The most profitable narrative in the bear market:

"Real Yield."

But what is it and how does it work?

Here's a Breakdown and 7 Protocols that Fit the Criteria:

(including a few hidden gems)

"Real Yield."

But what is it and how does it work?

Here's a Breakdown and 7 Protocols that Fit the Criteria:

(including a few hidden gems)

Most DeFi projects incentivize liquidity by providing inflationary tokens as rewards.

People LOVED it!

"If I provide ETH - USDC in a liquidity pool, I get X token at 200% APR!"

So projects could bootstrap growth this way.

People LOVED it!

"If I provide ETH - USDC in a liquidity pool, I get X token at 200% APR!"

So projects could bootstrap growth this way.

The Race Against Time

This buys time to create more revenue-generating products.

Problem:

1) The system fails if they keep printing tokens, but there's not enough value generated.

2) These users ain't loyal. Once incentives lower, they rotate to the next bright shiny DEX.

This buys time to create more revenue-generating products.

Problem:

1) The system fails if they keep printing tokens, but there's not enough value generated.

2) These users ain't loyal. Once incentives lower, they rotate to the next bright shiny DEX.

The Real Yield Checklist:

What qualifies as a real yield protocol?

1) There's product/market fit.

People are using the protocol regardless of market conditions or token incentives.

2) The Protocol generates on-chain revenue through its products.

What qualifies as a real yield protocol?

1) There's product/market fit.

People are using the protocol regardless of market conditions or token incentives.

2) The Protocol generates on-chain revenue through its products.

3) Revenue > Operating Expenses + Token Emissions.

SOME Token emissions is fine as long as revenue is higher.

4) Are they paying in sound money? The most popular choices are ETH and stablecoins.

Here are 7 Protocols that Qualify:

SOME Token emissions is fine as long as revenue is higher.

4) Are they paying in sound money? The most popular choices are ETH and stablecoins.

Here are 7 Protocols that Qualify:

#2. Gains Network on Polygon Matic

A decentralized leveraged trading platform.

It offers up to 150x leverage on crypto, stocks, and forex.

Currently, they offer DAI Vaults and GNS-Dai LP's

Single Side GNS Staking is Coming soon

A decentralized leveraged trading platform.

It offers up to 150x leverage on crypto, stocks, and forex.

Currently, they offer DAI Vaults and GNS-Dai LP's

Single Side GNS Staking is Coming soon

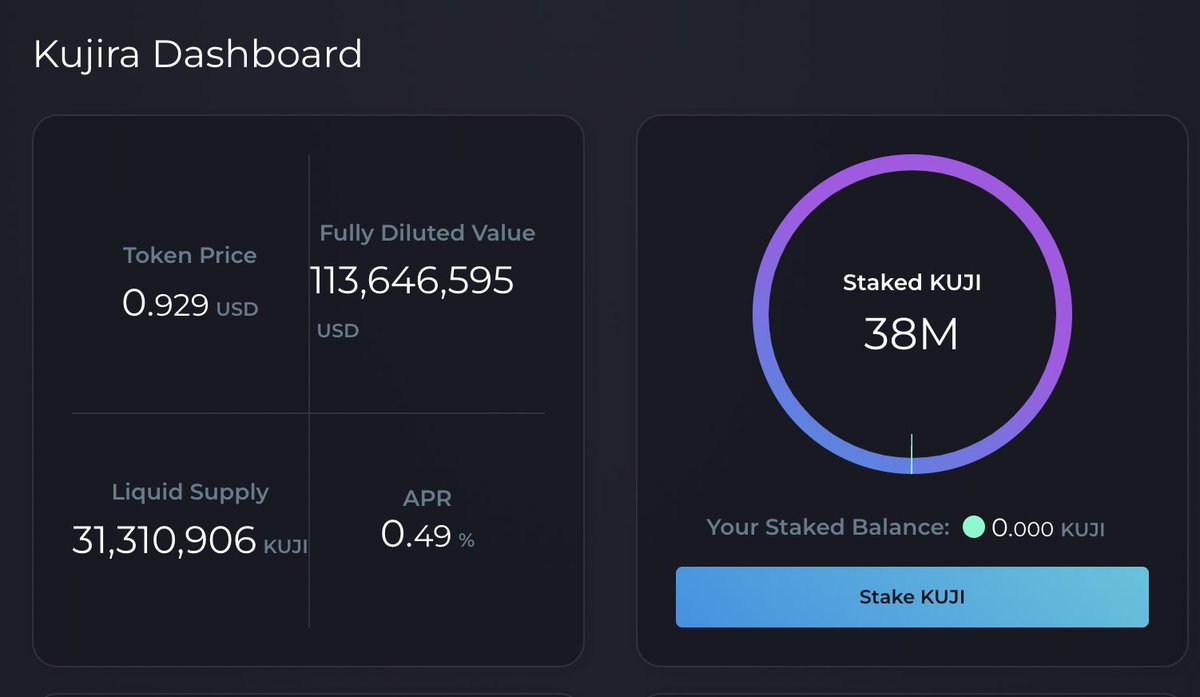

#4. Kujira (Cosmos Layer 1)

Kujira has several products:

• Orca - Buy assets at a discounted price via liquidations

• Fin - Decentralized orderbook-style exchange

• Blue - The Core of the ecosystem

• $USK - decentralized stablecoin

Kujira has several products:

• Orca - Buy assets at a discounted price via liquidations

• Fin - Decentralized orderbook-style exchange

• Blue - The Core of the ecosystem

• $USK - decentralized stablecoin

#6. Synthetix (Ethereum / Optimism)

One of the most impressive dapps in DeFi - a true innovator.

You can create synthetic assets, and trade real-world assets on-chain via Kentra.

Assets include crypto, forex, precious metals, etc.

One of the most impressive dapps in DeFi - a true innovator.

You can create synthetic assets, and trade real-world assets on-chain via Kentra.

Assets include crypto, forex, precious metals, etc.

Questions to Ask:

• Where is the yield coming from?

• How much revenue does the protocol generate?

• What is the native token supply and emissions?

• What tokens are they paying the shared revenue in?

• What is the overall base network traction?

• Where is the yield coming from?

• How much revenue does the protocol generate?

• What is the native token supply and emissions?

• What tokens are they paying the shared revenue in?

• What is the overall base network traction?

"Ser, you're missing X protocol"

I don't mean to fade your bags.

This is not meant to be a complete listing.

If something's missing either:

1) Tiny market cap

2) Too many emissions

3) I don't know about it (It happens)

4) I don't like it (DYDX banning Tornado Cash users)

I don't mean to fade your bags.

This is not meant to be a complete listing.

If something's missing either:

1) Tiny market cap

2) Too many emissions

3) I don't know about it (It happens)

4) I don't like it (DYDX banning Tornado Cash users)

The Risks

1) Some of the protocols may be labeled security due to the revenue-sharing model.

Jurisdictions may start trying to regulate them.

2) Quite a few of these are based on financial engineering such as perps and options.

1) Some of the protocols may be labeled security due to the revenue-sharing model.

Jurisdictions may start trying to regulate them.

2) Quite a few of these are based on financial engineering such as perps and options.

And finally, this narrative has been going on for a few months.

GMX has gone up 3x in the past few weeks, there may be a pullback.

Fortunately, I don't think this is a "metagame", but rather a fundamental shift going forward in DeFi.

These protocols have legs.

GMX has gone up 3x in the past few weeks, there may be a pullback.

Fortunately, I don't think this is a "metagame", but rather a fundamental shift going forward in DeFi.

These protocols have legs.

Additional View Point

My friend @milesdeutscher wrote a great thread earlier this week.

It's always good to see a different perspective on the same topic.

(That feel when you're writing a thread, and someone else publishes it first 😩)

My friend @milesdeutscher wrote a great thread earlier this week.

It's always good to see a different perspective on the same topic.

(That feel when you're writing a thread, and someone else publishes it first 😩)

Transparency

I have small positions in GMX, GNS, Umami, and Kujira.

I'm sharing for transparency reasons.

Don't buy something because I bought it.

This is an educational thread, and not meant to entice you to buy anything.

Please do your own research.

I have small positions in GMX, GNS, Umami, and Kujira.

I'm sharing for transparency reasons.

Don't buy something because I bought it.

This is an educational thread, and not meant to entice you to buy anything.

Please do your own research.

If you enjoyed this thread, then I'm sure you'll enjoy my free weekly newsletter.

I share some insights exclusively via email.

Sign up to TheDeFiEdge.com if you haven't yet.

I share some insights exclusively via email.

Sign up to TheDeFiEdge.com if you haven't yet.

Loading suggestions...