The Beginners Guide To Stablecoins

🧵 by @smyyguy

🧵 by @smyyguy

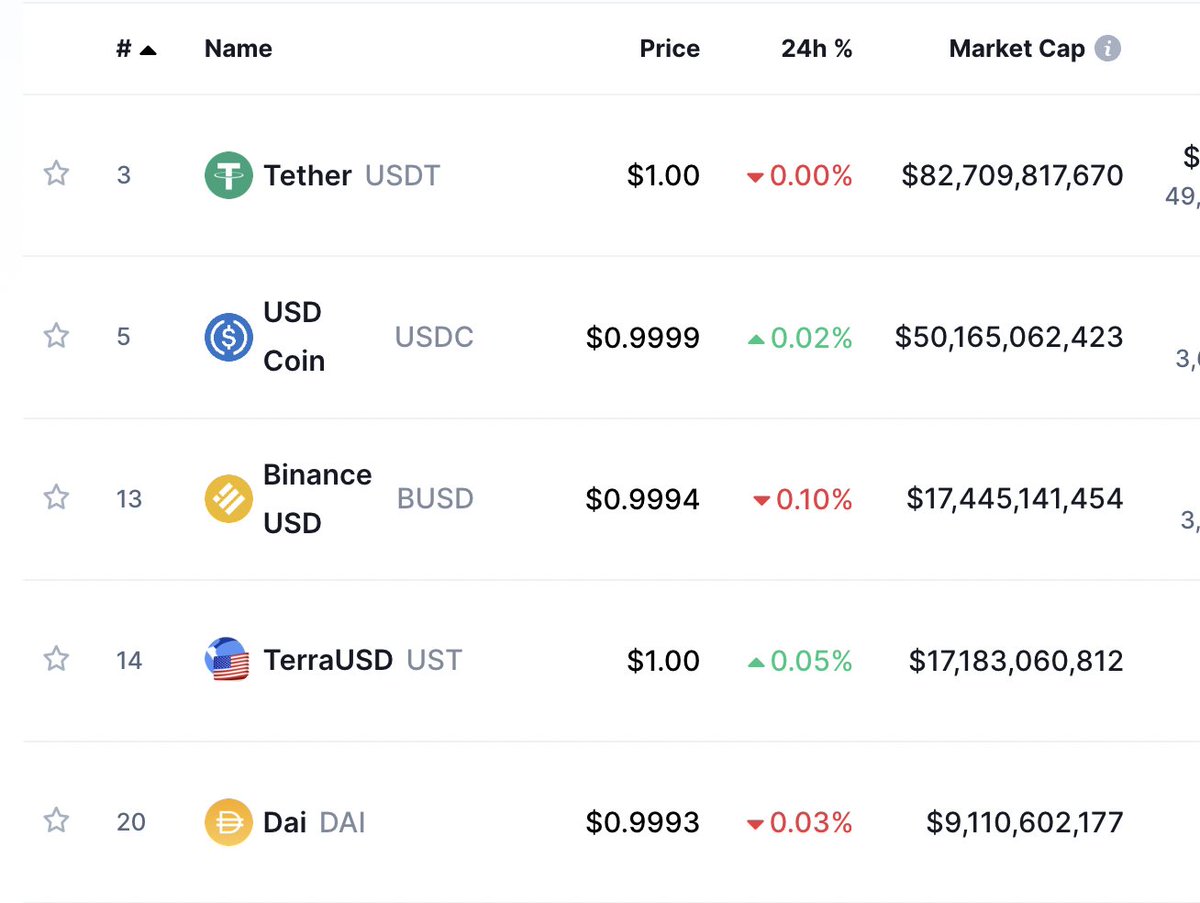

1/ A stablecoin is a digital asset that is "pegged" to the value of another asset, generally the US dollar

For example, 1 USDC is always redeemable for $1.00

For example, 1 USDC is always redeemable for $1.00

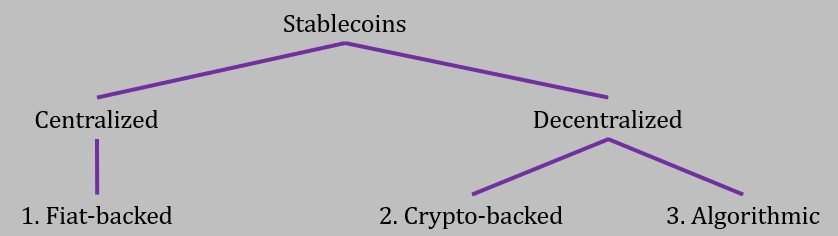

4.1/ Stablecoins: Fiat-backed

These stables are managed by various centralized custodians - example: USDC

They maintain their peg with a 100% collateralization approach.

This means every token in circulation is backed 1:1 with dollars/dollar equivalents held by the custodian

These stables are managed by various centralized custodians - example: USDC

They maintain their peg with a 100% collateralization approach.

This means every token in circulation is backed 1:1 with dollars/dollar equivalents held by the custodian

4.2/ Drawback: Trust

Users must trust that the centralized custodian has the 1:1 backing they claim to have. If a bank run occurs, can they pay their token-holders?

Users must trust that the centralized custodian has the 1:1 backing they claim to have. If a bank run occurs, can they pay their token-holders?

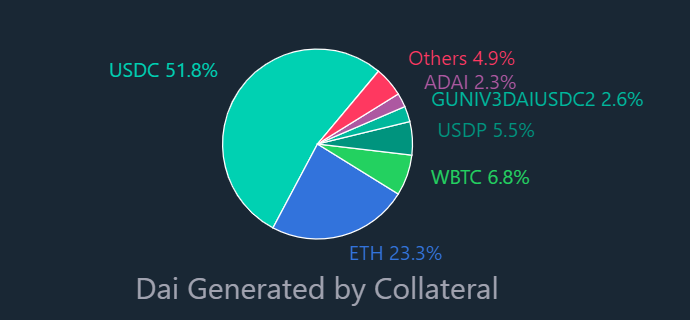

5/ Stablecoins: Crypto-backed

These are backed by over-collateralized crypto loans, meaning users must deposit more than $1 of crypto collateral to mint $1 in stablecoins

In contrast to fiat-backed, these are decentralized assets managed via smart contracts

These are backed by over-collateralized crypto loans, meaning users must deposit more than $1 of crypto collateral to mint $1 in stablecoins

In contrast to fiat-backed, these are decentralized assets managed via smart contracts

5.2/ Drawback: Capital Inefficiency

It does not always make sense for users to deposit more than $1 of crypto to receive just $1 in stables

Users also risk losing their collateral if the deposited value drops below the liquidation price. A necessary evil to maintain the peg

It does not always make sense for users to deposit more than $1 of crypto to receive just $1 in stables

Users also risk losing their collateral if the deposited value drops below the liquidation price. A necessary evil to maintain the peg

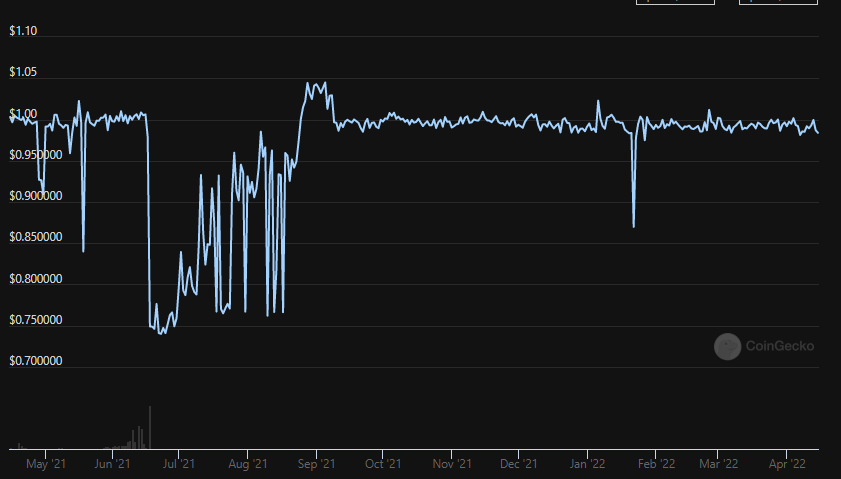

6/ Stablecoins: Algorithmic

Commonly viewed as the most decentralized, algorithmic stablecoins are either not backed by any collateral or are under-collateralized

They maintain their peg with mathematically determined expansion and contraction in supply

Commonly viewed as the most decentralized, algorithmic stablecoins are either not backed by any collateral or are under-collateralized

They maintain their peg with mathematically determined expansion and contraction in supply

6.1/ UST is the largest algo stable, and it maintains its peg by relying on LUNA to absorb any price volatility

The LUNA supply actively adds to or subtracts from UST's supply as users:

- burn $1 of LUNA to mint $1 of UST

- burn $1 of UST to mint $1 of LUNA

The LUNA supply actively adds to or subtracts from UST's supply as users:

- burn $1 of LUNA to mint $1 of UST

- burn $1 of UST to mint $1 of LUNA

6.2/ But the key to success for algo stablecoins is demand...

@bgilliam1982 wrote a fantastic piece on why @stablekwon focuses on generating demand for UST

"A stablecoin can only hold its peg for as long as there is enough demand to keep it there"

blockworks.co

@bgilliam1982 wrote a fantastic piece on why @stablekwon focuses on generating demand for UST

"A stablecoin can only hold its peg for as long as there is enough demand to keep it there"

blockworks.co

7/ Follow @smyyguy the get insights on the future of DeFi- Soon he will dive into how to earn yield on stablecoins👀

Loading suggestions...