2/n

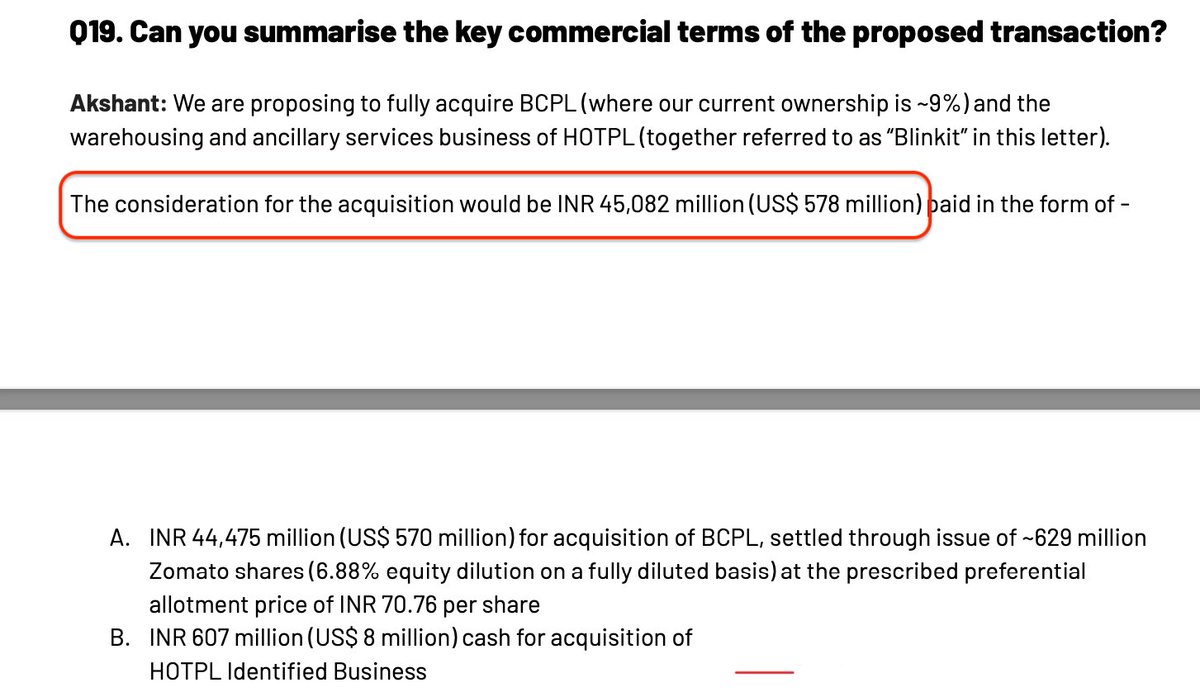

Zomato announced that it plans to acquire Blinkit for a “consideration” of $ 578 Mn. We will revisit valuation later. Below is the snapshot of financials.

Who pays $578 Mn on unaudited financials of just 2 mths ? Not even even 1 quarter nos are provided.

@SEBI listening?

Zomato announced that it plans to acquire Blinkit for a “consideration” of $ 578 Mn. We will revisit valuation later. Below is the snapshot of financials.

Who pays $578 Mn on unaudited financials of just 2 mths ? Not even even 1 quarter nos are provided.

@SEBI listening?

3/n

Is the company really growing topline at 162% as claimed ? This invites some curiosity. Where are the past YoY nos ?

I tried to dig out what I could with public reported info. Here is what the past looks like for #Blinkit .Revenues touched Rs 177 Cr in FY 2020 before covid

Is the company really growing topline at 162% as claimed ? This invites some curiosity. Where are the past YoY nos ?

I tried to dig out what I could with public reported info. Here is what the past looks like for #Blinkit .Revenues touched Rs 177 Cr in FY 2020 before covid

9/n

Enter June 2022.

May be it was time to disclose something in “actual numbers” since Blinkit is getting acquired by a listed company. What does the company disclose ? Jan & May’22 nos only.

Why do you need anything more for "just" $ 578 Mn acquisition?

Enter June 2022.

May be it was time to disclose something in “actual numbers” since Blinkit is getting acquired by a listed company. What does the company disclose ? Jan & May’22 nos only.

Why do you need anything more for "just" $ 578 Mn acquisition?

13/n

2022 June: Post acquisition plan, the tone is much subtle.

#Zomato CFO says “Given the early stage of business, it is very hard to commit a timeline for profitability……..it is possible in next 3 yrs, but it is an educated guess, not a guidance”.

Bravo !

2022 June: Post acquisition plan, the tone is much subtle.

#Zomato CFO says “Given the early stage of business, it is very hard to commit a timeline for profitability……..it is possible in next 3 yrs, but it is an educated guess, not a guidance”.

Bravo !

14/n

Where does this brazen confidence come from ? This is where it turns from opaque to muddy.

#Zomato says the acquisition price is $ 578 Mn. Really ?

Zomato already had 9% stake. So valuation of Blinkit is higher.

Add to this another $ 150 Mn “loan” given in March 2020.

Where does this brazen confidence come from ? This is where it turns from opaque to muddy.

#Zomato says the acquisition price is $ 578 Mn. Really ?

Zomato already had 9% stake. So valuation of Blinkit is higher.

Add to this another $ 150 Mn “loan” given in March 2020.

15/n

So what does the valuation of Blinkit add up to?

$578 Mn +57 Mn +150 Mn – cash on B/S)

Total = $ 720 Mn.

This is the actual price paid by Zomato for Blinkit.

Do you now how much money has been raised & spent by Grofers & Blinkit since 2015 ?

You guessed it : $ 700 Mn.

So what does the valuation of Blinkit add up to?

$578 Mn +57 Mn +150 Mn – cash on B/S)

Total = $ 720 Mn.

This is the actual price paid by Zomato for Blinkit.

Do you now how much money has been raised & spent by Grofers & Blinkit since 2015 ?

You guessed it : $ 700 Mn.

16/n

So how was the valuation of Blinkit arrived at ?

$ 700 Mn has been sunk in Grofers/Blinkit since inception. All that money has to be recovered by VCs. Since listing plans got derailed, plan B is to take money out from one of their own listed entities.

Welcome #Zomato

So how was the valuation of Blinkit arrived at ?

$ 700 Mn has been sunk in Grofers/Blinkit since inception. All that money has to be recovered by VCs. Since listing plans got derailed, plan B is to take money out from one of their own listed entities.

Welcome #Zomato

18/n

Conclusion:

My concern is not with the promotors or VCs of #Zomato. After all they are in the business to make money & recover losses where they can.

My question is to the mutual funds who are investing retail money in such muddy ventures.

Conclusion:

My concern is not with the promotors or VCs of #Zomato. After all they are in the business to make money & recover losses where they can.

My question is to the mutual funds who are investing retail money in such muddy ventures.

19/n

#DoorDash in US is valued at $ 28 BN in a $ 25 TN economy. An Indian replica venture with much poor metrics can’t be worth $ 8 BN. Zomato looks overpriced by 3x.

See comparison below:

#DoorDash in US is valued at $ 28 BN in a $ 25 TN economy. An Indian replica venture with much poor metrics can’t be worth $ 8 BN. Zomato looks overpriced by 3x.

See comparison below:

Loading suggestions...