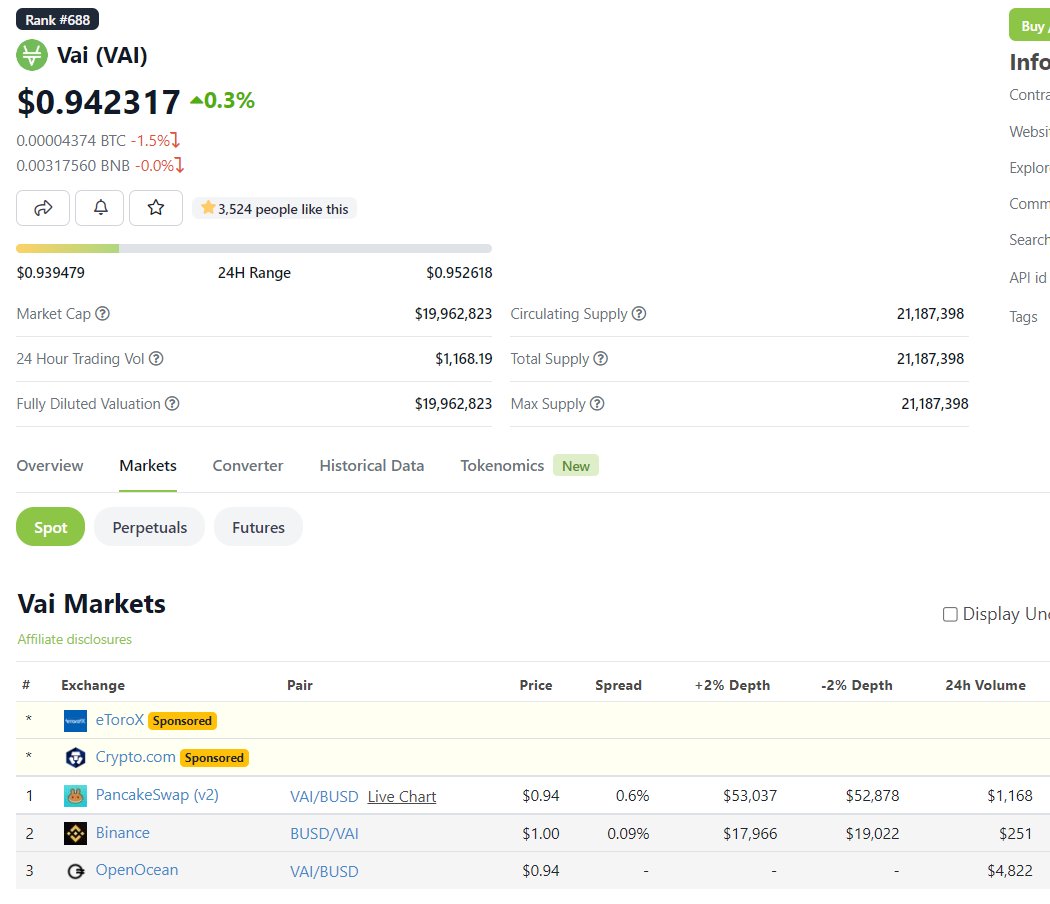

1/ $FRAX stablecoin is a giant compared to Venus $VAI

$1.3B market cap for FRAX vs $20M for VAI.

But just a year ago VAI was double the size at $250M, while FRAX only $133M.

So, what happened? 🧵

$1.3B market cap for FRAX vs $20M for VAI.

But just a year ago VAI was double the size at $250M, while FRAX only $133M.

So, what happened? 🧵

2/@VenusProtocol is a lending market similar to Compound or Aave, but available only on #BNB Chain.

It launched in late 2020 by forking Compound and MakerDAO's smart contracts, and had a successful $XVS token sale on Binance Launch Pad.

It launched in late 2020 by forking Compound and MakerDAO's smart contracts, and had a successful $XVS token sale on Binance Launch Pad.

3/ One of the unique Venus features is the stablecoin $VAI.

The protocol allows using deposited assets as collateral to mint $VAI.

When VAI first launched, it supported the following assets as collateral: $SXP, $BNB, $USDT, $USDC, $BUSD and, crucially, $XVS.

The protocol allows using deposited assets as collateral to mint $VAI.

When VAI first launched, it supported the following assets as collateral: $SXP, $BNB, $USDT, $USDC, $BUSD and, crucially, $XVS.

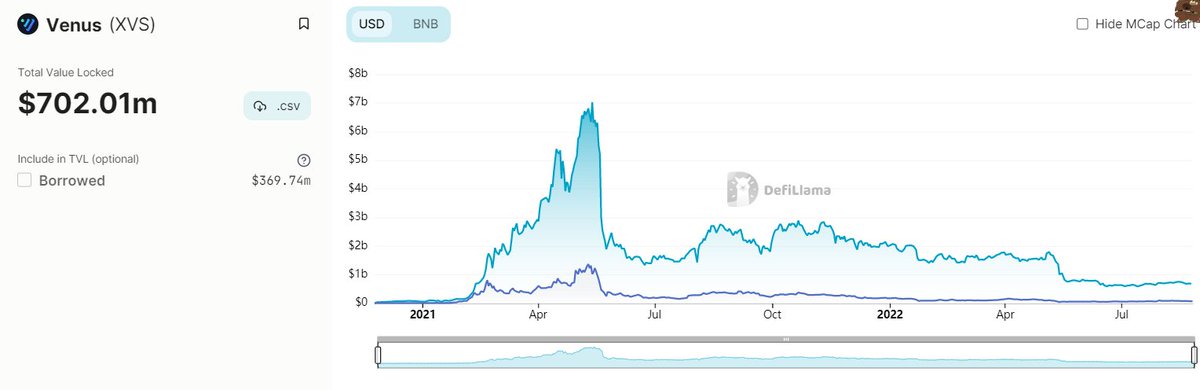

4/Today Venus is the 17th largest protocol in #DeFi with $702M USD in Total Value Locked (TVL).

On BNB Chain, only Pancakeswap's TVL is larger.

Yet in May last year, Venus had almost $7B in TVL. 10x more than today.

So, why such a big and sudden drop?

On BNB Chain, only Pancakeswap's TVL is larger.

Yet in May last year, Venus had almost $7B in TVL. 10x more than today.

So, why such a big and sudden drop?

5/ On May 18th, Venus Protocol suffered $200M+ in liquidation.

This was due to price manipulation of the governance token $XVS which led to a $100M+ of bad debt accumulation.

@QuillHash wrote an easy to understand report on it: quillhashteam.medium.com

This was due to price manipulation of the governance token $XVS which led to a $100M+ of bad debt accumulation.

@QuillHash wrote an easy to understand report on it: quillhashteam.medium.com

7/ To make matters worse, $XVS Collateral Factor for borrowing was increased from 60% to 80% a few days before the attack.

Some blamed Chainlink for supporting XVS oracle, despite lack of XVS liquidity.

Some blamed Chainlink for supporting XVS oracle, despite lack of XVS liquidity.

9/ There's another, fundamental reason for $VAI failure:

VAI has no other use case, beyond maximizing $XVS yield farming returns.

It's not supported anywhere else in #DeFi ecosystem

And while yield has been decreasing, Venus is not adding any more features to it.

VAI has no other use case, beyond maximizing $XVS yield farming returns.

It's not supported anywhere else in #DeFi ecosystem

And while yield has been decreasing, Venus is not adding any more features to it.

10/ In contrast to VAI, $FRAX kept innovating and increased FRAX's adoption in #DeFi.

Frax strengths include:

• Capital efficient minting

• Supported on Curve, Convex etc.

• Automated-Market-Operations boost supply

• Building Fraxlend and Fraxswap.

Frax strengths include:

• Capital efficient minting

• Supported on Curve, Convex etc.

• Automated-Market-Operations boost supply

• Building Fraxlend and Fraxswap.

10/ Why does it matter?

VAI serves as a lesson to other #DeFi stablecoins that need to consider:

• Risk/reward ratio for supporting illiquid collateral

• Need to create use cases beyond yield farming

• Risk of accepting its own governance token as collateral

VAI serves as a lesson to other #DeFi stablecoins that need to consider:

• Risk/reward ratio for supporting illiquid collateral

• Need to create use cases beyond yield farming

• Risk of accepting its own governance token as collateral

11/ What's more, during bear markets liquidity dries up, which makes token price manipulation attacks easier & cheaper to execute.

Understand this, Cream Finance announced today it would remove most of the tokens to 'ensure protocol health.'

Understand this, Cream Finance announced today it would remove most of the tokens to 'ensure protocol health.'

12/ In any case, Venus is a successful lending protocol with $700M in deposits.

Yet success in building a lending market wasn't enough to establish a strong stablecoin.

Yet success in building a lending market wasn't enough to establish a strong stablecoin.

13/ If you want to learn more about #DeFi stablecoins, check my research on 25+ projects below👇

Loading suggestions...