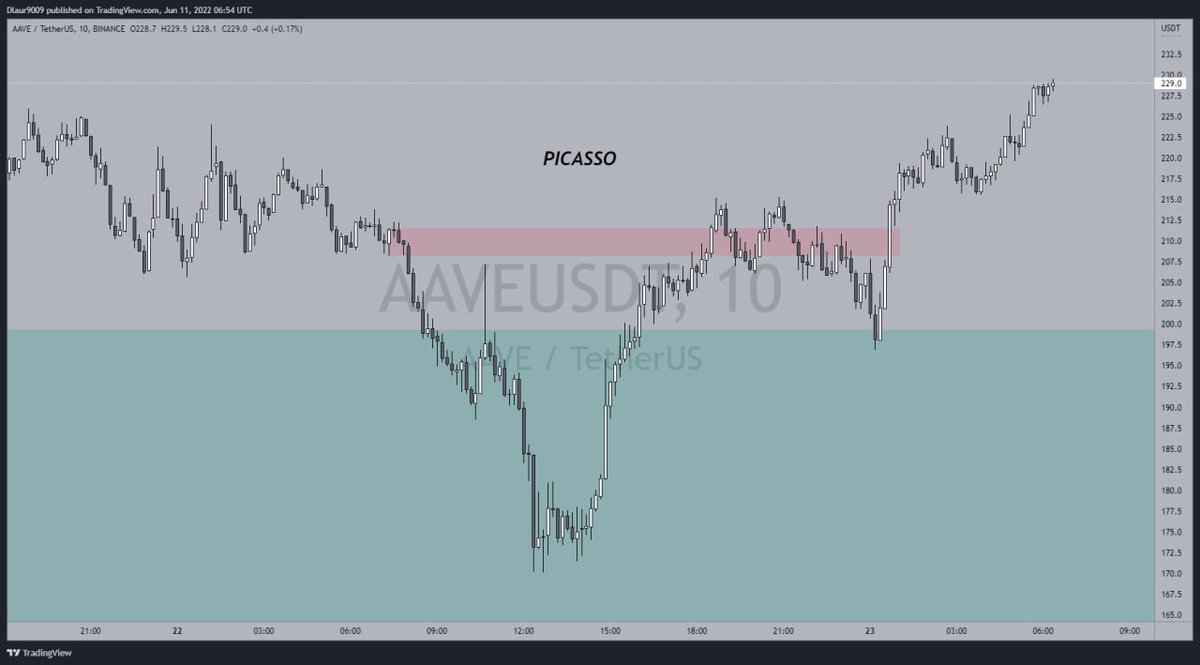

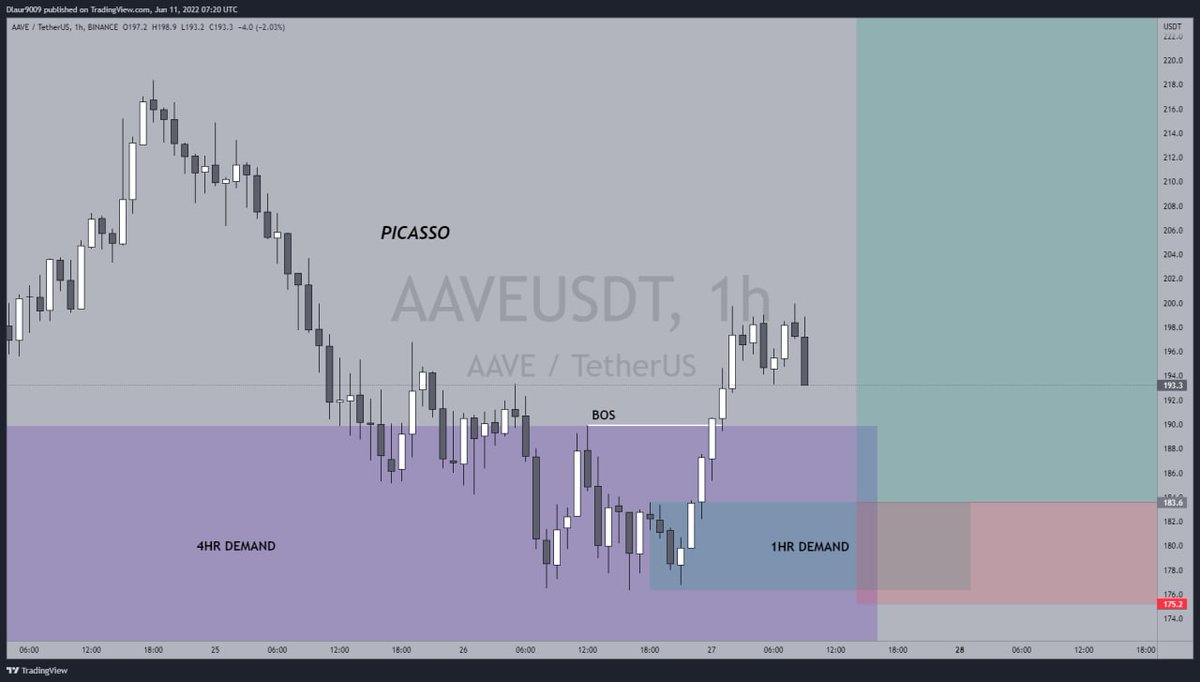

How not to get REKT trading against the trend.

Case study: $AAVE

Another thread on "Learning Technical Analysis".

Case study: $AAVE

Another thread on "Learning Technical Analysis".

It is highly important that you understand the levels where price is reacting from and how they affect how price moves subsequently.

Let's dive into the $AAVE example.

Let's dive into the $AAVE example.

I hope you got value from this.

Do well to follow me for more value like this.

Like, retweet and share so others could benefit as well.

Do well to follow me for more value like this.

Like, retweet and share so others could benefit as well.

Here's a thread of all my Educational threads.

Loading suggestions...