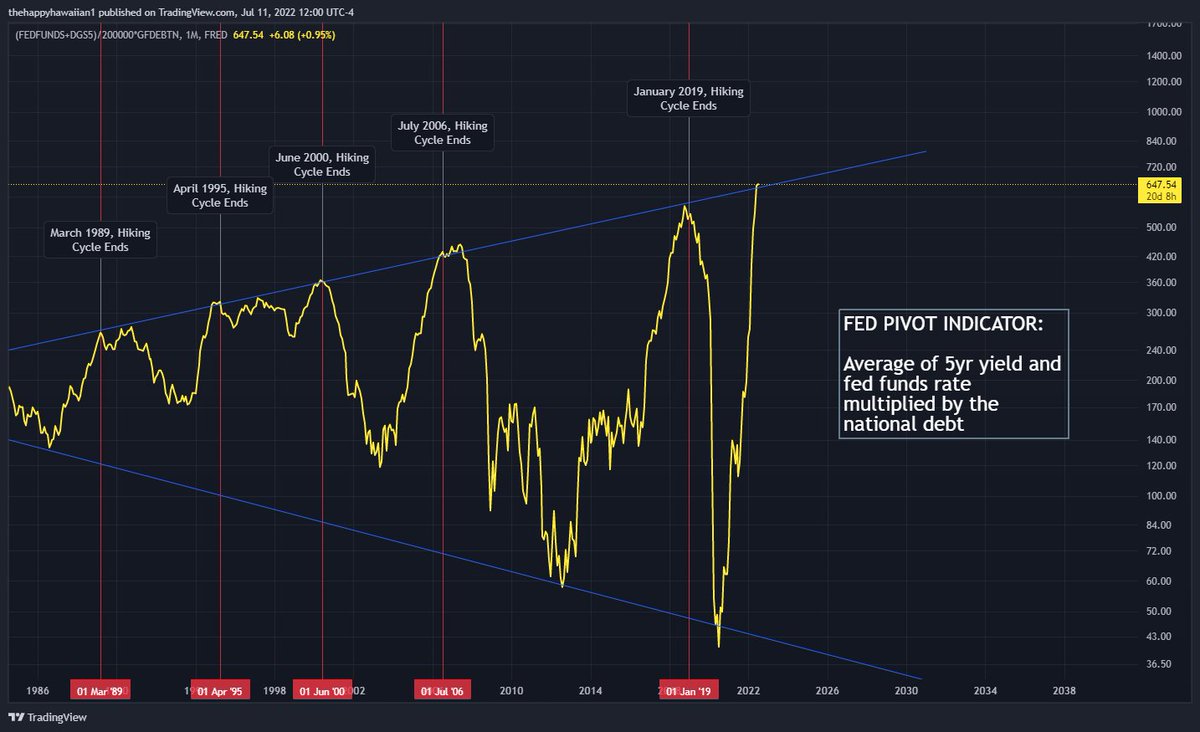

This chart is essentially proxy for the acceleration rate of interest expense for the US government, and has been a reliable indicator of fed pivot for 30+ years as the fed has ensured the US doesn't enter a debt death spiral

what is a debt death spiral? It's an increasingly large debt load, with ongoing deficit, that only gets exponentially larger as interest expense increases

The treasury has to issue more bills/notes/bonds to fund interest which drives up supply and can overwhelm demand

The treasury has to issue more bills/notes/bonds to fund interest which drives up supply and can overwhelm demand

thus increasing interest expense even more as yields increase and this spirals out of control, with the only way to make payments being issuing even more treasuries

For the past 33 years the fed has used monetary policy to ensure this spiral doesn't occur

For the past 33 years the fed has used monetary policy to ensure this spiral doesn't occur

To avoid this, the fed will need to pivot soon otherwise they risk having to do even more easing and monetizing of debt down the road

To keep this line 'inbounds' they need the middle of the curve to fall ~75bp between now and the 24th

To keep this line 'inbounds' they need the middle of the curve to fall ~75bp between now and the 24th

Or maybe they'll allow a brief spike above, and given the length of that chart, maybe 'brief' can be a number of months

But as far as what would be normal fed behavior, we're at the tightening limit for interest rates

But as far as what would be normal fed behavior, we're at the tightening limit for interest rates

the 28th is what i meant to say above! not the 24th

Feel free to follow me on Reddit too guys, I actually first posted this chart there way back in January of this year (though I’m more active on Twitter now)

Cheers!

reddit.com

Cheers!

reddit.com

Also should point out I am forecasting a new record print on CPI this month, meaning the fed is really backed into a corner with the US likely being recession already

Another way the fed could get this back inbounds even with a big rate hike is to announce that July’s hike would be the last one for a while as they wait for more data

Market wouldn’t digest it as a pause but as a reversal and the middle of the curve could collapse down

Market wouldn’t digest it as a pause but as a reversal and the middle of the curve could collapse down

#CPI comes in hot!

I predicted 8.84% and it was 9.06% (0.22% error)

Rate hike expectations are now putting some probability on a 100bp hike

The fed is likely going to hike us even further into recession

GDP in a couple weeks will show we have officially entered #stagflation

I predicted 8.84% and it was 9.06% (0.22% error)

Rate hike expectations are now putting some probability on a 100bp hike

The fed is likely going to hike us even further into recession

GDP in a couple weeks will show we have officially entered #stagflation

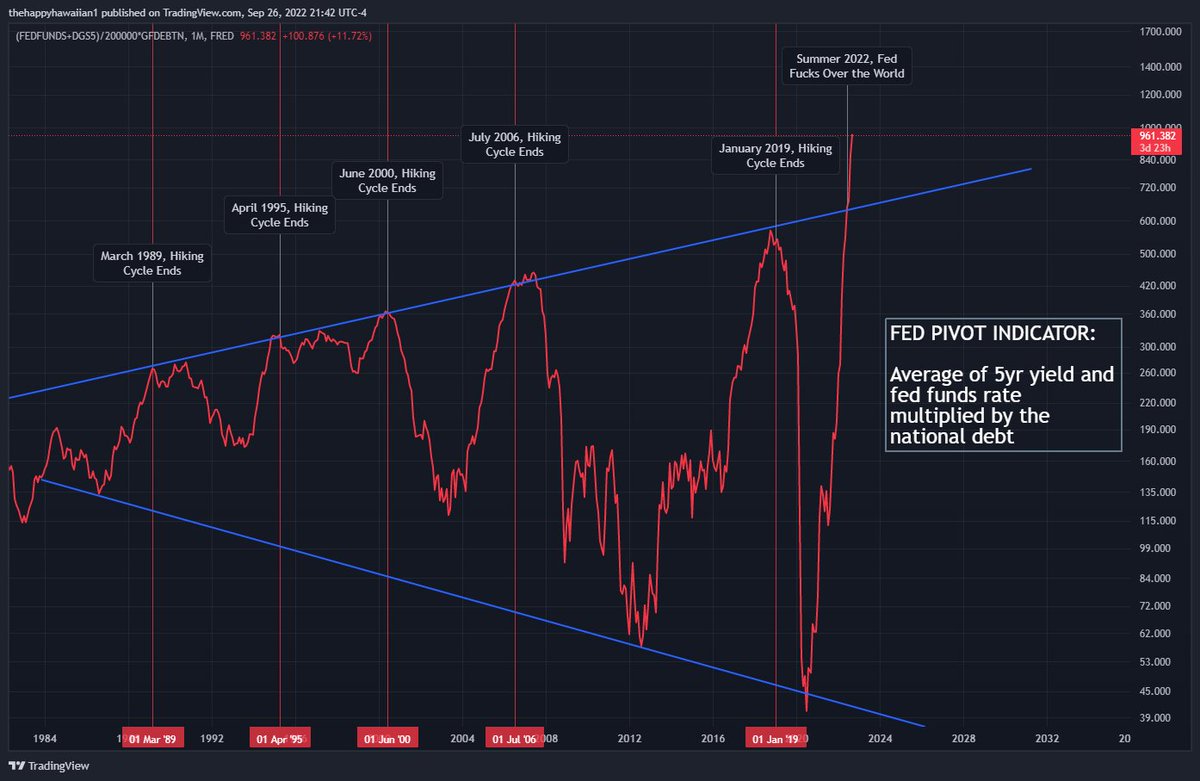

Update:

They blew up the system, knowingly

They blew up the system, knowingly

Here's the update on interest expense if you missed it also:

Loading suggestions...