This Thread will teach you how to perform a Discounted Cash Flow (DCF) Model 👇🏼

The DCF is a valuation method to estimate the value of future cashflows.

Because the “Time Value of Money” concept money is worth more today than in the future.

(Because you can earn interest on it)

That‘s why investors need to figure out what future cashflows are worth today.

Because the “Time Value of Money” concept money is worth more today than in the future.

(Because you can earn interest on it)

That‘s why investors need to figure out what future cashflows are worth today.

Step 1 - Forecasting

Since the future is unknown, you have to forecast future cash flows.

You do that based on historical data, own research, estimates, etc.

As for every single estimate made in the process of a DCF, the number 1 rule is to stay conservative.

Since the future is unknown, you have to forecast future cash flows.

You do that based on historical data, own research, estimates, etc.

As for every single estimate made in the process of a DCF, the number 1 rule is to stay conservative.

Step 2 - The Discount Rate

Next, you need to figure out the discount rate you’re using.

There are a couple of different ideas on the discount rate.

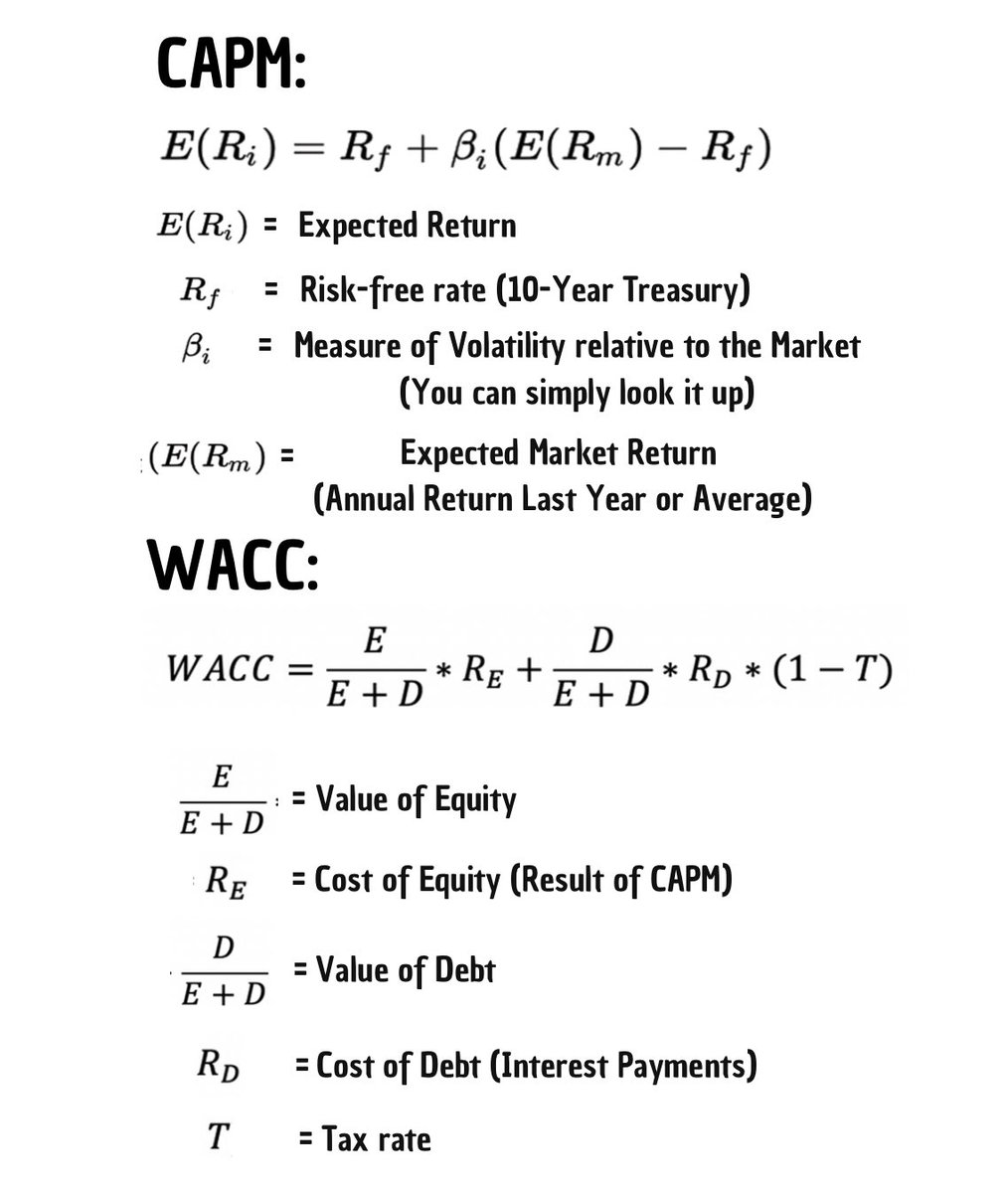

In academia and in banks, the WACC (Weighted average cost of capital) is used.

Buffett goes with a “long-term government” rate.

Next, you need to figure out the discount rate you’re using.

There are a couple of different ideas on the discount rate.

In academia and in banks, the WACC (Weighted average cost of capital) is used.

Buffett goes with a “long-term government” rate.

2.1 Weighted Average Cost of Capital

The WACC is more complicated, don’t be frustrated if you don’t fully understand it right away.

It measures how costly it is for a company to borrow money.

It focuses on both the company’s debt (bank loans, etc.) and equity (issued shares).

The WACC is more complicated, don’t be frustrated if you don’t fully understand it right away.

It measures how costly it is for a company to borrow money.

It focuses on both the company’s debt (bank loans, etc.) and equity (issued shares).

2.2 Long-Term Government Rate

What this means is simply to go with a “realistic” risk-free rate (10-Year gov. Bond).

Realistic means, based on historical rates and not too low.

Never use a rate below 6%.

Otherwise your valuation would be too sensitive to changes in rates.

What this means is simply to go with a “realistic” risk-free rate (10-Year gov. Bond).

Realistic means, based on historical rates and not too low.

Never use a rate below 6%.

Otherwise your valuation would be too sensitive to changes in rates.

A third, and the easiest option, is to go with your desired return.

If you aim for a 10% return, then use 10% as your interest rate.

Generally, the higher your discount rate, the higher your margin of safety.

At least from a valuation standpoint.

If you aim for a 10% return, then use 10% as your interest rate.

Generally, the higher your discount rate, the higher your margin of safety.

At least from a valuation standpoint.

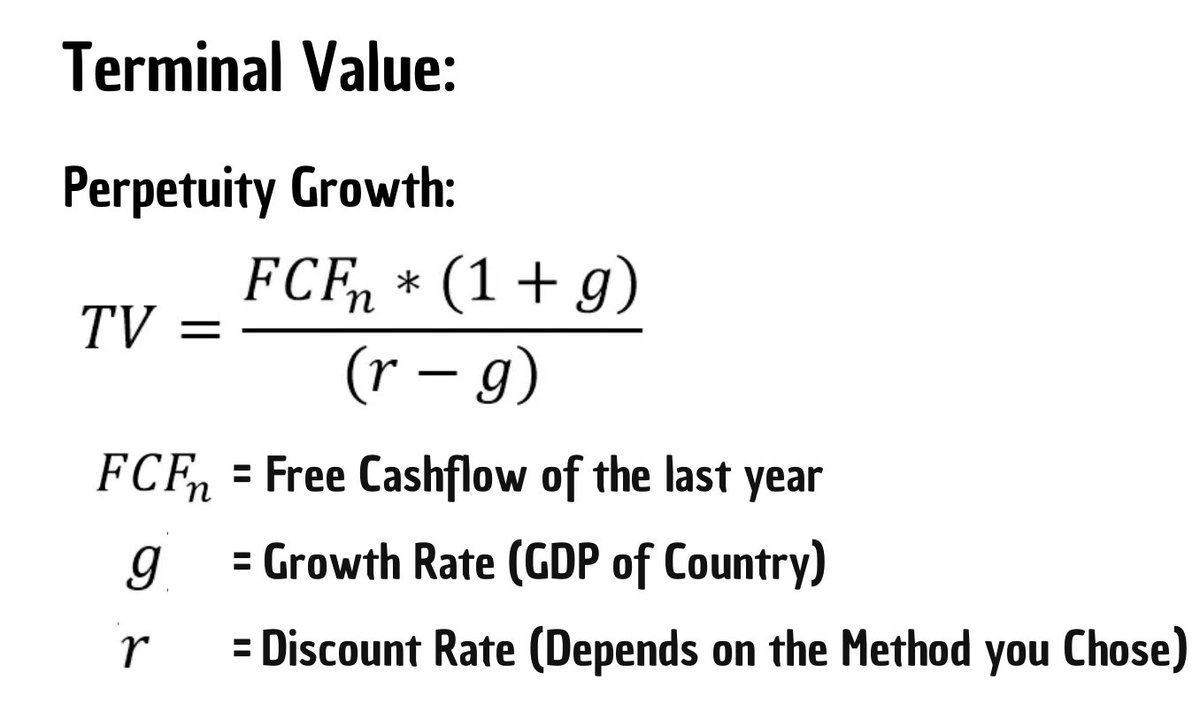

3. Terminal Value

The terminal value is the value of the business after your forecast period.

So let’s say you forecast 10 years of cash-flows (I wouldn’t go beyond that).

The company won’t just vanish after 10 years.

So to take that into account, you come up with the TV.

The terminal value is the value of the business after your forecast period.

So let’s say you forecast 10 years of cash-flows (I wouldn’t go beyond that).

The company won’t just vanish after 10 years.

So to take that into account, you come up with the TV.

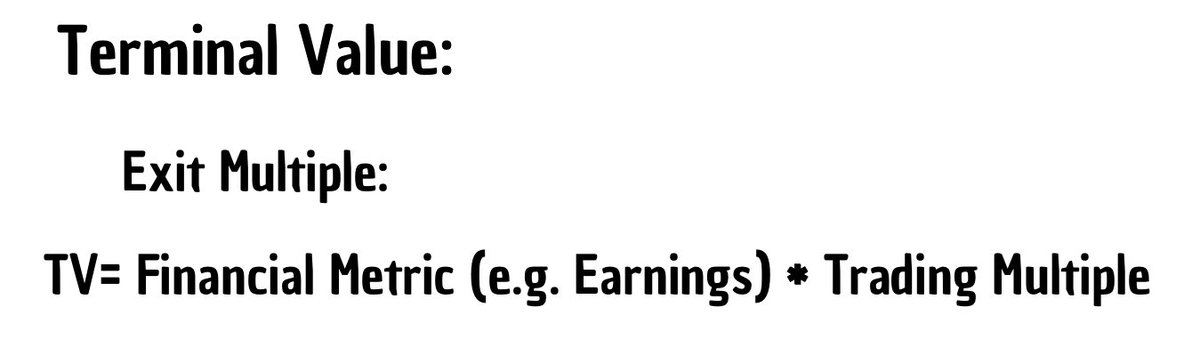

Once again, there are two ways to determine the TV.

1. Perpetuity Growth

And

2. Exit Multiple

Before we get to them, remember to be conservative with your growth rates.

As you can imagine, the TV has a big impact on your DCF (After all, it’s growth to “infinity”).

1. Perpetuity Growth

And

2. Exit Multiple

Before we get to them, remember to be conservative with your growth rates.

As you can imagine, the TV has a big impact on your DCF (After all, it’s growth to “infinity”).

Multiply the cashflows with the discount factor and you’re left with the discounted cashflows.

The Terminal Value gets discounted by multiplying it with the discount factor of the latest forecasted year.

For a 10-year period, multiply the TV with the discount factor of year 10.

The Terminal Value gets discounted by multiplying it with the discount factor of the latest forecasted year.

For a 10-year period, multiply the TV with the discount factor of year 10.

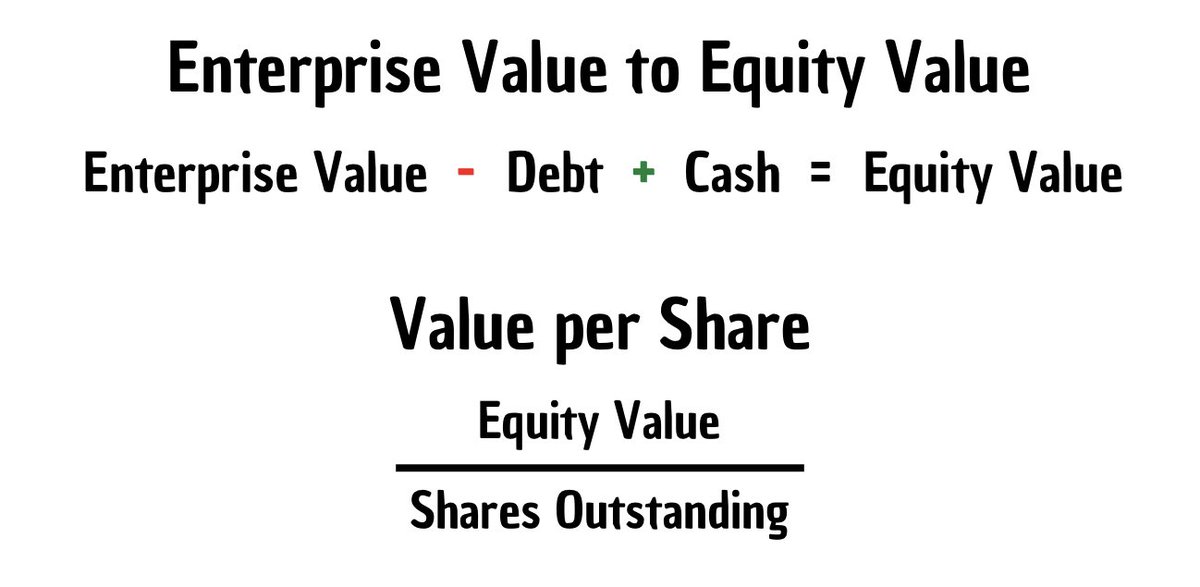

5. Equity Value

Now, we can add the discounted value of the cashflows and the TV.

The result is the Enterprise Value (EV).

EV is a more precise measure for the value of a company than market capitalization.

From the EV we can finally get to how much one share is worth today.

Now, we can add the discounted value of the cashflows and the TV.

The result is the Enterprise Value (EV).

EV is a more precise measure for the value of a company than market capitalization.

From the EV we can finally get to how much one share is worth today.

That’s it, you’re done!

I really hope you learned something and this was helpful.

If so, please Retweet and Like this Thread so that more people get to see it.

If it resonates well, I can post more of this type.

For more content on investing, follow me @MnkeDaniel

Cheers!

I really hope you learned something and this was helpful.

If so, please Retweet and Like this Thread so that more people get to see it.

If it resonates well, I can post more of this type.

For more content on investing, follow me @MnkeDaniel

Cheers!

جاري تحميل الاقتراحات...