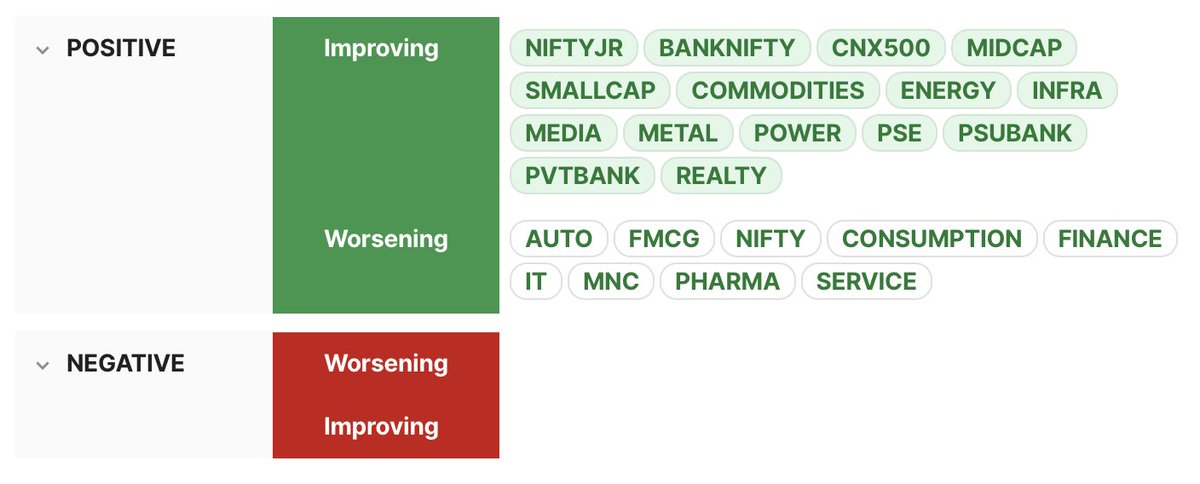

⦿ Momentum: Short-term positive & improving, long-term negative but improving

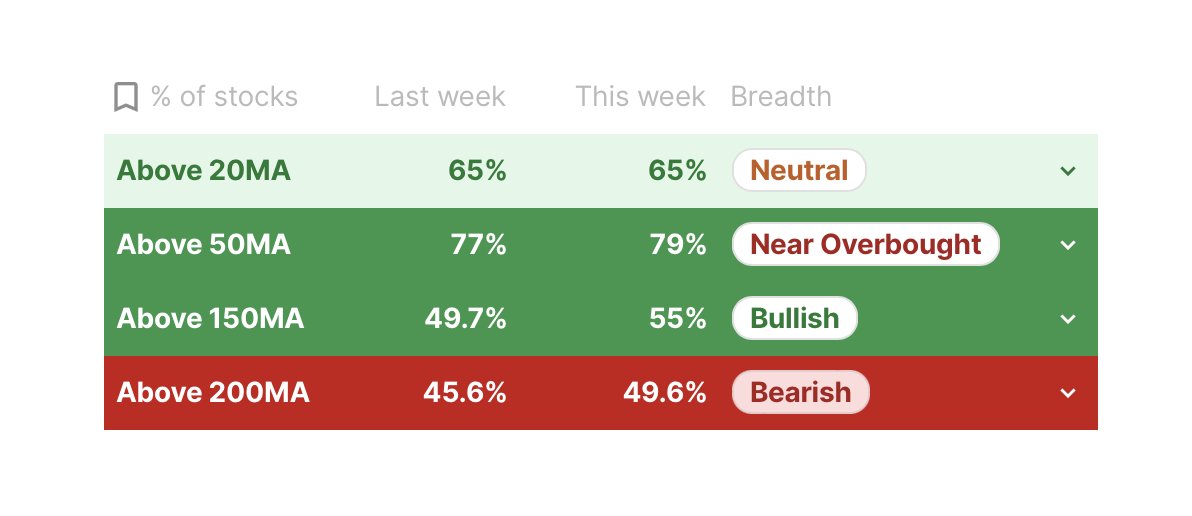

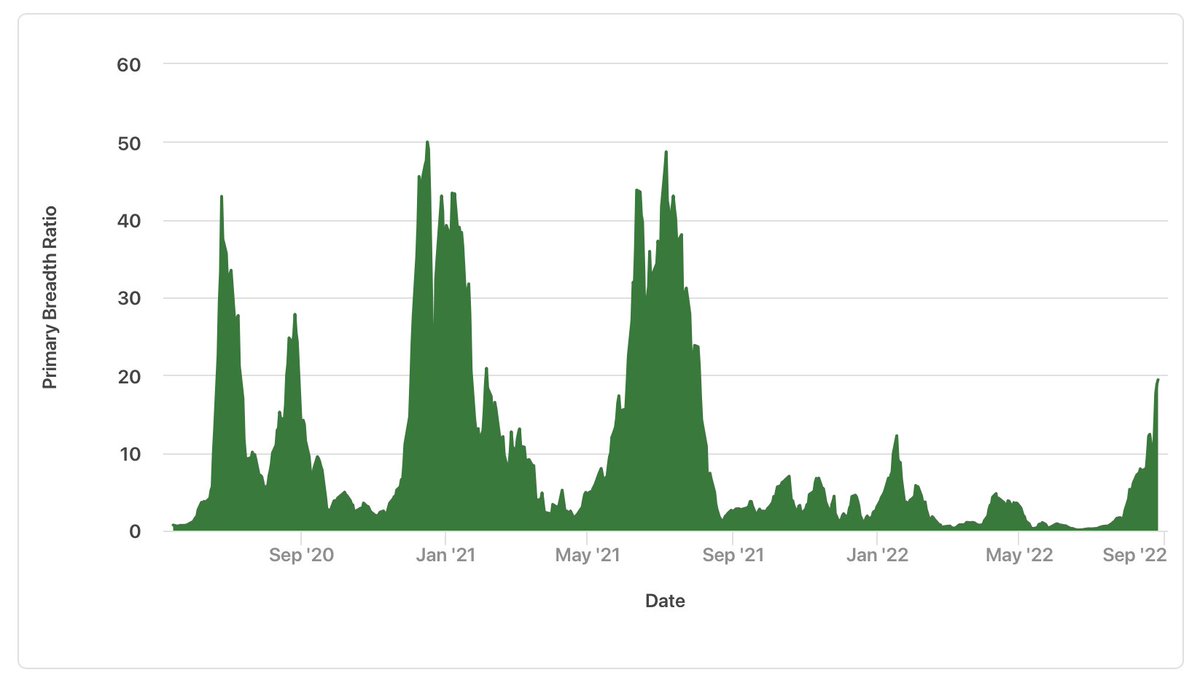

⦿ Breadth: Higher timeframes almost bullish

⦿ Bias: Bullish

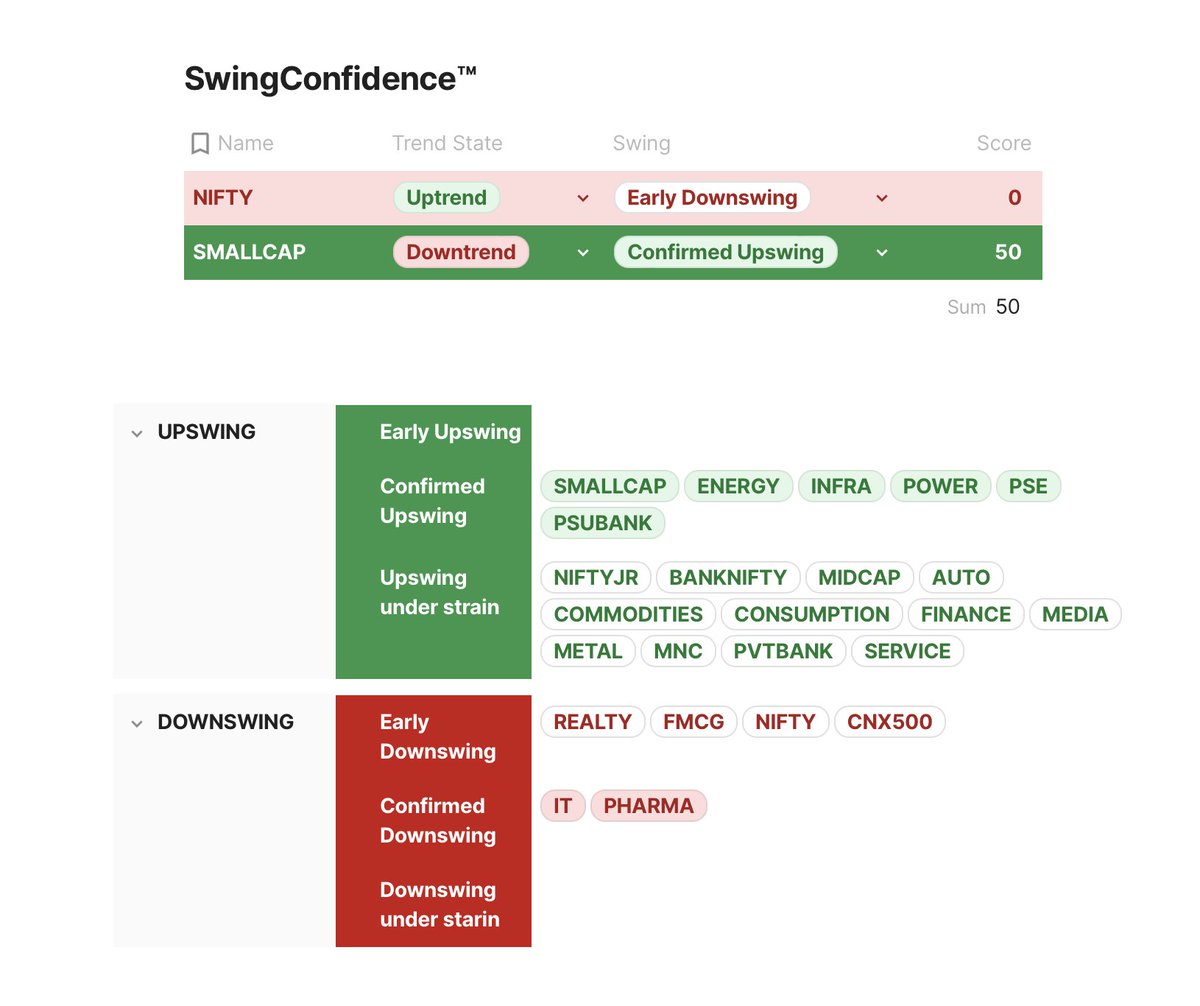

⦿ Swing Confidence: 50

Market Quadrant:

⦿ Trend: Confirmed Uptrend

⦿ Momentum: Short-term positive & improving, long-term negative but improving

⦿ Breadth: Higher timeframes almost bullish

⦿ Bias: Bullish

⦿ Swing Confidence: 50

That’s all for CW34/2022. If you'd like to read this as a newsletter, find it here:

world.hey.com

world.hey.com

Loading suggestions...