1/ Rocket Pool started to prepare for #ETH staking already in 2017!

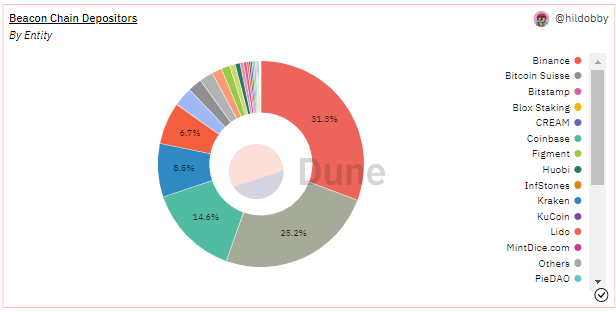

Yet Lido dominates liquid $ETH with 90% market share, despite announcing itself 1 month before the Beacon Chain launch in 2020

Rocket Pool market share is only 4.3%

Why and how can Rocket Pool catch up 🧵

Yet Lido dominates liquid $ETH with 90% market share, despite announcing itself 1 month before the Beacon Chain launch in 2020

Rocket Pool market share is only 4.3%

Why and how can Rocket Pool catch up 🧵

4/ But first, how did Lido gain such dominance?

@Jasper_ETH wrote a great explanation. In short:

• Lido launched first

• Allowed unlimited amount of #ETH to be staked

• Launched aggressive liquidity mining

• Got integrated into Curve, Yearn etc.

mirror.xyz

@Jasper_ETH wrote a great explanation. In short:

• Lido launched first

• Allowed unlimited amount of #ETH to be staked

• Launched aggressive liquidity mining

• Got integrated into Curve, Yearn etc.

mirror.xyz

5/ But not all is lost

To scale Rocket Pool is planning:

• Less $ETH bonded minipools reducing collateral requirement from 16 ETH to as low as 4 #ETH

• Staking as a Service for institutions etc.

• Integrate solo staker migration

Check the full plan

To scale Rocket Pool is planning:

• Less $ETH bonded minipools reducing collateral requirement from 16 ETH to as low as 4 #ETH

• Staking as a Service for institutions etc.

• Integrate solo staker migration

Check the full plan

Loading suggestions...