How to avoid getting your positions underwater and becoming the MM's liquidity 👇

🔸Don’t trade at the weekend:

Exchanges are closed so we don’t have trading sessions (no liquidity)

MM knows retail traders have more time to trade during the weekend so they set many traps. Also, most weekend moves get retraced the next week filling the CME gap

Exchanges are closed so we don’t have trading sessions (no liquidity)

MM knows retail traders have more time to trade during the weekend so they set many traps. Also, most weekend moves get retraced the next week filling the CME gap

🔸Don’t trust Asia pumps:

This is something I mentioned several times after Asia pumps. Time has proved me right.

Most Asia pumps get fully retraced in the next sessions. You can learn more about the trading sessions in the pinned tweet.

This is something I mentioned several times after Asia pumps. Time has proved me right.

Most Asia pumps get fully retraced in the next sessions. You can learn more about the trading sessions in the pinned tweet.

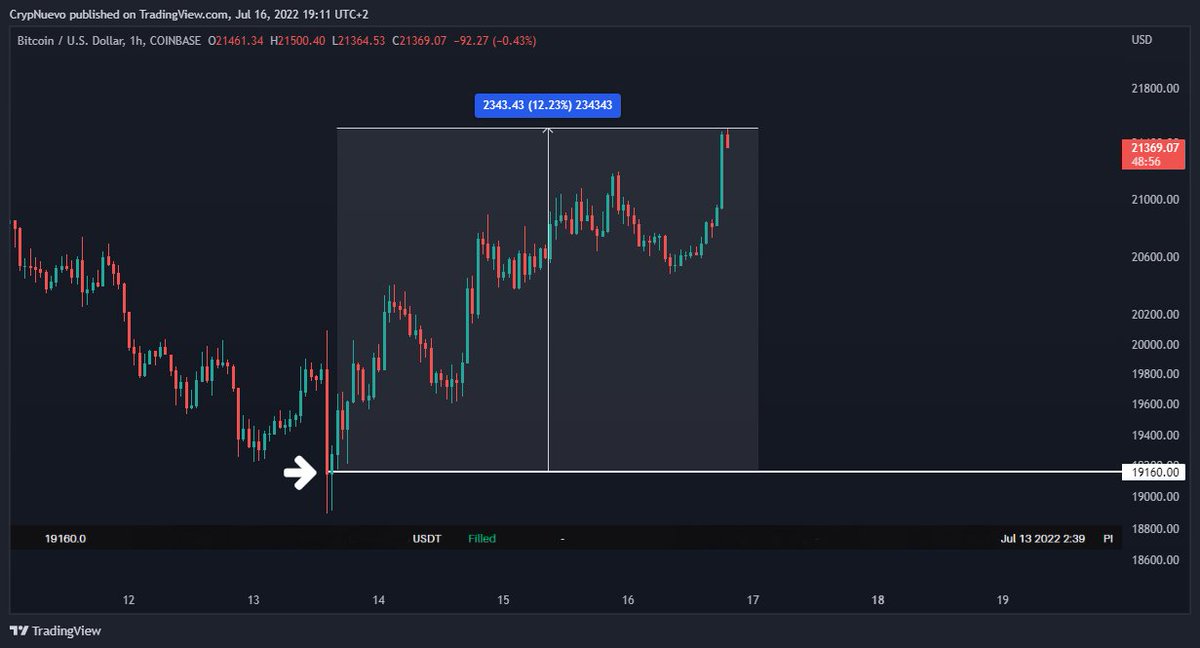

🔸Don’t trade days with news announcements unless you have a strategy:

News announcement days such as FOMC and CPI reports are very volatile and you can see long and short positions being hunted.

News announcement days such as FOMC and CPI reports are very volatile and you can see long and short positions being hunted.

Loading suggestions...