$CVX Mega-🧵 and catalysts

🔹 overview

🔹 fundamentals

🔹 catalysts

🔹 community & tools

🔹 summary

I approach things from a product manager mentality because that is what I do, building VC-backed companies for a living.

Let’s dive in 👇

🔹 overview

🔹 fundamentals

🔹 catalysts

🔹 community & tools

🔹 summary

I approach things from a product manager mentality because that is what I do, building VC-backed companies for a living.

Let’s dive in 👇

/1

Overview

I did a 90 min chat with @TaikiMaeda2 in early December, sharing with his community an overview of @ConvexFinance and my thoughts.

It assumes knowledge of $CRV so it’s more of a level 2 discussion.

Overview

I did a 90 min chat with @TaikiMaeda2 in early December, sharing with his community an overview of @ConvexFinance and my thoughts.

It assumes knowledge of $CRV so it’s more of a level 2 discussion.

/2

@ConvexFinance, abstractly, is a vertically integrated framework that makes veTKN models better

They do so with a 3 solutions or products

🔹 Boost utility for LPs

🔹 Liquid locking of veTKN

🔹 Incentive market for votes

@ConvexFinance, abstractly, is a vertically integrated framework that makes veTKN models better

They do so with a 3 solutions or products

🔹 Boost utility for LPs

🔹 Liquid locking of veTKN

🔹 Incentive market for votes

/3

Analogy

🔹Google is a search utility

🔹Google aggregates demand (advertisers) and allows them to bid on supply (your attention) via AdWords

🔹Google aggregates more supply (publishers) via Adsense

Synergistic economy. Google profits then distributes to stakeholders

Analogy

🔹Google is a search utility

🔹Google aggregates demand (advertisers) and allows them to bid on supply (your attention) via AdWords

🔹Google aggregates more supply (publishers) via Adsense

Synergistic economy. Google profits then distributes to stakeholders

/4

Applied to @CurveFinance

🔹 $CVX enables Curve LPs max boost and rewards

🔹 $CVX aggregates supply or voting power on Curve ($cvxCRV)

🔹 $CVX aggregates demand by allowing protocols to bid on CRV emissions ($vlCVX)

Synergistic economy. $CVX distributes fees to stakeholders

Applied to @CurveFinance

🔹 $CVX enables Curve LPs max boost and rewards

🔹 $CVX aggregates supply or voting power on Curve ($cvxCRV)

🔹 $CVX aggregates demand by allowing protocols to bid on CRV emissions ($vlCVX)

Synergistic economy. $CVX distributes fees to stakeholders

/5

Stakeholders

Depending on which product you use, your value of @ConvexFinance differs. You can be only 1 bucket or all 3

🔹 LPs - care about max boost

🔹 Incoomers - care about veCRV and fees from bids for emissions

🔹DAOs - care about CRV + CVX emissions to their LPs

Stakeholders

Depending on which product you use, your value of @ConvexFinance differs. You can be only 1 bucket or all 3

🔹 LPs - care about max boost

🔹 Incoomers - care about veCRV and fees from bids for emissions

🔹DAOs - care about CRV + CVX emissions to their LPs

/7

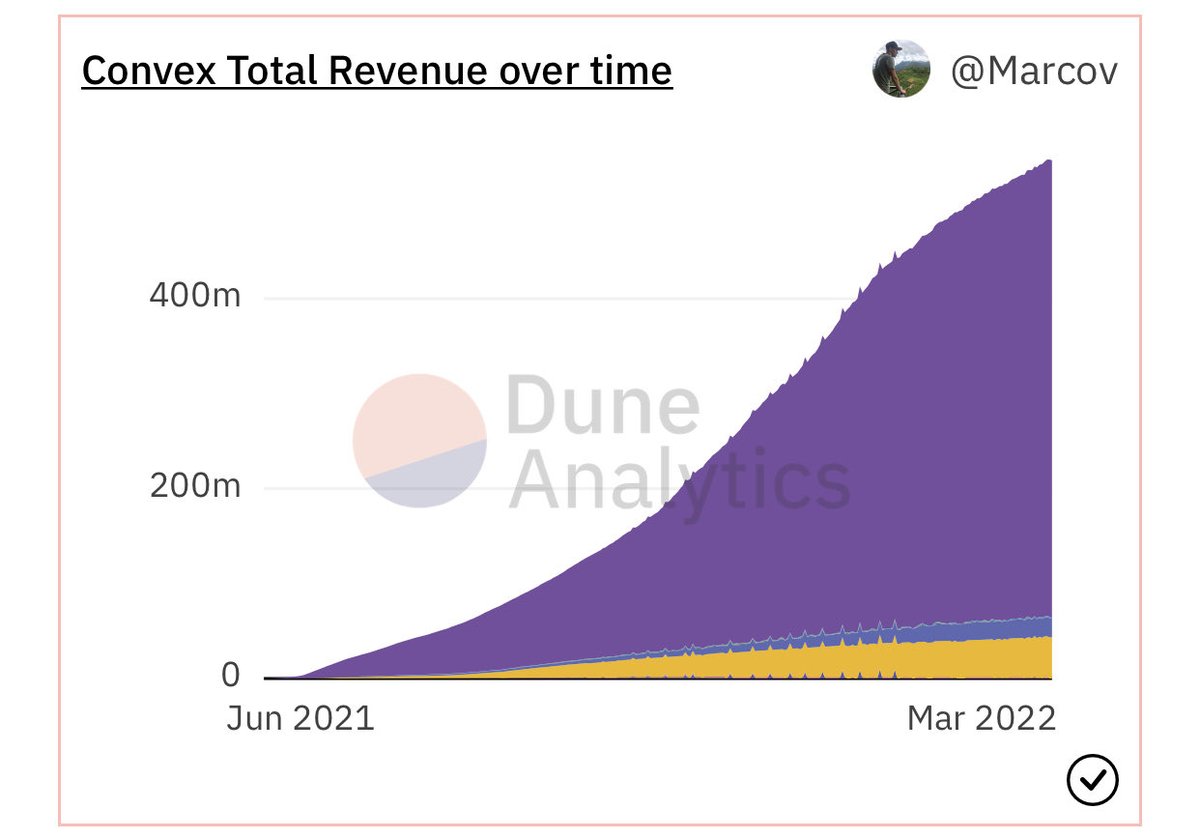

$CRV locked in @ConvexFinance

LP boost solution has enabled $CVX to lock over 43% (blue line) of voting power, and this will flip to majority over time based on current velocity creating a strong moat

$CRV locked in @ConvexFinance

LP boost solution has enabled $CVX to lock over 43% (blue line) of voting power, and this will flip to majority over time based on current velocity creating a strong moat

/9

Product Market Fit

There are so many metrics to monitor. How does a product manager monitor protocol health though?

Facebook used 7 connections per user as its primary KPI early on as that was the critical # of connections to make app useful.

What is it for $CVX?

Product Market Fit

There are so many metrics to monitor. How does a product manager monitor protocol health though?

Facebook used 7 connections per user as its primary KPI early on as that was the critical # of connections to make app useful.

What is it for $CVX?

/10

Primary KPI - Moat

cvxCRV locked / veCRV locked > 50%

People focus on % CRV daily emissions, but what really matters is majority of locked veCRV is in convex.

Ie % daily emissions locked could be 5%. If all 5% were locked in cvxCRV then ratio is 100% on convex that day

Primary KPI - Moat

cvxCRV locked / veCRV locked > 50%

People focus on % CRV daily emissions, but what really matters is majority of locked veCRV is in convex.

Ie % daily emissions locked could be 5%. If all 5% were locked in cvxCRV then ratio is 100% on convex that day

/11

Why is this the moat?

$CVX value lies in the governance power the DAO controls. If the protocol utility is healthy (LP boosties, liquid locked veTKN) then it will aggregate veTKN faster via incentives on-platform vs user’s options off-platform.

Why is this the moat?

$CVX value lies in the governance power the DAO controls. If the protocol utility is healthy (LP boosties, liquid locked veTKN) then it will aggregate veTKN faster via incentives on-platform vs user’s options off-platform.

/13

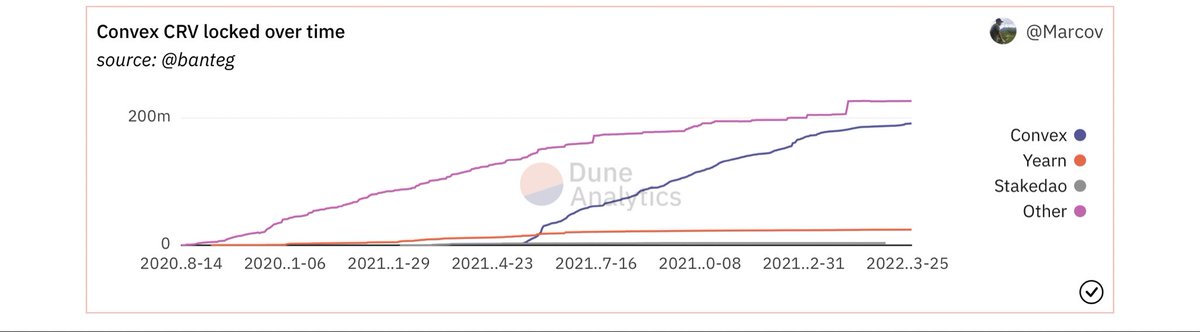

Other KPIs to be mindful of as they signal weakness or strength by product:

LPs

🔹 $cvxCRV farmed over time

🔹 $cvxCRV yield

🔹 # apps built on top of $CVX

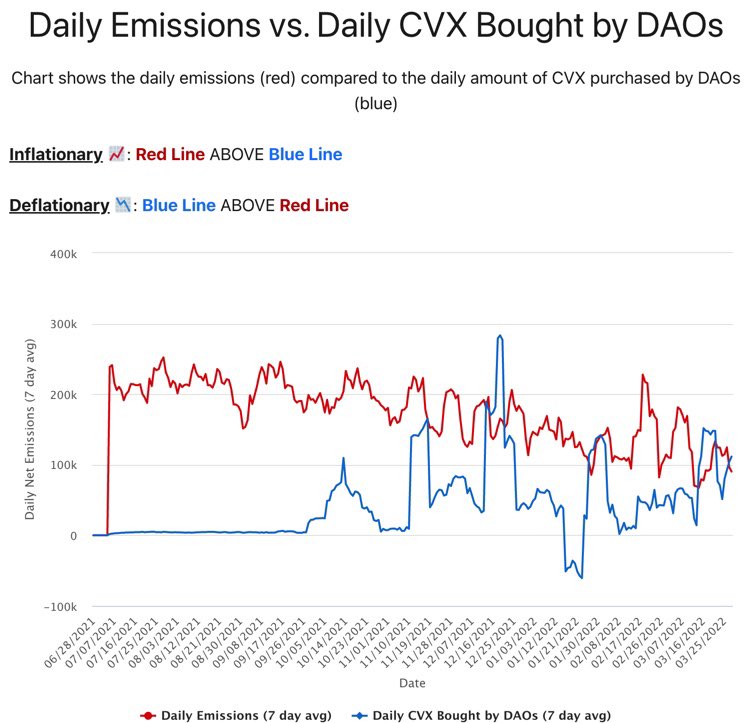

vlCVX

🔹 yield per $CVX

🔹 % locked 🔒

🔹 # DAOs bribing & retention

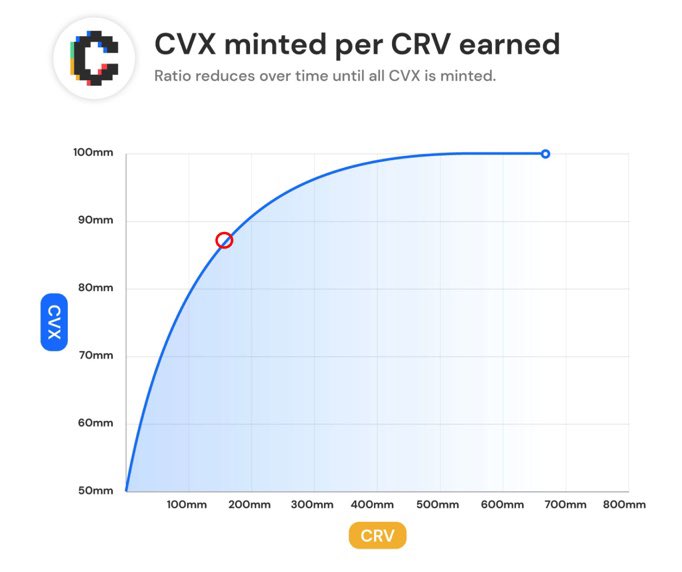

🔹 % $CVX daily emissions / $CVX bought

Other KPIs to be mindful of as they signal weakness or strength by product:

LPs

🔹 $cvxCRV farmed over time

🔹 $cvxCRV yield

🔹 # apps built on top of $CVX

vlCVX

🔹 yield per $CVX

🔹 % locked 🔒

🔹 # DAOs bribing & retention

🔹 % $CVX daily emissions / $CVX bought

/14

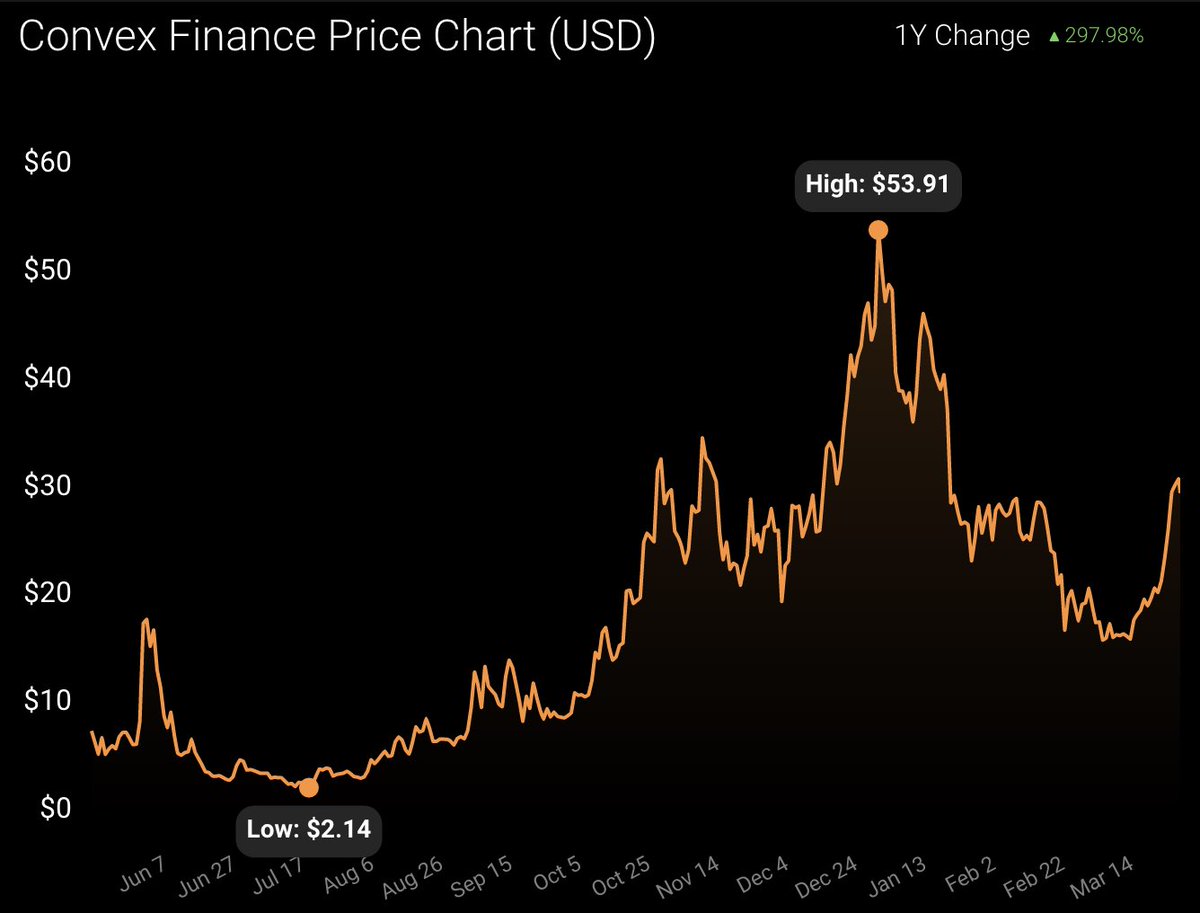

Catalysts

There are a number of catalysts to 👀

🔹 @fraxfinance app (q2)

🔹 @CurveFinance v2 adoption (q2 and beyond)

🔹 $CRV emissions tapering (Aug)

🔹 $CVX emissions tapering 90% farmed (q3-q4)

Let’s dive into each 👇

Catalysts

There are a number of catalysts to 👀

🔹 @fraxfinance app (q2)

🔹 @CurveFinance v2 adoption (q2 and beyond)

🔹 $CRV emissions tapering (Aug)

🔹 $CVX emissions tapering 90% farmed (q3-q4)

Let’s dive into each 👇

/15

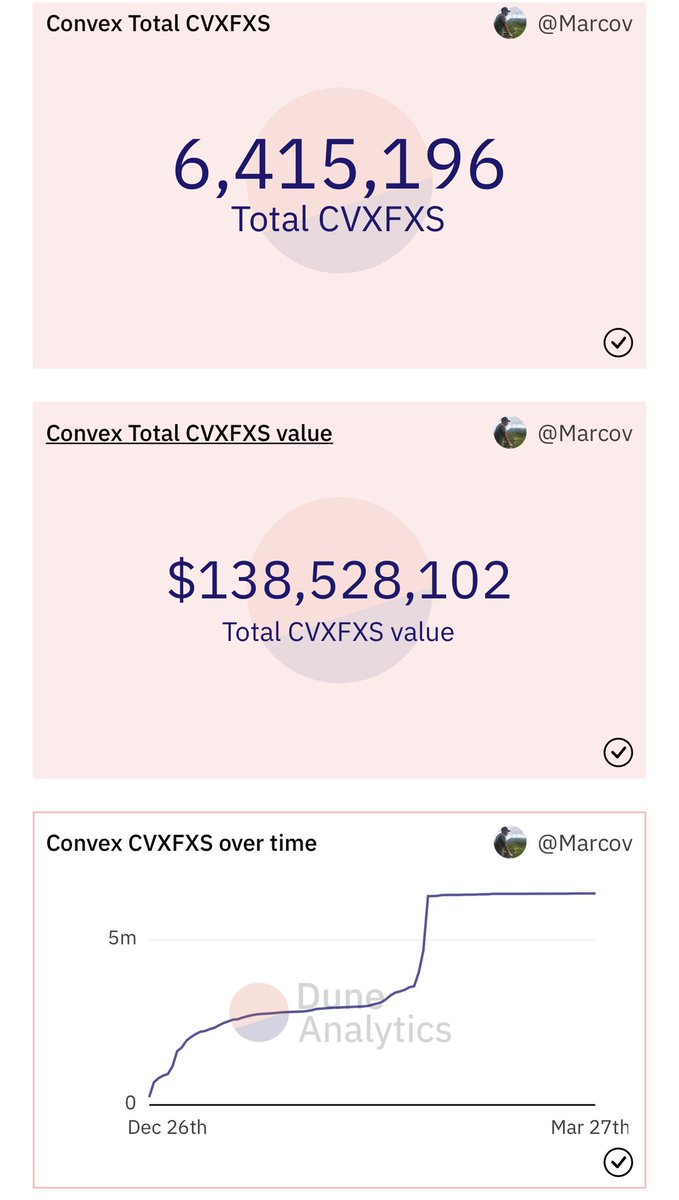

@fraxfinance is a decentralized algostable ecosystem. It’s token $FXS and stable is $FRAX.

$CVX soft launched $cvxFXS late last year and already controls 6.4m tkns or $138m.

This is before LP boost solution for $FXS LPs. Remember $cvxCRV chart? Same deal 📈 soon

@fraxfinance is a decentralized algostable ecosystem. It’s token $FXS and stable is $FRAX.

$CVX soft launched $cvxFXS late last year and already controls 6.4m tkns or $138m.

This is before LP boost solution for $FXS LPs. Remember $cvxCRV chart? Same deal 📈 soon

/16

@CurveFinance v2 was released earlier this year, and supports volatile pairs comparable to $UNI v3.

🔹24 pairs to date

🔹vol share 📈

🔹v2pools.com for metrics

Helpful update from @CurveCap 👇

@CurveFinance v2 was released earlier this year, and supports volatile pairs comparable to $UNI v3.

🔹24 pairs to date

🔹vol share 📈

🔹v2pools.com for metrics

Helpful update from @CurveCap 👇

/21

Analytics

Dune analytics dashboard containing many of the core KPIs discussed by @marcov_91

dune.xyz

Analytics

Dune analytics dashboard containing many of the core KPIs discussed by @marcov_91

dune.xyz

/22

Follows

@crypto_condom - fa

@CurveCap - newsletter

@DefiMoon - updates

@DefiDividends - fa + tools

@0xAlunara - tools

@wagmiAlexander - fa

@CFrogE1 - memes

@CredibleCrypto - ta

@C2tP - dev

@CurveFinance

@ConvexFinance

@VotiumProtocol

If I missed anyone let me know

Follows

@crypto_condom - fa

@CurveCap - newsletter

@DefiMoon - updates

@DefiDividends - fa + tools

@0xAlunara - tools

@wagmiAlexander - fa

@CFrogE1 - memes

@CredibleCrypto - ta

@C2tP - dev

@CurveFinance

@ConvexFinance

@VotiumProtocol

If I missed anyone let me know

/23

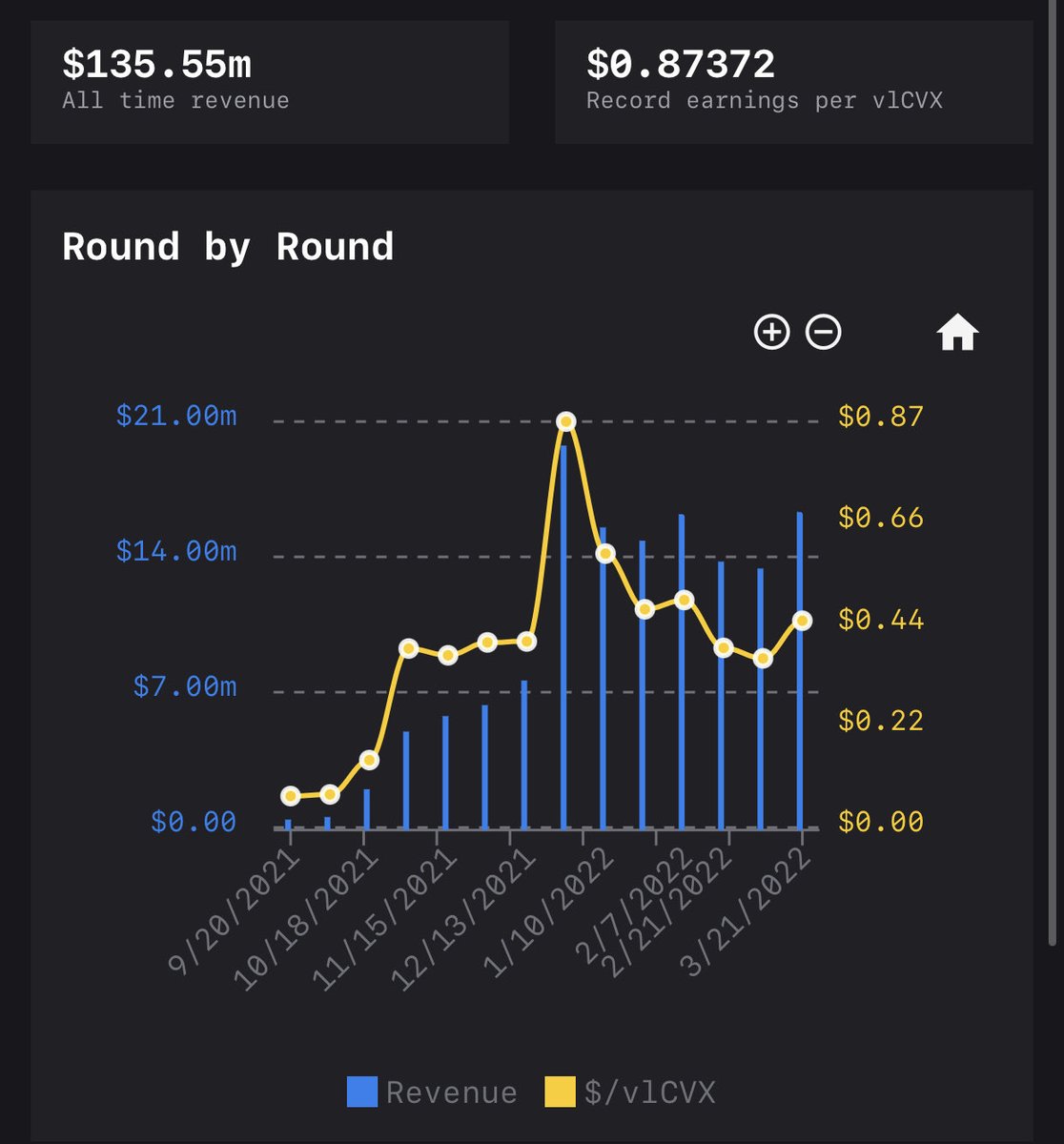

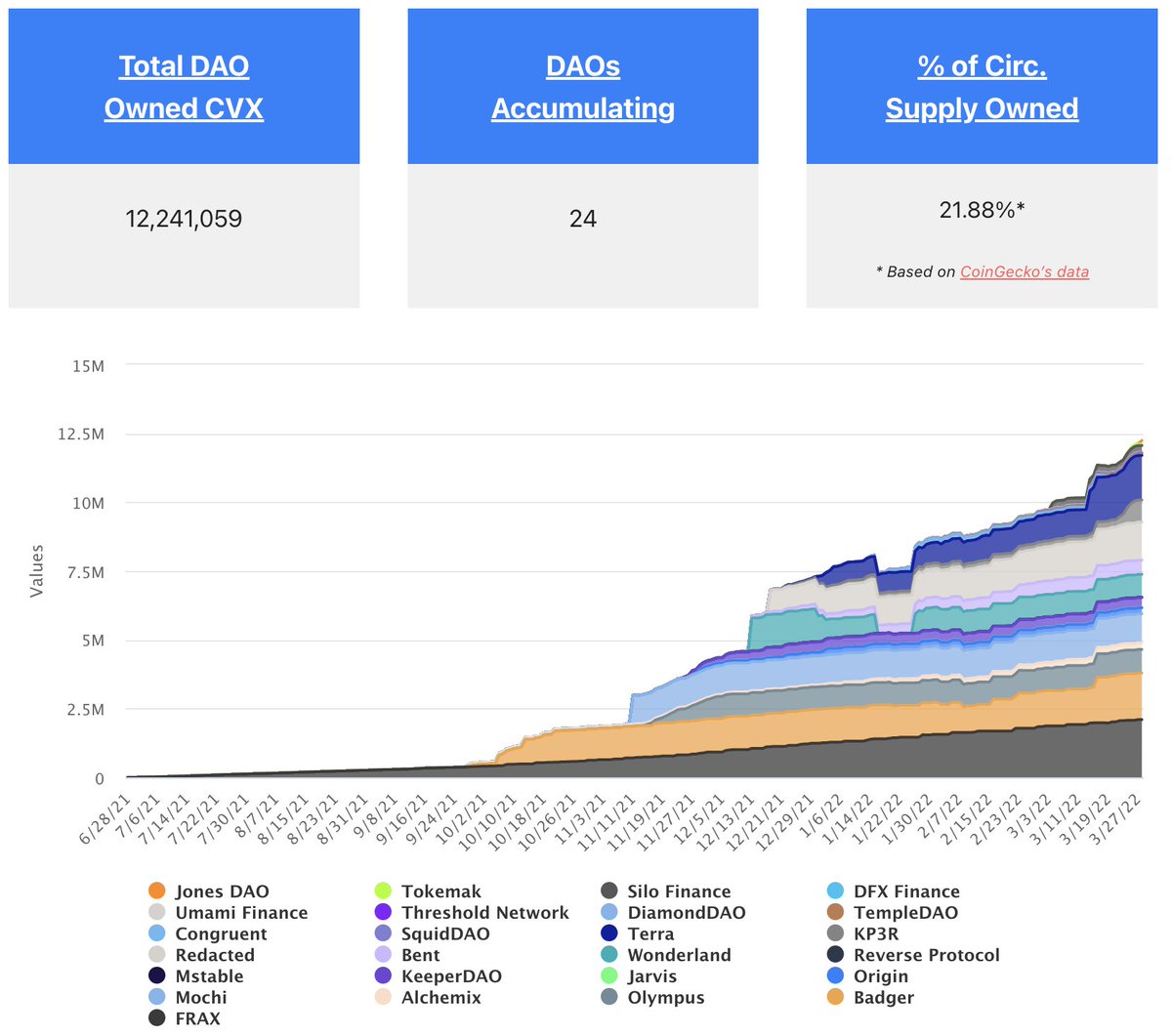

Community apps

Llama.airforce (@0xAlunara)

🔹promo flyer easy to share

🔹LP data

🔹Votium bribes overview and rounds

Daocvx.com (@DefiDividends)

🔹stats on DAOs acquiring

V2pools.com

🔹 $CRV v2 pool performance

Community apps

Llama.airforce (@0xAlunara)

🔹promo flyer easy to share

🔹LP data

🔹Votium bribes overview and rounds

Daocvx.com (@DefiDividends)

🔹stats on DAOs acquiring

V2pools.com

🔹 $CRV v2 pool performance

/

Summary

🔹 $CVX makes veTKN better

🔹 largest owner of $CRV (and soon $FXS)

🔹 levered bet on $CRV and $FXS ecosystems

🔹 net-deflationary due to market demand

🔹 blue chip yield paying 40-70% Apr in non-native TKN

🔹 strong community, team and trusted brand

Summary

🔹 $CVX makes veTKN better

🔹 largest owner of $CRV (and soon $FXS)

🔹 levered bet on $CRV and $FXS ecosystems

🔹 net-deflationary due to market demand

🔹 blue chip yield paying 40-70% Apr in non-native TKN

🔹 strong community, team and trusted brand

/

Sharing means caring

If you found @ConvexFinance interesting or the thread helpful please share the original post 🙏

Give me a follow if you like deep dives into protocols I find interesting

Sharing means caring

If you found @ConvexFinance interesting or the thread helpful please share the original post 🙏

Give me a follow if you like deep dives into protocols I find interesting

/ Request

If you are an app building on top of $CVX $CRV let me know. I didn’t forget about this important pillar but selfishly want to dig deeper and add to this thread as a resource as an addendum

If you are an app building on top of $CVX $CRV let me know. I didn’t forget about this important pillar but selfishly want to dig deeper and add to this thread as a resource as an addendum

جاري تحميل الاقتراحات...