How to Catch 3X-5X Multibagger IPOs

Happiest Minds : 4X

Angel One : 5X

Laxmi Organics : 3X

Here are 4 Stocks Which Can Become Next Multibaggers

A Thread (1/n) 🧵

❤️Like & Retweet to Support our work

Happiest Minds : 4X

Angel One : 5X

Laxmi Organics : 3X

Here are 4 Stocks Which Can Become Next Multibaggers

A Thread (1/n) 🧵

❤️Like & Retweet to Support our work

To get exact entry our Next Multibaggers Join Our FREE Telegram Channel

(Note : If you face any issue with link just search "Curious Community" and join

FREE Telegram Link : t.me

(Note : If you face any issue with link just search "Curious Community" and join

FREE Telegram Link : t.me

Before we begin with thread let's understand how last few IPOs have given Multibagger returns and what's common in these IPOs

Common Fundamentals Factors :

1. Valuation (Future Cash Flow)

2. Growth

Technical Factors :

1.Breaking IPO base

2.Good Base Formation

3.Volume on BO

Common Fundamentals Factors :

1. Valuation (Future Cash Flow)

2. Growth

Technical Factors :

1.Breaking IPO base

2.Good Base Formation

3.Volume on BO

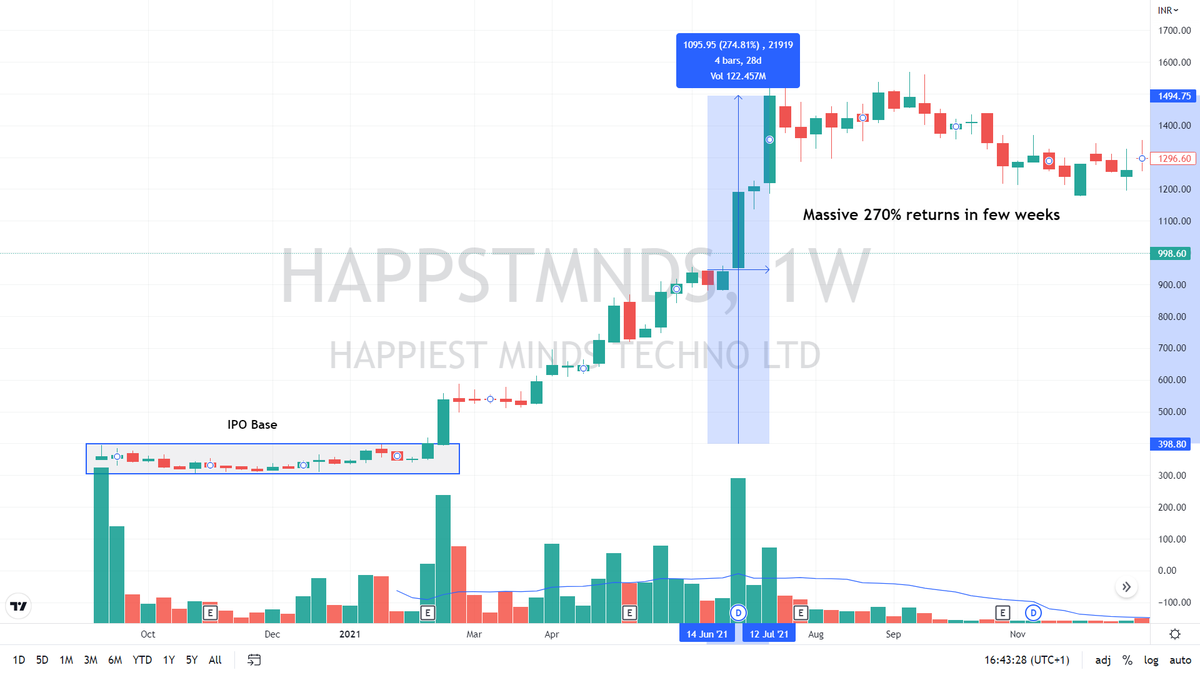

#IPO1 #HappiestMinds

IPO base BO : 4X Returns

Very good base and Multibaggers Returns

High Growth Stock

Huge Growth was thete in Quarterly results

Sector was also trending

IPO base BO : 4X Returns

Very good base and Multibaggers Returns

High Growth Stock

Huge Growth was thete in Quarterly results

Sector was also trending

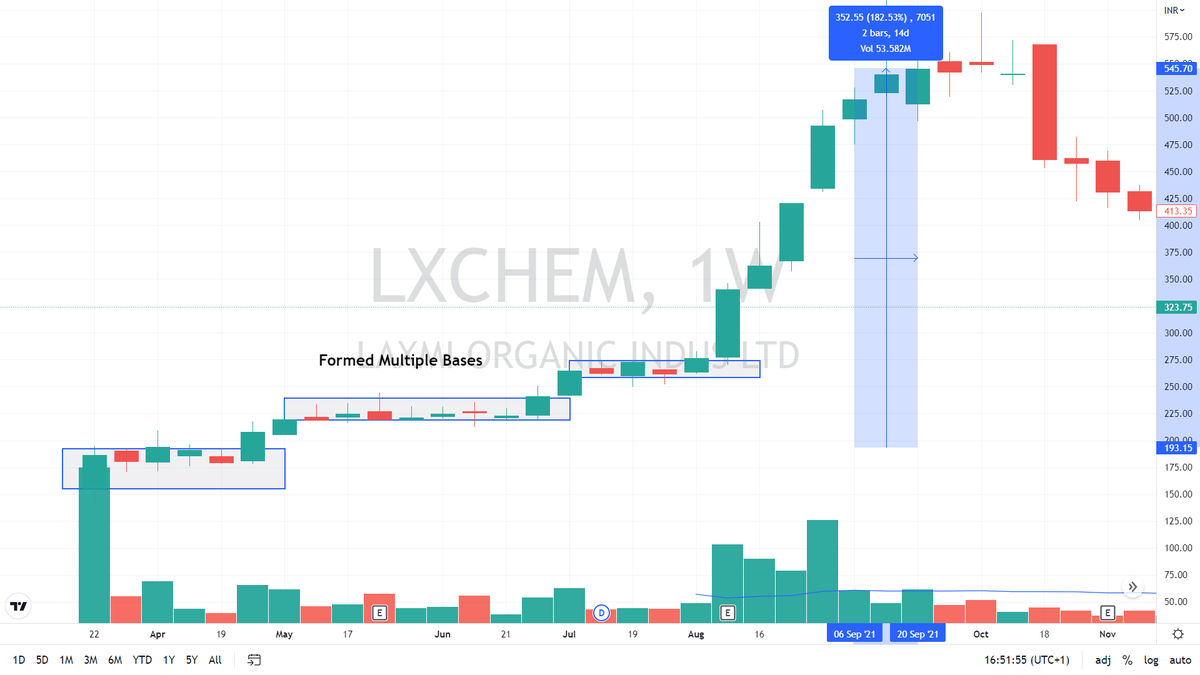

#IPO3 #LaxmiOrganics

IPO base BO : 3X Multibagger Returns

Again High Growth Name

Clean 3 Bases After IPO

And Massive Follow Through Move

Sector was also in favour

Once sectorial Headwinds started stock broken down

IPO base BO : 3X Multibagger Returns

Again High Growth Name

Clean 3 Bases After IPO

And Massive Follow Through Move

Sector was also in favour

Once sectorial Headwinds started stock broken down

#IPO4 #NazaraTech

IPO base BO : 55% Returns

This is failure example

Let's learn how it can fail also

Once Stock does not sustain above previous weeks base it just fails to sustain BO and gives Breakdown

That's why it's necessary to follow trailing SL with every trade

IPO base BO : 55% Returns

This is failure example

Let's learn how it can fail also

Once Stock does not sustain above previous weeks base it just fails to sustain BO and gives Breakdown

That's why it's necessary to follow trailing SL with every trade

Cont...

Now NazaraTech may face resistance near IPO base box earlier it was support but now it will turn into Resistance

Fundamentals Factors:

No QoQ Growth

Expensive Valuation

Now NazaraTech may face resistance near IPO base box earlier it was support but now it will turn into Resistance

Fundamentals Factors:

No QoQ Growth

Expensive Valuation

So to conclude

What was common in above IPOs

1) Sector was trending

2) QoQ growth was amazing

3) Valuation should be sustainable before BO

4) Good Management is icing on cake

What was common in above IPOs

1) Sector was trending

2) QoQ growth was amazing

3) Valuation should be sustainable before BO

4) Good Management is icing on cake

Now let's start with similar next Multibaggers

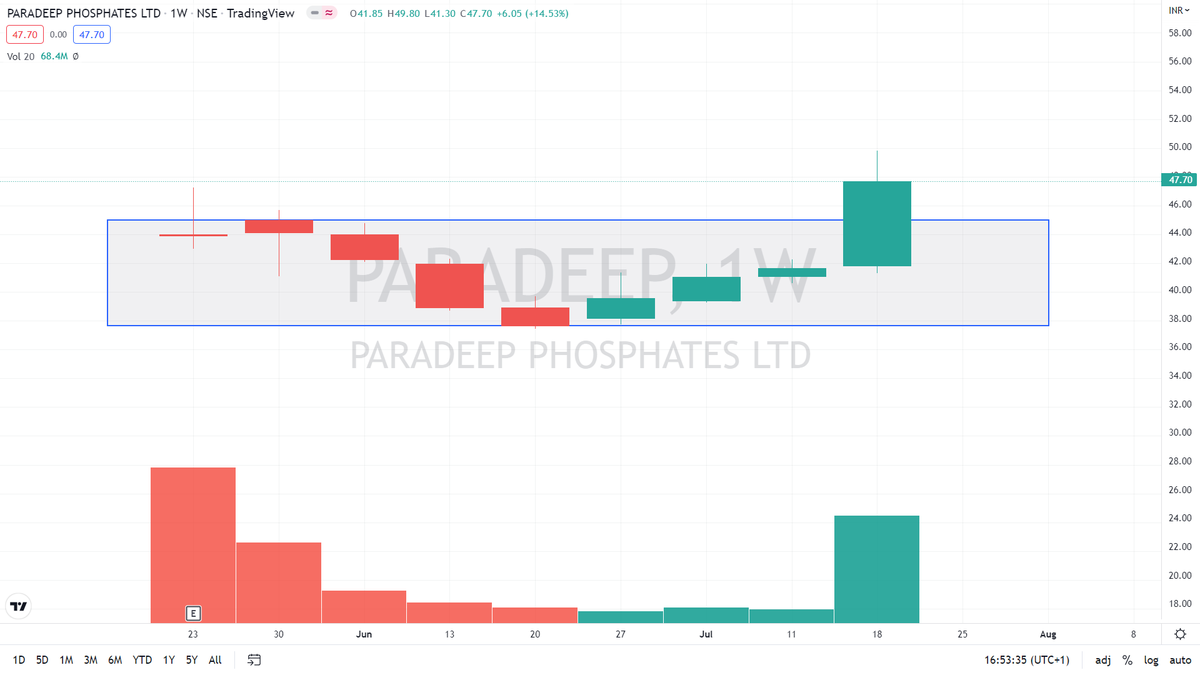

#Stock1 #ParadeepPhosphate

Given on YouTube & Telegram before anyone else at 41 on last Monday

📌Here's Video Link : youtu.be

Subscribe YouTube for more amazing timely updates at PERFECT time

#Stock1 #ParadeepPhosphate

Given on YouTube & Telegram before anyone else at 41 on last Monday

📌Here's Video Link : youtu.be

Subscribe YouTube for more amazing timely updates at PERFECT time

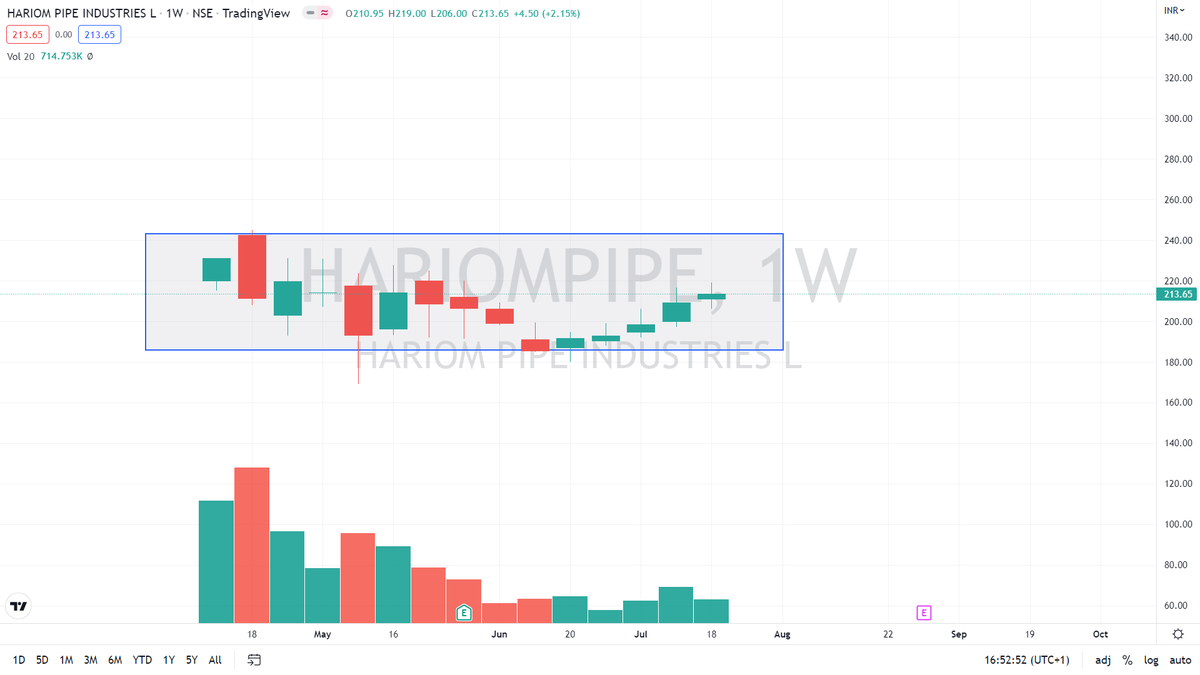

#Stock3 #HariomPipe

Awaiting Breakout

Base is ready now

BO is pending

Fundamentals already shared on YouTube & Telegram

Awaiting Breakout

Base is ready now

BO is pending

Fundamentals already shared on YouTube & Telegram

If you want to learn more Technical Analysis

You may join our course which cheapest in whole industry

Whole course is recorded so you can watch anytime

Lifetimes video access

Joining Link (25% Discount Added for 2 Days) : app.cosmofeed.com

You may join our course which cheapest in whole industry

Whole course is recorded so you can watch anytime

Lifetimes video access

Joining Link (25% Discount Added for 2 Days) : app.cosmofeed.com

Loading suggestions...