🧵 CeFi degeneracy knows no bounds. Here's a case study into Hodlnaut - a centralized yield platform - and why I believe they have both lied to & misrepresented stablecoin staking risks to customers. These websites are not as trustworthy as you may think. (1/25)

Hodlnaut is a relatively small CeFi service akin to Celsius - it currently has $350m AUM and operates in Singapore, sporting the elusive in-principle approval from the Monetary Authority of Singapore. To be fair, there is a lot that makes Hodlnaut appear trustworthy. (2/25)

1. A regulatory nod from the Singaporean government

2. Responsible rate management (they lowered interest rates before the Celsius debacle)

3. They rejected 3AC's loan requests since Su Zhu didn't want to provide audited balance sheets

4. An esteemed reputation (3/25)

2. Responsible rate management (they lowered interest rates before the Celsius debacle)

3. They rejected 3AC's loan requests since Su Zhu didn't want to provide audited balance sheets

4. An esteemed reputation (3/25)

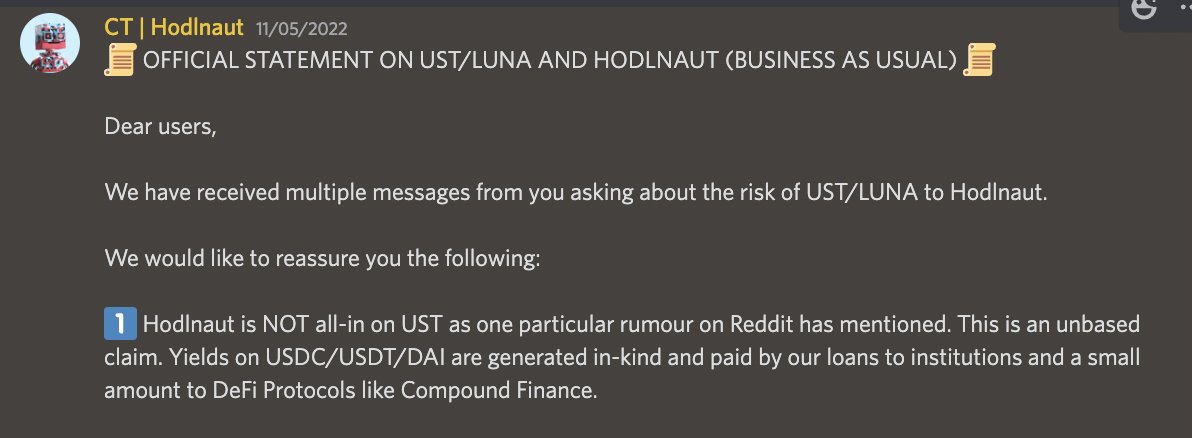

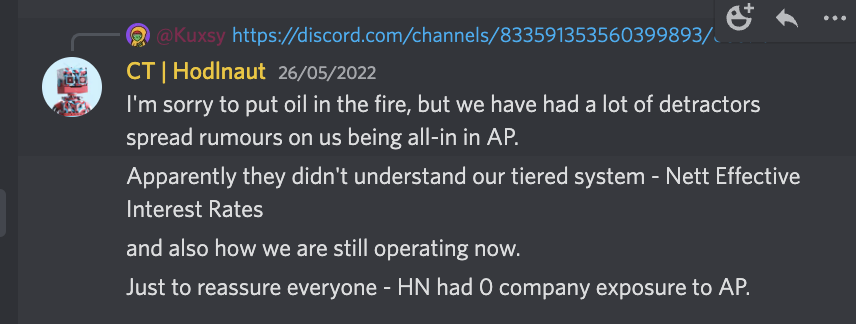

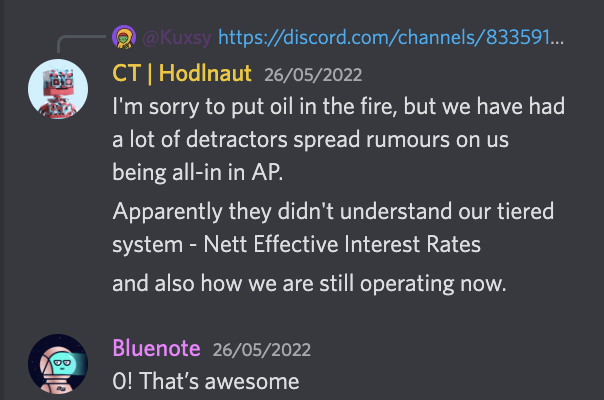

But despite this, once Terra collapsed, Hodlnaut stated that they had no exposure to Anchor. Although they blocked UST swaps & withdrawals for some time during the depeg, they maintained to customers that they weren't simply storing money in Anchor and skimming off a cut. (5/25)

The other day, an anonymous account, @Cycle_22, messaged me with some information and wallet addresses allegedly proving Hodlnaut had massive UST exposure during the depeg. My initial instinct was skepticism - surely Hodlnaut wouldn't brazenly lie to their customers. (7/25)

I sent the addresses to one of my new researcher friends, @Die_Nub_Plz, and I also asked Hodlnaut some questions. After reviewing all of this, I have come to the conclusion that Hodlnaut has indeed been misrepresenting their yield sources and risk profile. (8/25)

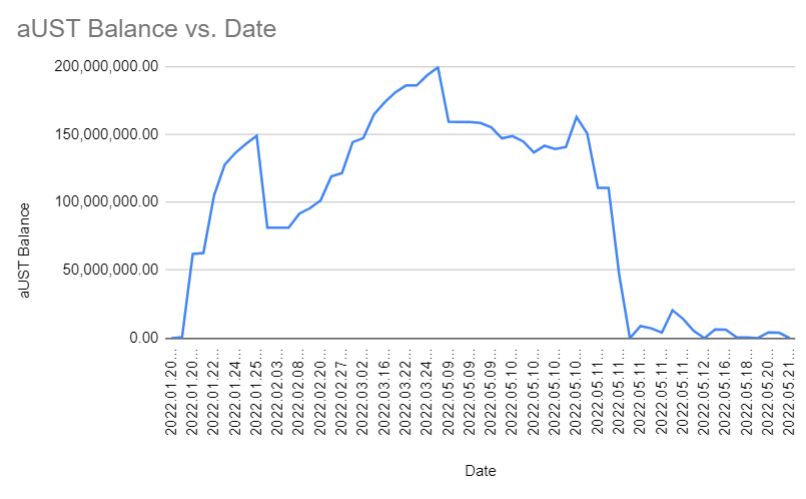

For a while, Hodlnaut was in the UST/3Crv pool. Here's an example transaction of them withdrawing $120m from it fairly late: etherscan.io. But in January of this year, Hodlnaut began moving funds into Anchor en masse without telling their customers. (10/25)

Here is the Terra address Hodlnaut's trading wallet bridges to: terra1ny3ndl9awztxn52ktuakw8zrtdkmvu0cc8g32g. It has some interesting, highly degenerate activites, especially during the depeg. Here's @Die_Nub_Plz's great breakdown with tx evidence: docs.google.com (11/25)

Things ramp up during the depeg. They start providing bETH collateral to Anchor and borrow millions in UST to send it to Binance. They also begin burning UST for LUNA and sending it to exchanges, presumably to arbitrage the huge price difference at the time. (13/25)

To give them the benefit of the doubt, there are ways to hedge their nine-figure aUST position such as shorting on FTX, but this would require Hodlnaut to collateralize the majority of their AUM on an exchange, which is highly irresponsible to say the least. (14/25)

They sold some UST as low as $0.40, degen shorted through bETH cross-margining, had huge, risky shorts on exchanges in the best case scenario, and in a hilarious move of brave defiance, they even re-entered Anchor after the collapse (small size). finder.terra.money (15/25)

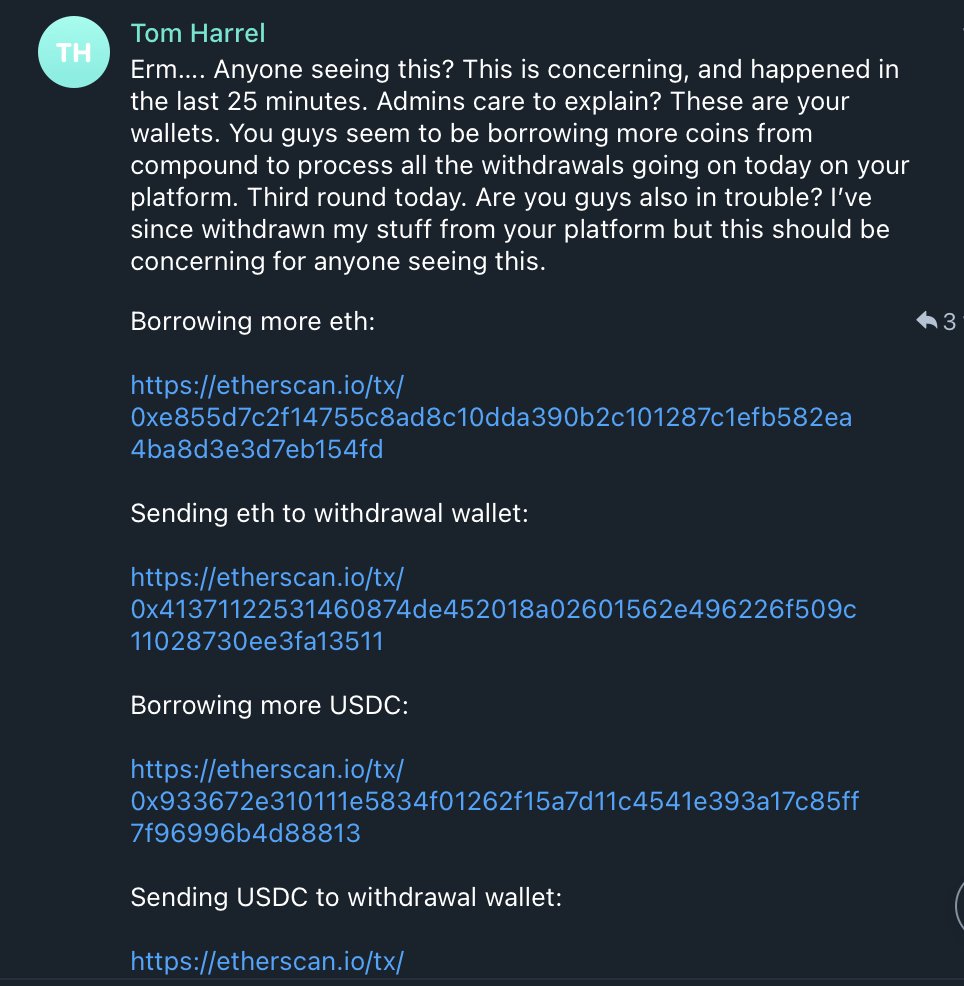

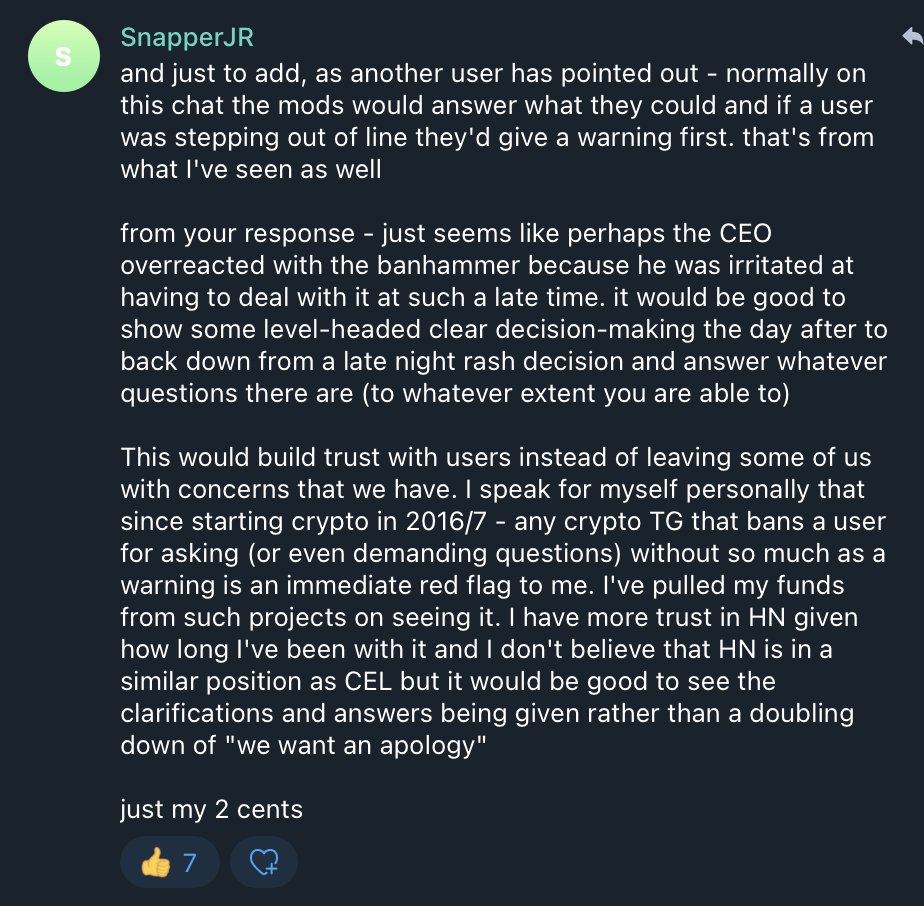

I have tried getting straight answers from Hodlnaut about the degen activites of their trading wallet. They deny that it belongs to them - they tell some people it's a custodian, and they tell others it's a counterparty, but the lack of transparency is alarming. (16/25)

I have also spoken to a few industry experts who told me that it is common for a company to set up a separate legal entity for DeFi trading to circumvent certain liability issues and disclosures, even if the wallets are owned and operated by the same people. (20/25)

The facts: Hodlnaut's own spinoff entity (likely) or a counterparty they lend to (unlikely) had millions in exposure to Anchor long before they ever listed UST. They lied to clients about the safety of their deposits (in-kind yield generation), and they lied about Anchor. (21/25)

The best case scenario: Hodlnaut parked funds with a custodian who degen shorted UST by locking in a massive amount of their AUM on FTX and arbed LUNA to escape their losses. When everything was crumbling down, they made a high-risk play with client money, and it worked. (22/25)

The worst case scenario: Hodlnaut's own spinoff entity lost millions trading UST - losses were ameliorated but not completely mitigated, and to avoid a deep bank run & cashflow insolvency, they are appearing strong on the outside by hiding their true losses & exposure. (23/25)

I wish there was more transparency - Hodlnaut needs to tell customers what really happened here. But, in either scenario, Hodlnaut has done highly irresponsible things with clients' money. They misrepresented risks and all this could have potentially turned out far worse. (24/25)

The truth is, many of these CeFi platforms are far more irresponsible & degenerate than you can imagine, and the public needs to know the *real* risks behind all the magical 8% stablecoin APYs. It's self-custody season. The tide is receding. Don't be the one caught next. (25/25)

PS. Huge shout-out to @Die_Nub_Plz and @Cycle_22 for the invaluable research work & evidence provision.

Loading suggestions...