#WeeklyIndexCheck CW30/2022

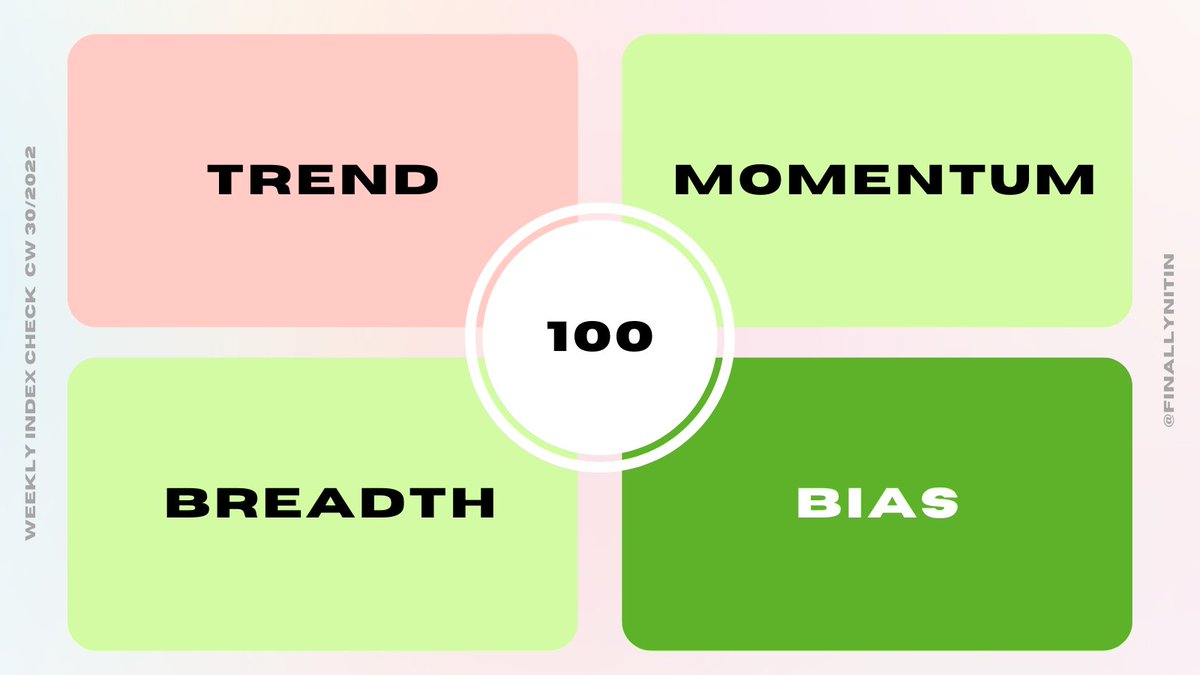

Market Quadrant:

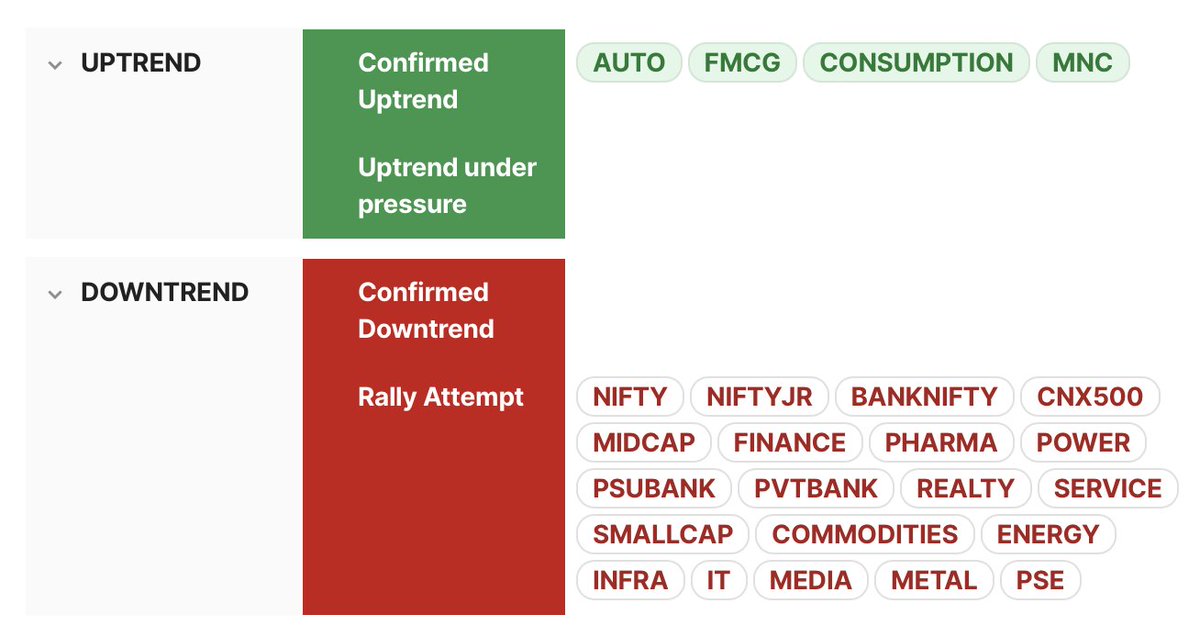

⦿ Trend: Rally Attempt

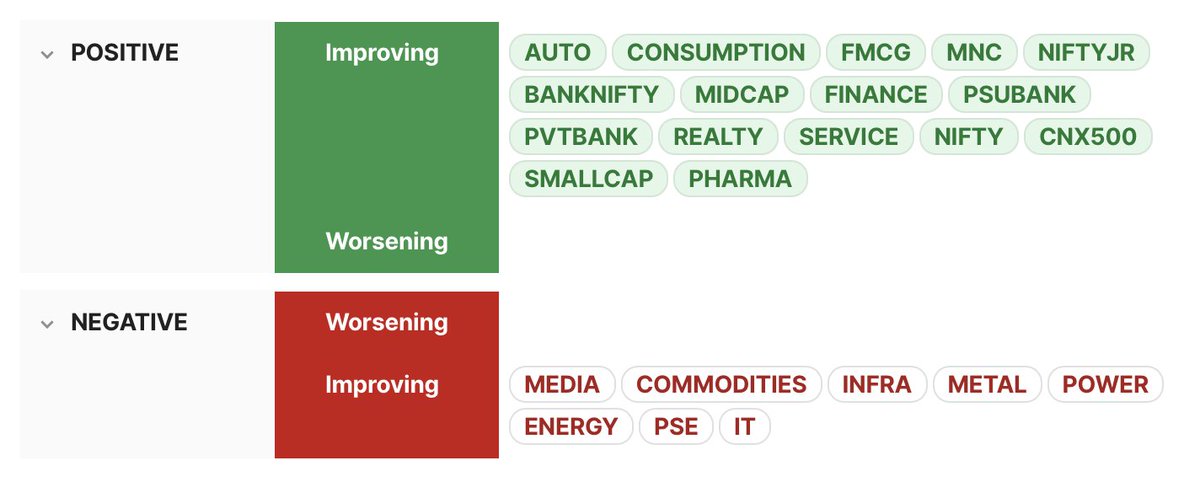

⦿ Momentum: Short-term positive & improving, long-term negative but improving

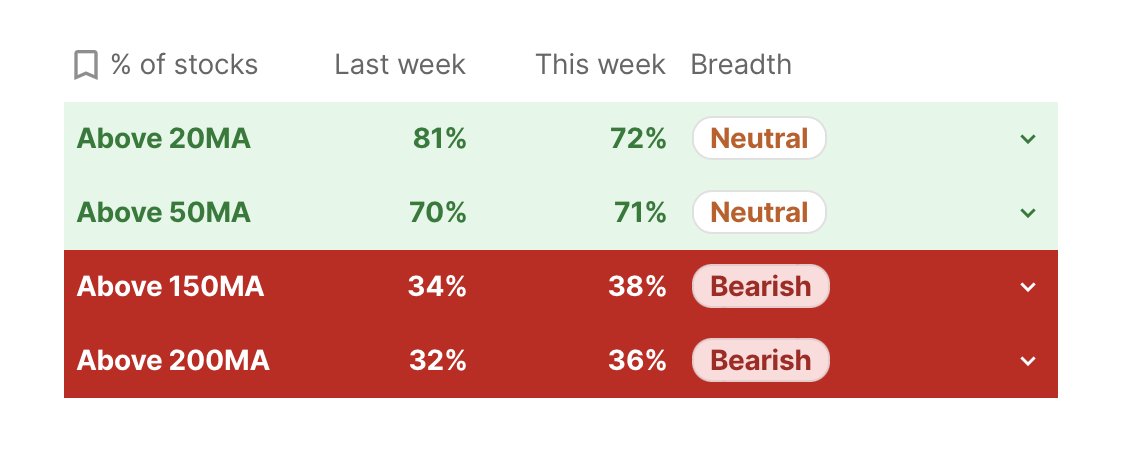

⦿ Breadth: Lower timeframes neutral, higher still bearish

⦿ Bias: Bullish

⦿ Swing Confidence: 100 (Confirmed Upswing)

Market Quadrant:

⦿ Trend: Rally Attempt

⦿ Momentum: Short-term positive & improving, long-term negative but improving

⦿ Breadth: Lower timeframes neutral, higher still bearish

⦿ Bias: Bullish

⦿ Swing Confidence: 100 (Confirmed Upswing)

That’s all for CW30/2022. If you'd like to read this as a newsletter, find it here:

world.hey.com

world.hey.com

Loading suggestions...