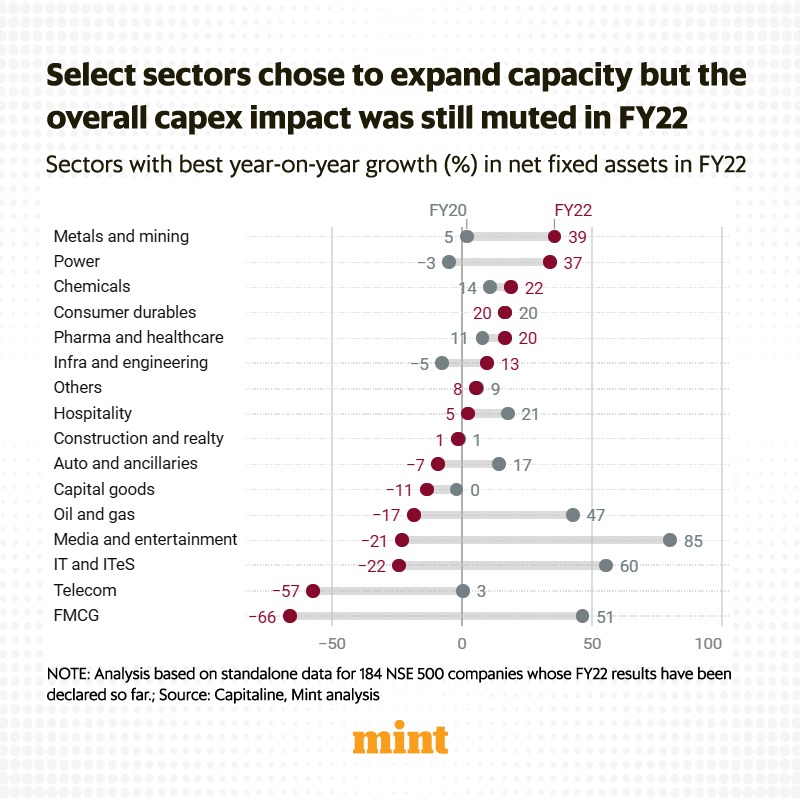

#MintPlainFacts | The improving business sentiments may prod companies to deploy their ample reserves to build new capacities but they are expected to tread with caution.

(By Niti Kiran)

Read here: bit.ly

(By Niti Kiran)

Read here: bit.ly

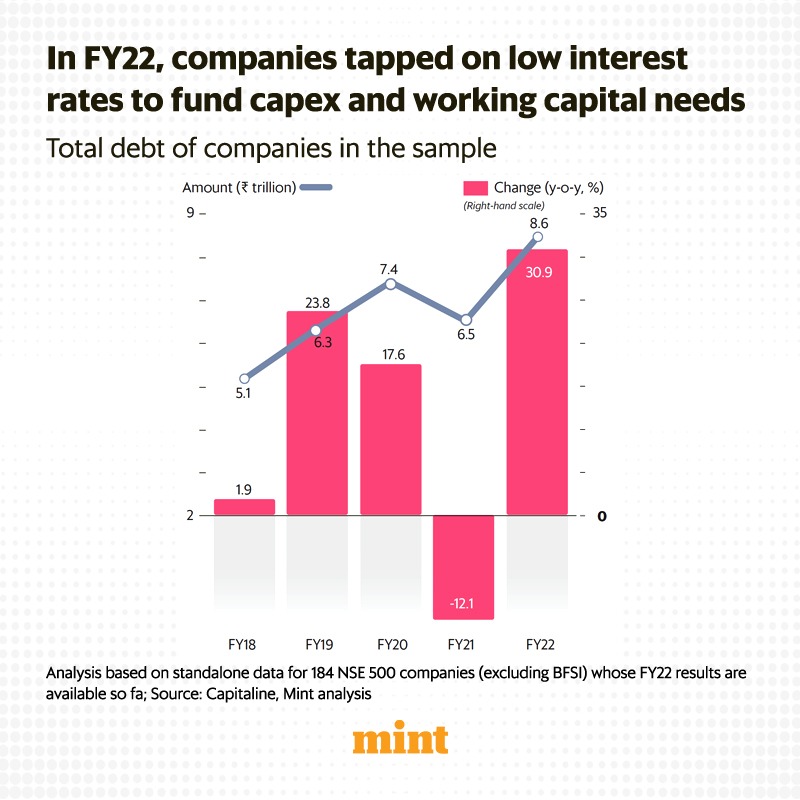

#MintPlainFacts | The debt-retiring spree helped shrink the combined gross debt by 12% in 2020-21, shows a Mint analysis of a sample of India’s top listed firms.

Read here: bit.ly

Read here: bit.ly

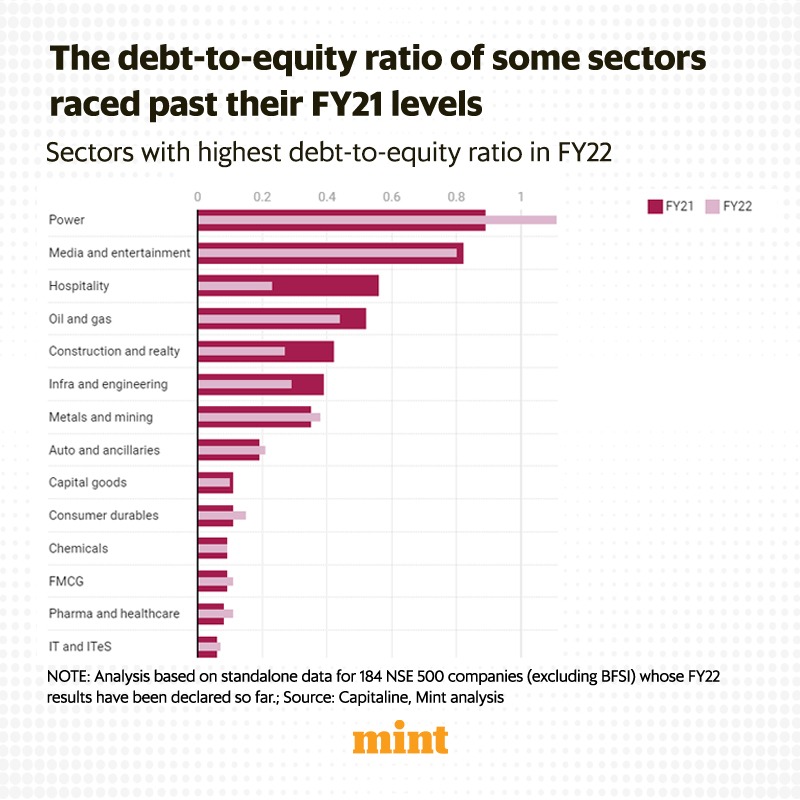

#MintPlainFacts | Debt-to-equity ratio, another proxy for leverage, also rose in FY22 in some sectors such as power, metals and mining, automobile and pharma.

Read here: bit.ly

Read here: bit.ly

#MintPlainFacts | Acute business uncertainty and weak demand, both domestically and externally, kept India Inc. low on animal spirits even before the pandemic.

Read here: bit.ly

Read here: bit.ly

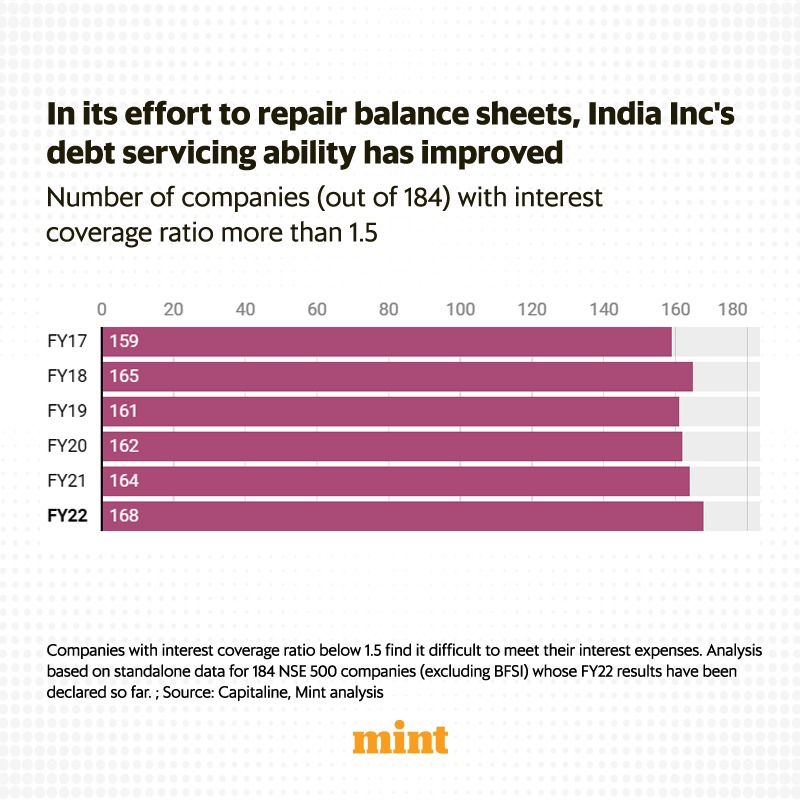

#MintPlainFacts | In an effort to deleverage balance sheets, companies’ ability to service debt has only improved on the back of healthy operating profits.

Read here: bit.ly

Read here: bit.ly

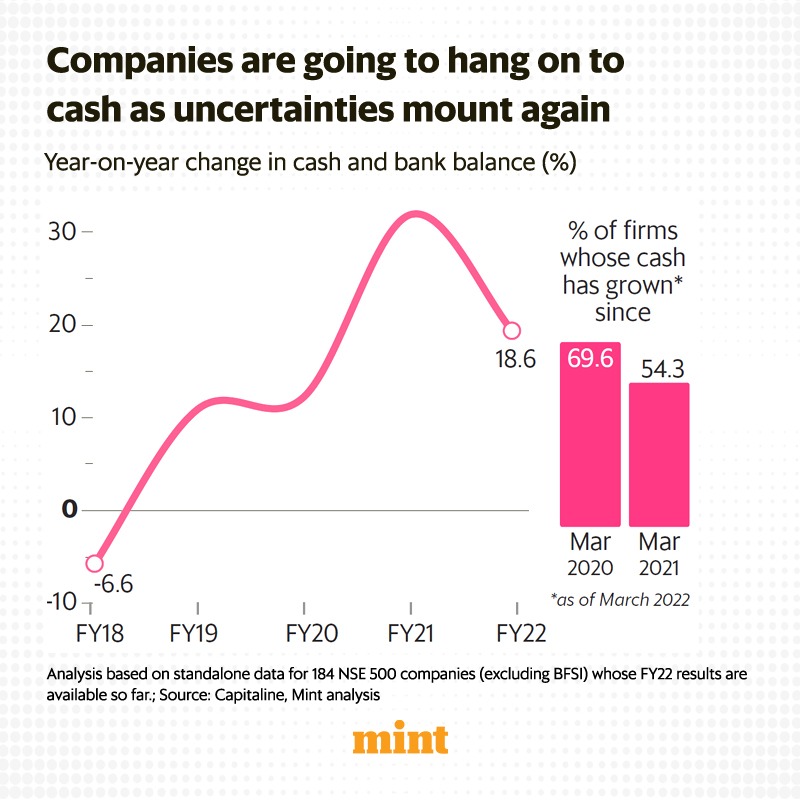

#MintPlainFacts | Amidst the pandemic, companies' cash hoarding jumped 32% in FY21 and 19% in FY22.

Read here: bit.ly

Read here: bit.ly

Loading suggestions...