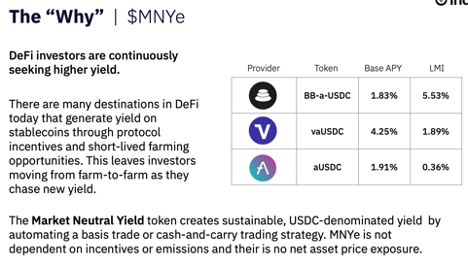

Do I still believe that there is still an opportunity to sustainably extract yield in a risk-adjusted manner? short answer, yes - but you'll have to get a bit smarter in how you go about it.

Firstly, how sustainable is all this?

Well, DeFi yields are driven by 2 main factors:

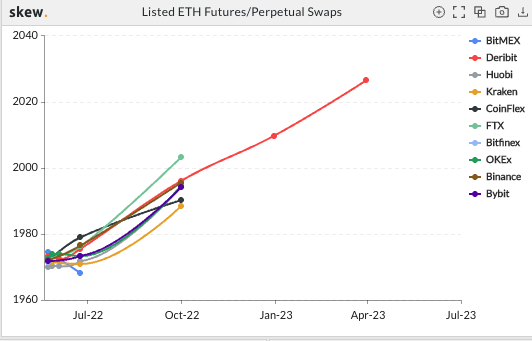

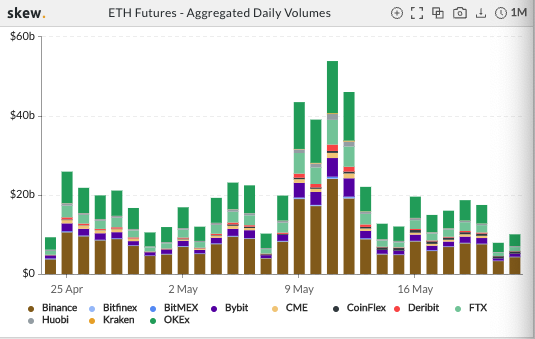

1. Demand for leverage (margin)

2. Fees generated from network activity (transaction volume)

let's look at the trends for both

Well, DeFi yields are driven by 2 main factors:

1. Demand for leverage (margin)

2. Fees generated from network activity (transaction volume)

let's look at the trends for both

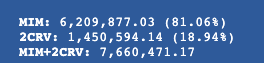

Demand for leverage aside, the more encouraging picture for a DeFi investor is from the fees generated by DeFi protocols. Here are the weekly fees generated by Curve Finance amidst the recent market volatility.

Those are record-breaking fees and re-affirm our view that we want to own productive assets like $CRV and $CVX in the long-term, and dollar cost average (DCA) at these low valuation multiples.

so if yield farming you'll want to dynamically adjust your allocation to both stable coin farming and blue-chip token farming depending on supply/demand outlook. Platforms like CRV offer counter-cyclical opportunities but take profits and don't lockup for long imo.

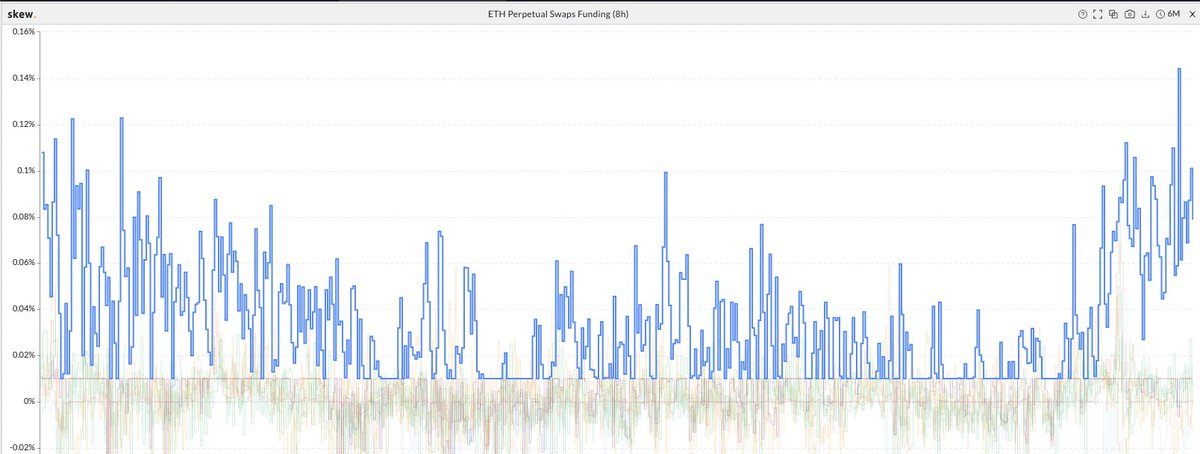

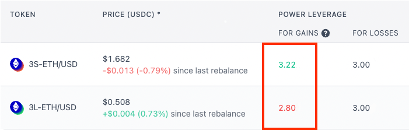

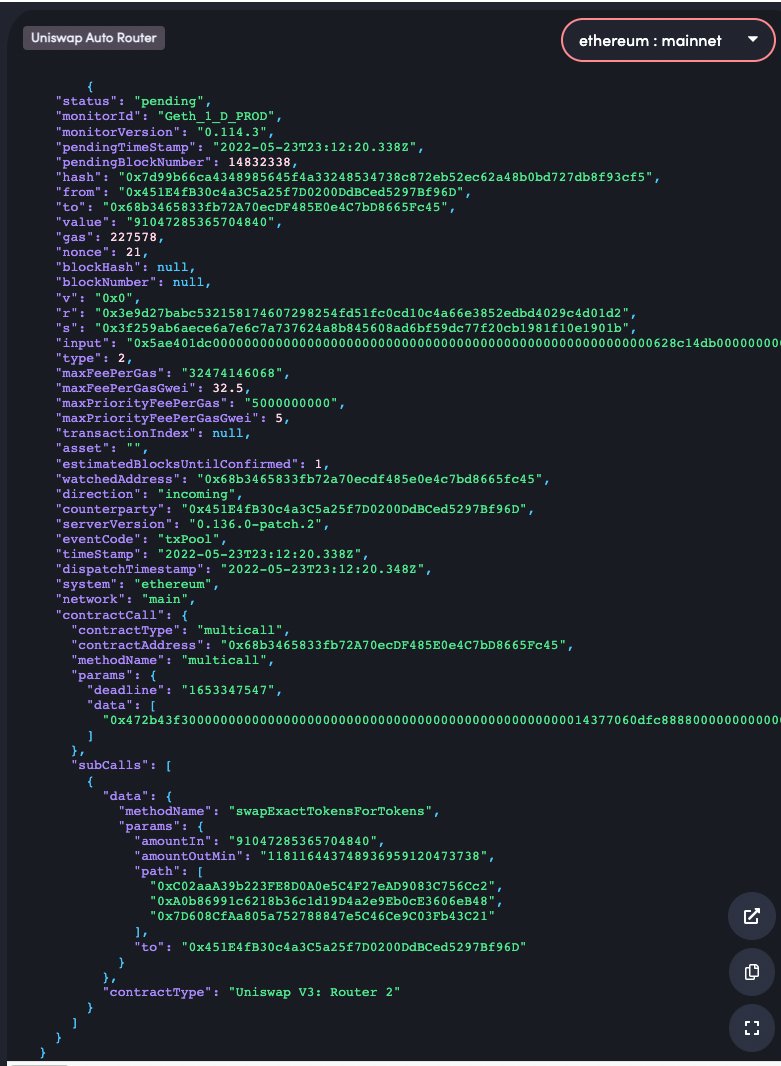

Here we have developed our relationship with a leading VC-backed DeFi protocol (@TracerDAO) to build a strategy for market-neutral returns. Essentially this involves an arbitrage opportunity where we take both a long and a short position on an asset, but on different platforms.

Implemented in a bespoke manner, we could easily extend this to be a systematic strategy, coded up with signals and a trading API.

Other such strategies include a funding arbitrage strategy that we are working on together with the highly reputable @indexcoop

Other such strategies include a funding arbitrage strategy that we are working on together with the highly reputable @indexcoop

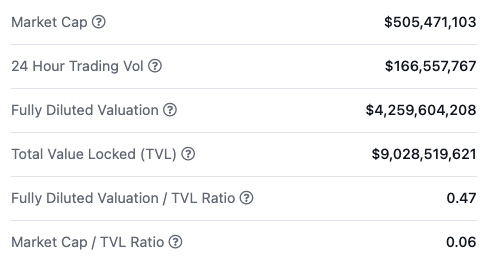

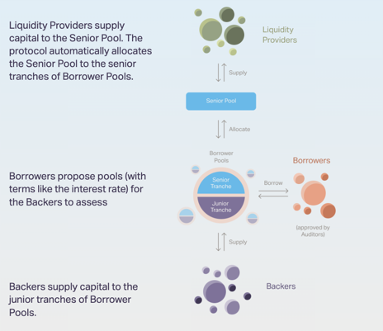

Lastly, we are increasing our exposure to DeFi protocols where there is a real-world use case.

@goldfinch_fi allows real-world borrowers to take out a loan in their domestic currency. On the back end, liquidity providers like me make a crypto loan and earn 12-14% APY from high-quality borrowers. In the event of a default, this is absorbed by riskier junior tranches.

..but rotating capital even on an L2 can be really inefficient once you've factored in deposit, withdrawal and performance fees. Honestly I don't know many people who can be arsed for a few hundred/thousand dollars on millions of dollar deposit.

And generally speaking, as ever - short euphoria and buy extreme fear. Take profits and enjoy the summer.

Loading suggestions...