#Neulandlabs

Your question was absolutely spot on. @AdityaKhemka5

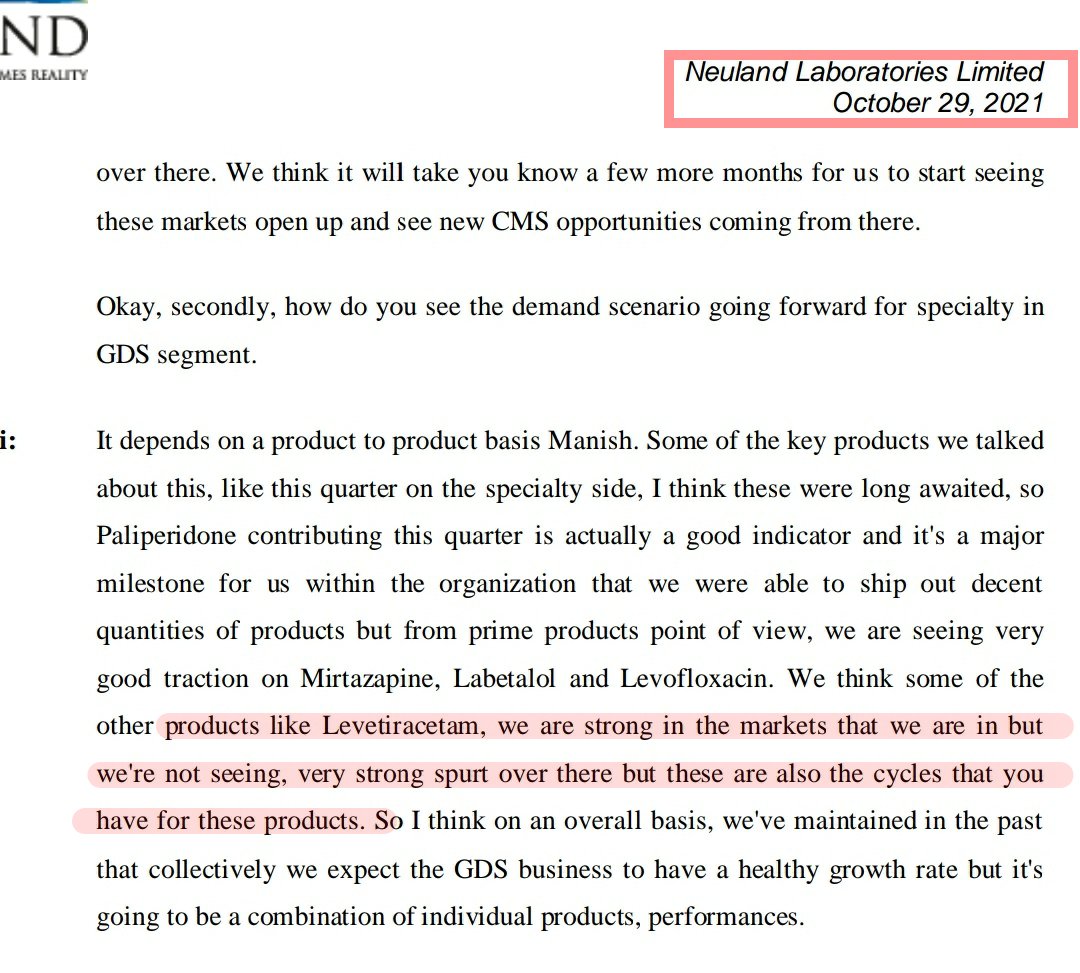

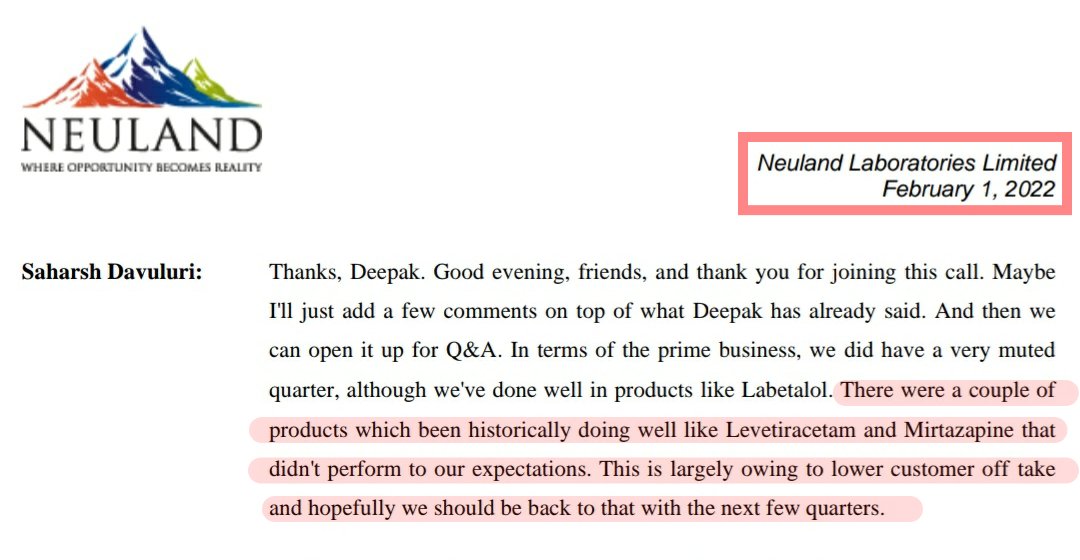

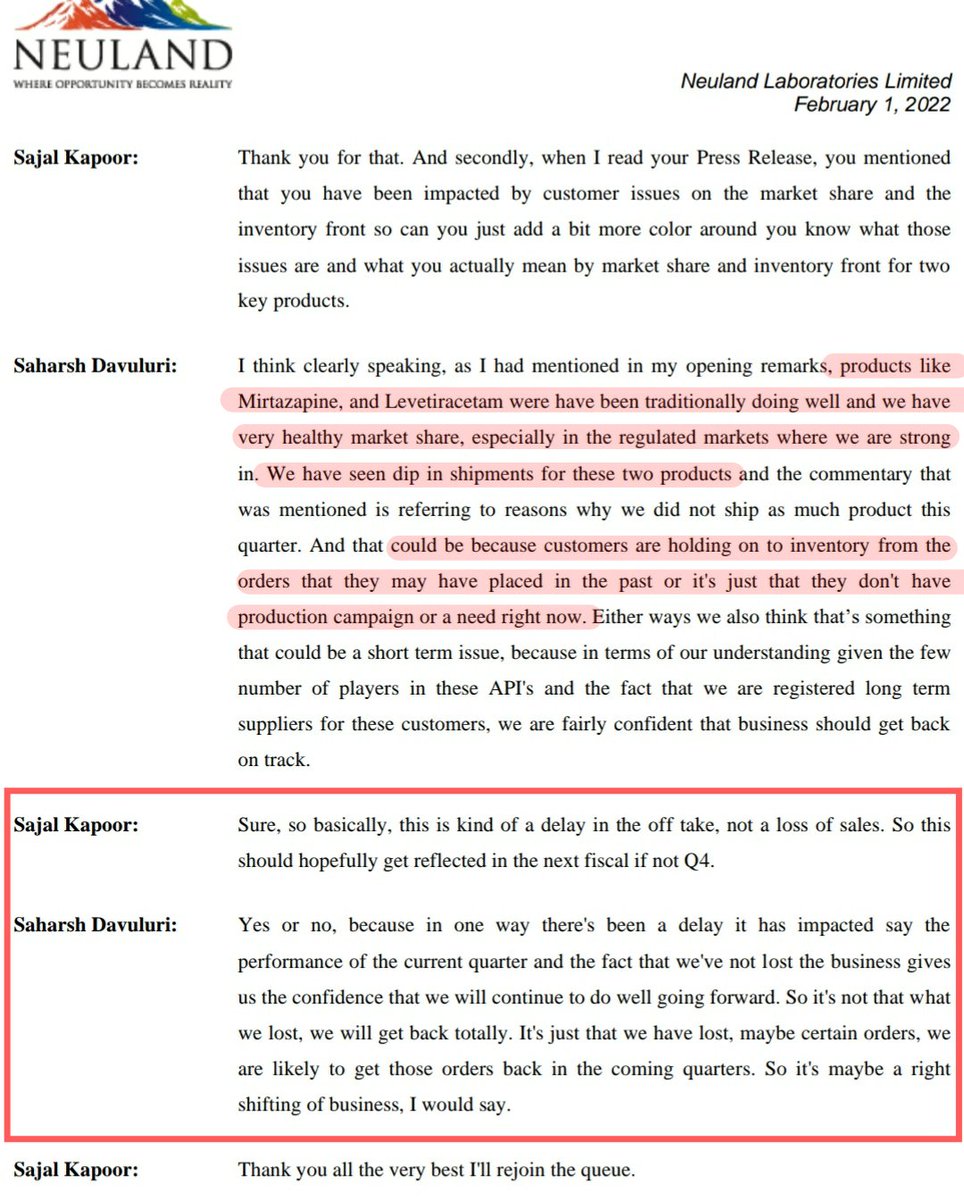

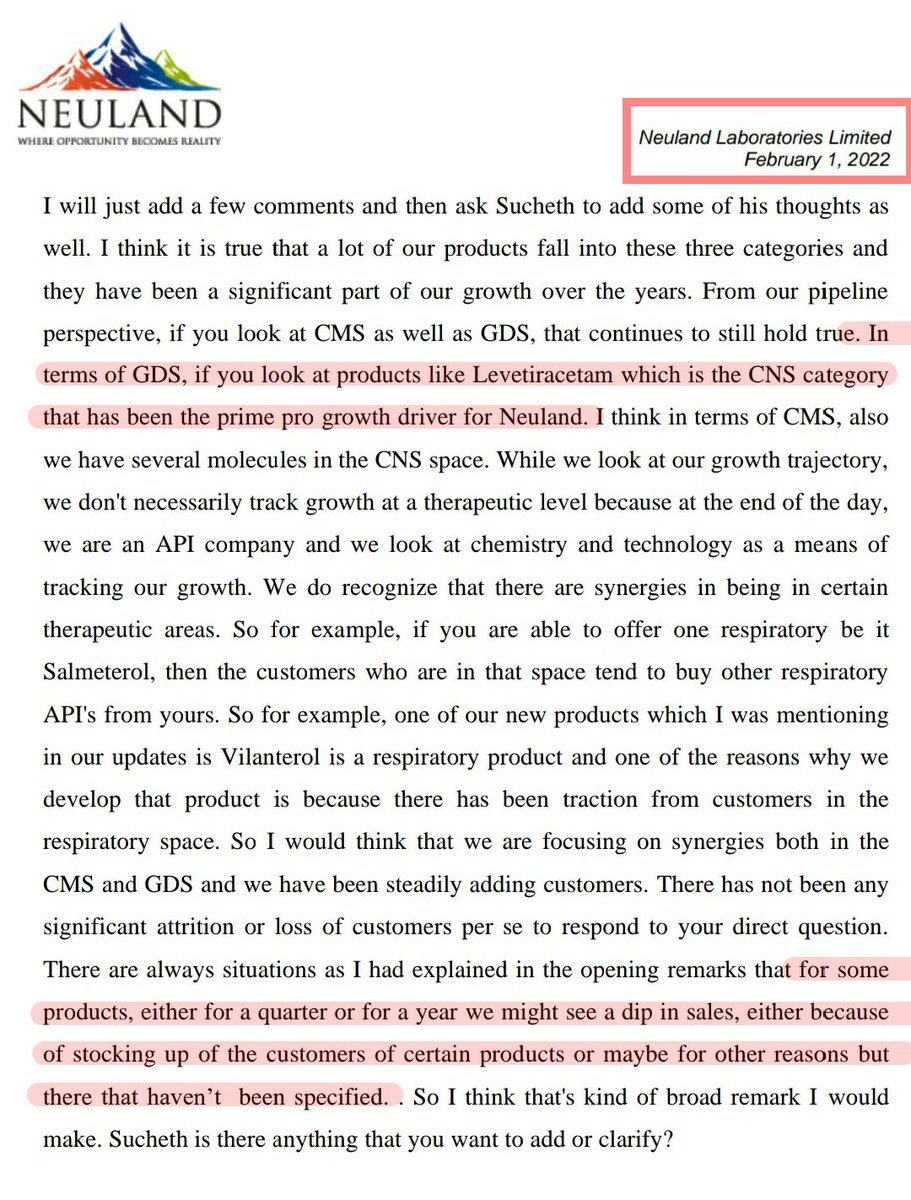

Challenges in the Levetiracetam sales were there for the past few quarters. Management always tried to convey the issues to be temporary.

Same old explanation.

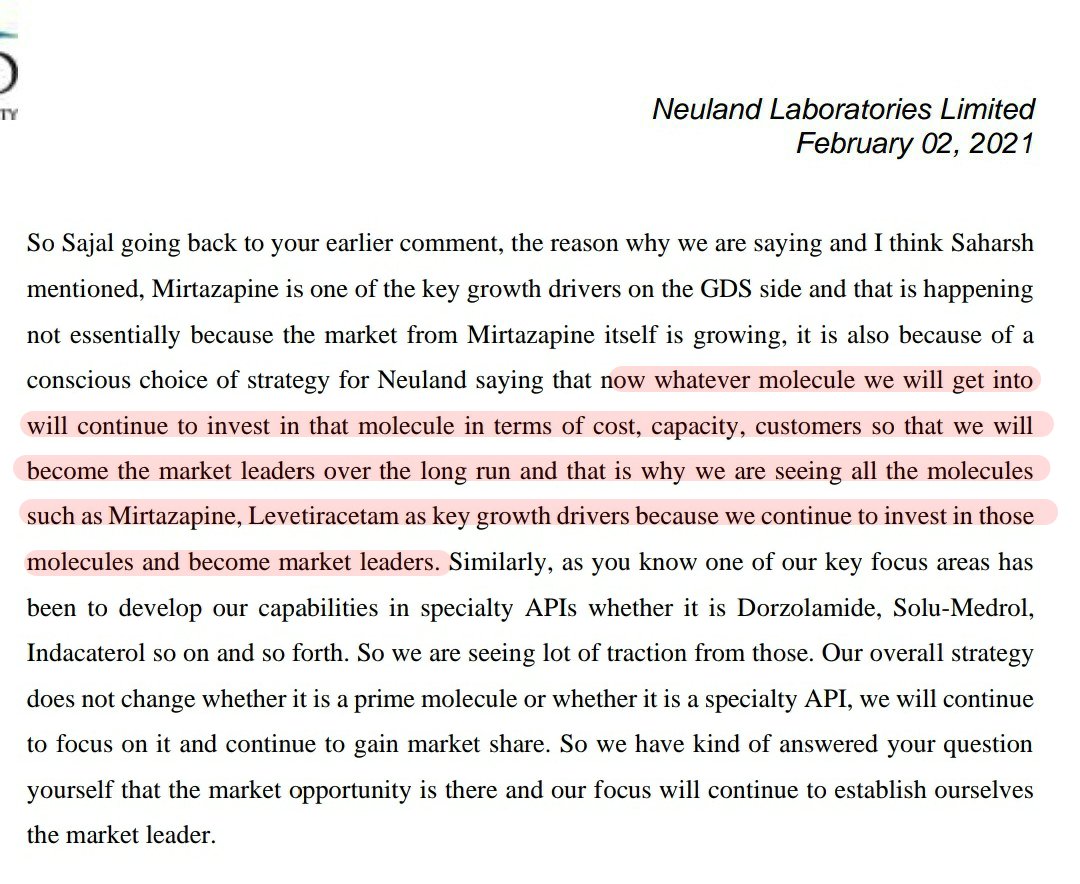

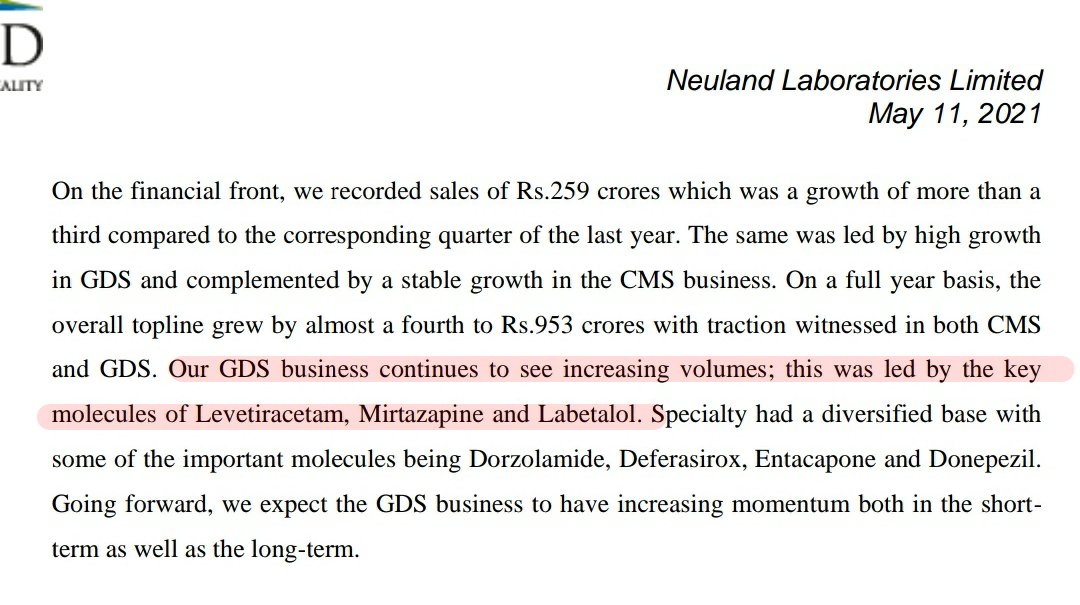

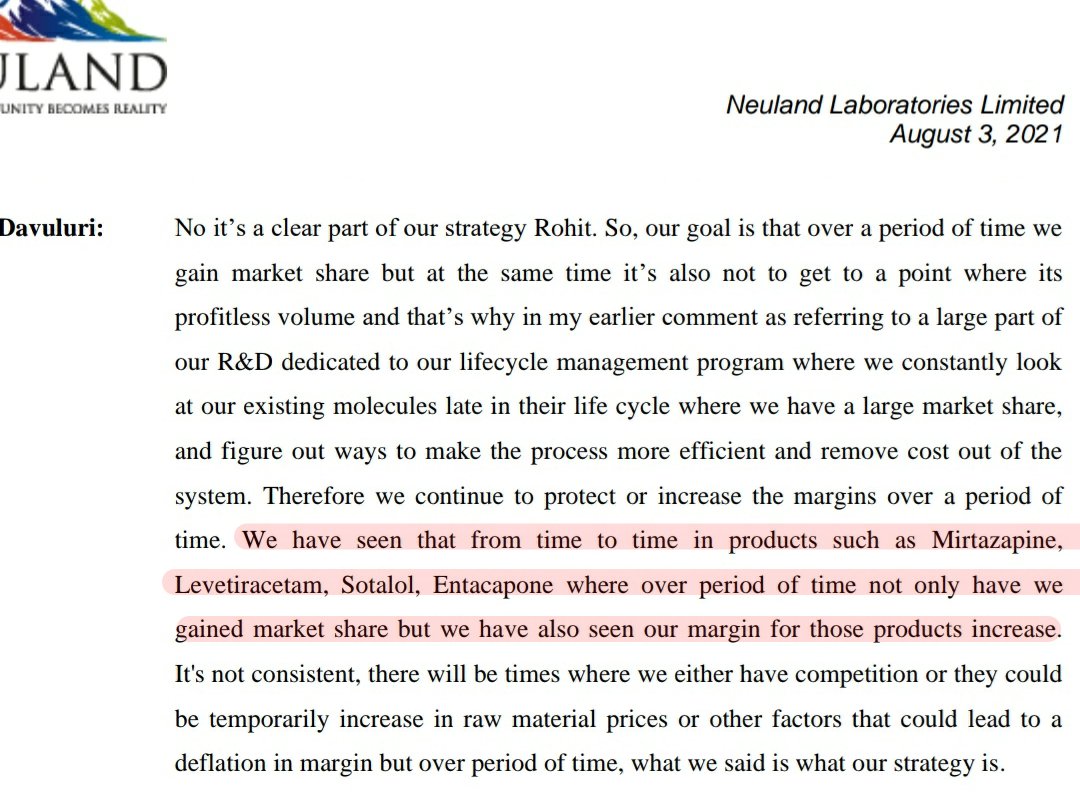

Snippets to understand the progression👇

Your question was absolutely spot on. @AdityaKhemka5

Challenges in the Levetiracetam sales were there for the past few quarters. Management always tried to convey the issues to be temporary.

Same old explanation.

Snippets to understand the progression👇

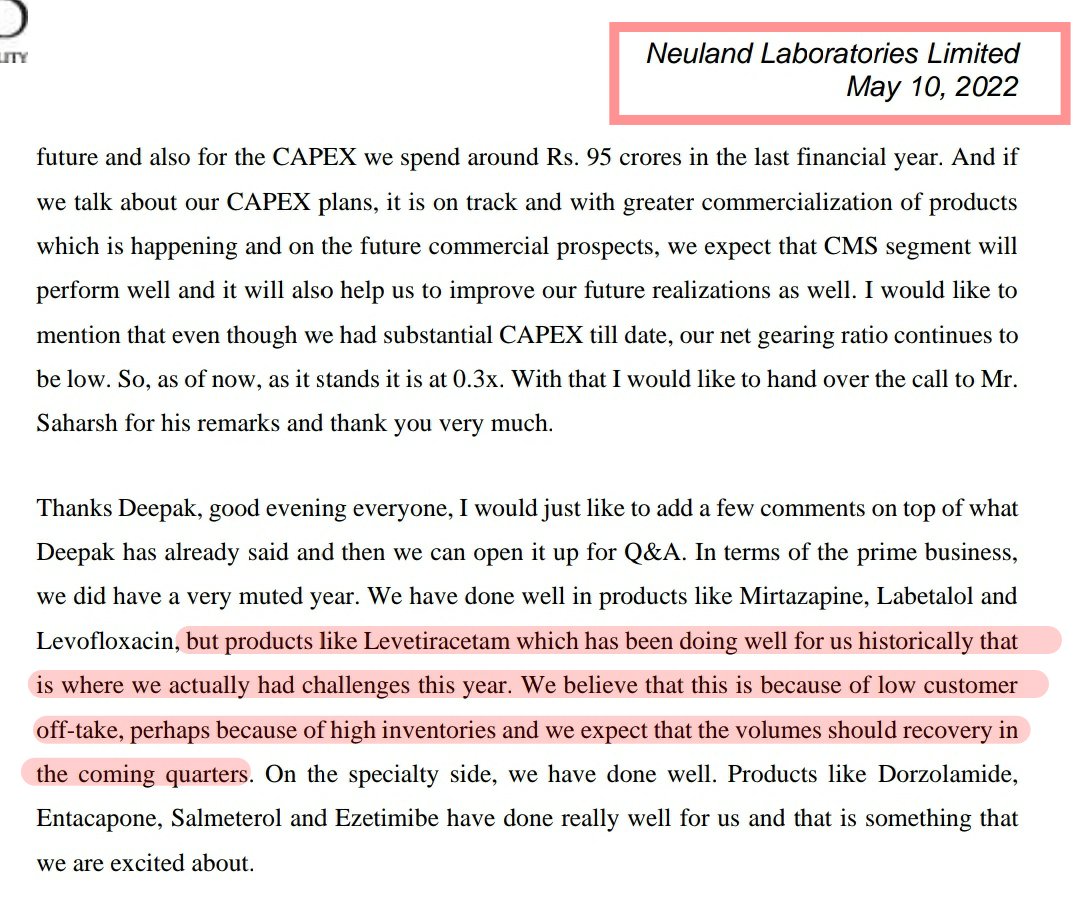

Today's con call

Q1 FY23: Biggest impact in the GDS was from Levetirazetam. It is also the largest product in our GDS segment which impacted our performance. We think it is temporary.

Reason- because of combination of reduction in demand & inventory build up at customer's end.

Q1 FY23: Biggest impact in the GDS was from Levetirazetam. It is also the largest product in our GDS segment which impacted our performance. We think it is temporary.

Reason- because of combination of reduction in demand & inventory build up at customer's end.

neulandlabs.com

You can hear the Q1FY23 earnings call recording from 34:13 for this particular question.

You can hear the Q1FY23 earnings call recording from 34:13 for this particular question.

Loading suggestions...