2/ THORChain (TC) value proposition is straightforward:

Earning yield and swapping crypto assets in their native form, thus no need for wrapped assets like $WBTC or renDOGE.

In theory, this should reduce centralization and complexity risks.

Earning yield and swapping crypto assets in their native form, thus no need for wrapped assets like $WBTC or renDOGE.

In theory, this should reduce centralization and complexity risks.

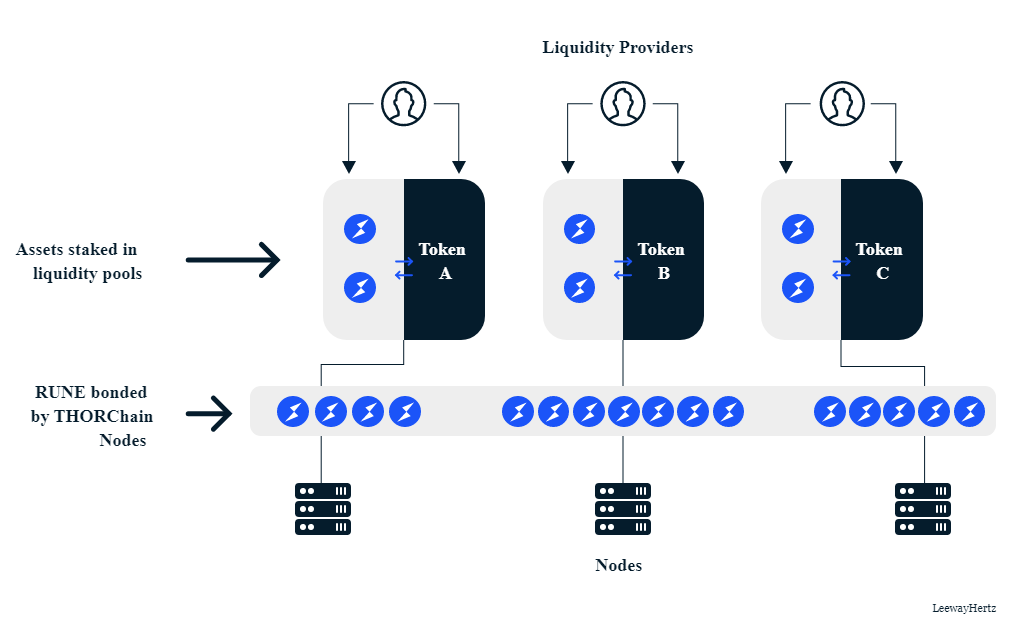

4/ Currently all liquidity providers need to deposit a native asset & $RUNE at 50/50 ratio to earn yield.

It creates two headaches to LPs:

• You are exposed to the price of $RUNE;

• Impermanent loss (IL) that can be higher than the yield.

cointelegraph.com

It creates two headaches to LPs:

• You are exposed to the price of $RUNE;

• Impermanent loss (IL) that can be higher than the yield.

cointelegraph.com

5/ TC has IL protection à la Bancor V2.1 that requires to keep liquidity for 100 days to get 100% cover.

Bancor later removed this limit and also allowed single asset LP.

It proved fatal as the market crashed and Bancor stopped the IL protection.

cryptoslate.com

Bancor later removed this limit and also allowed single asset LP.

It proved fatal as the market crashed and Bancor stopped the IL protection.

cryptoslate.com

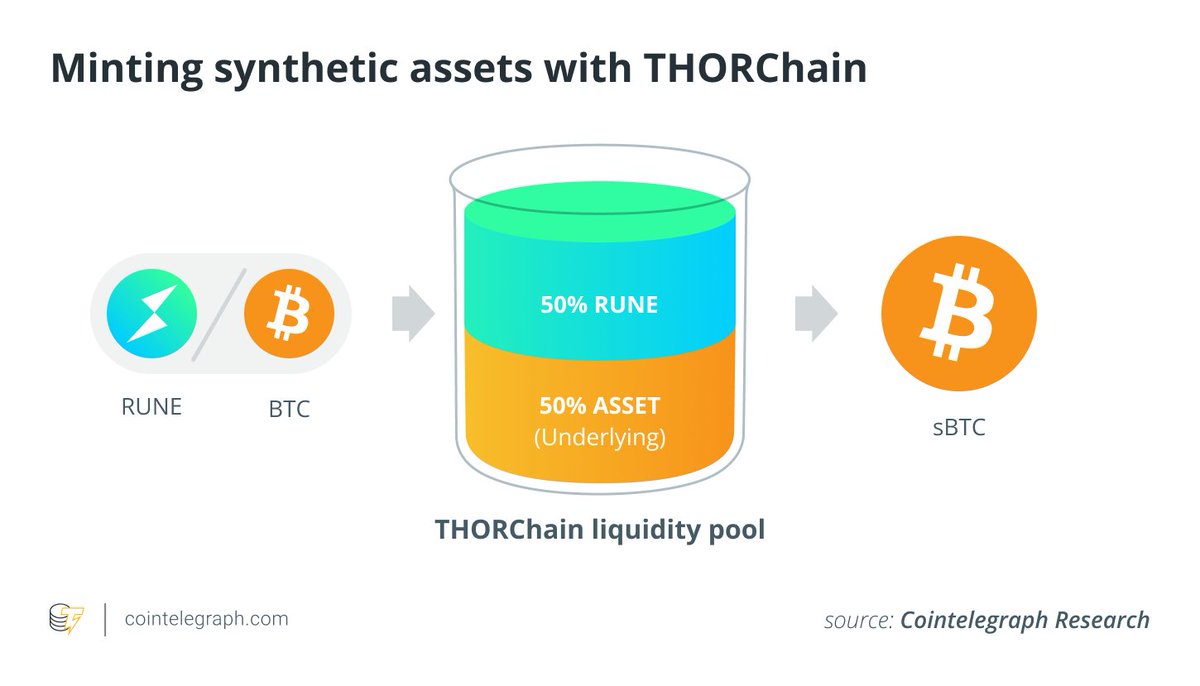

8/ Currently these synths contribute to the pool depth, but are not yet yield-bearing.

The plan now is to "lock it up" into a vault to generate yield.

Synths have no IL, but the yield will be max 50% of the typical dual pool.

Learn more here: gitlab.com

The plan now is to "lock it up" into a vault to generate yield.

Synths have no IL, but the yield will be max 50% of the typical dual pool.

Learn more here: gitlab.com

9/ The Next Phase plan also focuses on:

• Allowing small $RUNE holders to contribute bonded RUNE to the network

• Multi-sig wallet

• #DEX aggregation for more assets

• Adding more chains with $AVAX coming soon.

But for me the two most interesting upcoming features are 👇

• Allowing small $RUNE holders to contribute bonded RUNE to the network

• Multi-sig wallet

• #DEX aggregation for more assets

• Adding more chains with $AVAX coming soon.

But for me the two most interesting upcoming features are 👇

10/

1⃣ Orderbook

Adding orderbook will attract new types of users: market makers and users who use limit orders.

The design enables the orders awaiting execution at a certain price to contribute to pool depth & produce revenue for LP/nodes.

Learn more gitlab.com

1⃣ Orderbook

Adding orderbook will attract new types of users: market makers and users who use limit orders.

The design enables the orders awaiting execution at a certain price to contribute to pool depth & produce revenue for LP/nodes.

Learn more gitlab.com

11/

2⃣ Protocol-owned-stablecoin $TOR

Initially planned after Terra’s $UST, the plan ‘is not scrapped and will be revisited at a later point.’

Instead of following UST design though, TC could follow Aave by using already deposited capital as collateral to issue a stablecoin.

2⃣ Protocol-owned-stablecoin $TOR

Initially planned after Terra’s $UST, the plan ‘is not scrapped and will be revisited at a later point.’

Instead of following UST design though, TC could follow Aave by using already deposited capital as collateral to issue a stablecoin.

12/ I am intriguedby $RUNE’s value proposition.

It is heading towards Progressive decentralization and contributing to the multichain future that doesn't rely on 3rd party bridges.

It is heading towards Progressive decentralization and contributing to the multichain future that doesn't rely on 3rd party bridges.

14/ With these upgrades @THORChain hopes to attract more liquidity, trading volume and RUNE bonded in Nodes.

Loading suggestions...