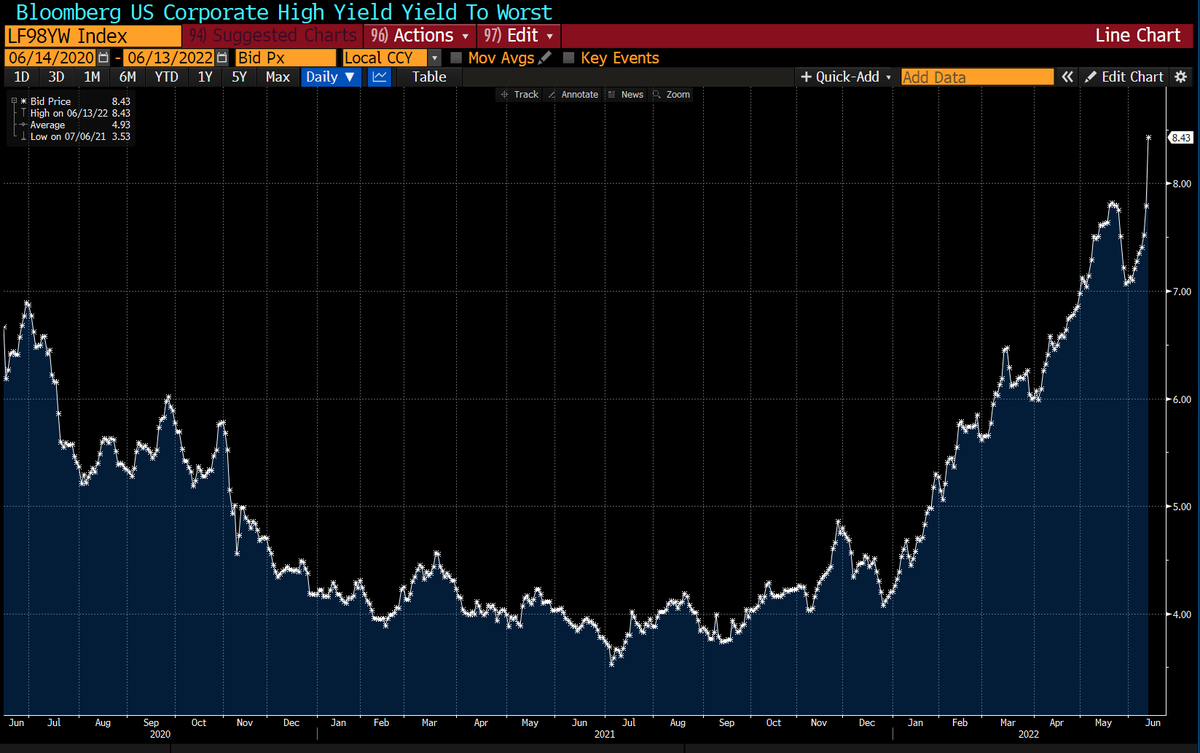

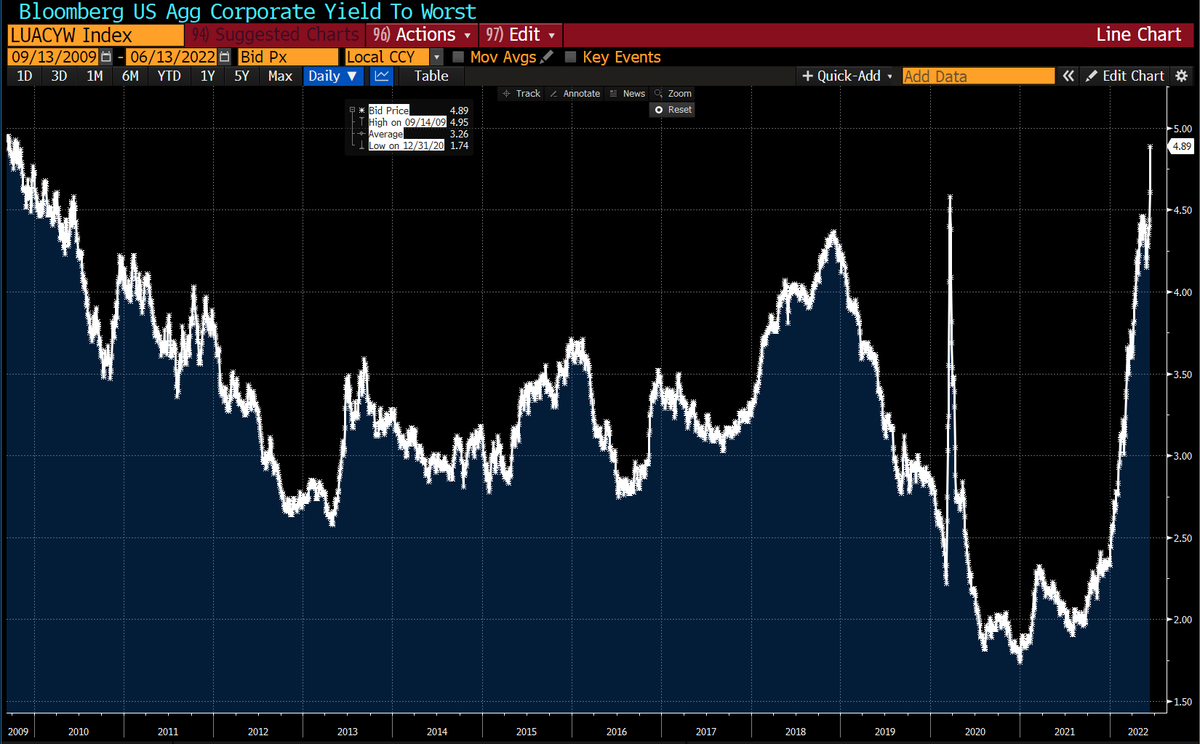

The steady drip of losses in credit, driven first by rates, then by credit spreads, and now by both, is accelerating. This is suddenly a new financing regime that'll be punishing for companies forced to borrow in the near term.

Loading suggestions...