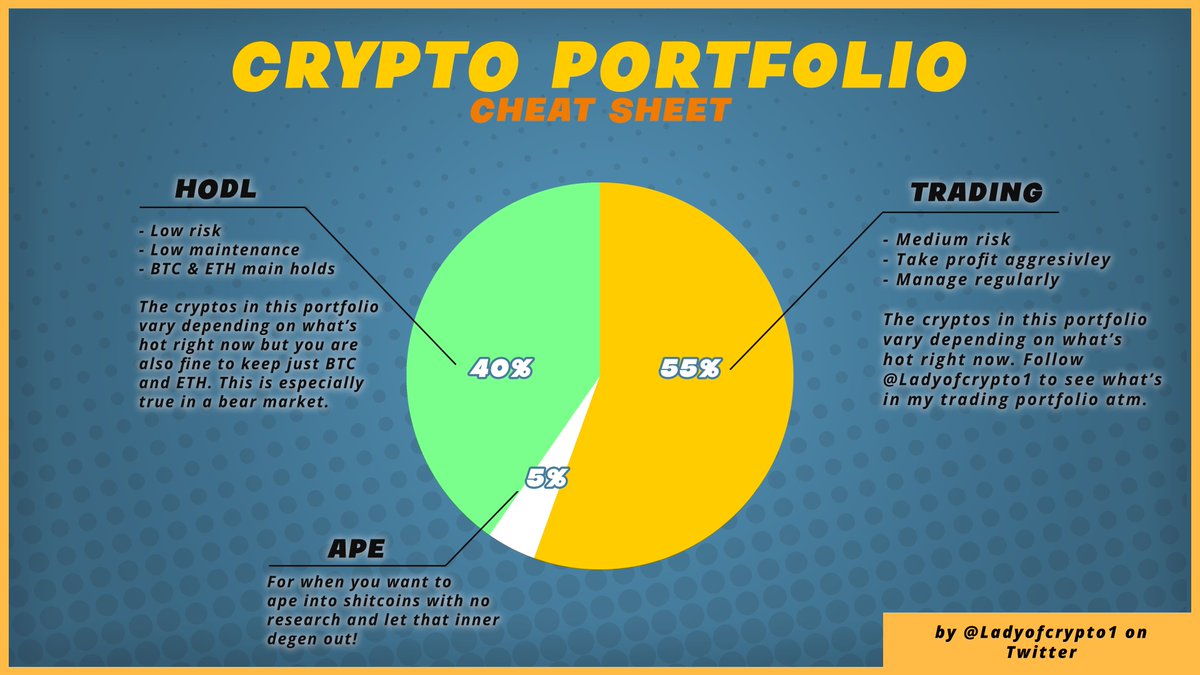

1/ -- PORTFOLIO SPLIT ---

I split my portfolio into three sub-portfolios

HODL (40%) - I don't touch this much other than to DCA.

Trading (55%) - Where I take most positions I share on CT.

Ape (5%) - More on this later.

I split my portfolio into three sub-portfolios

HODL (40%) - I don't touch this much other than to DCA.

Trading (55%) - Where I take most positions I share on CT.

Ape (5%) - More on this later.

2/ -- HODL ---

My HODL portfolio is simple. It currently holds $BTC, $ETH, $SOL, $LUNA n $LTC.

I've taken profit aggressively on SOL and LUNA though.

Even though this is a HODL portfolio I occasionally TP everything that isn't BTC or ETH.

My HODL portfolio is simple. It currently holds $BTC, $ETH, $SOL, $LUNA n $LTC.

I've taken profit aggressively on SOL and LUNA though.

Even though this is a HODL portfolio I occasionally TP everything that isn't BTC or ETH.

3/ -- Trading ---

This is my day-to-day portfolio that I use to invest in medium/low risk projects.

I manage these trades regularly by taking profit and resistance and buying back at support. Some of my biggest bags in this portfolio atm are $GMT and $PYR. I'll share more below.

This is my day-to-day portfolio that I use to invest in medium/low risk projects.

I manage these trades regularly by taking profit and resistance and buying back at support. Some of my biggest bags in this portfolio atm are $GMT and $PYR. I'll share more below.

6/ -- Stable --

Keeping stable sidelined is vital for buying dips.

In a bull market I keep min 20% stable on my Trading portfolio and 10% in my HODL.

In a bear market I keep min 60% stable on my Trading portfolio and 40% in my HODL. I aim for more stable though!

Keeping stable sidelined is vital for buying dips.

In a bull market I keep min 20% stable on my Trading portfolio and 10% in my HODL.

In a bear market I keep min 60% stable on my Trading portfolio and 40% in my HODL. I aim for more stable though!

7/ -- Stable cont --

My Ape portfolio is 100% stable unless I'm apeing at which point I risk at most half of it per trade.

My Ape portfolio is 100% stable unless I'm apeing at which point I risk at most half of it per trade.

8/ -- Why Ape? --

Sometimes taking dumb undisciplined trades is fun, which is why I allocate 5% of my portfolio to apeing.

This way I can satiate that thirst for degen trades without it impacting me too badly if I lose.

Sometimes taking dumb undisciplined trades is fun, which is why I allocate 5% of my portfolio to apeing.

This way I can satiate that thirst for degen trades without it impacting me too badly if I lose.

9/ -- Ape Losses --

The 5% of my capital allocated to my Ape portfolio isn't counted towards my total capital on my tracking spreadsheet.

Psychologically this helps because I consider the capital already lost. So if I ape into a trade and get rugged I don't care.

The 5% of my capital allocated to my Ape portfolio isn't counted towards my total capital on my tracking spreadsheet.

Psychologically this helps because I consider the capital already lost. So if I ape into a trade and get rugged I don't care.

10/ -- HODL & DCA --

I move gains made in my Ape and Trading portfolios over to my HODL weekly which allows me to DCA into $BTC and $ETH.

In a proper bear market, I'll narrow my HODL portfolio down to BTC n ETH and hodl just those two. They are the only safe bets.

I move gains made in my Ape and Trading portfolios over to my HODL weekly which allows me to DCA into $BTC and $ETH.

In a proper bear market, I'll narrow my HODL portfolio down to BTC n ETH and hodl just those two. They are the only safe bets.

11/ -- Staking --

I put my stable to work for me by staking it for high APY. 4% to 19% depending on where it's staked.

I stake different stables in different places to spread my risk. $UST $USDT $USDC $DAI and I'll do $USN soon too.

I put my stable to work for me by staking it for high APY. 4% to 19% depending on where it's staked.

I stake different stables in different places to spread my risk. $UST $USDT $USDC $DAI and I'll do $USN soon too.

12/ -- Current Holdings --

HODL - Mostly $BTC and $ETH n little $LTC n $METIS. Sold most $SOL n $LUNA.

Trading - Biggest holds are $GMT, $PYR, $UOS, $NEAR & $ILV. I've taken enough profit on all of these to be way up even if they dump!

Ape - Nothing atm.

HODL - Mostly $BTC and $ETH n little $LTC n $METIS. Sold most $SOL n $LUNA.

Trading - Biggest holds are $GMT, $PYR, $UOS, $NEAR & $ILV. I've taken enough profit on all of these to be way up even if they dump!

Ape - Nothing atm.

13/ -- Vesting --

I am an early investor in several projects which I am vested into for up to 2 years.

I do not calculate vested amounts as crypto holdings.

If I did then 95% of my capital would be in crypto but I couldn't take profit 👀

I am an early investor in several projects which I am vested into for up to 2 years.

I do not calculate vested amounts as crypto holdings.

If I did then 95% of my capital would be in crypto but I couldn't take profit 👀

If you found this thread useful, please like and retweet the first tweet below 👇

Loading suggestions...