"Yield Stripping" is a huge opportunity in DeFi.

@KentonPrescott and I will discuss this on our Twitter Spaces tomorrow

wondering what the hell is Yield Stripping?! 🤔🧵

@KentonPrescott and I will discuss this on our Twitter Spaces tomorrow

wondering what the hell is Yield Stripping?! 🤔🧵

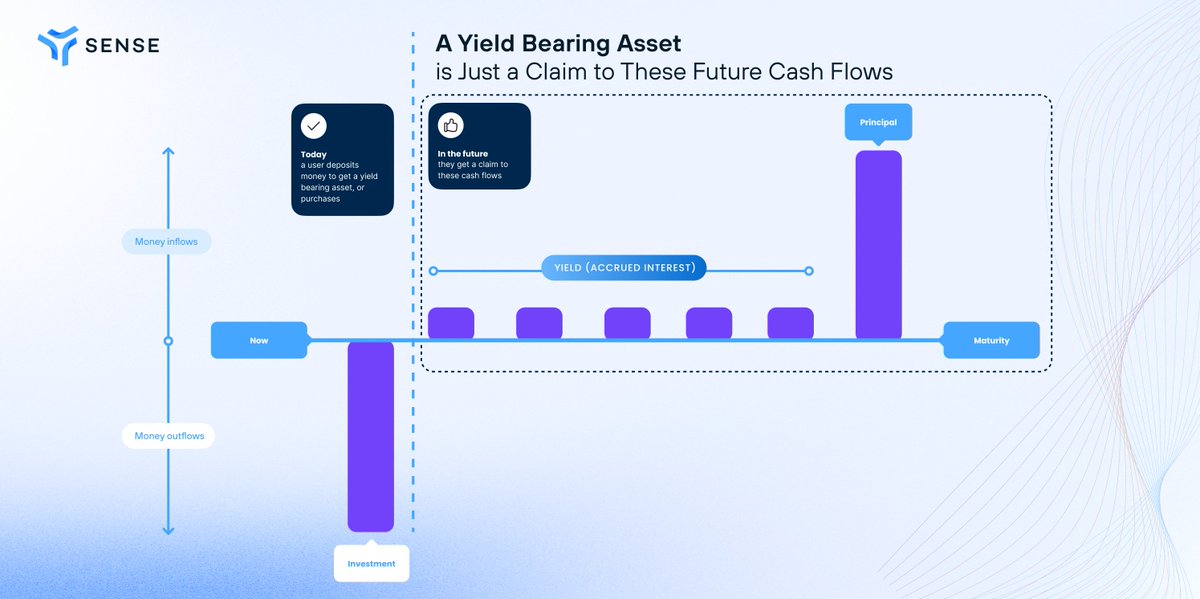

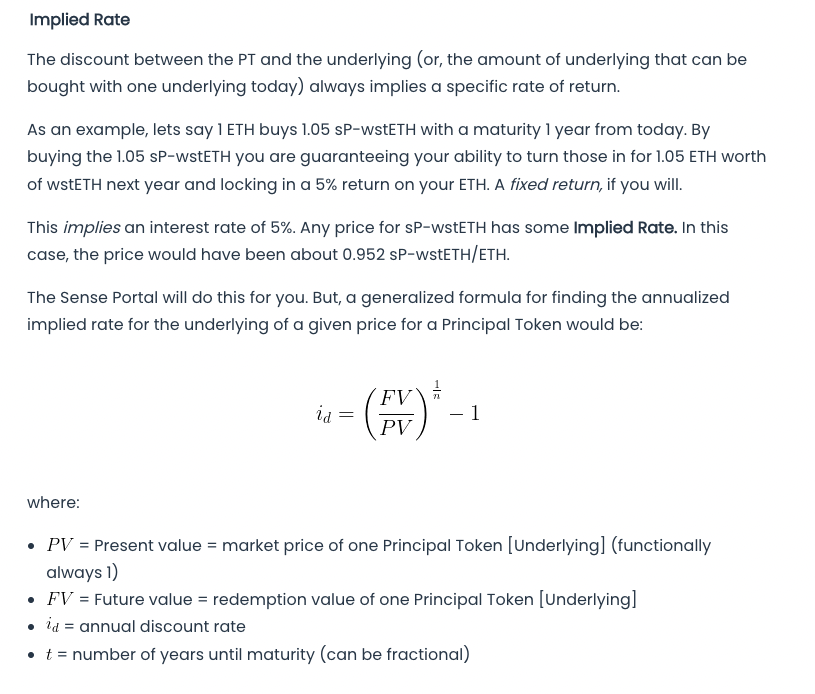

but institutions need predictable cashflows. It helps in so many ways, but most importantly having FIXED INCOME helps to match your Assets vs. your Liabilities (ALM) i.e. to know how much is coming in vs. going out. As @senseprotocol notes:

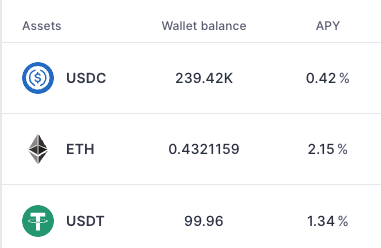

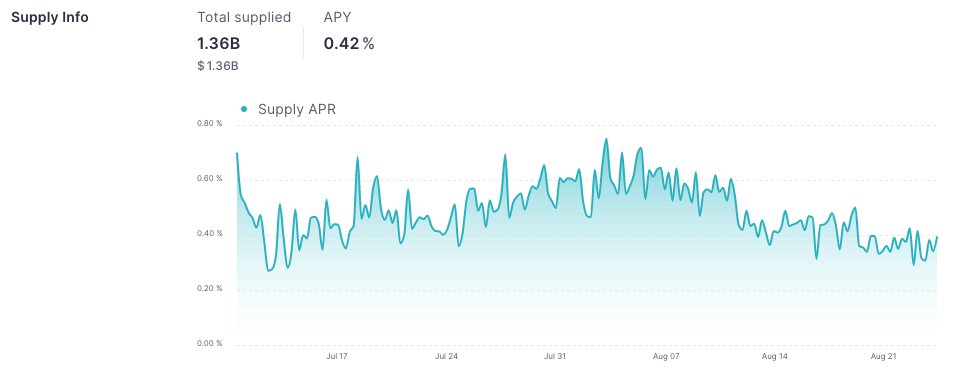

Today we have a bunch of variable-yield generating assets, whether that be interest-bearing deposits such as cDAI (compound) and aUSDC (aave), or interest-bearing LP positions on Uniswap such as ETH/USD SLP.

ok I'll stop there but if you want to know more tune in tomorrow and hear me and @KentonPrescott talk about how this is also a capital-efficient way to bet on stETH yield (trading realised vs. implied)

Loading suggestions...