How to do Top-down analysis and how to get directional bias and lower time frame entries.

Welcome to another thread on "Learning Technical Analysis".

-Time frames.

Let's dive in.

Here we'd start from a higher time frame, then work our way down to the lower time frames.

Welcome to another thread on "Learning Technical Analysis".

-Time frames.

Let's dive in.

Here we'd start from a higher time frame, then work our way down to the lower time frames.

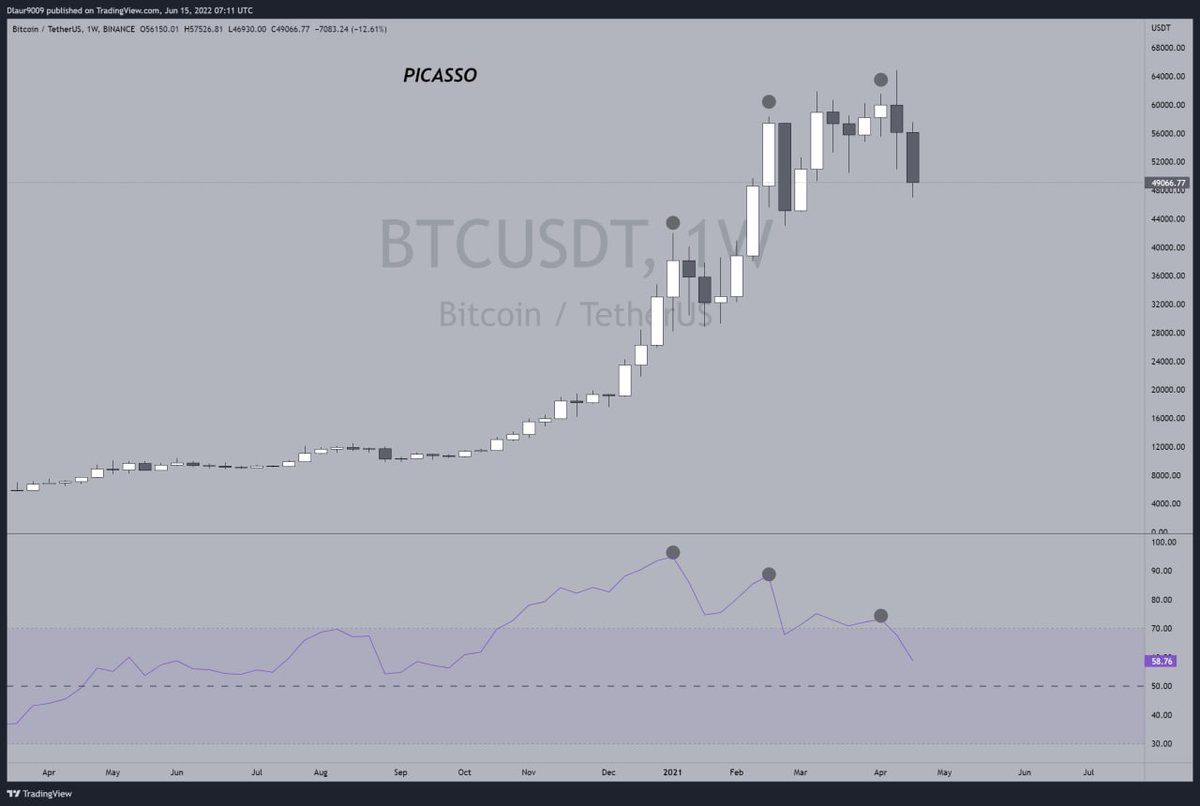

Case study: #BTC

Weekly time frame.

The rally starts looking weak, no more impulsive pumps, RSI is overbought and have formed a bearish divergence.

This sets us up for where we think we may be headed, so we go down to another timeframe for more confirmation.

Weekly time frame.

The rally starts looking weak, no more impulsive pumps, RSI is overbought and have formed a bearish divergence.

This sets us up for where we think we may be headed, so we go down to another timeframe for more confirmation.

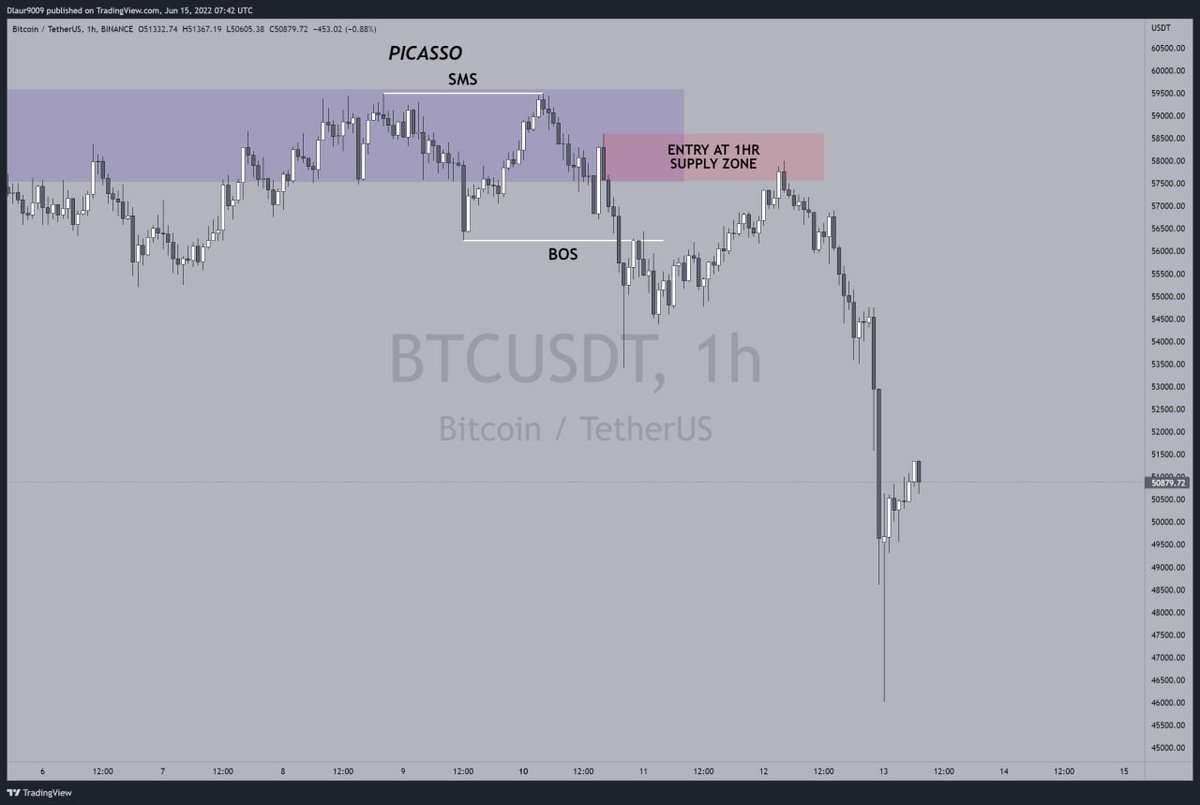

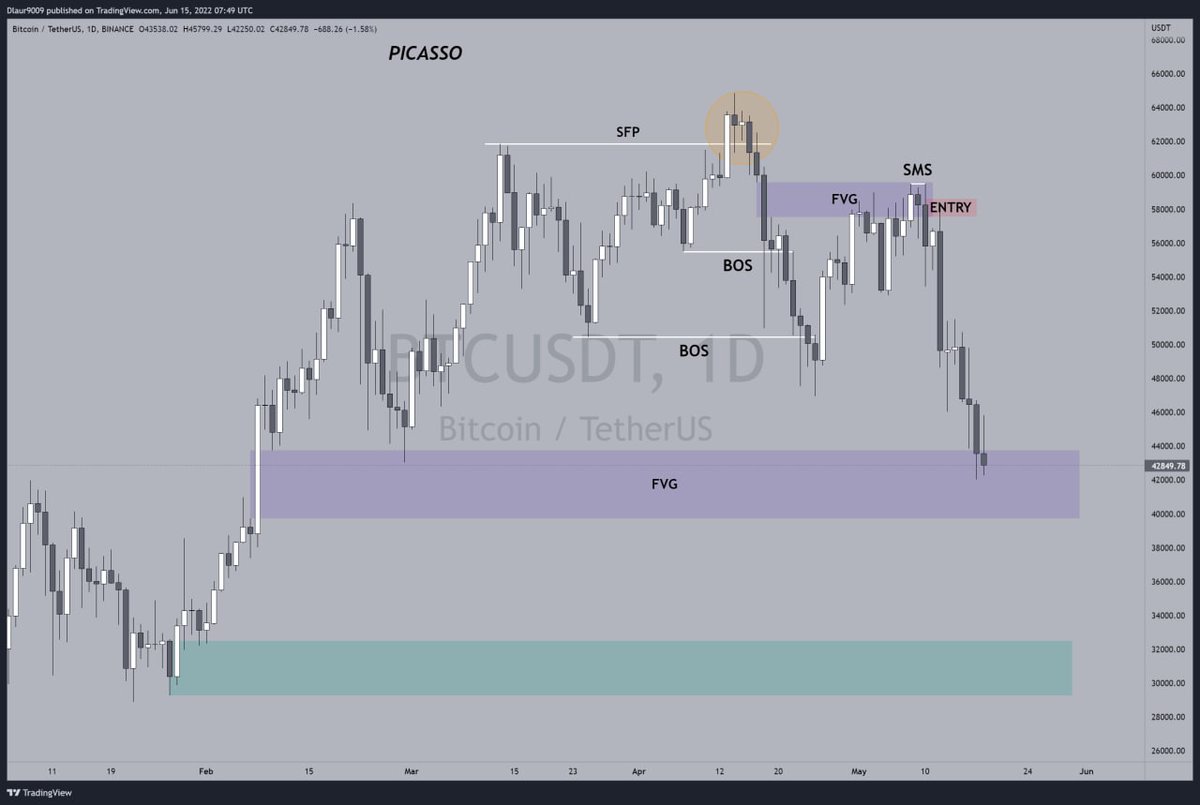

So we want to sell/short from the FVG above.

FVG below on the daily acts as our 1st target for the move.

FVG below on the daily acts as our 1st target for the move.

Note: I didn't take this particular trade because I wasn't well knowledgeable as at the time.

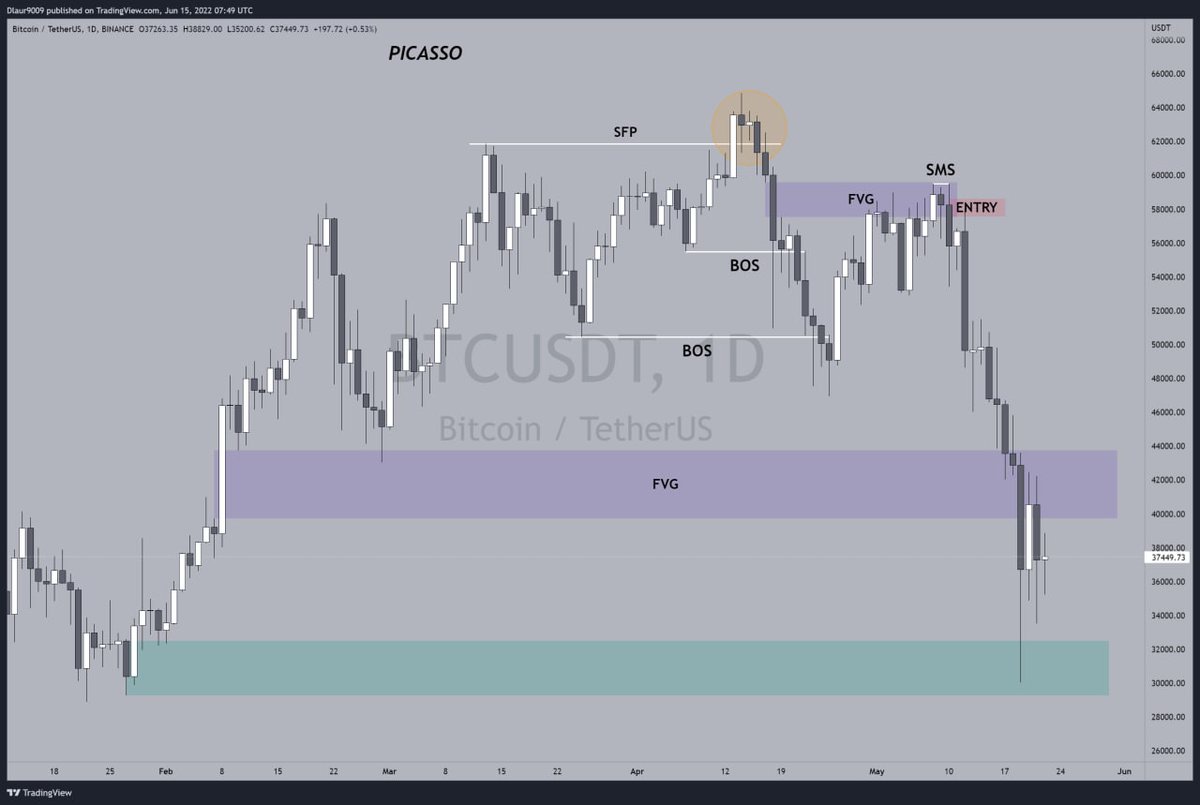

Case study: #ETH

D1

RSI bearish divergence suggests a weak uptrend. Price taking out multiple lows gives us confirmation on our bias.

D1

RSI bearish divergence suggests a weak uptrend. Price taking out multiple lows gives us confirmation on our bias.

These are just 2 examples but the lessons in them can be used anywhere.

I hope you got value from this piece.

Kindly follow me for more of these.

Like, retweet and share this tweet so other people who need it would learn as well.

Peace.

✌

I hope you got value from this piece.

Kindly follow me for more of these.

Like, retweet and share this tweet so other people who need it would learn as well.

Peace.

✌

Here's a thread of all my Educational threads.

جاري تحميل الاقتراحات...