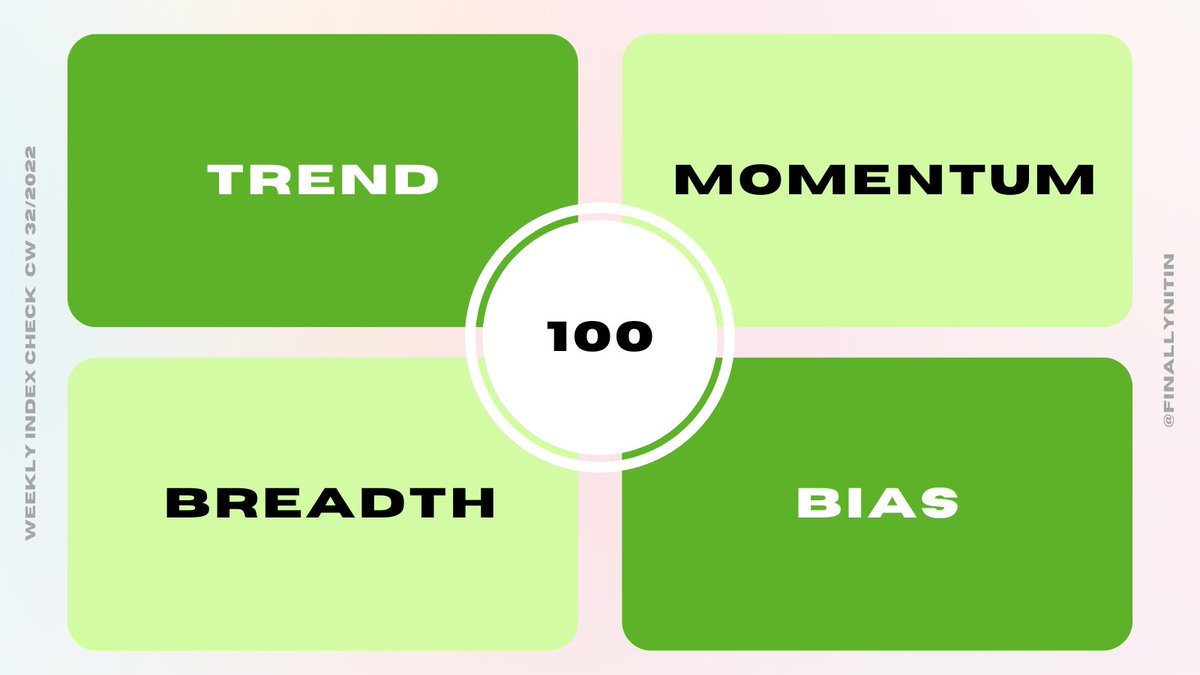

#WeeklyIndexCheck CW32/2022

Market Quadrant

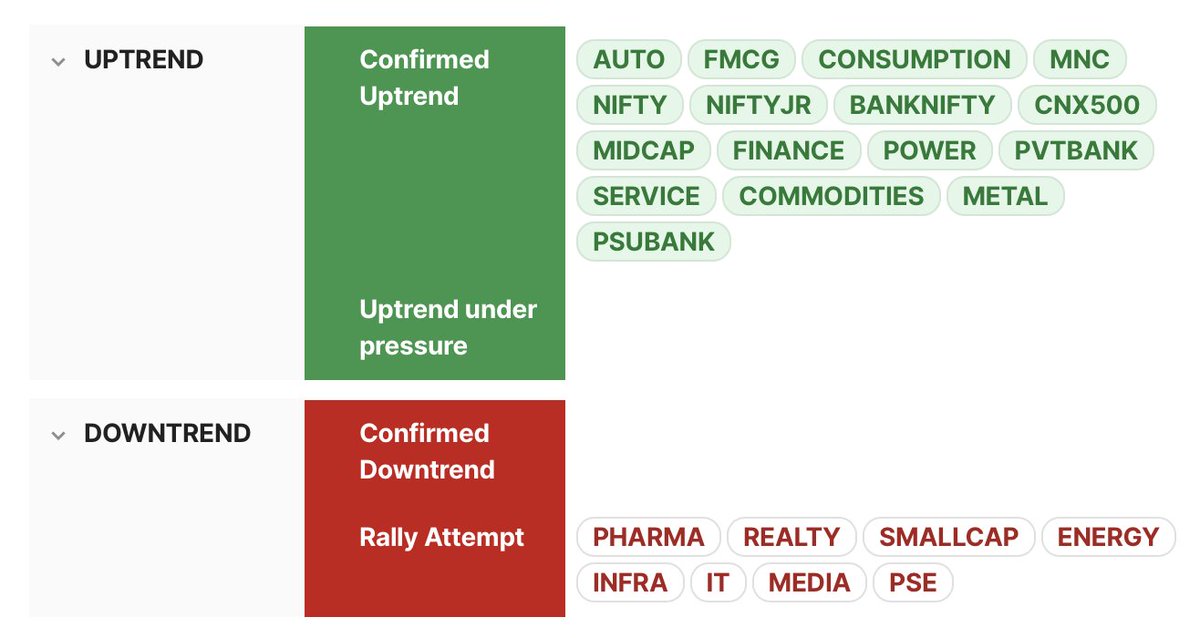

⦿ Trend: Confirmed Uptrend

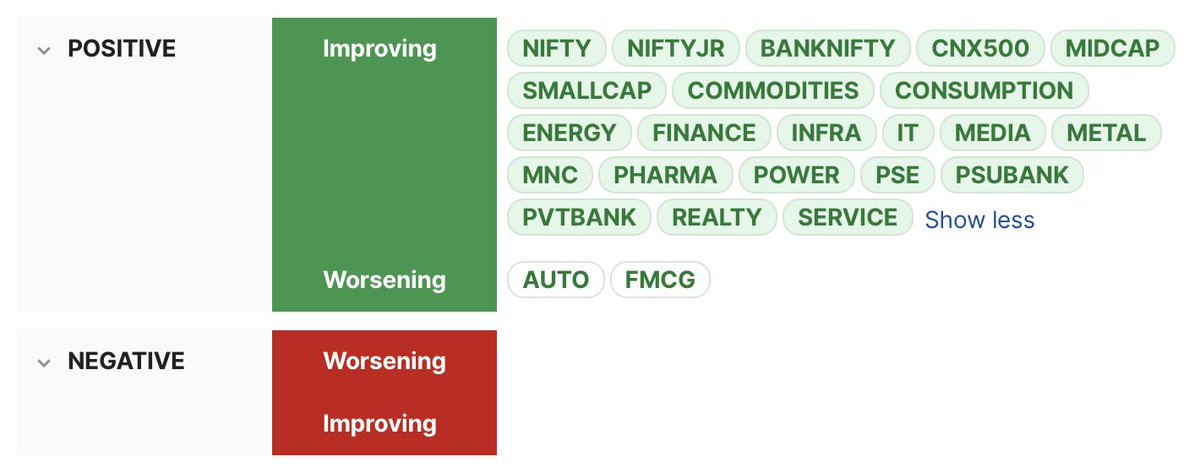

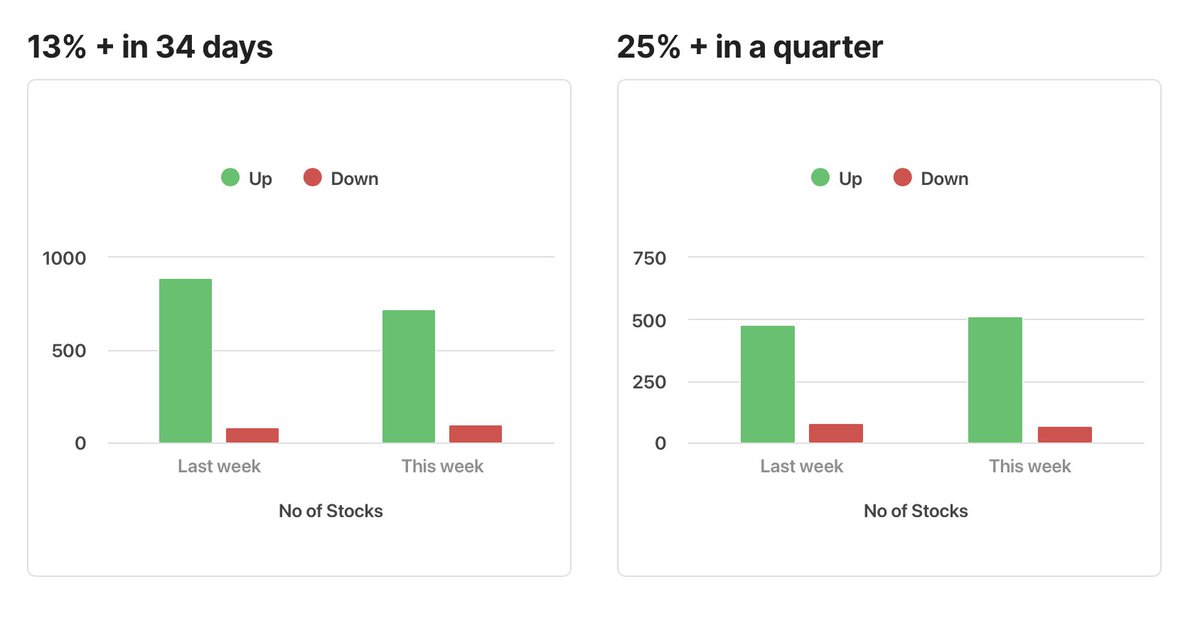

⦿ Momentum: Short-term positive & improving, long-term negative but improving

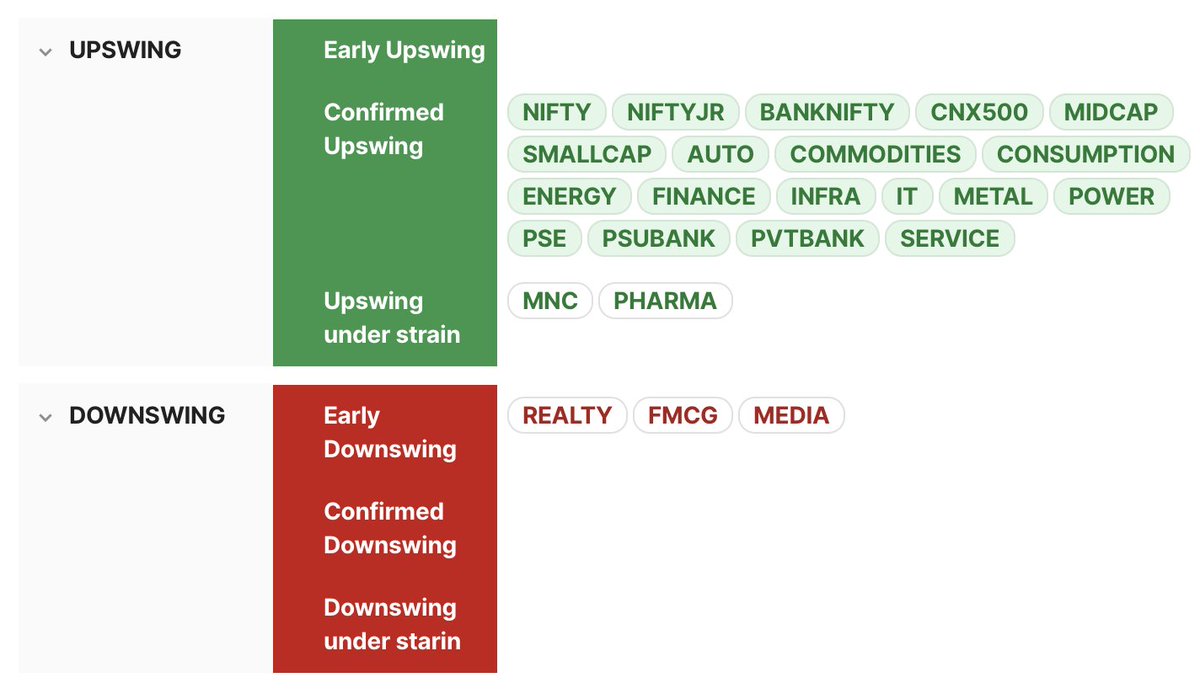

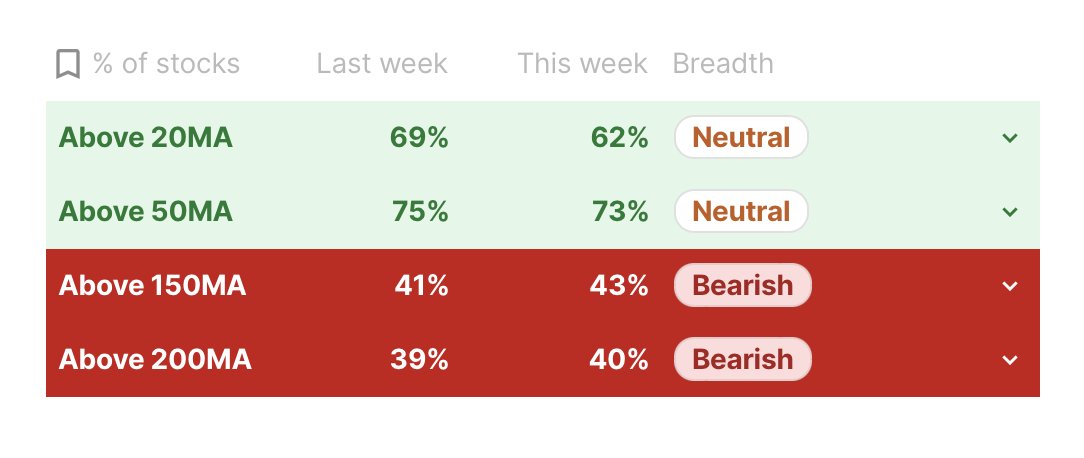

⦿ Breadth: Lower timeframes neutral, higher still bearish

⦿ Bias: Bullish

⦿ Swing Confidence: 100 (Confirmed Upswing)

Market Quadrant

⦿ Trend: Confirmed Uptrend

⦿ Momentum: Short-term positive & improving, long-term negative but improving

⦿ Breadth: Lower timeframes neutral, higher still bearish

⦿ Bias: Bullish

⦿ Swing Confidence: 100 (Confirmed Upswing)

That’s all for CW32/2022. If you'd like to read this as a newsletter, find it here:

world.hey.com

world.hey.com

Loading suggestions...