1/ There are 63 decentralized stablecoins on Defi Llama

Yet Aave and Curve are about to join the crowded market.

So, I researched 25 #DeFi stablecoins to understand:

• How do they function & keep the peg?

• What are their use cases and risks?

• What makes them special?

🧵

Yet Aave and Curve are about to join the crowded market.

So, I researched 25 #DeFi stablecoins to understand:

• How do they function & keep the peg?

• What are their use cases and risks?

• What makes them special?

🧵

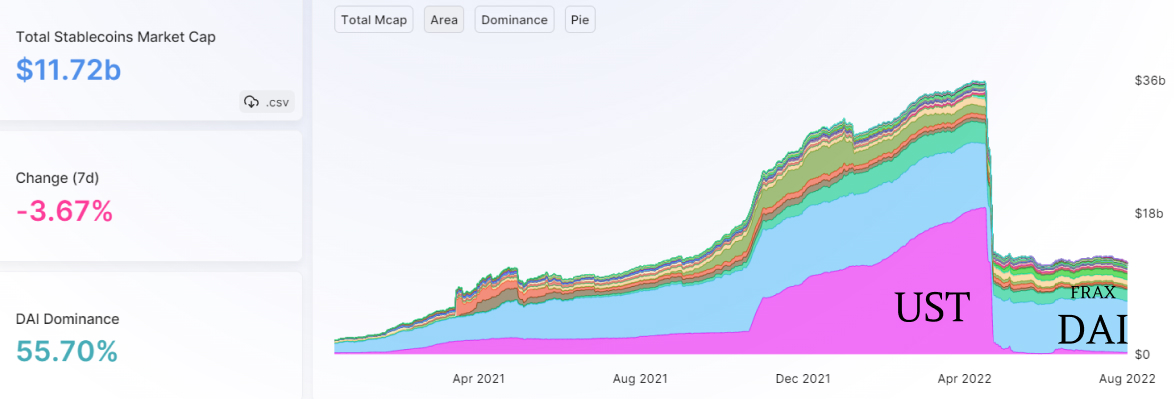

2/ 14.2% of the total $1.07T crypto market is stablecoins!

Just 3 ( $USDT $USDC and $BUSD) dominate 90% of the total stablecoin market cap.

In contrast, 63 smart-contract based #DeFi stablecoins together amount to a mere 8.3% ($11.72B) share.

Dwarfs against $USDT

Just 3 ( $USDT $USDC and $BUSD) dominate 90% of the total stablecoin market cap.

In contrast, 63 smart-contract based #DeFi stablecoins together amount to a mere 8.3% ($11.72B) share.

Dwarfs against $USDT

3/Terra's $UST collapse wiped out half of the decentralized stablecoin market cap.

In April 2022 UST market cap was higher than Maker's DAI.

But UST collapsed due to algorithmic model design flaws, leaving DAI the leading #DeFi stablecoin.

In April 2022 UST market cap was higher than Maker's DAI.

But UST collapsed due to algorithmic model design flaws, leaving DAI the leading #DeFi stablecoin.

4/ By the way, for a more detailed explanation please chech the blog post

@Ignas_defi_research/state-of-decentralized-stablecoins-in-2022-analysis-of-25-projects-8fbdd458ecdd" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com

You can also find each stablecoin comparison table at ignasdefi.notion.site

@Ignas_defi_research/state-of-decentralized-stablecoins-in-2022-analysis-of-25-projects-8fbdd458ecdd" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com

You can also find each stablecoin comparison table at ignasdefi.notion.site

6/ There are 3 more algorithmic stablecoins you should know about:

• $USDD: Minting is centralized and limited to 9 Tron DAO members.

• $USDN: Current collateral ratio is only 11% 🚨

• $CUSD: Minted only by $CEL but more transparent than other two.

• $USDD: Minting is centralized and limited to 9 Tron DAO members.

• $USDN: Current collateral ratio is only 11% 🚨

• $CUSD: Minted only by $CEL but more transparent than other two.

9/ @LiquityProtocol's $LUSD is like Maker Lite.

ETH is the sole collateral accepted.

It shuns cumbersome Maker governance model, offers borrowing at 0% interest rate and collateral rate is only 110%.

Smart-contracts are immutable and minting fees are algorithmically adjusted.

ETH is the sole collateral accepted.

It shuns cumbersome Maker governance model, offers borrowing at 0% interest rate and collateral rate is only 110%.

Smart-contracts are immutable and minting fees are algorithmically adjusted.

10/ Tron's $JUST, Kava's $USDX and $MAI also use Maker's CDP model.

Why two stablecoins for Tron?

t makes sense to prefer USDD instead of JUST as it doesn't need to be over-collateralized.

Tron can just mint a lot more USDD than JUST with the same amount of $TRX.

Why two stablecoins for Tron?

t makes sense to prefer USDD instead of JUST as it doesn't need to be over-collateralized.

Tron can just mint a lot more USDD than JUST with the same amount of $TRX.

12/ At this point, we can see that algorithmic stablecoins are more capital efficient, but unstable.

Over-collateralized stables have hard peg mechanism, but issuing money is expensive.

👀There are a few stablecoins that are trying to find the perfect middle.

Over-collateralized stables have hard peg mechanism, but issuing money is expensive.

👀There are a few stablecoins that are trying to find the perfect middle.

13/ Frax, is a fractional-algorithmic stablecoin: partially backed by collateral and partially stabilized algorithmically.

It started 100% collateralized by USDC, but later some of the value that enters into the system during minting becomes FXS (which is then burned).

It started 100% collateralized by USDC, but later some of the value that enters into the system during minting becomes FXS (which is then burned).

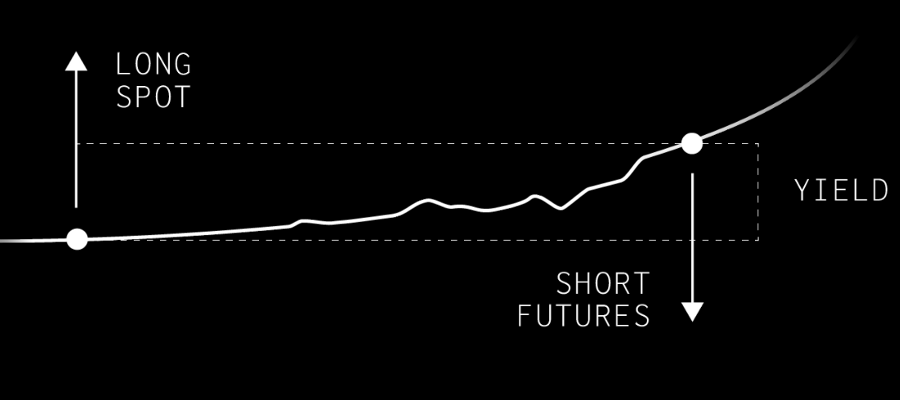

15/ @UXDProtocol

Few have heard about $UXD, as the market cap is only $21M.

It uses delta-neutral position derivates to keep the peg.

When 1 $SOL is deposited, the protocol opens a short positions on @mangomarkets to earn funding rate, which is distributed to UXD holders.

Few have heard about $UXD, as the market cap is only $21M.

It uses delta-neutral position derivates to keep the peg.

When 1 $SOL is deposited, the protocol opens a short positions on @mangomarkets to earn funding rate, which is distributed to UXD holders.

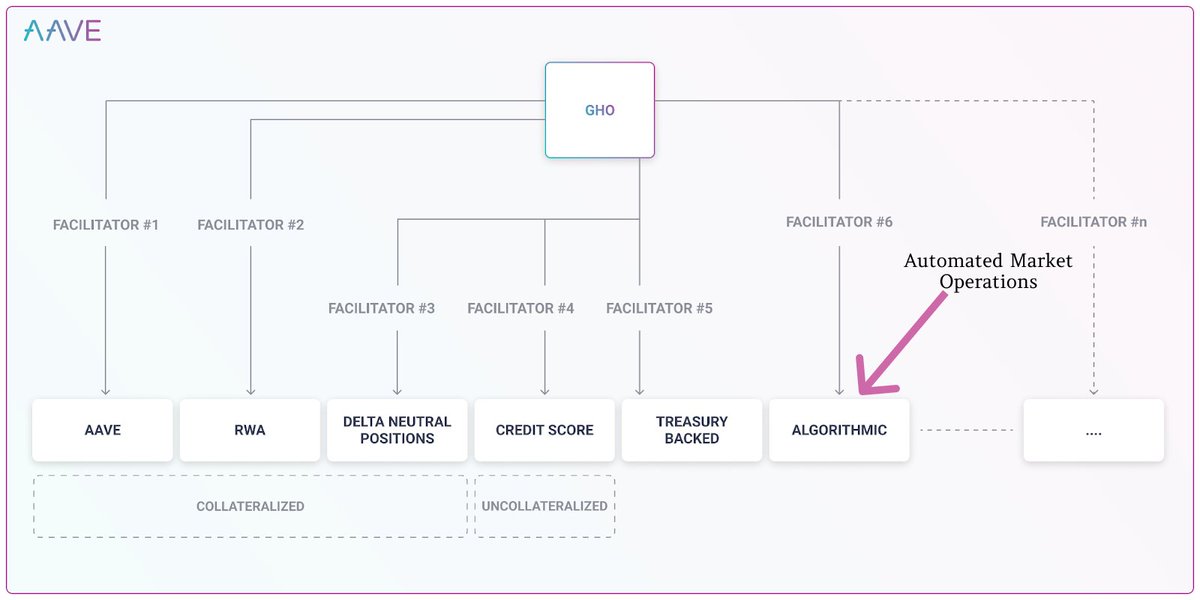

16/ However, the biggest innovation in #DeFi stablecoins is Automated Market Operations.

You see, the Fed engages in "Open Market Operations" by minting $USD to buy securities, lend to banks etc.

This way it influences the money supply and manipulates interest rates.

You see, the Fed engages in "Open Market Operations" by minting $USD to buy securities, lend to banks etc.

This way it influences the money supply and manipulates interest rates.

18/ AMOs have the following effects:

• Decreases borrowing rate on lending markets, making FRAX more attractive to borrow.

• Curve AMO ensures deep liquidity and strengthens the peg

• Generates revenue for the protocol

• Increases FRAX supply.

• Decreases borrowing rate on lending markets, making FRAX more attractive to borrow.

• Curve AMO ensures deep liquidity and strengthens the peg

• Generates revenue for the protocol

• Increases FRAX supply.

19/ Under different names, other protocols below do the brrrrrrrrrr a well:

• Maker's D3M on Aave

• @Synthetix about to launch DDM.

• @AngleProtocol mints $agEUR to @eulerfinance

• @InverseFinance's Whale Extractable Value

• @AlchemixFi Elixir's AMOs

• @feiprotocol's LaaS

• Maker's D3M on Aave

• @Synthetix about to launch DDM.

• @AngleProtocol mints $agEUR to @eulerfinance

• @InverseFinance's Whale Extractable Value

• @AlchemixFi Elixir's AMOs

• @feiprotocol's LaaS

21/ This also partly explains why Aave and Curve are launching their own stablecoins.

Aave and Curve need liquidity to generate revenue.

Currently they attract liquidity thanks to liquidity mining, so with their own stablecoins they'll increase capital efficiency to LPs.

Aave and Curve need liquidity to generate revenue.

Currently they attract liquidity thanks to liquidity mining, so with their own stablecoins they'll increase capital efficiency to LPs.

23/ As more stablecoins add AMOs, yields for stablecoins will continue to drop.

Lending rates will drop even for USDT, BUSD and USDC (and other crypto assets) as they will be deposited as collateral to borrow FRAX, DAI etc., at low interest rates to farm elsewhere.

Lending rates will drop even for USDT, BUSD and USDC (and other crypto assets) as they will be deposited as collateral to borrow FRAX, DAI etc., at low interest rates to farm elsewhere.

24/ This could potentially jump start a new bull run, as leverage will become cheaper and liquidity abundant.

25/ Finally, I haven't mentioned @OriginProtocol's $OUSD, @mstable_'s $MUSD or $FEI.

These protocols are like hedge funds, generating revenue to depositors.

But with yields low and risks increasing, they're having hard time generating revenue.

These protocols are like hedge funds, generating revenue to depositors.

But with yields low and risks increasing, they're having hard time generating revenue.

Loading suggestions...