Politics

International Relations

Economics

Health

Public Health

COVID-19 Response

Fiscal Policy

Public Policy

COVID-19 Policy

Amidst the US recession, #Thread to understand how India was +vely different in its Covid policy. @paulkrugman says "Take it as given that large fiscal stimulus and Fed complacency allowed the U.S. economy to get overheated." 1/n

While all other economies – both advanced and emerging – focused their policy primarily on stimulating demand, India’s policy focused on enhancing demand and supply. Crucially, India identified early that the Covid pandemic would negatively impact aggregate supply. 2/n

Reorientation of fiscal policy to infrastructure spending by sovereign, structural reforms to alleviate supply-side frictions, & incentives for firms to ramp up production in particular sectors formed the bulwark of India’s policy focus on limiting damage to aggregate supply 3/n

India pursued a three-pronged demand-side policy to maximize the bang for every taxpayer buck spent during Covid. 4/n

1. India undertook in-kind transfers of cereals and pulses to 800 million citizens through its public distribution system. These did not impose additional fiscal costs as they tapped into existing reserves created from its food procurement policy. 5/n

2. Government undertook direct benefit transfers to the vulnerable by leveraging the digital identity of Aadhar and over 400 million PMJDY bank accounts created for the poor post-2014. 6/n

3. India recognized that financial sector not only possesses granular information on borrowers, which the sovereign can never rival, but also employs financial leverage. So, India provided sovereign loan guarantees for lending to SMEs by banks & the urban poor by MFIs. 7/n

Bcos financial sector tracks borrower credit scores, only a borrower who continues to be genuinely distressed would default. For genuinely distressed borrowers, sovereign guarantee ensures that loan becomes a “quasi cash-transfer.” For details see timesofindia.indiatimes.com 8/n

All other borrowers have incentives to repay for fear of permanently damaging their credit history – an inducement absent when the sovereign doles out free money. For details see timesofindia.indiatimes.com 9/n

We understood that the sovereign guarantees itself would have to be paid NOT during the Covid year but later when the economy would have recovered (unlike direct transfers that would get paid then). So, sovereign makes payments when its fiscal situation is much better 10/n

Loans with guarantees from sovereign thus ensured that demand-side policy was TARGETED to the genuinely distressed for whom it became a QUASI-CASH TRANSFER. This concept that turns "adverse selection in credit on its head" is explained in timesofindia.indiatimes.com 11/n

Instead of a direct transfer of Rs. 100 in Covid year that could not have been TARGETED sharply, loans with guarantees ensured that Sovereign only spends Rs. 5 when economy has picked up and that too in a well-targeted way (assuming a default rate of 5% on the loans). 12/n

Contrast such sagacious policy to shambolic policy response after GFC in 2008-09. The farm loan waiver, whose benefits were cornered by rich farmers (see my research on it in journals.uchicago.edu) & 6th CPC put money ONLY in hands of the rich & privileged 13/n

Even w/o supply-side disruptions during GFC in 2008-09, inflation was in high double digits for 1.5 years. If India had followed such shambolic policy during Covid, inflation wud've been 20%+ for >1.5 years bcos of huge supply-side disruptions + ONLY rich wud've benefited 14/n

What India did during GFC was playing from the same Keynesian playbook that the world played from during Covid (just demand-side stimulus by printing money like there's no tomorrow). India in Covid was +vely different by combining clarity of thought & courage of conviction 15/n

Thus, India by maximizing the bang for the taxpayer buck on demand side and recognizing early the need for supply-side measures ensured that India is in a better macro-situation compared to the rest of the world. End of #Thread

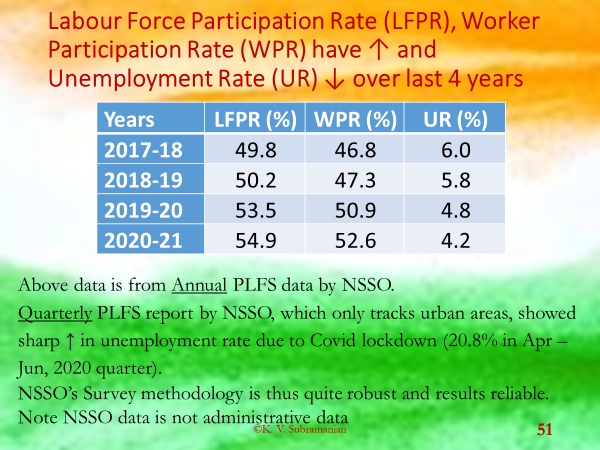

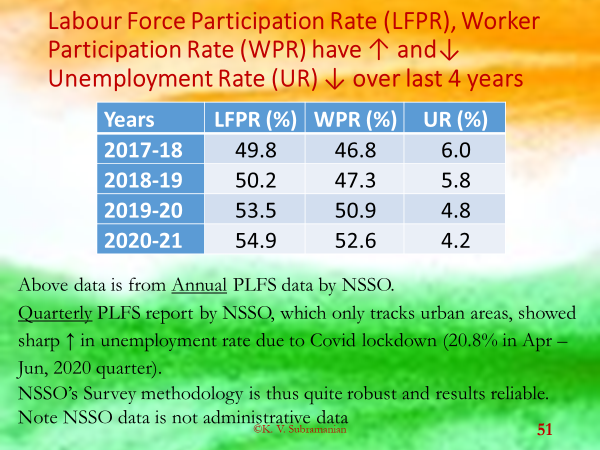

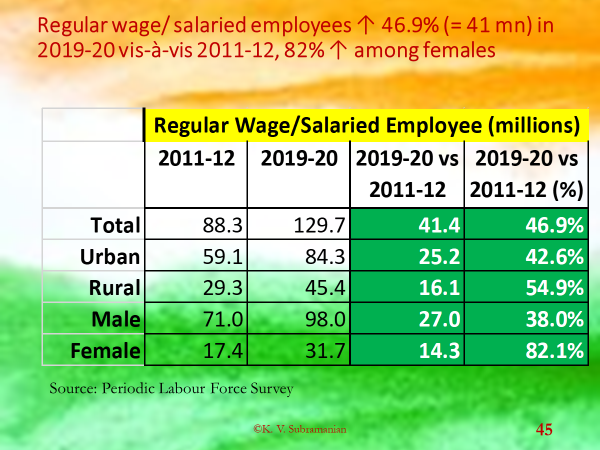

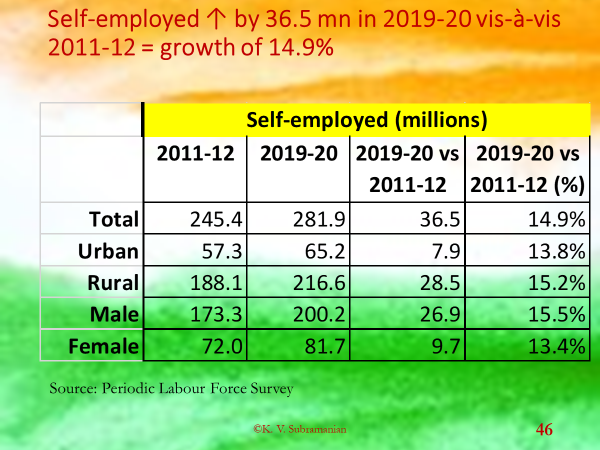

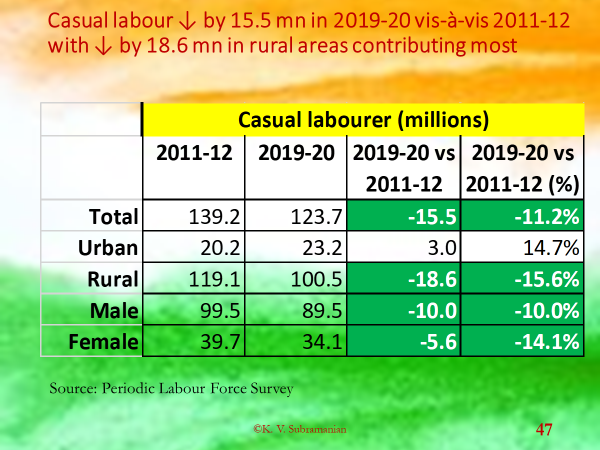

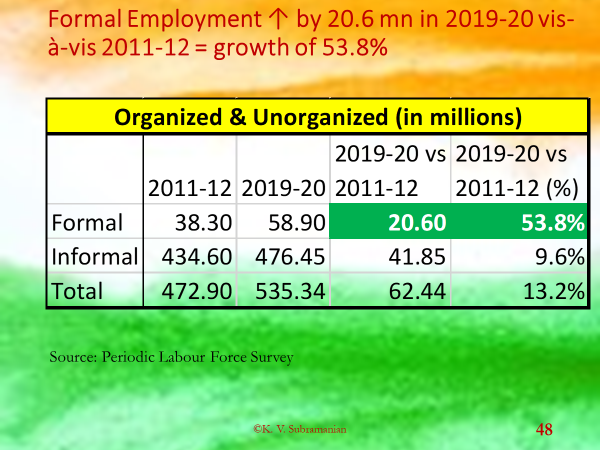

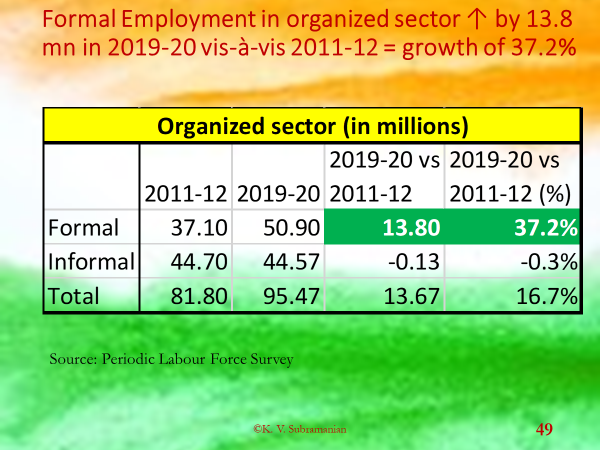

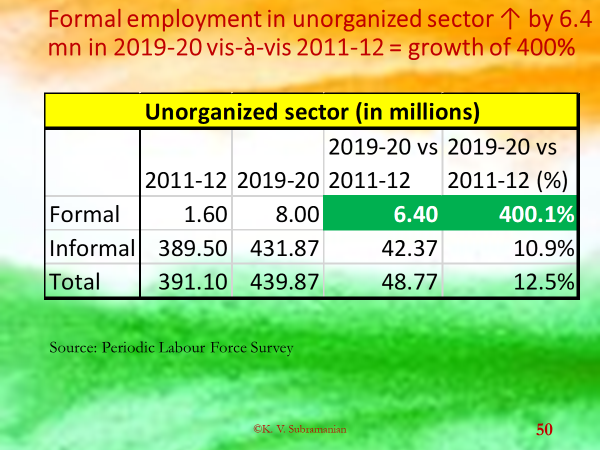

Some others claim Indian labour mkt was under-heated b4 Covid. Again, mis-informed claim. Apart from improvement in Labour Force Participation Rate, Worker Participation Rate & Unemployment Rate over last 4 years as seen in above tweet, see data on quality of employment 3/n

Finally, those who claim that US chose to have inflation by over-heating the economy are rationalizing ex-post. It is similar to claiming ex-post that V-shaped recovery due to low base after ex-ante never believing that V-shaped recovery wud happen. End 🧵

Loading suggestions...