Another 🧵, just to see if I can get any good at these.

Stablecoin yields are something I get asked about all the time and something that my team has dedicated a lot of time towards researching.

1/x

Stablecoin yields are something I get asked about all the time and something that my team has dedicated a lot of time towards researching.

1/x

2/x @anchor_protocol comes as no surprise. 20% APY, relatively stable yield on aUST, lasts as long as it maintains reserve injections, bAsset interest, and borrow interest.

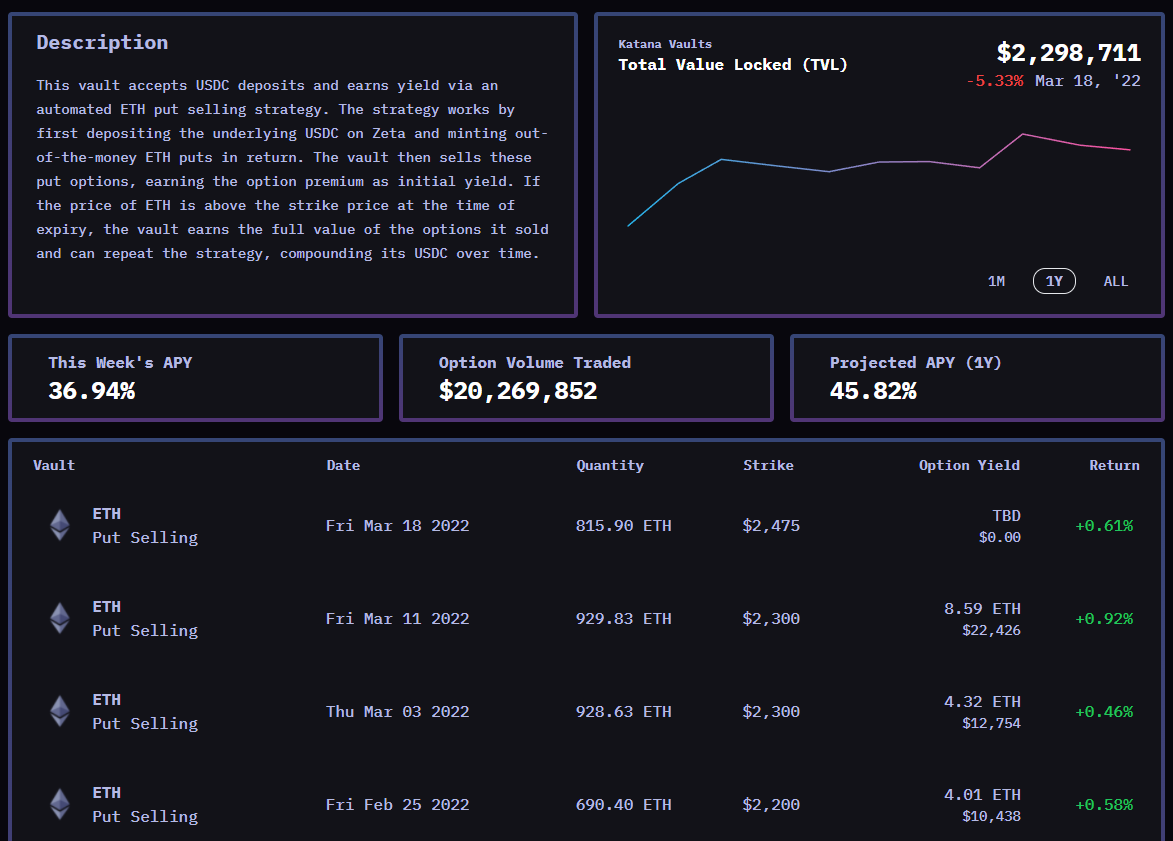

3/x Cash-Secured Puts Option vaults range from 15%->50% APY & are designed to expire out of the money.

Some great CSP vaults can be found on @ThetanutsFi, @friktion_labs, & Katana.

Deposit a stablecoin and get a positive yield on it so long as the underlying stays above strike.

Some great CSP vaults can be found on @ThetanutsFi, @friktion_labs, & Katana.

Deposit a stablecoin and get a positive yield on it so long as the underlying stays above strike.

4/x Looping: high risk & gotta be fast.

Directions:

1. Collateralize stable on lending platform

2. Borrow stable against it

3. Swap to collateralized stable

4. Add that to collateral

5. Repeat

Done right, you can get >50% APY for a couple of whiles.

Pictured: @solendprotocol

Directions:

1. Collateralize stable on lending platform

2. Borrow stable against it

3. Swap to collateralized stable

4. Add that to collateral

5. Repeat

Done right, you can get >50% APY for a couple of whiles.

Pictured: @solendprotocol

5/x @BeanstalkFarms

Over 30% APY on the 3crv - $bean stable LP

Over 20% on the $bean single asset staking LP ( $bean is a stable )

Note: 3CRV is a stable that can be used to get yield on various places, but the bean LP is one of the most consistent at the moment.

Over 30% APY on the 3crv - $bean stable LP

Over 20% on the $bean single asset staking LP ( $bean is a stable )

Note: 3CRV is a stable that can be used to get yield on various places, but the bean LP is one of the most consistent at the moment.

6/x Degenbox on abracadabra.money still yields over 50% APY on stables, BUT it relies on MIM being available.

If you can get in this strategy, do, but then forget about it for a few months. Exiting and entering can be costly, and people will be quick to take your spot.

If you can get in this strategy, do, but then forget about it for a few months. Exiting and entering can be costly, and people will be quick to take your spot.

7/x Forex pairs using Jarvis assets on Polygon (I use @beefyfinance) consistently yield 10%-45% APY and get you exposure to non-USD stables //if// you're looking to diversify.

8/x @HectorDAO_HEC's $TOR LP is currently yielding over 20% and has been remarkably consistent. You can also "zap" in various different stables to start earning yield.

You could also lend ETH on HEC Bank, borrow 50% FRAX & zap into $TOR LP for ETH exposure & >25% APY.

You could also lend ETH on HEC Bank, borrow 50% FRAX & zap into $TOR LP for ETH exposure & >25% APY.

9/x Delta Neutral Positions are similar to stablecoin yields because there's no volatility to the staked strategy.

Unfortunately, impermanent loss is still a buzzkill.

Protocols like @single_finance, @Francium_Defi, & @ApertureFinance have done a great job with this.

>25% APY

Unfortunately, impermanent loss is still a buzzkill.

Protocols like @single_finance, @Francium_Defi, & @ApertureFinance have done a great job with this.

>25% APY

10/x

I'll leave it at that, though there are certainly more to consider.

FWIW, my team works hard on curating/vetting strategies and if you want to talk to us about or discuss these strats, consider joining the Patreon & premium discord.

We'd love to have you!

Links in bio

I'll leave it at that, though there are certainly more to consider.

FWIW, my team works hard on curating/vetting strategies and if you want to talk to us about or discuss these strats, consider joining the Patreon & premium discord.

We'd love to have you!

Links in bio

Loading suggestions...