#WeeklyIndexCheck CW24/2022

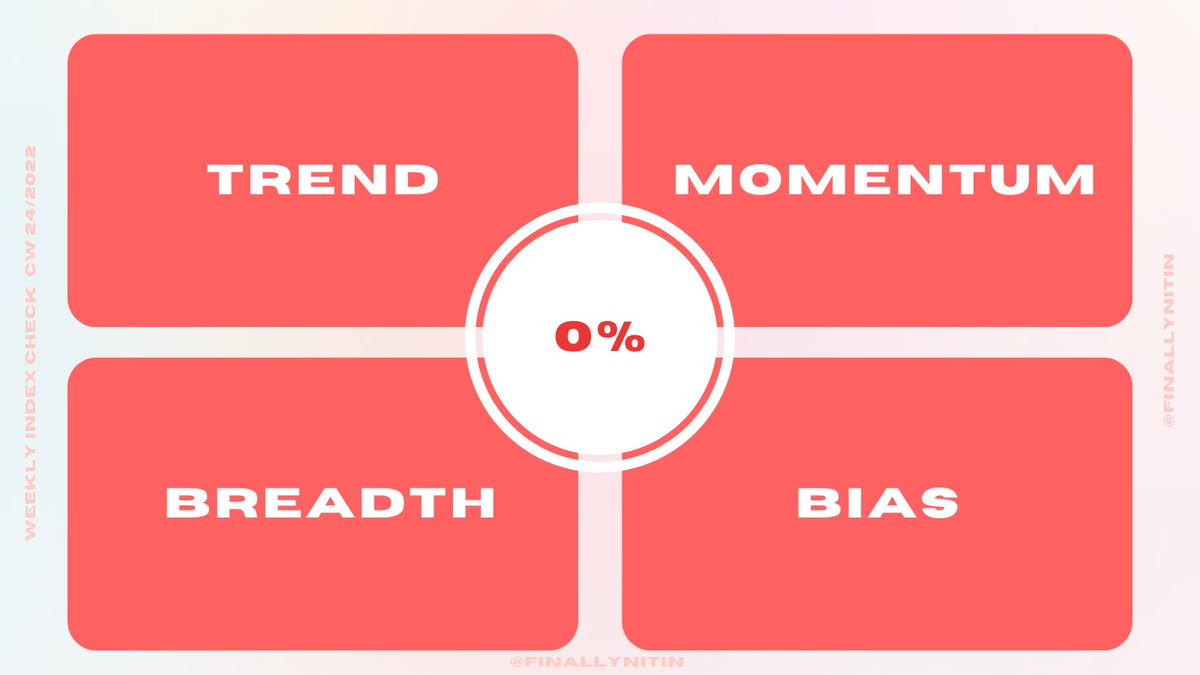

Market Quadrant:

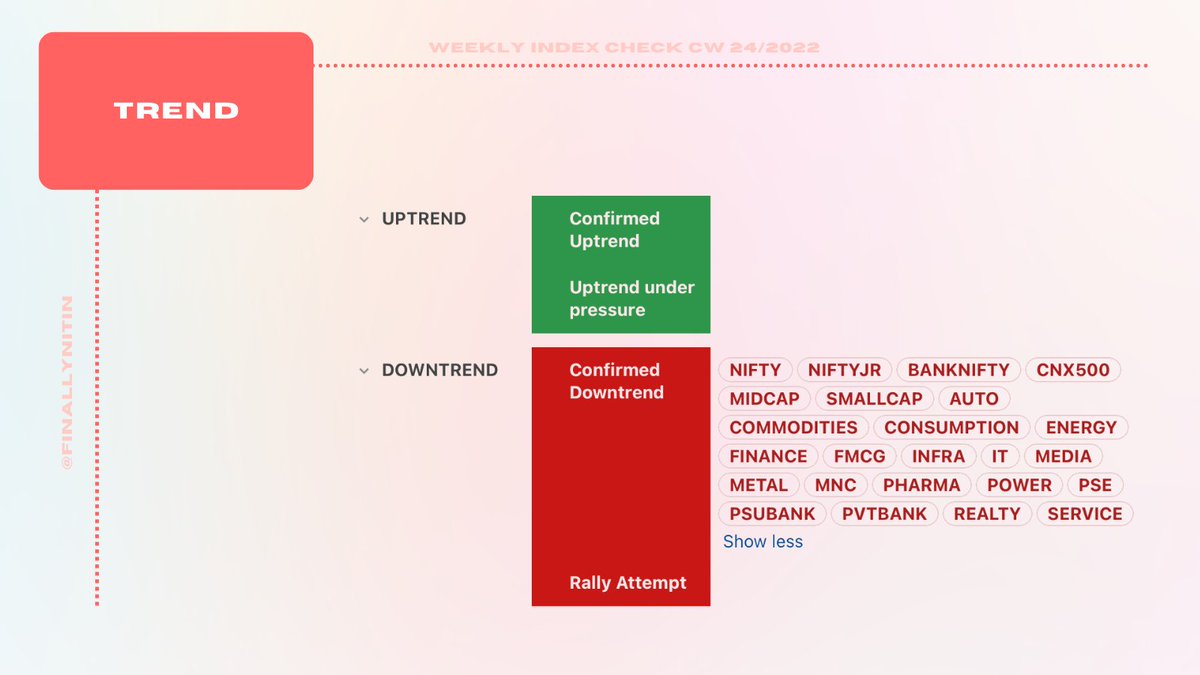

⦿ Trend: Confirmed Downtrend

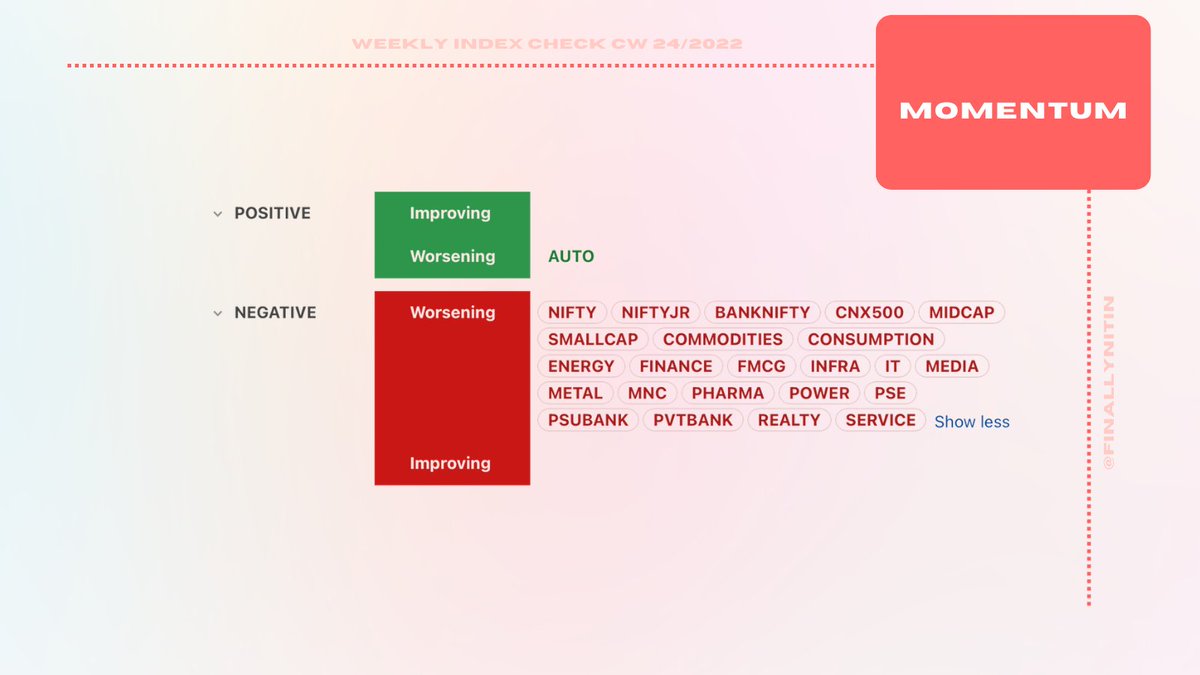

⦿ Momentum: Negative & worsening

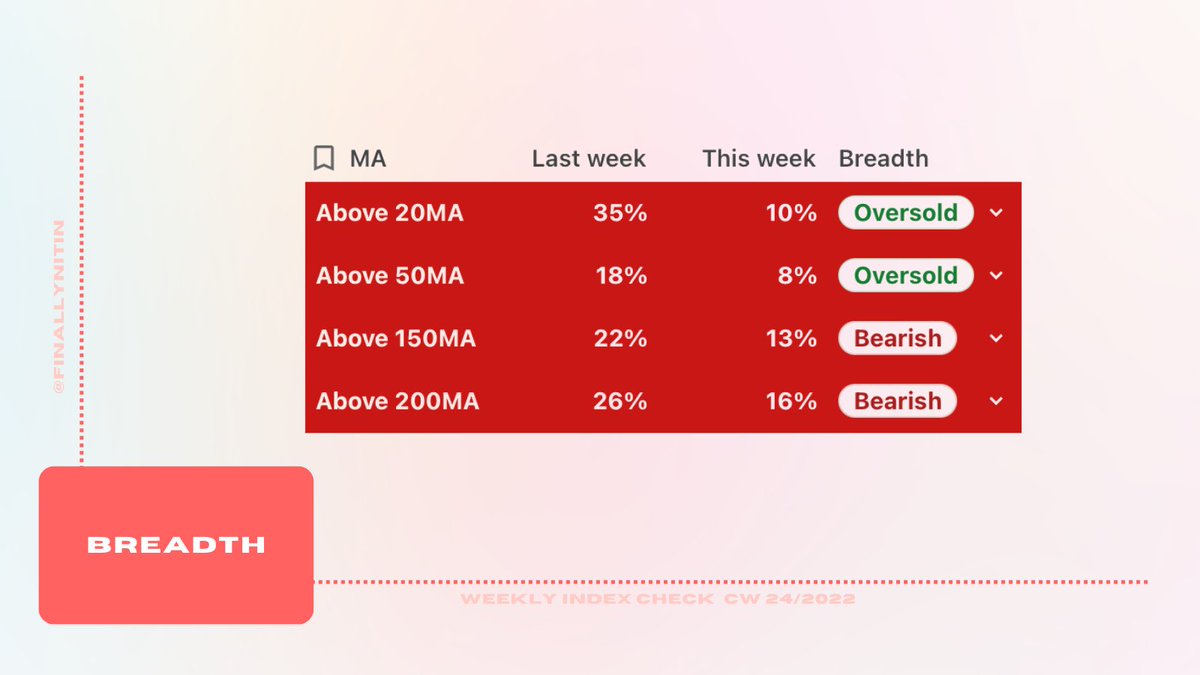

⦿ Breadth: Worsening but Oversold

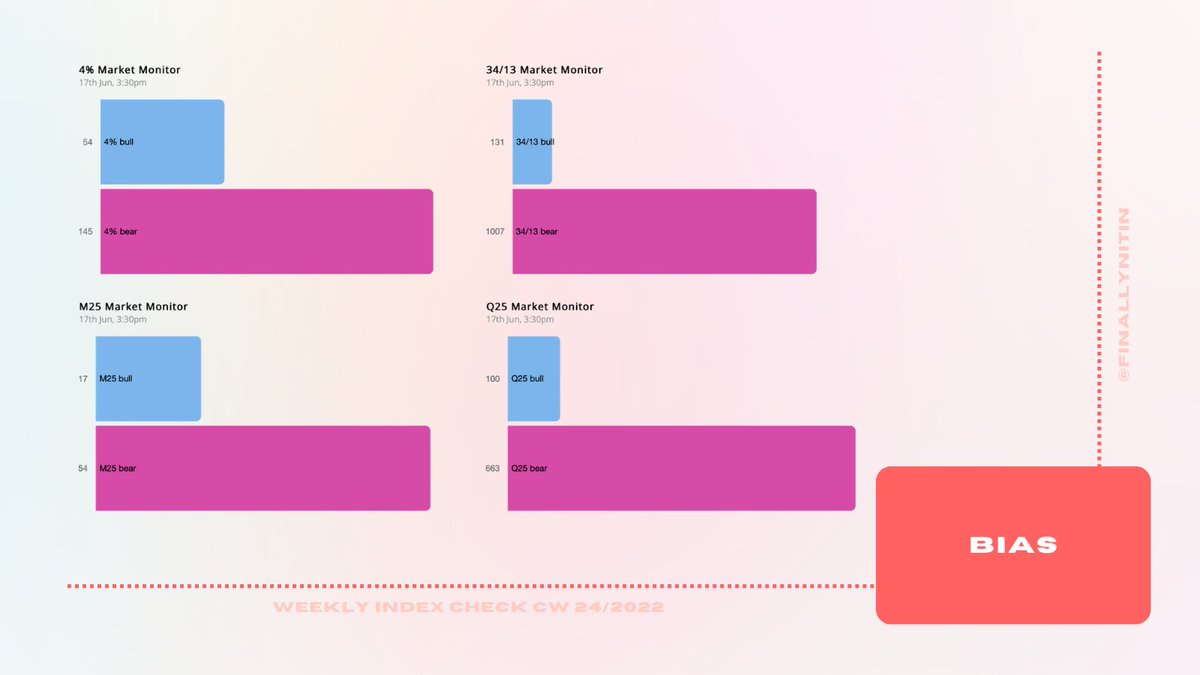

⦿ Bias: Bearish on both long & short timeframes

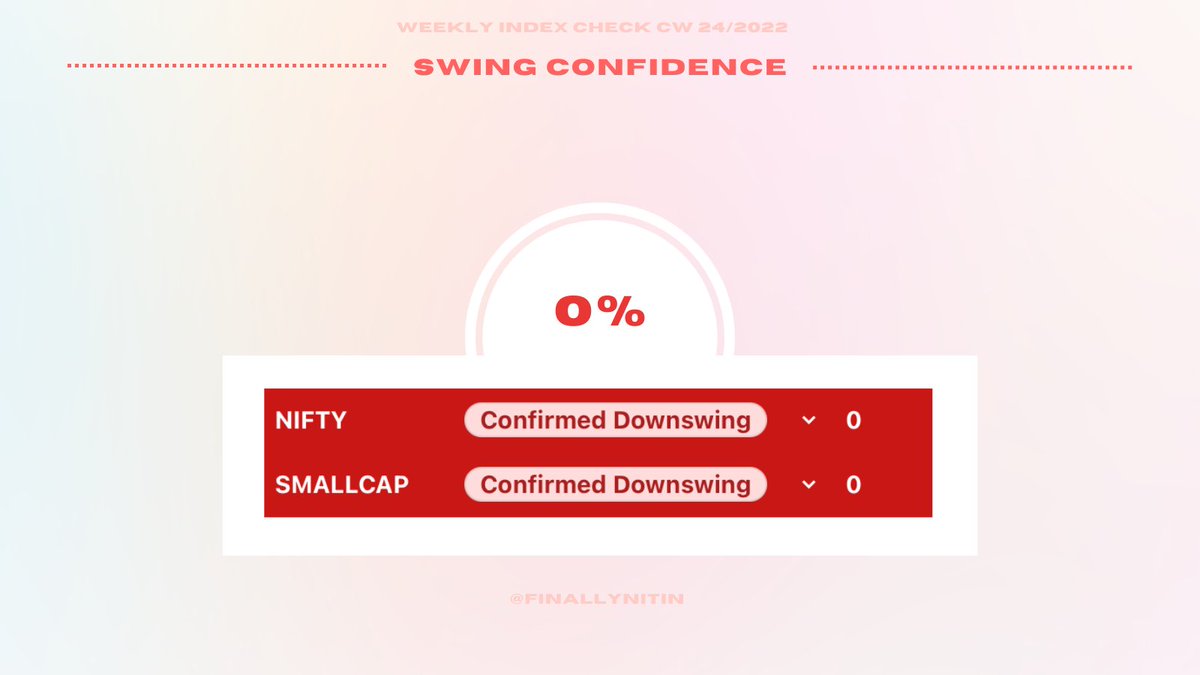

⦿ Swing Confidence: 0% (all cash)

Market Quadrant:

⦿ Trend: Confirmed Downtrend

⦿ Momentum: Negative & worsening

⦿ Breadth: Worsening but Oversold

⦿ Bias: Bearish on both long & short timeframes

⦿ Swing Confidence: 0% (all cash)

That’s all for CW24/2022. If you'd like to read this as a newsletter, find it here:

world.hey.com

world.hey.com

Loading suggestions...