#WeeklyIndexCheck CW33/2022

Market Quadrant

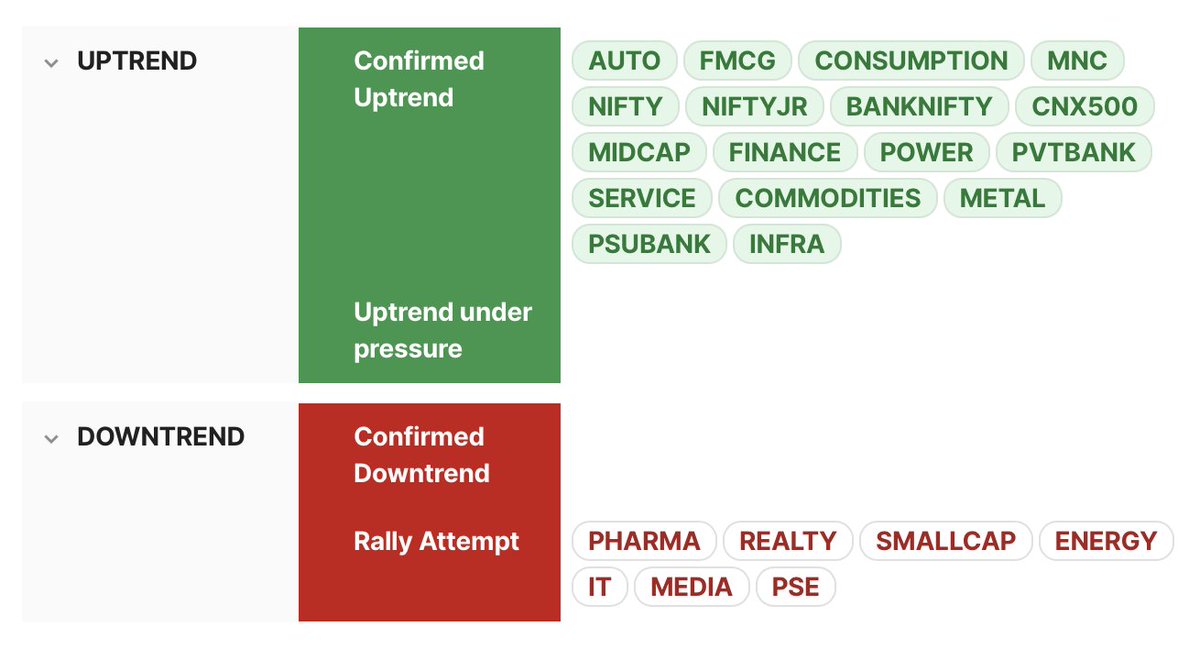

⦿ Trend: Confirmed Uptrend

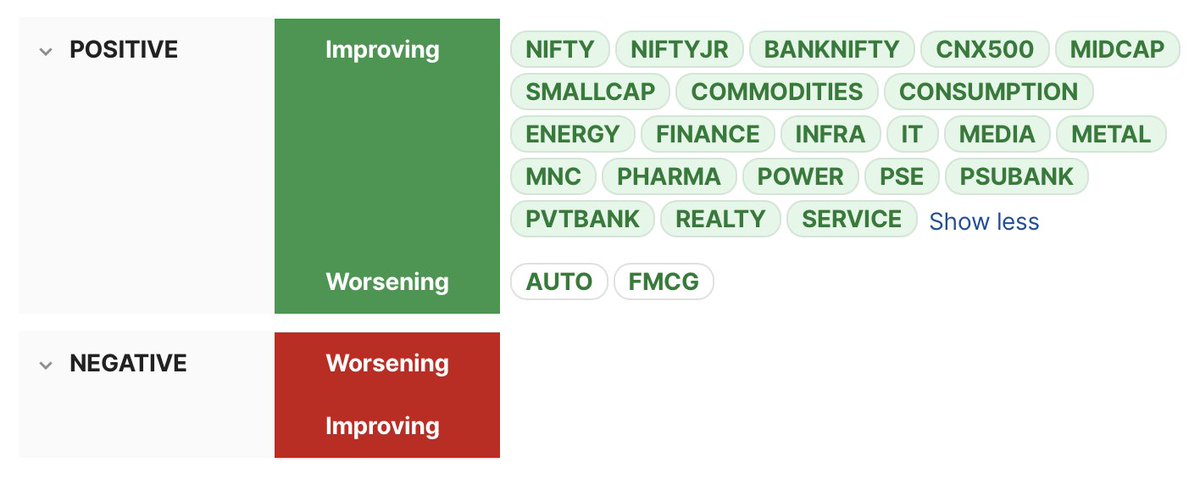

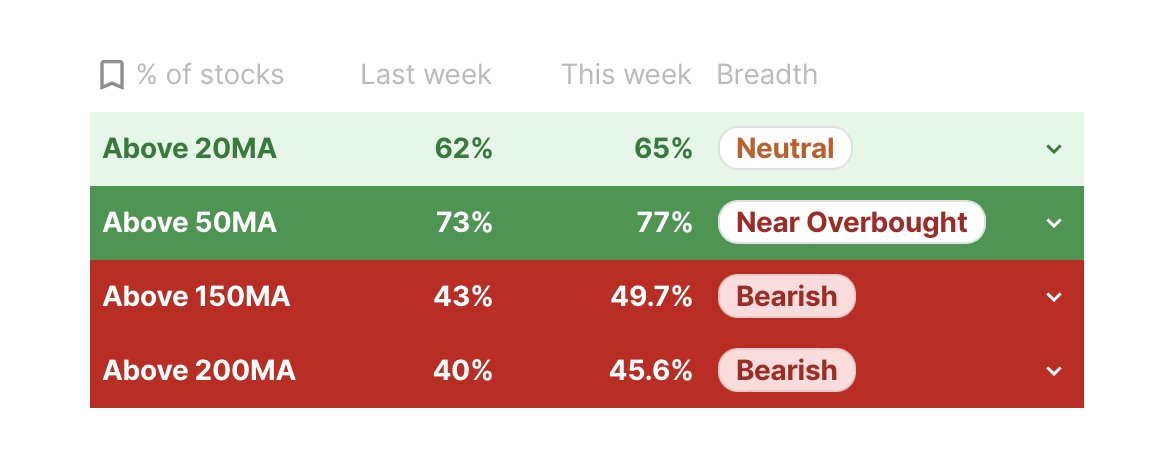

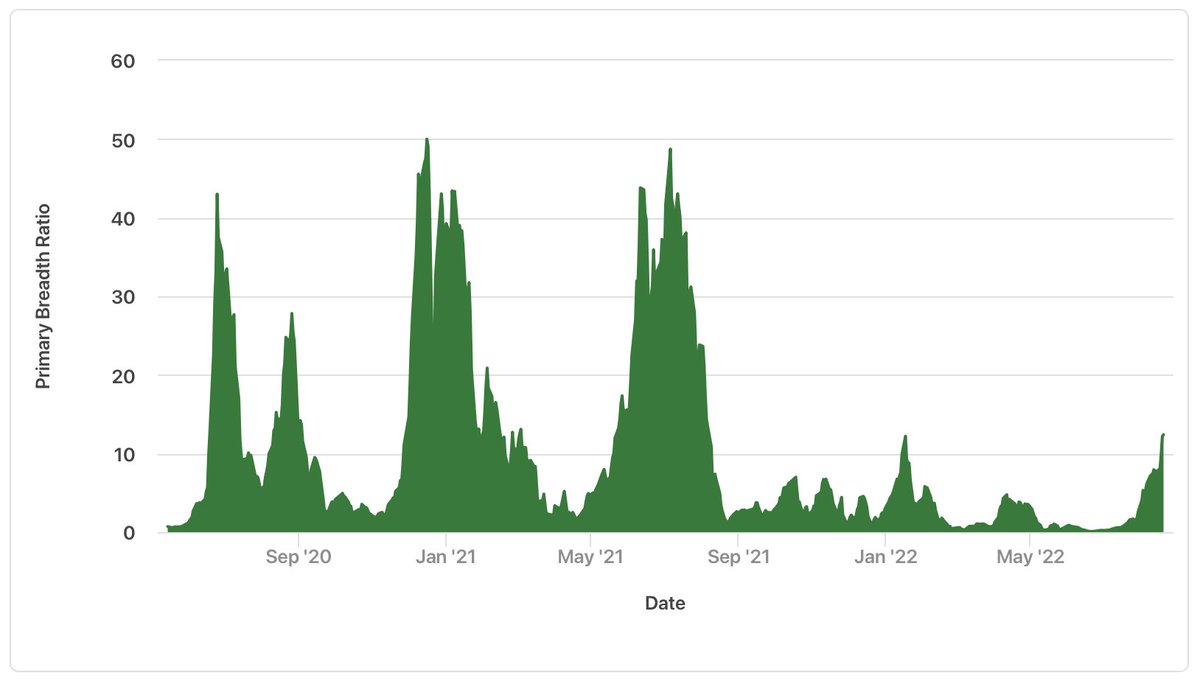

⦿ Momentum: Short-term positive & improving, long-term negative but improving

⦿ Breadth: Higher timeframes about to turn bullish

⦿ Bias: Bullish

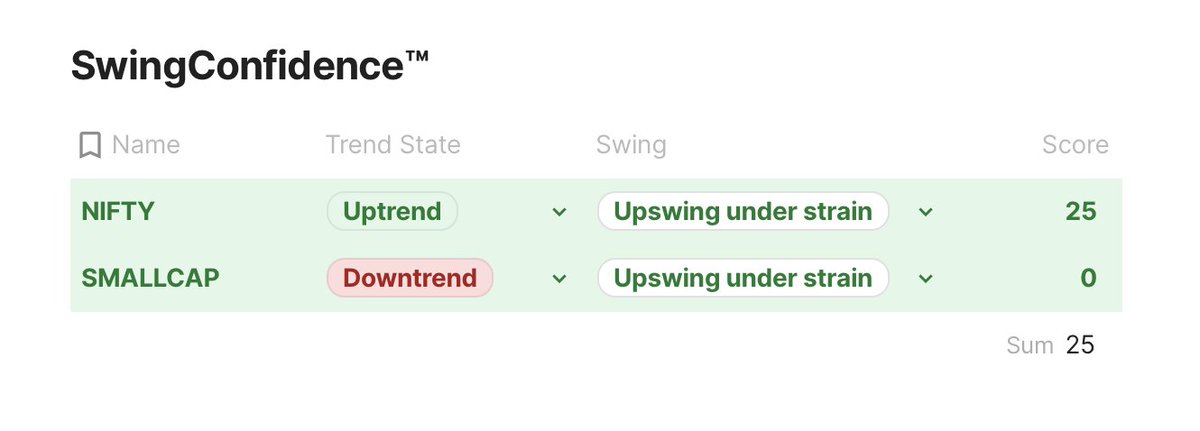

⦿ Swing Confidence: 25 (Upswing under strain)

Market Quadrant

⦿ Trend: Confirmed Uptrend

⦿ Momentum: Short-term positive & improving, long-term negative but improving

⦿ Breadth: Higher timeframes about to turn bullish

⦿ Bias: Bullish

⦿ Swing Confidence: 25 (Upswing under strain)

That’s all for CW33/2022. If you'd like to read this as a newsletter, find it here:

world.hey.com

world.hey.com

Loading suggestions...