1. Company Overview

Paras Defence and Space Technologies is involved in designing, developing, manufacturing and testing of a wide range of defence and space engineering products and solutions.

Paras Defence and Space Technologies is involved in designing, developing, manufacturing and testing of a wide range of defence and space engineering products and solutions.

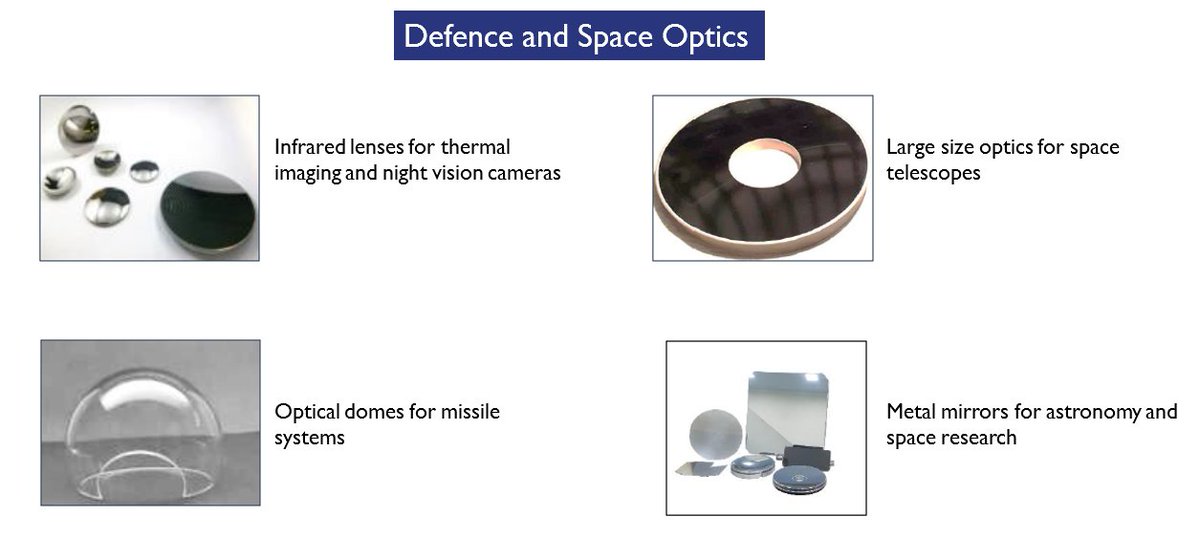

They are one of the largest private companies involved in indigenously developing and manufacturing defence and space technology. They are the sole Indian supplier of critical imaging components such as large size optics and diffractive gratings for space applications in India.

The management has indicated that all the PSUs involved in defence source at least some part of their products from the company.

2. Business Segments

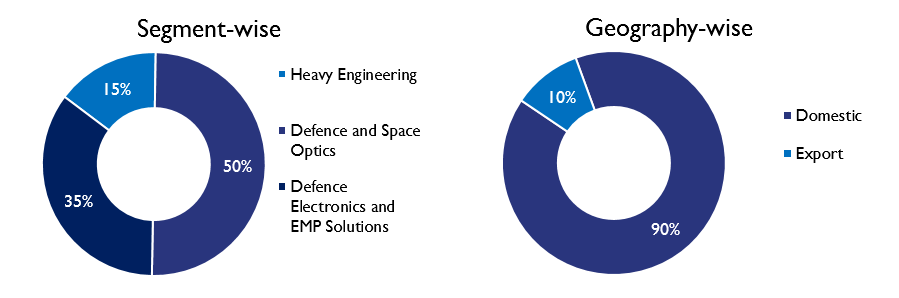

Paras is involved in 4 main business segments -

i) Defence and Space Optics

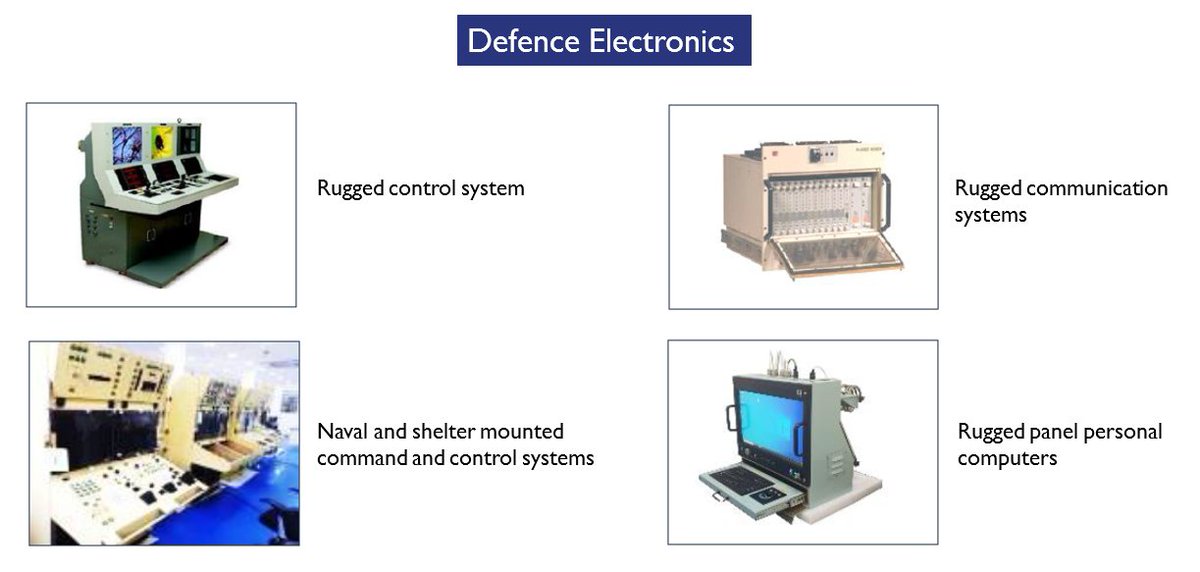

ii) Defence Electronics

ii) EMP Protection

iv) Heavy Engineering.

They are also involved in Niche Technologies where they make antennas for satellites and capsule-sized drones.

Paras is involved in 4 main business segments -

i) Defence and Space Optics

ii) Defence Electronics

ii) EMP Protection

iv) Heavy Engineering.

They are also involved in Niche Technologies where they make antennas for satellites and capsule-sized drones.

Their private sector clients include TCS and Astra Rafael Comsys. They also have international clients like the Chaban Group from Israel, AMOS from Belgium and Tae Young Optics from South Korea.

Which means it is a low volume high value type of business.

In a recent interview dated March 30 2022, the management indicated that another ₹200-250 Cr of orders were in negotiation and they will be getting them very soon.

In a recent interview dated March 30 2022, the management indicated that another ₹200-250 Cr of orders were in negotiation and they will be getting them very soon.

They are hoping to start FY23 with an order book size of ₹550-600 Cr.

7. Financials

The company has shown a decline in revenues and profitability in the past 2 years. The management has indicated that they were hit by Covid much earlier than others and Q4 revenues were deferred since Feb of 2020.

The company has shown a decline in revenues and profitability in the past 2 years. The management has indicated that they were hit by Covid much earlier than others and Q4 revenues were deferred since Feb of 2020.

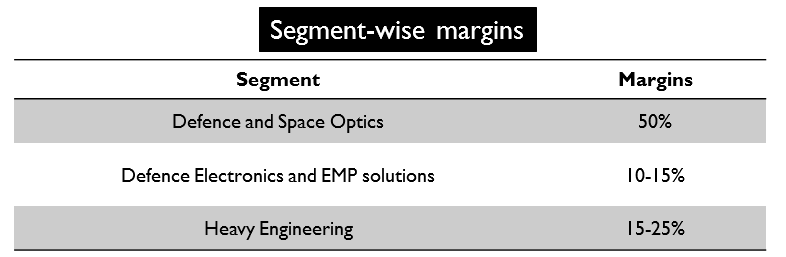

The company has healthy margins in the Optics and Heavy Engineering segments. Their margins in the Electronics segment are low because there is more competition in that segment from other domestic producers. The variability in margins depends on the product mix.

8. Sector Tailwinds

The government has indicated that 68% of the defence procurement will be happening from domestic companies. In addition to this, the government has also banned the import of more than 100 items for defence purposes which included the EMP protection equipment

The government has indicated that 68% of the defence procurement will be happening from domestic companies. In addition to this, the government has also banned the import of more than 100 items for defence purposes which included the EMP protection equipment

manufactured by Paras. Paras has also greatly benefitted from the Make in India and Atma Nirbhar Bharat initiatives where the government has encouraged domestic manufacturing as opposed to import.

With the current political scenario, defence budgets are expected to rise owing

With the current political scenario, defence budgets are expected to rise owing

to the need to modernize militaries. Paras has claimed that they are a supplier to all the defence PSUs in India which should increase the size of the order book.

9. Future Outlook

Paras is looking to expand in the optics segment. They are developing high-end cameras used in satellites. They are also looking to break into drones and into anti-drone technologies. Both these segments have tremendous scope for growth.

Paras is looking to expand in the optics segment. They are developing high-end cameras used in satellites. They are also looking to break into drones and into anti-drone technologies. Both these segments have tremendous scope for growth.

If the orders do come through as the management indicated, the company will be starting FY23 with an order book of close to 4 times FY21 revenues. Whether or not they can execute these orders remains to be seen.

Loading suggestions...