#WeeklyIndexCheck CW26/2022

Market Quadrant:

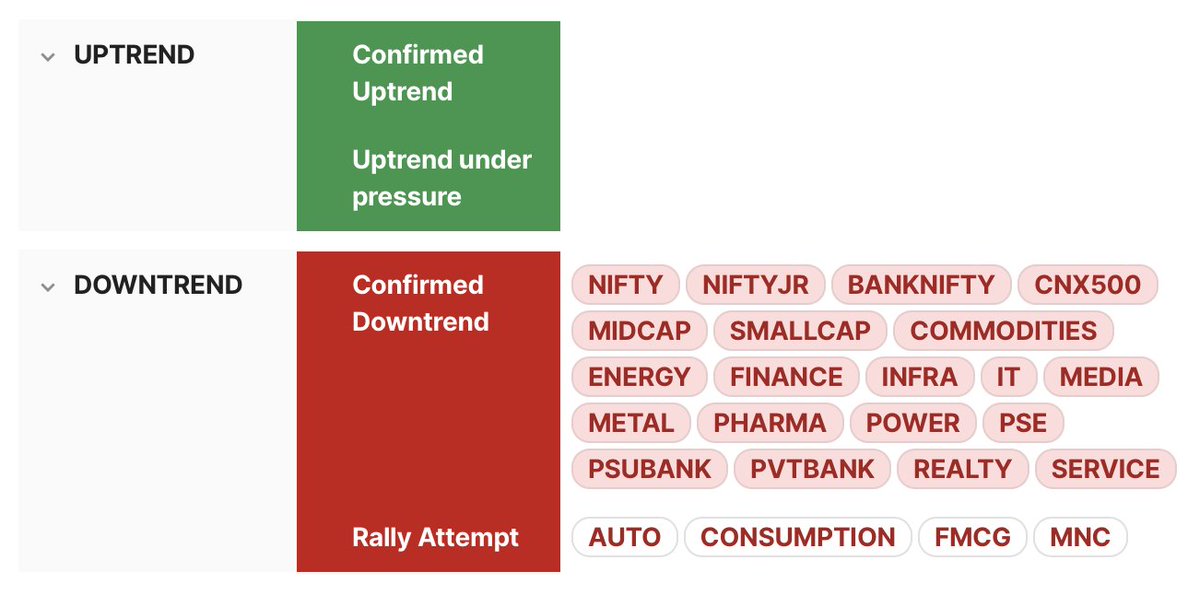

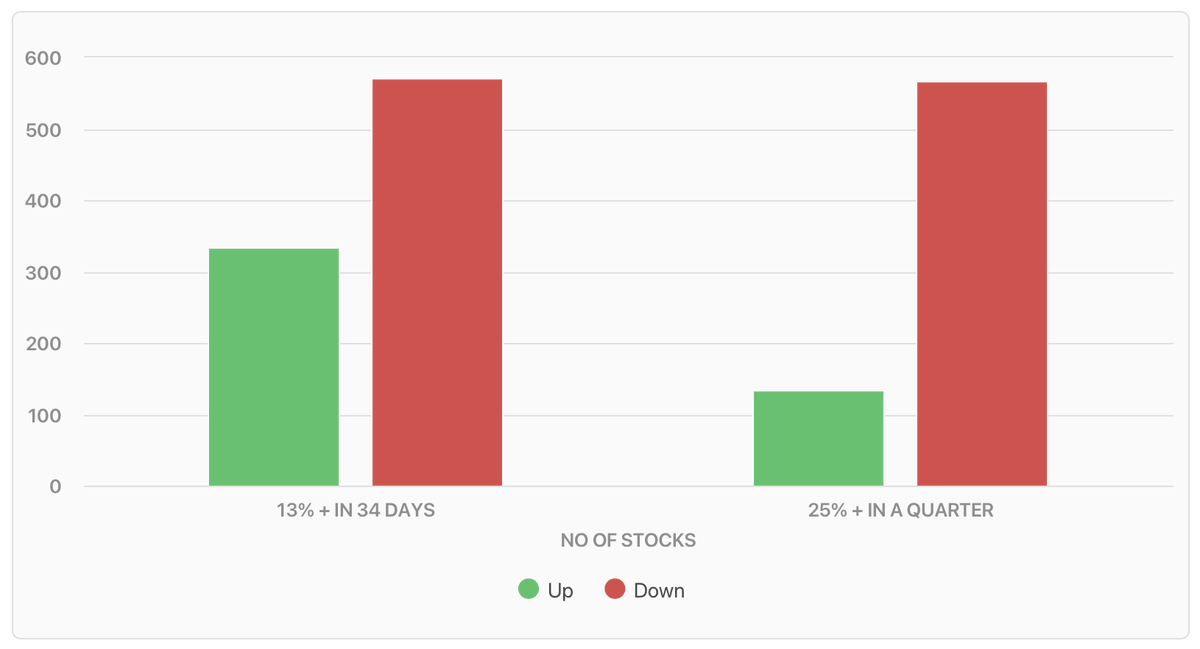

⦿ Trend: Confirmed Downtrend

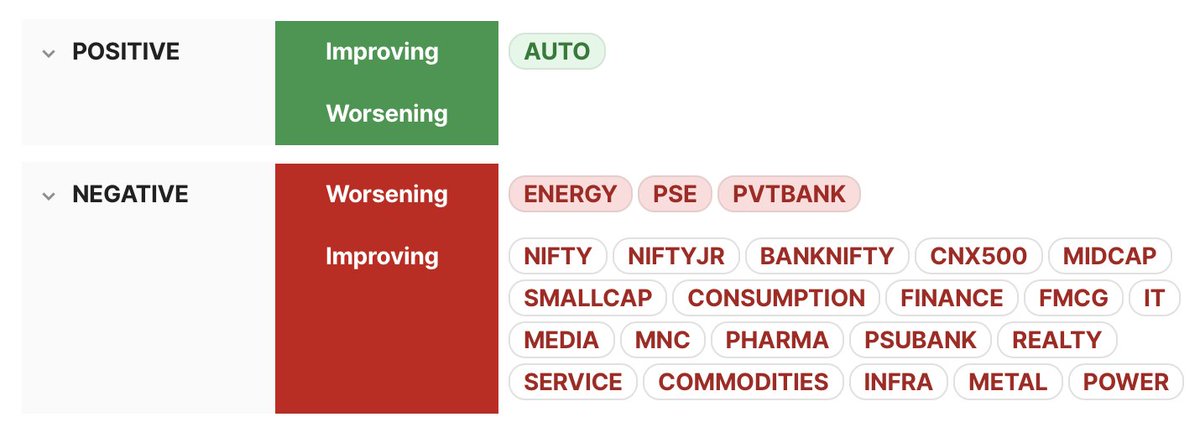

⦿ Momentum: Negative but improving

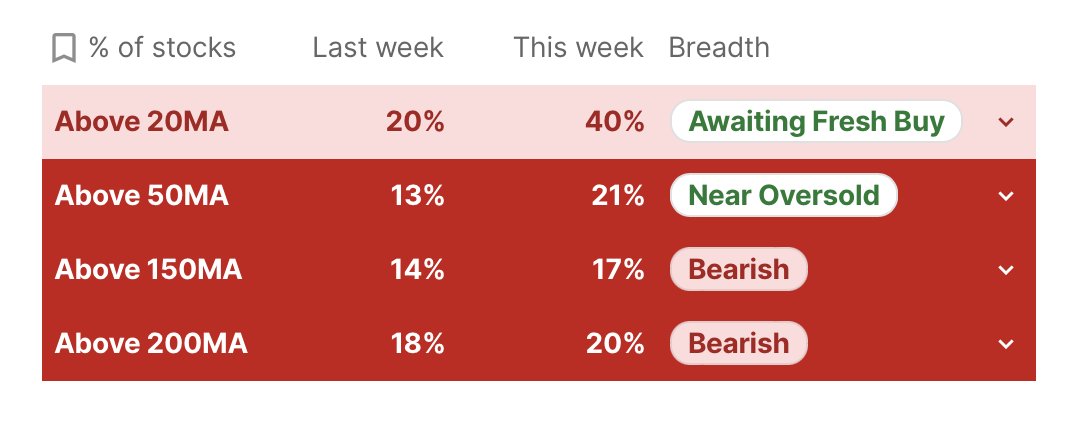

⦿ Breadth: Weak but improving

⦿ Bias: Bearish on both long & short timeframes

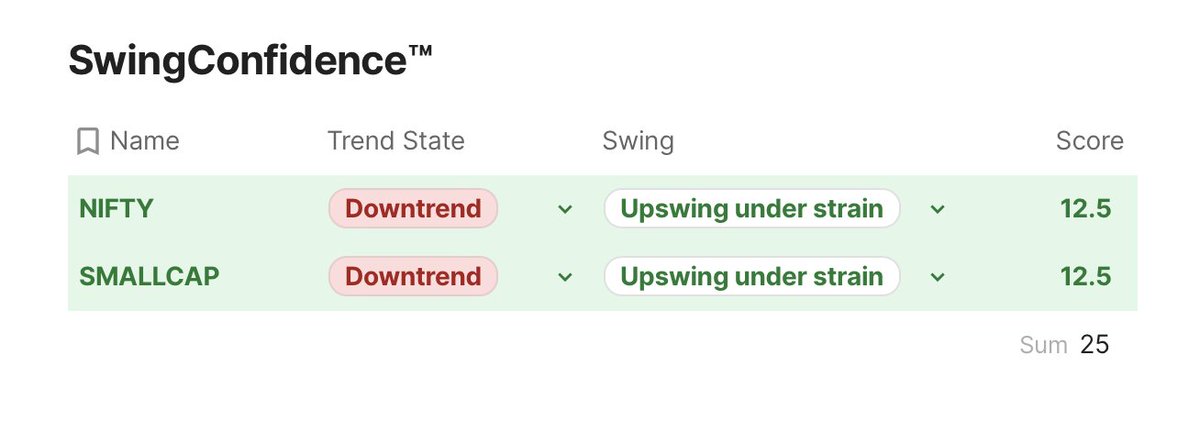

⦿ Swing Confidence: 25 (Upswing under strain)

Market Quadrant:

⦿ Trend: Confirmed Downtrend

⦿ Momentum: Negative but improving

⦿ Breadth: Weak but improving

⦿ Bias: Bearish on both long & short timeframes

⦿ Swing Confidence: 25 (Upswing under strain)

That’s all for CW26/2022. If you'd like to read this as a newsletter, find it here:

world.hey.com

world.hey.com

Loading suggestions...