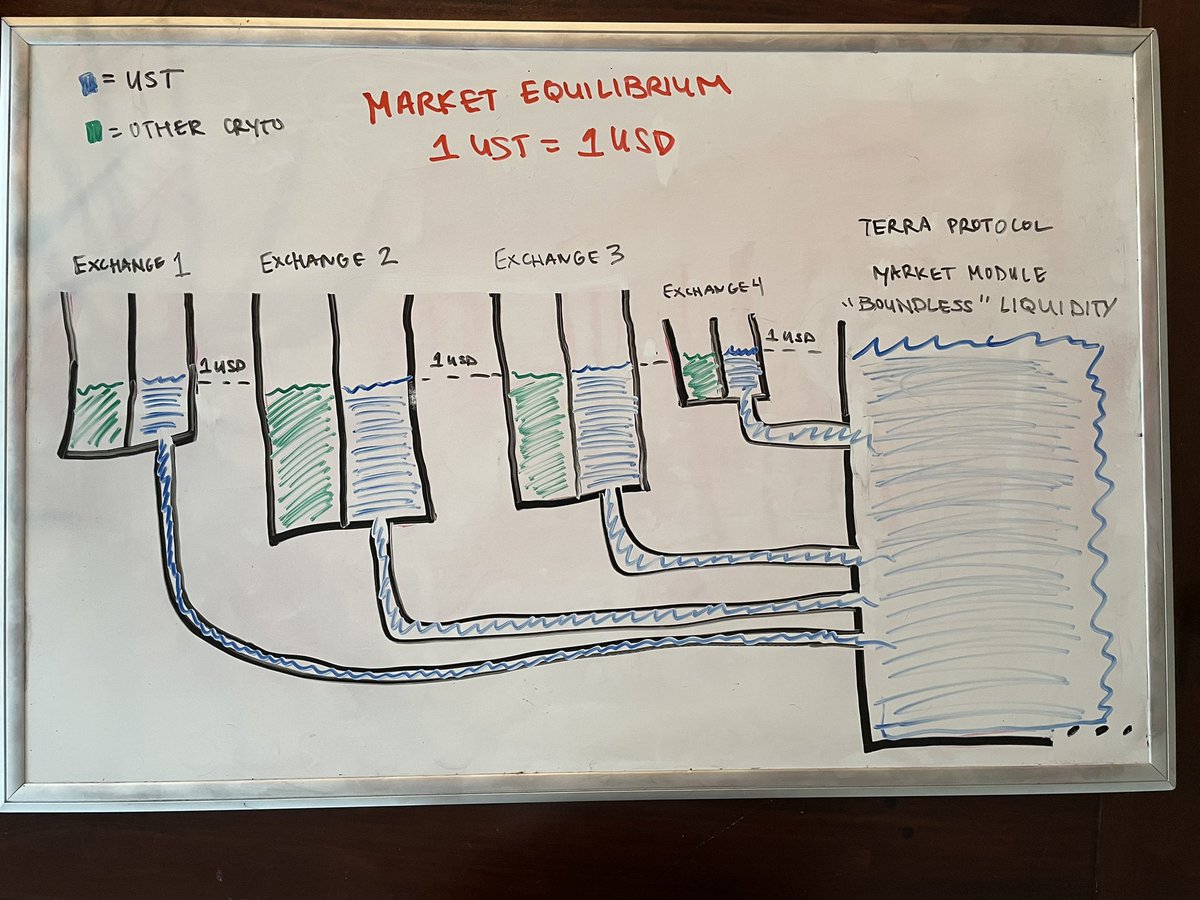

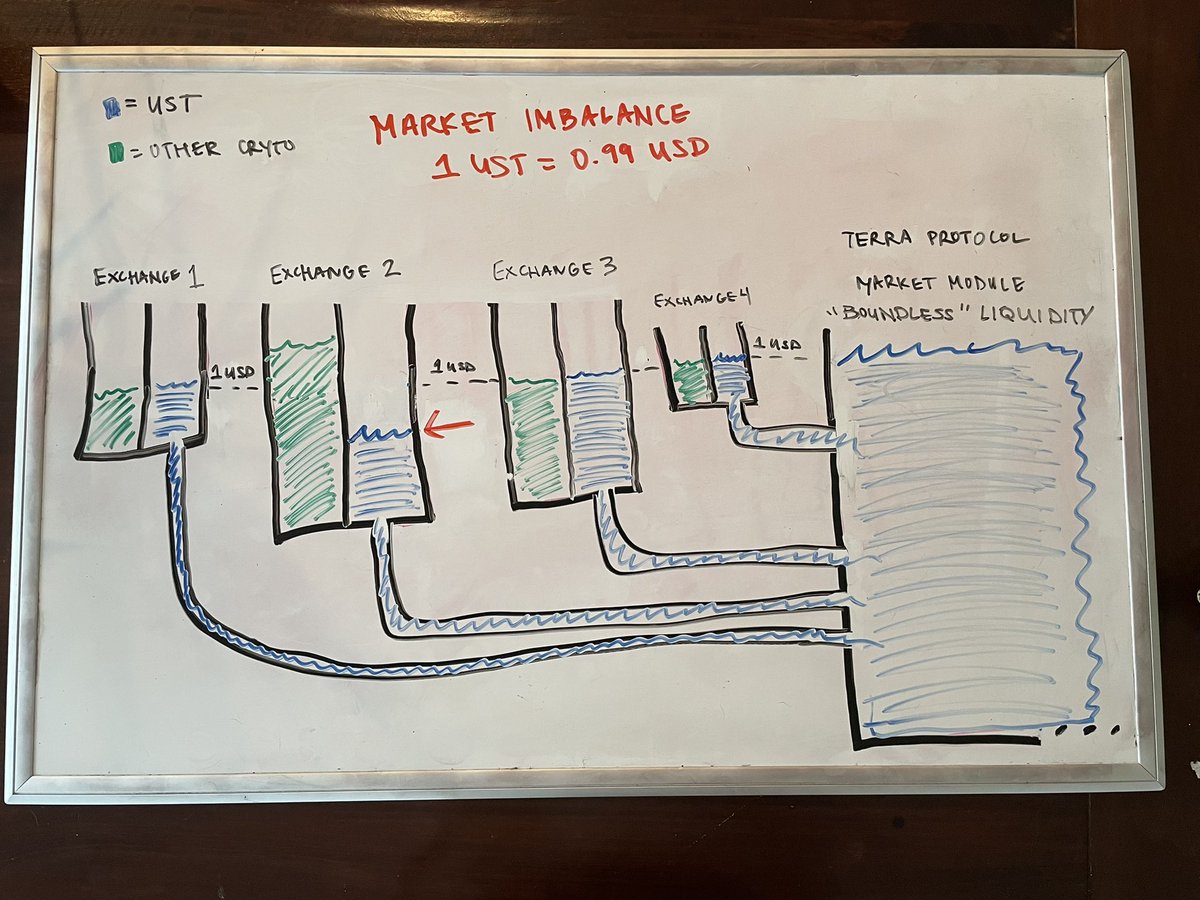

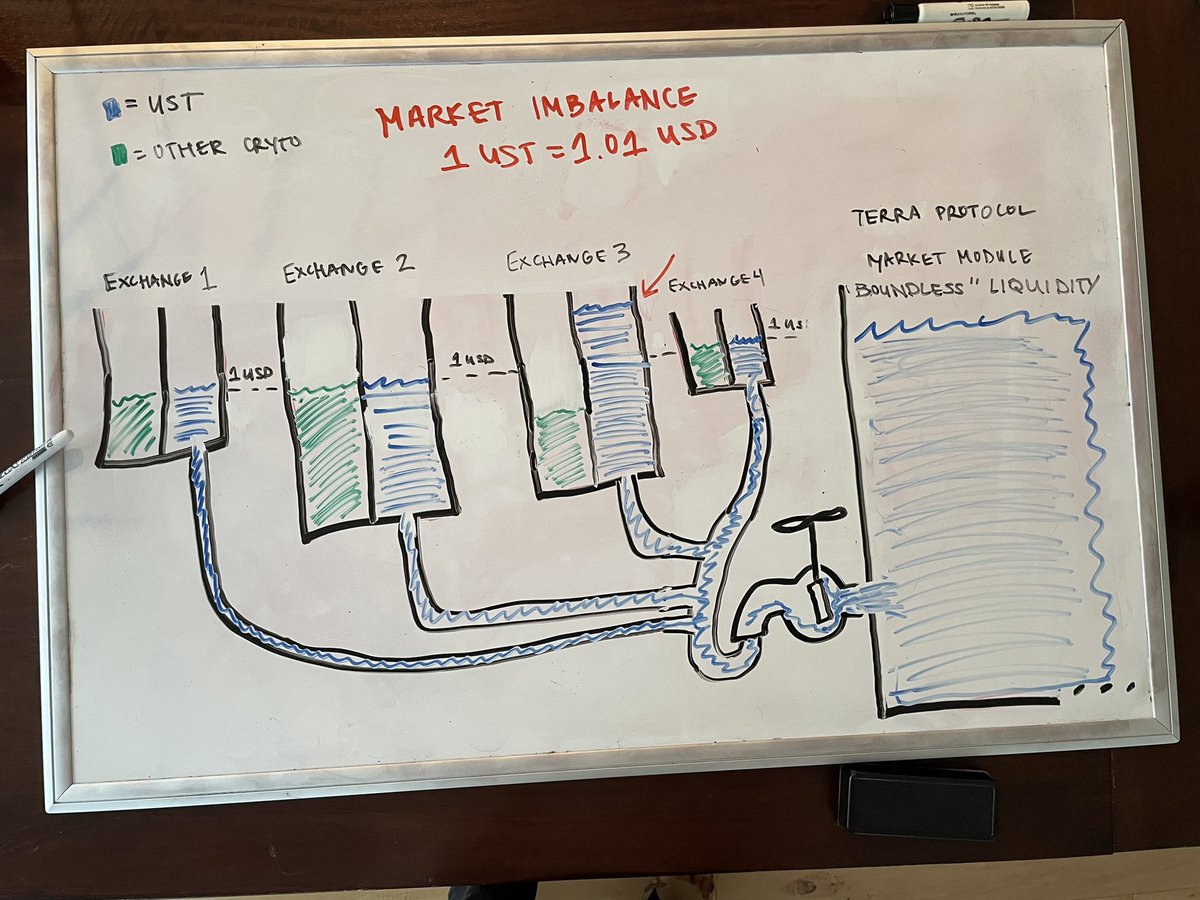

1/7 I’ll let you in on a secret: ON CHAIN, 1 UST ALWAYS EQUALS 1USD. The market module makes no distinction between fiat per Luna rates and their corresponding Terra stablecoin per Luna rates. UST “depeg” only happens on external exchanges, when pools are unbalanced.

2/7 AMM pools get unbalanced. It’s normal. They rebalance through arbitrage incentives. When one pool is unbalanced, people use other balanced pools or sources to trade against and profit the difference, leading to a “leveling” effect. Imagine the way water always seeks level.

6/7 I’ll talk about how the spread works and why we have one another time. Just know that it prevents Oracle attacks and combats volatility spikes. TLDR: market module mint/burn process modulates supply of UST and balances prices of external exchanges through arbitrage.

7/7 The example pics in this tweet are not perfect, but they provide a good visualization of pool balancing effects. Think of the market module as a source of constant price. More drawings and interactive explanations are on their way. Further reading: docs.terra.money

#terra $luna @terra_money

جاري تحميل الاقتراحات...