Studying the past will give you clues about the future.

Here's what happened in DeFi in

Quarter 1 2022:

(including two chains that doubled their TVL)

Here's what happened in DeFi in

Quarter 1 2022:

(including two chains that doubled their TVL)

Today we'll look at

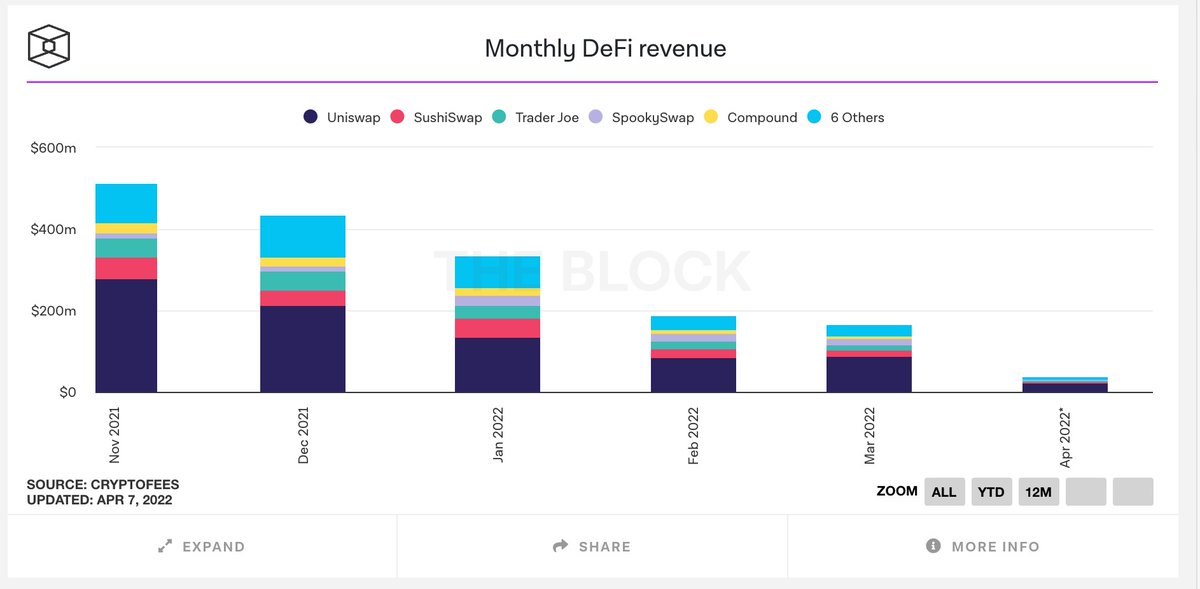

• Several #'s and metrics around DeFi

• The biggest stories and narratives in Q1

• Some things I'm paying attention to next in Q2

Let's level ↑

• Several #'s and metrics around DeFi

• The biggest stories and narratives in Q1

• Some things I'm paying attention to next in Q2

Let's level ↑

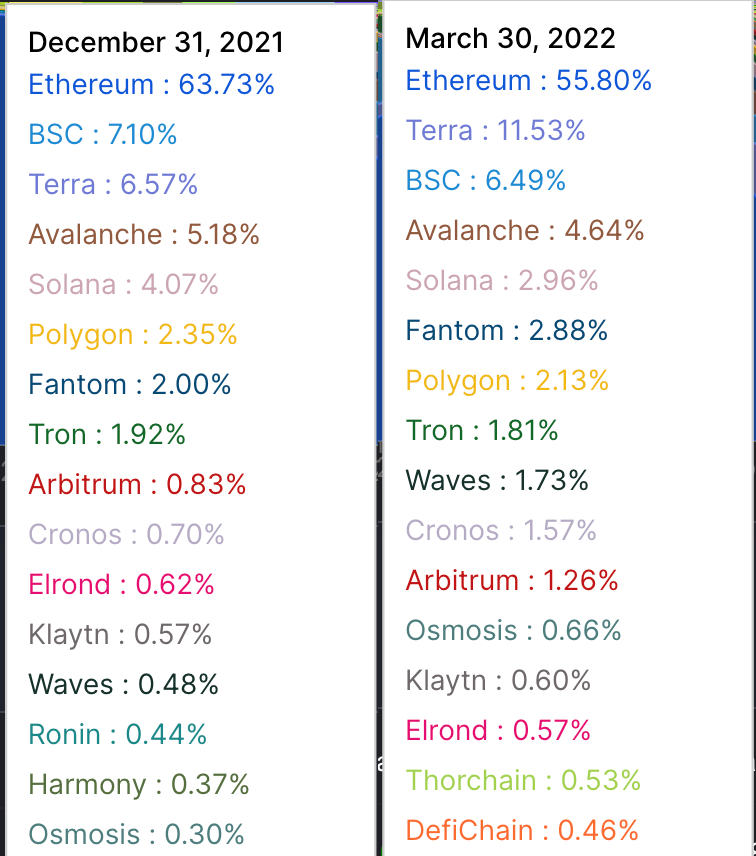

Comparing the TVL of Different Chains

Let's look at how the different chains compared.

The most drastic:

• Ethereum: -7.93% (Keep in mind some went to L2s)

• Terra: +4.95%

@Osmosiszone and @Cronos_chain each DOUBLED their TVL despite the dip.

Let's look at how the different chains compared.

The most drastic:

• Ethereum: -7.93% (Keep in mind some went to L2s)

• Terra: +4.95%

@Osmosiszone and @Cronos_chain each DOUBLED their TVL despite the dip.

The Stories of Quarter 1

Quarter 1 was a wild rollercoaster full of ups and downs.

It's not DeFi without exploits and drama.

Let's look at some of the different stories that affected DeFi in the past few months.

Quarter 1 was a wild rollercoaster full of ups and downs.

It's not DeFi without exploits and drama.

Let's look at some of the different stories that affected DeFi in the past few months.

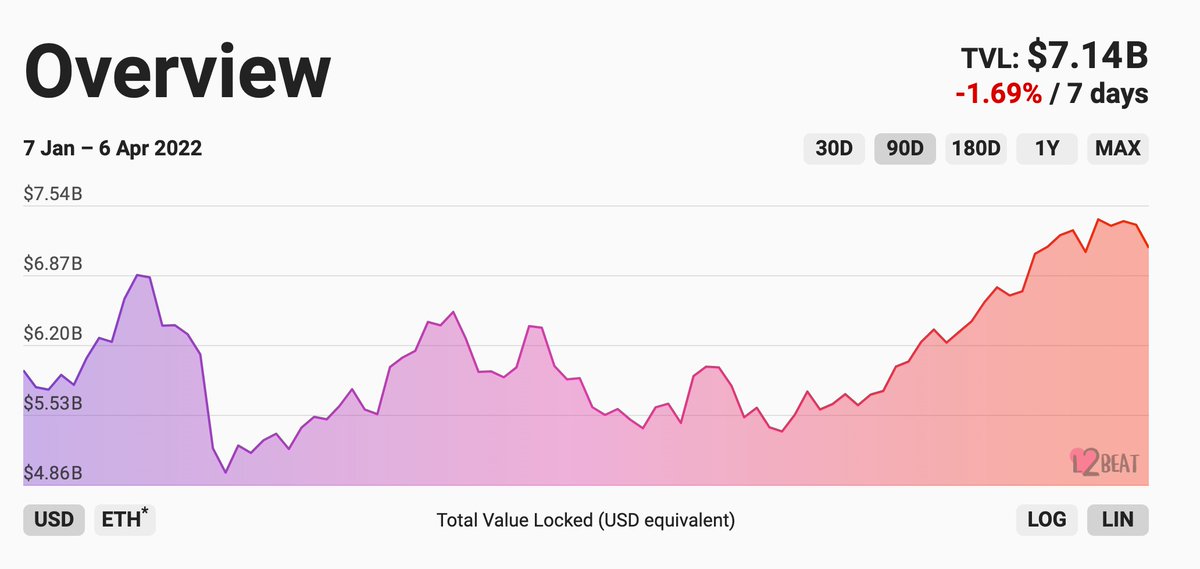

Ethereum Layer 2s Heating Up

The TVL of Ethereum Layer 2s keeps increasing.

• @Arbitrum is leading the way

• @MetisDAO is building its ecosystem

• @starkwareltd is coming. Starkware is a BIG deal.

@l2beatcom

The TVL of Ethereum Layer 2s keeps increasing.

• @Arbitrum is leading the way

• @MetisDAO is building its ecosystem

• @starkwareltd is coming. Starkware is a BIG deal.

@l2beatcom

Terra Luna 🌕 Defies the Market

• Luna broke all-time highs during the dip.

• The @lfg_org topped off @anchor_protocol reserves with $450m to maintain the 19.5% APY

• The @lfg_org committed to buying $10b worth of Bitcoin to help defend the $UST peg.

• Luna broke all-time highs during the dip.

• The @lfg_org topped off @anchor_protocol reserves with $450m to maintain the 19.5% APY

• The @lfg_org committed to buying $10b worth of Bitcoin to help defend the $UST peg.

AVAX 🔺

• AVAX released subnets to increase scaling

• @defikingdoms expanded to AVAX with Crystalvale using AVAX subnet.

• Terra just bought $200m worth of AVAX.

• @Platypusdefi the stable coin swap of AVAX hit $1B TVL

• Liquid staking via sAVAX

• AVAX released subnets to increase scaling

• @defikingdoms expanded to AVAX with Crystalvale using AVAX subnet.

• Terra just bought $200m worth of AVAX.

• @Platypusdefi the stable coin swap of AVAX hit $1B TVL

• Liquid staking via sAVAX

Solana

I haven't paid too much attention because the DeFi stuff isn't interesting.

There are two tailwinds for @solana:

• @Opensea is integrating Solana NFT's

• @auroryproject is a hyped gaming project set to release.

I haven't paid too much attention because the DeFi stuff isn't interesting.

There are two tailwinds for @solana:

• @Opensea is integrating Solana NFT's

• @auroryproject is a hyped gaming project set to release.

Cosmos ⚛️

• The Gravity bridge launched which connects COSMOS and ETH

• They're launching interchain security which allows newer blockchains to bootstrap security

• There will be more value accrual to the ATOM token. Staking ATOM will let you gain rewards from many chains.

• The Gravity bridge launched which connects COSMOS and ETH

• They're launching interchain security which allows newer blockchains to bootstrap security

• There will be more value accrual to the ATOM token. Staking ATOM will let you gain rewards from many chains.

Frog Nation Falls 🐸

Dani & Frog Nation was the hottest thing in Q1.

• $Ice, $spell, & $time were on Fire.

• They engineered a takeover of @SushiSwap

Everything crashed when the identity of Sifu was discovered to be Michael Patryn (Serial scammer)

Dani & Frog Nation was the hottest thing in Q1.

• $Ice, $spell, & $time were on Fire.

• They engineered a takeover of @SushiSwap

Everything crashed when the identity of Sifu was discovered to be Michael Patryn (Serial scammer)

Rebasing Projects

Rebasing projects were all the rage in Q1 and most of them have kinda died out.

2 exceptions:

1. @olympusdao is still building out products

2. @redactedcartel has formed several strong partnerships including 1 with @terra_money

Rebasing projects were all the rage in Q1 and most of them have kinda died out.

2 exceptions:

1. @olympusdao is still building out products

2. @redactedcartel has formed several strong partnerships including 1 with @terra_money

SOLIDLY ve(3,3) Flops

Solidly was the most hyped event in Q1.

Investors transferred millions of dollars to FTM to try and get a piece of SOLID NFTs.

A bad launch and a missing founder have caused SOLIDY to flop.

Solidly was the most hyped event in Q1.

Investors transferred millions of dollars to FTM to try and get a piece of SOLID NFTs.

A bad launch and a missing founder have caused SOLIDY to flop.

FAAS

Farming as a Service is a new sector that wants to help people /w farming.

Let's see how they do when the bull arrives.

Major Players: @ReimaginedFi, @alphacap_io, @schaincapital (Wolf Ventures), @expo_capital

Farming as a Service is a new sector that wants to help people /w farming.

Let's see how they do when the bull arrives.

Major Players: @ReimaginedFi, @alphacap_io, @schaincapital (Wolf Ventures), @expo_capital

NFTs

• @yugalabs acquires Cryptopunks

• @Gamestop is launching an NFT marketplace soon

• @yugalabs raises $450m for a metaverse project

• @Azukiofficial reached blue-chip NFT status within months

I'm not familiar with NFTs but their success will onboard more normies.

• @yugalabs acquires Cryptopunks

• @Gamestop is launching an NFT marketplace soon

• @yugalabs raises $450m for a metaverse project

• @Azukiofficial reached blue-chip NFT status within months

I'm not familiar with NFTs but their success will onboard more normies.

Some Areas I'm Paying More Attention to Next Quarter:

• The Cosmos ecosystem

• The NEAR ecosystem

• Options / Perpetuals

• ETH Layer 2 adoption / The Merge

• GameFi plays

Can't wait to see how this quarter plays out!

• The Cosmos ecosystem

• The NEAR ecosystem

• Options / Perpetuals

• ETH Layer 2 adoption / The Merge

• GameFi plays

Can't wait to see how this quarter plays out!

Predictions

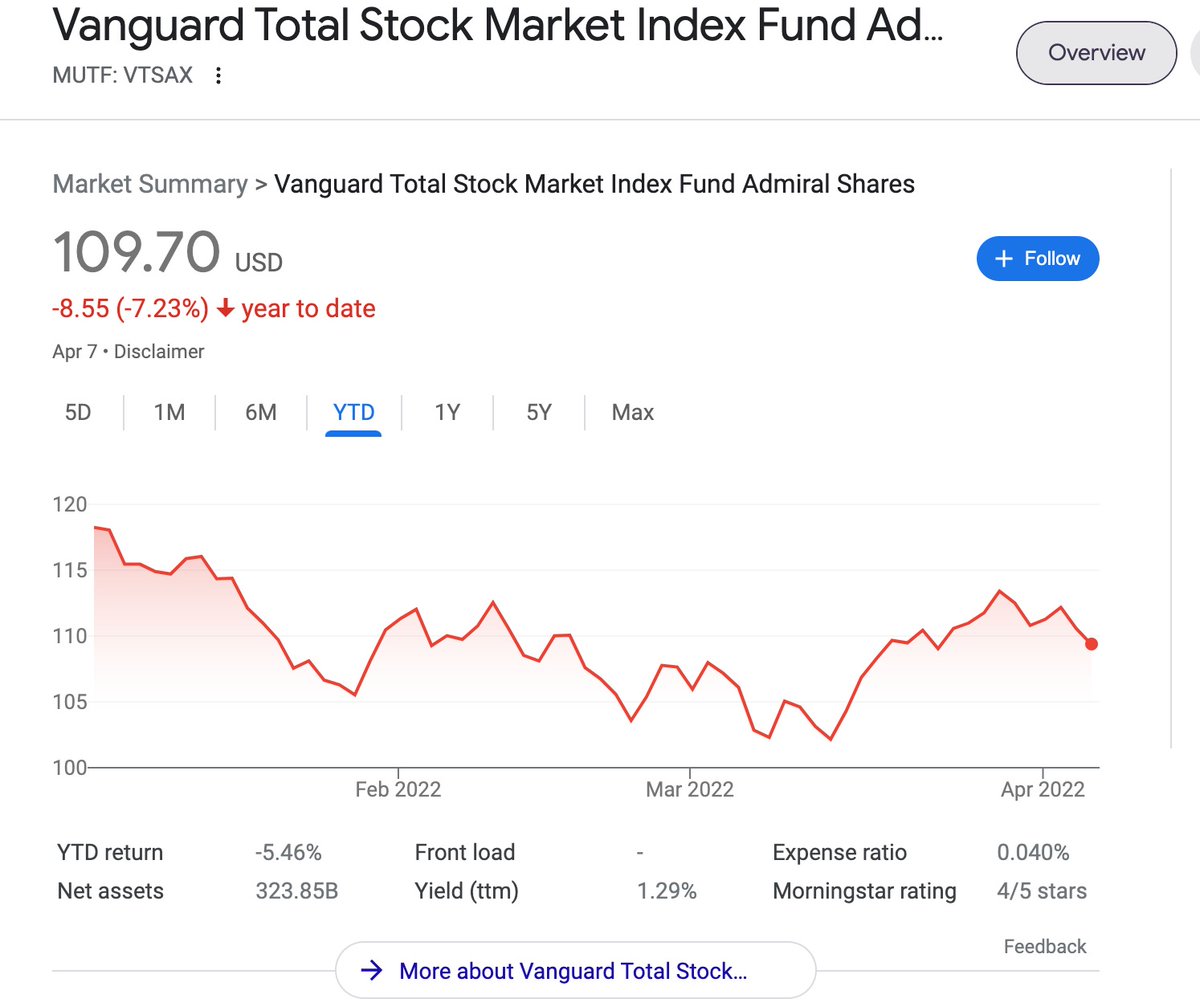

I'm cautious near term but bullish over the next 3 years.

Normal people are being squeezed by inflation + gas prices.

We need new $ inflows to trigger a bull run.

Way too many unknowns with how the war plays out, and how governments are handling inflation.

I'm cautious near term but bullish over the next 3 years.

Normal people are being squeezed by inflation + gas prices.

We need new $ inflows to trigger a bull run.

Way too many unknowns with how the war plays out, and how governments are handling inflation.

Takeaways:

• TVL and Inflows were down this quarter due to large macro forces. I'm impressed with how resilient crypto has been.

• One way to profit is to understand the different metagame and narratives.

You can look at #'s to see which chains are gaining momentum.

• TVL and Inflows were down this quarter due to large macro forces. I'm impressed with how resilient crypto has been.

• One way to profit is to understand the different metagame and narratives.

You can look at #'s to see which chains are gaining momentum.

I hope you've found this thread helpful!

Two things you can do next:

1. Follow me @thedefiedge for more DeFi insights.

2. Like/Retweet the first tweet below if you can:

Two things you can do next:

1. Follow me @thedefiedge for more DeFi insights.

2. Like/Retweet the first tweet below if you can:

Also, I started the year with 0 followers.

Thank you for the opportunity to share my thoughts with you.

I'm forever grateful.

Make sure you subscribe to thedefiedge.com so you don't miss out on anything!

Thank you for the opportunity to share my thoughts with you.

I'm forever grateful.

Make sure you subscribe to thedefiedge.com so you don't miss out on anything!

Loading suggestions...